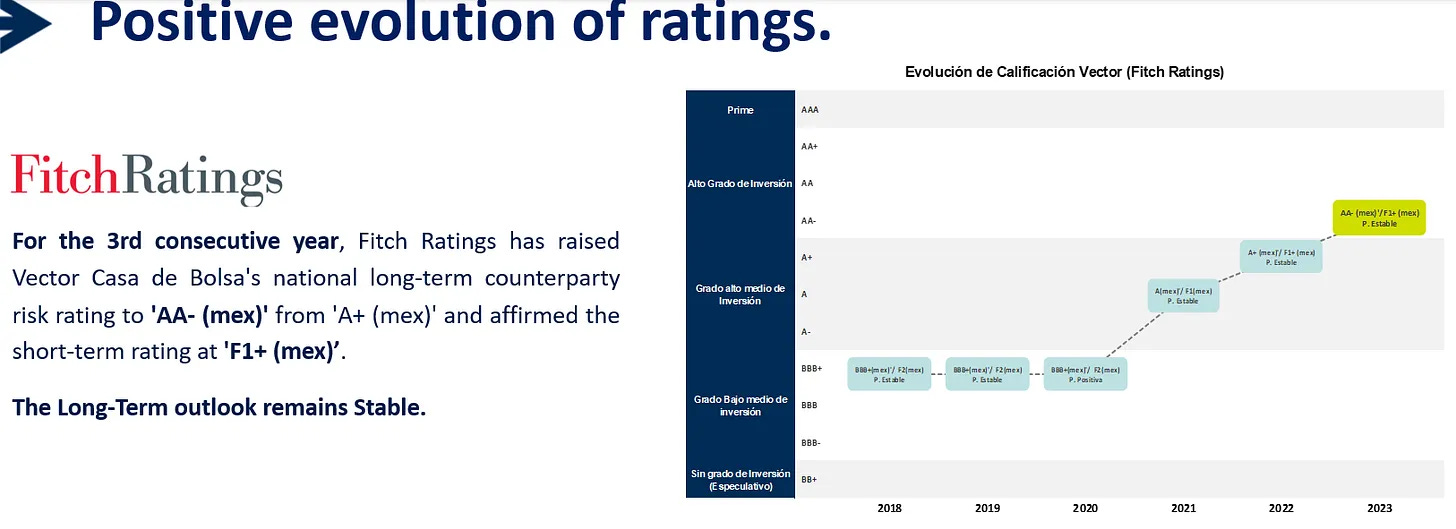

MEXICO: VECTOR CASA DE BOLSA

Vector Casa de Bolsa, CIBanco, and Intercam Banco were flagged by the U.S. Treasury for allegedly laundering money linked to fentanyl trafficking.

Treasury Issues Historic Orders under Powerful New Authority to Counter Fentanyl

On June 25, 2025, the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) designated CIBanco, Intercam Banco, and Vector Casa de Bolsa as institutions of primary money laundering concern under the FEND Off Fentanyl Act. These actions, the first of their kind under this new authority, prohibit U.S. financial institutions from executing any transmittals of funds involving these three entities. The sanctions aim to disrupt financial facilitation of fentanyl trafficking, which the Treasury attributes to Mexican drug cartels.

According to FinCEN, CIBanco and Intercam are alleged to have provided financial services to the Jalisco New Generation Cartel (CJNG), the Beltrán-Leyva Organization, and the Gulf Cartel, including facilitating payments for fentanyl precursor chemicals from China. Vector is accused of enabling money laundering for the Sinaloa and Gulf Cartels, including transferring over $2 million in proceeds and facilitating additional payments linked to chemical procurement. These findings point to significant deficiencies in anti-money laundering and counter-terrorism financing (AML/CFT) controls at the institutions.

The designations follow an executive order issued by President Trump in early 2025, which authorized the classification of major cartels as Foreign Terrorist Organizations (FTOs) and Specially Designated Global Terrorists (SDGTs). FinCEN’s actions form part of a broader bilateral strategy between the United States and Mexico to enhance security cooperation, though the Mexican Ministry of Finance has stated it has not received concrete evidence to substantiate the claims. The prohibitions will take effect 21 days after their publication in the Federal Register. US DEPARTMENT OF THE TREASURY

U.S. Accuses 3 Mexican Financial Firms of Money Laundering Tied to Fentanyl

The U.S. Treasury Department has imposed sanctions on three Mexican financial institutions—Vector Casa de Bolsa, Intercam Banco, and CIBanco—for allegedly facilitating money laundering operations linked to fentanyl trafficking by Mexican drug cartels. Among the firms named, Vector stands out due to its association with Alfonso Romo, a prominent businessman and former chief of staff to ex-President Andrés Manuel López Obrador. The allegations include laundering millions of dollars and enabling the purchase of precursor chemicals from China between 2013 and 2024.

These accusations have generated significant controversy in Mexico. Vector has firmly denied any wrongdoing, stating it operates under rigorous regulatory compliance and internal controls. The Mexican Ministry of Finance also responded by asserting that no evidence was provided by U.S. authorities to support the claims. It emphasized that the transactions in question involved legitimate Chinese firms and that the domestic regulatory reviews only identified administrative issues, not criminal behavior.

The implications of these actions are far-reaching, raising diplomatic tensions and underscoring increased scrutiny on financial institutions' role in combating illicit finance. The move signals a broader shift in U.S. enforcement, where banks and brokerage firms are expected to actively monitor and prevent the misuse of their platforms. Mexican authorities have reiterated their commitment to upholding the rule of law and pledged full cooperation should conclusive evidence of illegal activity emerge. NEW YORK TIMES

US imposes sanctions on three Mexican finance firms over China fentanyl trade

The U.S. Treasury Department has sanctioned three Mexican financial institutions — CIBanco, Intercam Banco, and Vector Casa de Bolsa — for allegedly facilitating payments to China related to fentanyl trafficking. Under the authority of the newly enacted FEND Off Fentanyl Act, these entities have been designated as being “of primary money laundering concern,” effectively restricting their access to the U.S. financial system. According to the Treasury, the firms played a long-standing and significant role in laundering millions of dollars for Mexican cartels and procuring precursor chemicals used in fentanyl production.

The sanctions, the first under the new legislation, are part of the Trump administration's broader crackdown on opioid smuggling. The move puts additional pressure on Mexico’s new president, Claudia Sheinbaum, and underscores the U.S. commitment to combating fentanyl at the financial level. While Vector is linked to Alfonso Romo — a former top aide to ex-President López Obrador — there are no allegations of wrongdoing against him or the former administration. Vector has publicly denied the allegations, stating that the transactions involved were with legally established companies.

Mexico’s Finance Ministry responded by affirming its cooperation with U.S. authorities but noted that no conclusive evidence has been provided to support the claims. The ministry emphasized that, should concrete proof be presented, it would act decisively within the rule of law. The episode highlights growing scrutiny of anti-money laundering protocols across the Mexican financial system and adds a new layer of complexity to U.S.-Mexico relations amid heightened trade and security tensions. FINANCIAL TIMES

VECTOR OFFICIAL STATEMENT

Mexico City, June 25, 2025

In response to the allegations issued by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC), Vector Casa de Bolsa declares the following:

Vector categorically rejects any accusation that compromises its institutional integrity. With more than 50 years of experience, our brokerage firm has operated under the highest standards of regulatory compliance, internal auditing, and oversight by Mexican financial authorities.

The Ministry of Finance and Public Credit (SHCP) has stated that, after requesting evidence from the U.S. Department of the Treasury, no proof was received linking Vector to any illicit activity. The transactions in question relate to ordinary operations with legally established companies. Furthermore, reviews conducted by Mexican authorities identified only administrative issues, which have been appropriately addressed and sanctioned in accordance with current regulations.

It is important to emphasize that the investments of each and every one of our clients are 100% backed by the investment instruments in which they are placed—those assets are safeguarded by the Securities Depository Institute (S.D. Indeval), as has been the case throughout Vector’s 50-year history. Our commitment to protecting the wealth of our clients is, and will continue to be, unwavering.

We reiterate our full willingness to cooperate with authorities in both Mexico and the United States to clarify any concerns, as we have always done within a framework of responsibility, legality, and transparency.

Vector reaffirms its commitment to Mexico, to its clients, and to the integrity of the national and international financial system.

Vector Casa de Bolsa, S.A. de C.V.

50 years of trust and financial responsibility.

Secretary of Treasury statement. SHCP

Today, the U.S. Department of the Treasury imposed administrative and civil sanctions on two Mexican banks and one brokerage firm for alleged money laundering and links to organized crime.

In response, the Ministry of Finance and Public Credit (SHCP) of Mexico issues the following statement:

The SHCP maintains a relationship of coordination and dialogue with the U.S. Department of the Treasury, grounded in mutual respect for sovereignty, shared responsibility, and cooperation without subordination.

Within this framework, the Department of the Treasury notified the Financial Intelligence Unit (UIF), through the General Directorate of Regulatory and International Affairs, as well as the Ministry of Finance, about alleged irregularities involving these institutions.

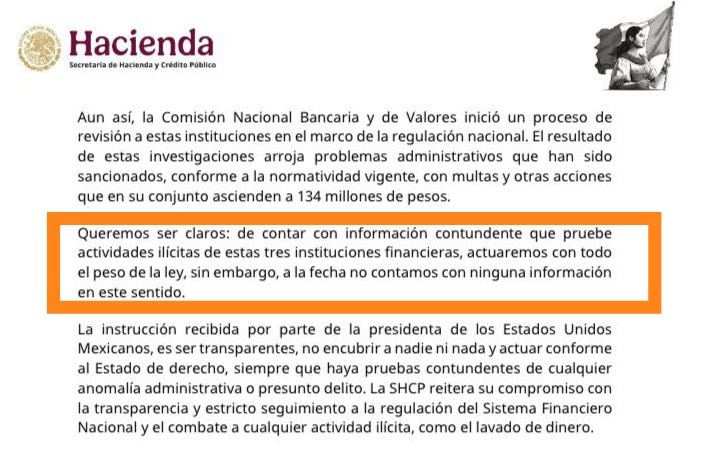

In response, the SHCP requested evidence from the Treasury Department to substantiate the link between these institutions and illicit activities that could be corroborated by the UIF or the National Banking and Securities Commission (CNBV); however, no such evidence was provided.

The only information shared by the Department of the Treasury that can be verified by Mexican authorities involves certain electronic transfers made through the mentioned financial institutions to legally established Chinese companies. Nonetheless, such transactions are conducted in the thousands across Mexican financial institutions. The UIF found that over 300 Mexican companies have made transactions to these Chinese companies through ten different national financial institutions. This is because Mexico conducts thousands of regular operations with legally established Chinese firms, with an annual trade volume of $139 billion USD.

Still, the National Banking and Securities Commission has initiated a review process of these institutions under national regulatory frameworks. The result of these investigations has revealed administrative issues that have been sanctioned in accordance with current regulations, through fines and other actions totaling 134 million pesos.

We want to be clear: if we are presented with solid evidence proving illicit activities by these three financial institutions, we will act with the full weight of the law. However, to date, we have not received any such information.

The instruction from the President of the United Mexican States is clear: be transparent, cover up nothing and no one, and act according to the rule of law, provided there is compelling evidence of any administrative irregularity or alleged crime. The SHCP reaffirms its commitment to transparency, strict adherence to national financial system regulation, and the fight against any illicit activity, including money laundering.

Sanctioned Banks Vector, Intercam, and CI Banco Hold Over $16 Billion in Fund Assets

Vector Casa de Bolsa, Intercam Banco, and CI Banco—three Mexican financial institutions collectively managing over $16 billion in assets—have been sanctioned by the U.S. Treasury Department for allegedly facilitating fentanyl trafficking and money laundering for drug cartels. These sanctions are the first actions executed under the newly enacted Fentanyl Sanctions Act and the FEND Off Fentanyl Act, granting expanded powers to FinCEN. While Intercam operates as a financial group in Mexico, Vector and CI Banco function under brokerage and banking licenses, respectively. Despite the uncertainty around the ultimate impact, the case has sparked heightened scrutiny across the Mexican financial system.

Vector Casa de Bolsa, the largest of the three by assets under management, has firmly rejected the allegations, emphasizing its five-decade history of regulatory compliance and operational transparency. Mexican authorities, including the Ministry of Finance, confirmed that no illicit activity has been substantiated, and that administrative irregularities have been addressed according to domestic regulation. The firm reiterated that all client investments remain fully backed and securely held at the national securities depository, S.D. Indeval. Vector’s fund offerings span fixed income, equity, and international debt, and the firm recently launched e-Vector, a digital platform targeting younger investors.

Meanwhile, Intercam manages approximately $1.3 billion in investment funds across five products, with TASAPR representing nearly 40% of its assets. The institution has yet to issue a formal response. CI Banco, while smaller in scale, remains active in Mexico’s fund ecosystem with offerings in both debt and equity markets, including CIUSD, which holds over $125 million in assets. Analysts suggest it is too early to gauge the lasting impact of the sanctions, noting the allegations pertain to specific operations rather than a systemic indictment of these institutions or the broader Mexican financial sector. FUND SOCIETY

Pam Bondi Places Mexico on U.S. Enemy List Alongside Iran: “We Will Not Be Intimidated”

U.S. Attorney General Pam Bondi declared during a Senate Appropriations Committee hearing that the United States would take a firm stance against any nation threatening its sovereignty—including Iran, Russia, China, and notably, Mexico. Bondi praised President Donald Trump’s leadership in global conflicts and reiterated his administration’s commitment to protecting the American public, particularly against the fentanyl overdose crisis. "We will not be intimidated and we will keep America safe, not just from Iran, but also from Russia, China, and Mexico," she said.

These comments followed accusations from the U.S. Treasury Department against three Mexican financial institutions—CIBanco, Intercam, and Vector Casa de Bolsa—for allegedly laundering money for cartels involved in fentanyl trafficking between Mexico and the U.S. Bondi emphasized that the trafficking of synthetic opioids represents a direct threat to American lives and signaled intensified pressure on Mexico and Canada to stem the flow of illegal drugs.

Bondi also noted that both Mexico and Canada are under active review for their role in the fentanyl supply chain. Trump, early in his new term, imposed tariffs on both nations to push for stronger border enforcement and crackdown on drug trafficking. While Mexico’s President Claudia Sheinbaum has deployed over 10,000 National Guard troops to the U.S. border in response, the U.S. has continued to escalate its stance—recently classifying several Mexican cartels as terrorist organizations. EL FINANCIERO

VECTOR SALES AND TRADING DESK

U.S. benchmark stock indices closed with mixed results on Wednesday, after Federal Reserve Chair Jerome Powell hinted at rising inflationary pressure due to tariffs.

The Nasdaq rose 0.31% to 19,973.55 points, while the S&P 500 remained flat at 6,092.16. The Dow Jones Industrial Average fell 0.25% to 42,982.43.

Mexico’s stock markets closed higher on Wednesday. Local indices posted gains for a second consecutive day, supported by the ongoing ceasefire in the Israel-Iran conflict and strong performance from Grupo Carso shares.

The benchmark S&P/BMV IPC index of the Mexican Stock Exchange (BMV), which tracks the most traded local stocks, rose 0.33% to 56,933.19 points.

Please find attached all news related to recent events about Vector Casa De Bolsa.

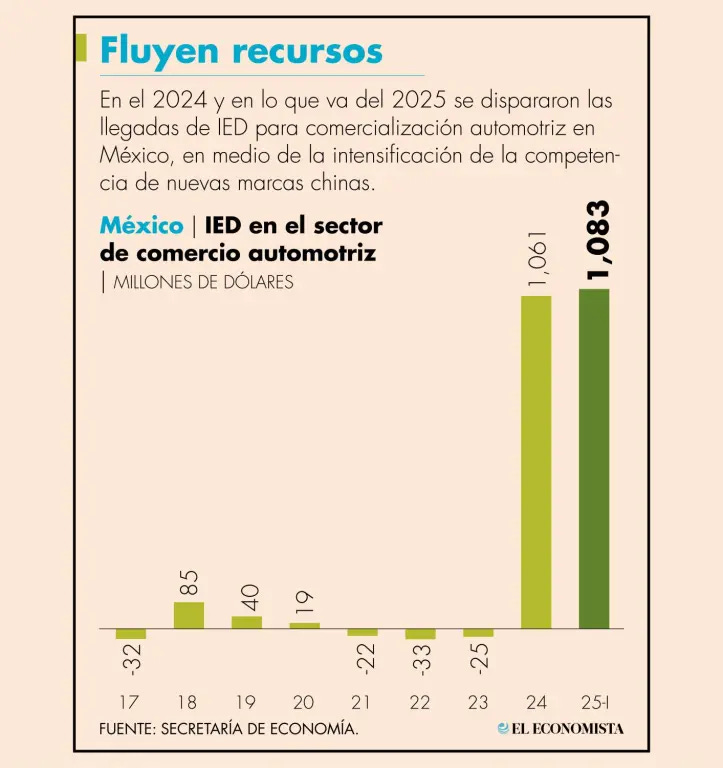

Foreign Direct Investment in Mexico’s Automotive Trade Surges Amid Market Shifts

Foreign Direct Investment (FDI) inflows into Mexico’s automotive trade sector soared to $2.144 billion over the last five quarters ending March 31, 2025, according to data from the Ministry of Economy. This surge coincides with the growing presence of Chinese automotive brands in the Mexican market and shifts in competition and company competitiveness following tariffs imposed on the sector by the U.S. and other countries. The amount accumulated in these five quarters accounts for 74.1% of the total FDI Mexico has received in this subsector since January 2006.

In the first quarter of 2025 alone, Mexico attracted a record $1.083 billion in FDI for the automotive trade, surpassing the total $1.061 billion recorded for all of 2024. These figures are comparable to FDI inflows in the mining sector for metallic minerals, which amounted to $2.142 billion in the same period. Between January and May 2025, 593,284 light vehicles were sold in Mexico, marking a 0.9% increase compared to the previous year, while retail sales of heavy vehicles dropped by 20.9% year-on-year.

The growing Chinese investment has sparked criticism. According to a 2024 U.S. International Trade Commission report, labor unions such as the United Auto Workers (UAW) and the Labor Advisory Committee for Trade Negotiations and Trade Policy (LAC) have expressed concerns that Chinese FDI in Mexico’s automotive sector is intended to circumvent U.S. tariffs under Sections 232 and 301. These groups urge the U.S. to collaborate with Canada and Mexico to scrutinize these investments and ensure that North American supply chains are not unduly benefiting from Chinese government-supported companies. Economist Adam Hersh also warned that regional content calculation rules may allow significant non-North American input to benefit from tax credits under the Inflation Reduction Act. EL ECONOMISTA

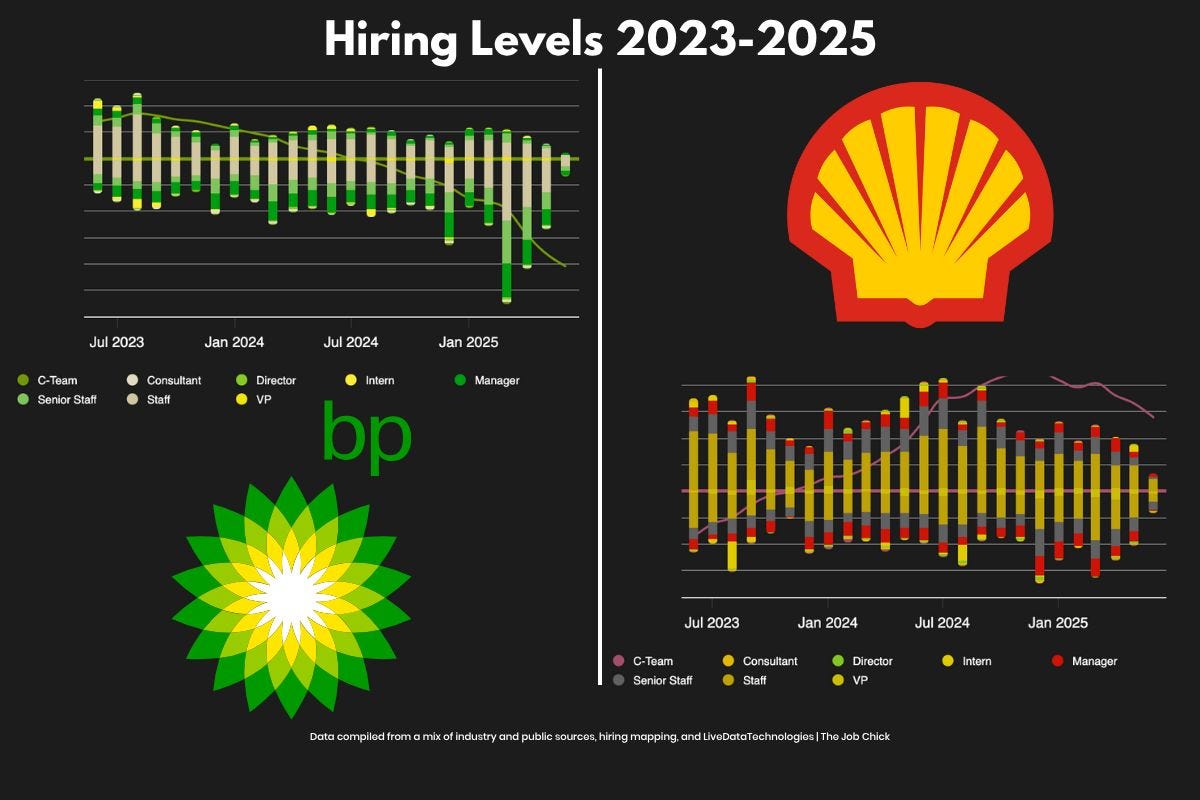

BP shares rise on takeover speculation; Shell denies

BP Shares Surge Amid Rumors of Potential Shell Acquisition

BP shares soared more than 10% on Wednesday following a Wall Street Journal report that Shell is in early-stage talks to acquire the British oil giant in a deal valued around $80 billion. The surge pushed BP’s stock to a session high of $32.94, reflecting investor excitement about what would be the industry’s largest deal since Exxon’s $83 billion acquisition of Mobil in the 1990s. However, the report also emphasized that any deal remains far from certain, causing significant volatility in BP’s shares throughout the day.

Shell quickly denied the rumors, with a spokesperson calling the report “further market speculation” and confirming no talks are taking place. BP shares retreated but still closed the day up 1.64% at $30.32. Sources familiar with the situation told CNBC it is unlikely Shell would buy BP outright; if an acquisition occurred, BP might be broken up and sold in parts to different buyers rather than a full takeover. This adds nuance to the speculation that has rattled markets.

BP’s recent struggles have made it a potential acquisition target. The company’s ambitious shift toward renewables and carbon reduction, announced five years ago, failed to deliver expected profits, prompting a strategic reset to focus back on oil and gas. This pivot away from renewables has drawn criticism, with analysts calling it a costly mistake. Meanwhile, activist investor Elliott Management’s recent stake exceeding 5% in BP has increased pressure on the company to concentrate on its core fossil fuel business, intensifying speculation around its future. CNBC

MEXBOL: Mexico’s Stock Market Shows Strong Dollar Gains Amid Economic and Political Developments

Mexico’s leading stock index has posted impressive gains in dollar terms, rising 24% year-to-date. In May, this momentum accelerated, largely driven by the strength of the peso-dollar exchange rate. Citi’s analysis team set a target of 58,500 points for the S&P/BMV IPC by the end of 2025 and 62,000 points for 2026. At the time, this implied an equity risk premium of 1.6%, which widened to 4.8% by June 20. Citi noted that investors’ main focus was not valuation but the growth potential in emerging markets, which could attract significant inflows if U.S. markets slow. Despite this, pension funds (Afores) contribute 6.77% to Mexico’s equity market—still below the long-term average of 7%—while foreign investors currently hold 28.19% of the market capitalization, down from a five-year average of 31.95%.

Citi further explained that investor debates have centered on two key political-economic issues: judicial elections and the renegotiation of the USMCA (T-MEC). Judicial elections largely met market expectations, but investors remain concerned about potential legal challenges that could affect market perceptions. Experts have yet to provide clear insights on possible outcomes, leaving investors uncertain about how adverse rulings might impact confidence.

Regarding the T-MEC renegotiation, which may begin earlier than expected on October 1, most investors view the development positively, believing it could reduce overall risks sooner than anticipated. Many are optimistic about a “nearshoring 2.0” trend becoming a dominant narrative in 2026. While investments may temporarily slow during negotiations, the consensus is that they will not stop entirely and are more likely to accelerate once the trade agreement is renewed. EL SOL DE MEXICO

VECTOR RESEARCH

NATO Meeting Concludes

NATO allies agreed to increase their defense spending. Trump wants the One Big Beautiful Bill approved before July 4. Australia’s inflation retreats.

Yesterday, Jerome Powell, Chair of the FOMC, appeared before the House Financial Services Committee. Powell noted that the economy remains strong, allowing them to wait for a better understanding of the impact of tariffs on inflation. He expects the tariffs to be reflected in inflation data for June, July, and August. He indicated that if after these reports the signals show the impact is less than expected, they could adjust monetary policy accordingly. This suggests we might see a rate cut as soon as September. Powell also said they could adjust policy if the labor market weakens. Today he will appear before the Senate. For more information, consult our flash report.

Yesterday, President Donald Trump issued a message to the Senate: he wants the One Big Beautiful Bill passed this week and said they should lock themselves in a room if necessary. He added they must work with the House of Representatives so it can be approved immediately. He said, “No one leaves for vacation until it is done.”

For now, the process still faces some obstacles. Senator Elizabeth MacDonough pointed out that some elements in the bill prevent it from passing by a simple majority, meaning they would need 60 votes in favor (with only 53 Republicans). The proposal is currently being modified to allow passage by simple majority. Mike Johnson, House Majority Leader, said the president is insisting the bill be approved before July 4 and expressed optimism about this possibility.

OMA Issues MXN 2,750 Million Debt in Mexico; Neutral Outlook

Grupo Aeroportuario del Centro Norte, S.A.B. de C.V. (OMA) placed long-term debt certificates totaling MXN 2,750 million in the Mexican market, with demand 4.3 times the offer across both tranches. The issuance consists of MXN 820 million in 3-year variable-rate notes tied to TIIE plus 45 basis points, maturing on June 23, 2028, and MXN 1,930 million in 7-year fixed-rate notes at 9.34%, maturing on June 18, 2032. Interest payments for the variable notes occur every 28 days, and for the fixed notes every 182 days.

The debt received the highest credit ratings in Mexico, AAA(mex) from Fitch and AAA.mx from Moody’s Local, both with stable outlooks. Net proceeds will be used to fully pay off MXN 600 million of short-term debt and the remainder will finance investments under the company’s Master Development Program for its thirteen airports (2021-2025), as well as general corporate purposes including working capital.

Based on our projections, the net increase in debt of MXN 2,150 million would raise OMA’s net debt to EBITDA ratio from 1.0x to 1.5x by year-end—a reasonable level given the company’s capital structure. Therefore, this news is expected to have a neutral effect on valuation and the stock price in the short term. We reiterate our fundamental recommendation to HOLD, with an estimated intrinsic value of MXN 243.00 per share.

ALFAA: Sigma to Restore Production Capacity in Europe

Sigma announced a plan to fully restore its production capacity following the flooding of its Torrente (Valencia) plant in Q4 2024. The company will invest EUR 157 million, financed primarily through insurance reimbursements and government incentives.

The Torrente plant suffered irreparable damage due to sudden floods, prompting Sigma to implement a comprehensive recovery plan. This includes building a new packaged meats plant in Valencia and expanding capacity at its "La Bureba" facility in Castilla y León. The estimated investment is EUR 134 million for the new Valencia plant and EUR 23 million for La Bureba, totaling EUR 157 million. Sigma expects full operational capacity to be restored by 2027, with improvements in efficiency, operational flexibility, and profitability for its European business.

In its Q1 2025 report, Sigma stated it anticipates receiving insurance reimbursements covering both material damages and business interruption before year-end, aiming to fully offset the economic impact of the floods. We maintain a BUY recommendation on Alfa, with a 12-month intrinsic value estimate of MXN 15.8.

GFNORTE O: Recovery Accelerates, Approaching Closing Highs at 177

The recovery in GFNORTE O is gaining momentum, nearing the previous closing highs at 177. Surpassing this level could open the door for a rise toward the next potential supply zone around 90.

However, technical indicators currently do not provide a clear bullish signal. There is a risk that the first resistance at 177 will act as a ceiling for short-term trading, potentially leading to a new decline with initial support expected near 170 pesos.

INTERNATIONAL DAY

June 26 is observed globally as the International Day Against Drug Abuse and Illicit Trafficking, established by the United Nations in 1987 to raise awareness about the serious social, economic, and health consequences of drug abuse and illegal drug trade. The day serves as a call to action for governments, organizations, and communities worldwide to strengthen efforts in prevention, treatment, and law enforcement to combat the widespread challenges posed by narcotics. It highlights the importance of international cooperation in addressing the root causes of drug addiction and trafficking, while promoting education and rehabilitation programs to build healthier, drug-free societies.