MEXICO: US RESHORING

President Trump’s policies have the potential to benefit the U.S. industrials sector, in particular domestic and cyclical areas of the market.

The reality behind Trump's incredible investment claims

Although President Trump has frequently cited corporate investment announcements as evidence of the success of his economic agenda, much of the available data suggests these claims are premature or overstated. Official U.S. investment statistics are released quarterly, and data from the first part of the year — which only partially reflects Trump’s time in office — indicates only a modest uptick in business investment. Economists such as Stanford’s Nick Bloom point out that many of these investment projects were likely planned before Trump took office, and that ongoing policy uncertainty may actually be dampening new investment decisions.

Furthermore, many high-profile corporate pledges — including those from Apple, Roche, and Stellantis — include previously announced or unrelated spending plans, inflating headline figures. Analysis by Goldman Sachs estimates that genuinely new investments attributable to the Trump administration likely total less than $134 billion — and potentially as little as $30 billion once adjusted for projects that may not materialize or would have happened regardless. Despite the administration’s narrative, many announcements appear to be motivated more by optics and regulatory signaling than by fundamental changes in business conditions.

While certain Trump policies — especially tariffs — have influenced investment behavior in select sectors like pharmaceuticals, their broader impact remains limited. Analysts caution that long-term risks tied to drug pricing reforms, trade uncertainty, and inconsistent regulatory signals may deter future investment. Moreover, structural factors like industry consolidation and a shift toward intangible investments (e.g., software) are more significant drivers of lower capital expenditures than global competition. In this context, many economists argue that the administration’s current tools may be insufficient to generate sustained investment growth. BBC

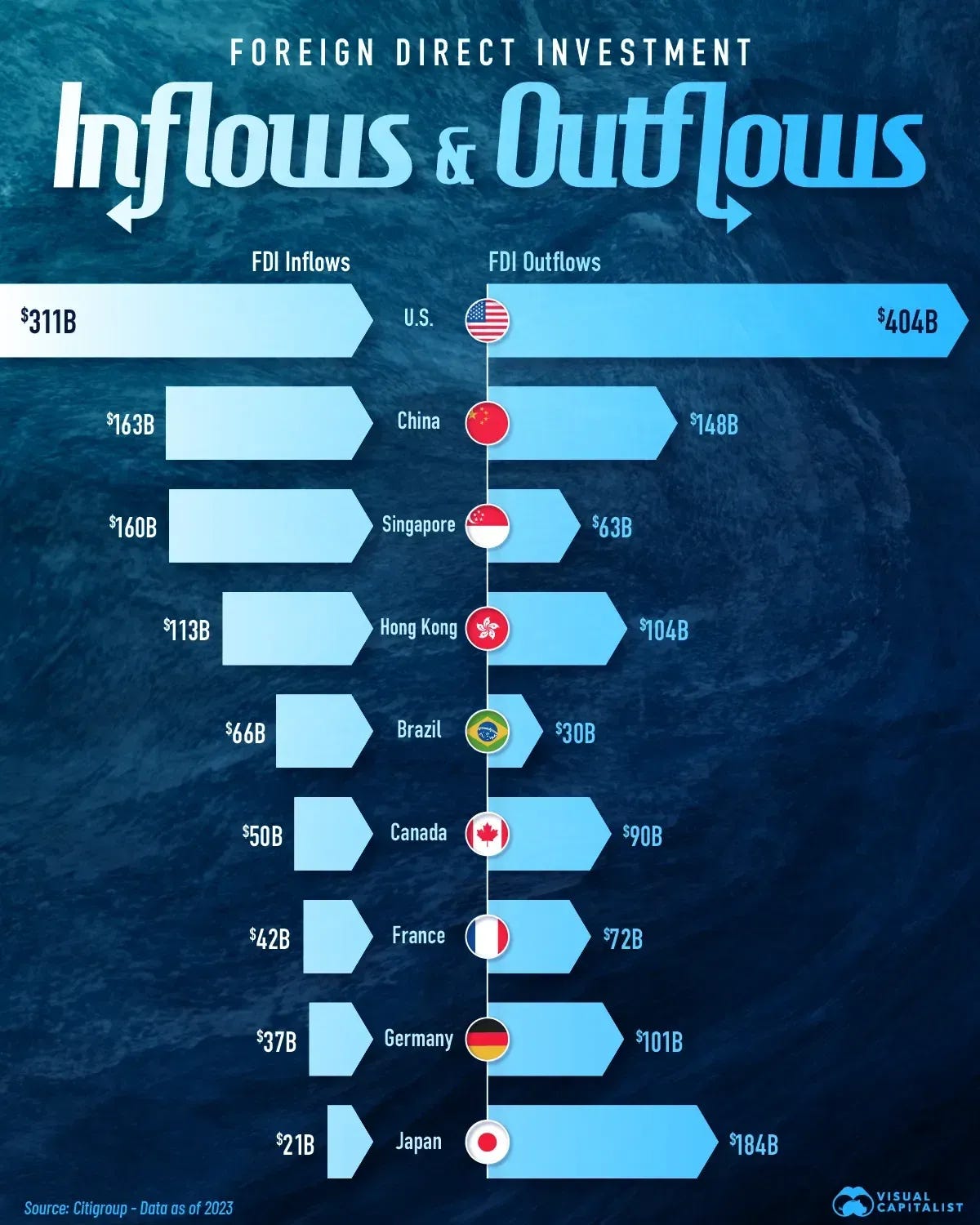

As US urges foreign investment, Chinese firms look at Trump’s trade policy and hesitate

Despite U.S. Commerce Secretary Howard Lutnick’s message of openness to foreign investment, Chinese companies remain wary. Although the recent U.S.-China trade truce offered temporary relief, inconsistent rhetoric from President Trump—ranging from praise for Xi Jinping to renewed accusations against Beijing—has deepened uncertainty. Chinese participation at the SelectUSA summit has steadily declined, reflecting how geopolitical tension and protectionist policies continue to discourage new commitments.

At the state level, Chinese firms face an uneven landscape. Democratic-led states like California welcome investment in clean tech, while Republican-led states are increasingly hostile, citing national security concerns and Communist Party ties. Projects by major Chinese firms such as Gotion and CATL have been delayed or blocked due to political pressure and community opposition, even when previously approved by local authorities. Meanwhile, some Republicans have shown selective openness, particularly when projects align with Trump’s reshoring agenda.

Long-term instability in U.S. regulatory policy has pushed Chinese companies to diversify away from the American market. Many are now focusing expansion efforts in Southeast Asia, Europe, and the Middle East. Even if tariffs ease, the broader risk calculus has shifted: companies now prioritize resilience and seek to avoid being blindsided again. For most Chinese investors, the U.S. is no longer seen as a reliably open or stable environment. SOUTH CHINA MORNING POST

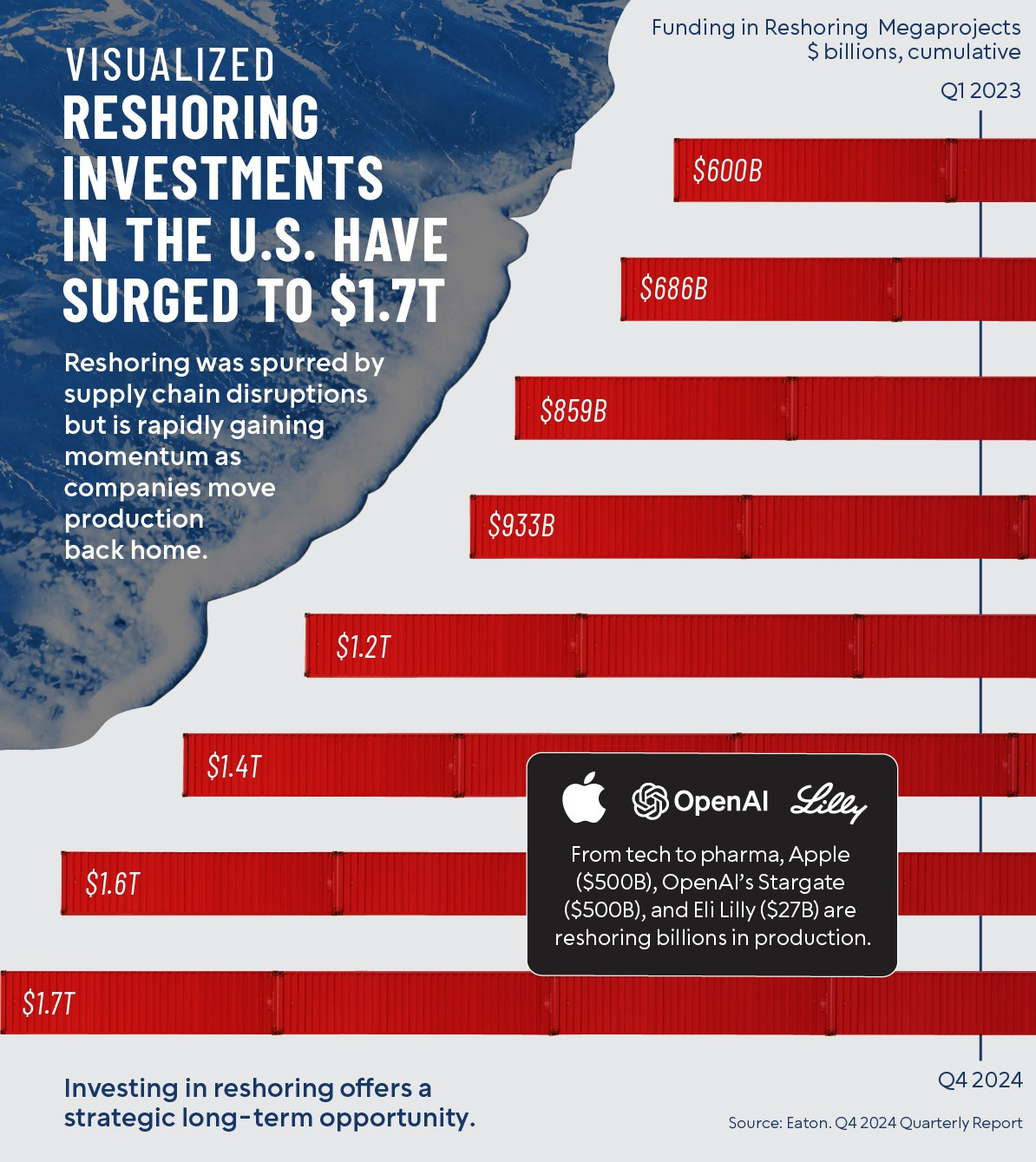

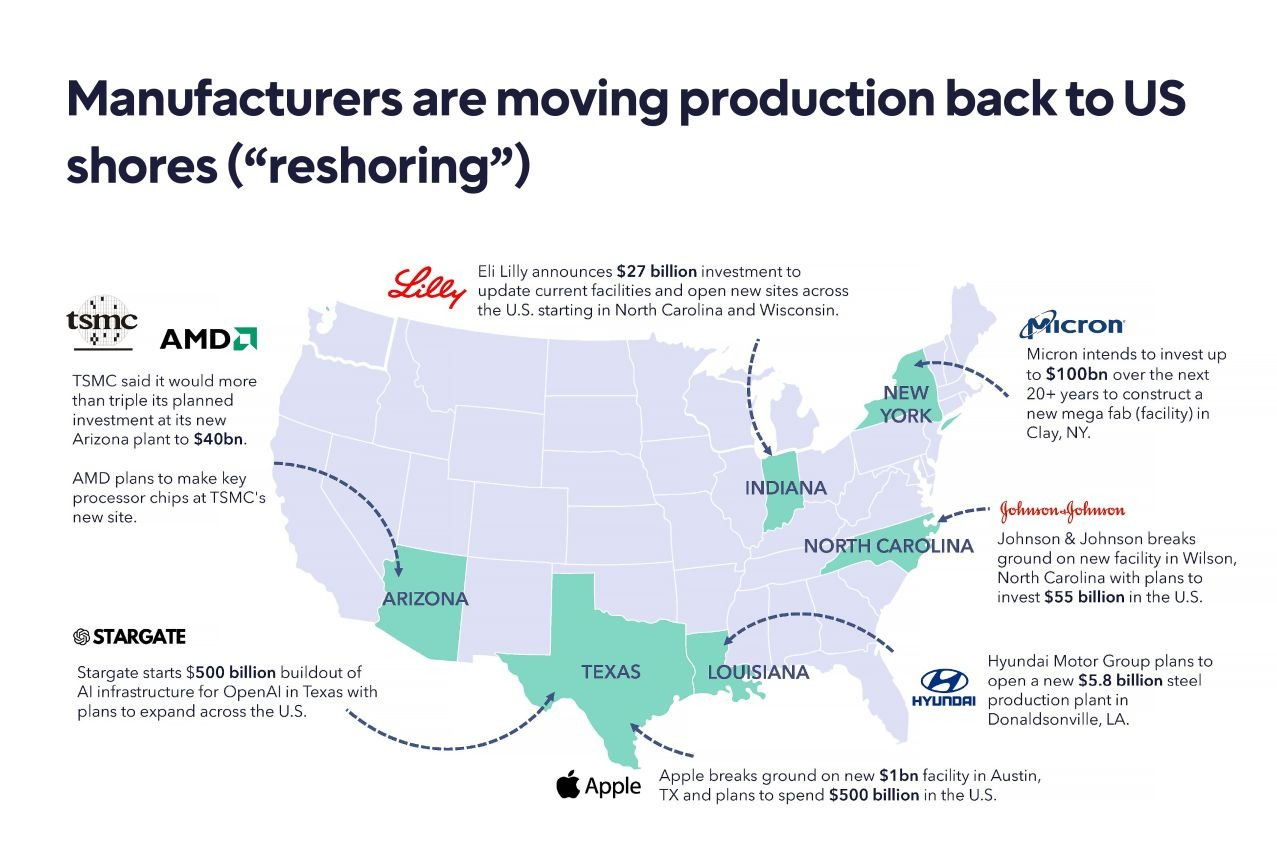

Will President Trump’s reshoring policies fuel an industrial acceleration?

U.S. manufacturing employment has steadily declined since the 1980s, but the construction sector shows signs of strength due to a prolonged housing undersupply. With annual homebuilding at 1.3 million units versus demand closer to 1.7 million, a growing population and aging housing stock are fueling structural imbalances. The gap widens further when factoring in second-home purchases and obsolete properties, adding around 400,000 units to yearly demand.

Although high mortgage rates have slowed home sales, they’re supporting demand in renovation, furnishings, and reconstruction. Consumers are increasingly staying in place and investing in upgrades instead of moving. This shift benefits businesses tied to home improvement and resilient housing demand despite financial constraints.

Industrial activity also shows signs of recovery, with recent manufacturing data turning positive for the first time in two years. Equity markets, however, have yet to fully reflect this momentum. While risks from tariffs and policy uncertainty remain, the long-term case for growth in sectors like freight, housing, and reshoring remains strong. TROWE PRICE

Why GM investors seem to like the idea of spending billions to boost U.S. production

General Motors’ $4 billion investment to expand capacity at existing U.S. plants is being well-received by investors, who typically view large capital expenditures with caution. Analysts believe this strategy—enhancing current facilities rather than building new ones—signals cost discipline and aligns with trade-related pressures to boost domestic manufacturing. It’s expected to increase GM’s U.S. output by around 300,000 vehicles annually.

The company’s decision to maintain its broader capital expenditure targets through 2027, while pausing share buybacks, reflects a cautious but deliberate shift toward long-term strategic planning. Analysts interpret this as a sign that GM sees greater clarity around tariffs and regulation—especially after CEO Mary Barra’s previous comments about withholding major investments without policy certainty.

More importantly, the investment may enable GM to bring production of its most profitable vehicles, like light pickup trucks, back to the U.S., supporting its bottom line. The move contrasts with Ford’s stock gains this year, as GM shares had lagged—making this shift a potential inflection point for sentiment. MARKET WATCH

Why reviving U.S. tech manufacturing is harder than you think

The Trump administration’s aggressive tariffs aim to restore U.S. manufacturing, but the reality is far more difficult. Decades of offshoring have entrenched complex global supply chains—especially in Asia—with vast pools of skilled labor and tightly integrated logistics. Even companies like Apple, despite political pressure, struggle to move production back without sharply increasing costs. Experts note that the infrastructure and scale simply don’t exist in the U.S. to match China’s manufacturing dominance.

While some assembly has shifted to places like India and Vietnam, the critical components still largely come from China. Creating an entirely U.S.-based supply chain would make products like the iPhone three times more expensive. Tariffs alone, especially when inconsistent or poorly coordinated, only create uncertainty for companies. Many businesses hesitate to commit to U.S. investments that could take years to bear fruit, especially with policy risks looming over every decision.

For reshoring to succeed, it would require more than protectionist trade policies. Experts argue that the U.S. must invest in automation, robotics, and industrial policy aimed at long-term competitiveness. Rather than trying to replicate China’s scale, the U.S. must define what kind of high-value manufacturing it wants to excel in. Without a coordinated, stable, and well-funded strategy, reshoring remains more of a political slogan than a practical path forward. FORTUNE

Analysts: Tariffs could undermine USMCA countries’ coordination against China

The upcoming USMCA review offers a critical chance for the U.S., Mexico, and Canada to deepen cooperation against China’s market dominance. Experts say aligning tariffs and trade policy across North America could strengthen a unified front. However, U.S. tariffs on its allies are undermining trust and raising doubts about Washington’s commitment to true regional integration.

Canadian and Mexican officials warn that unless the U.S. offers stability and reciprocity, they may reconsider their participation. Tariffs that hurt partners while asking for cooperation create tensions and reduce incentives for collaboration.

While USMCA has largely delivered positive results, experts agree that future success depends on trust and balanced gains. Without that, efforts to build a resilient, integrated North American economy—and to reshore manufacturing—could falter amid growing skepticism toward U.S. trade reliability. INSIDE TRADE

VECTOR SALES AND TRADING DESK

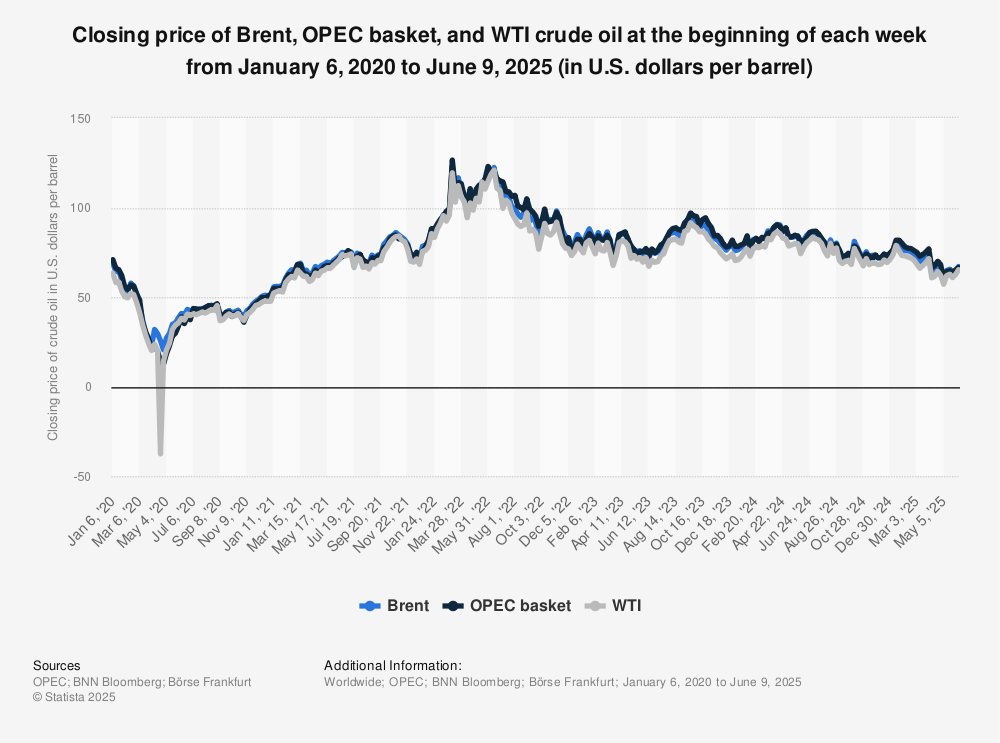

The three main Wall Street indexes closed higher on Monday, supported by a drop in oil prices as concerns over the Israel-Iran conflict eased. The Dow Jones rose 0.75% to 42,515.09 points, the S&P 500 gained 0.94% to 6,033.11, and the Nasdaq advanced 1.52% to 19,701.21.

In contrast, Mexican stock markets ended the day with losses. The S&P/BMV IPC index fell 0.68% to 57,046.85 points, led by declines in shares of mining company Industrias Peñoles, with investors remaining cautious over Middle East developments.

Reshoring Initiative 2024 Annual Report Including 1Q2025 Insights

Job announcements tied to reshoring and foreign direct investment (FDI) are trending lower in Q1 2025, projected at 174,000 for the year—well below the 244,000 in 2024. Despite that, early 2025 saw a record wave of conditional announcements driven by new policy expectations and potential tariffs. However, without a consistent industrial strategy, companies are hesitant to commit, especially as retaliatory threats from China and others could hurt U.S. exports and manufacturing momentum.

The Inflation Reduction Act and related incentives continued driving growth in "essential product" industries in 2024, especially in semiconductors, EV batteries, and solar. These sectors made up roughly two-thirds of all reshoring and FDI job announcements, showing how targeted government support can influence manufacturing activity. Still, progress remains closely tied to fiscal sustainability, as the federal deficit—projected at 5.5% of GDP—limits room for expanded subsidies.

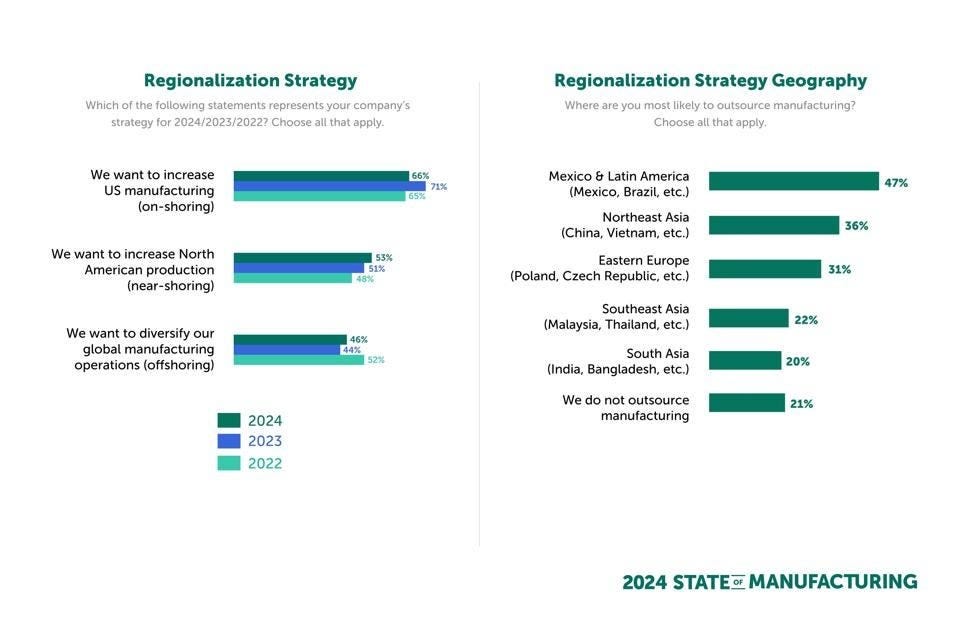

At the heart of reshoring is the U.S. effort to close the cost gap with foreign manufacturing—currently 10–50% higher onshore, depending on the region. President Trump’s push to “reindustrialize America” hinges on a strong national industrial policy that addresses this cost disparity. Without reducing offshore cost advantages or boosting onshore competitiveness, the reshoring wave may remain limited, conditional, and vulnerable to shifting global dynamics.

Rare earths revisited: why countries stop producing things they need, and then try to start again

he U.S. is working to rebuild its rare earths industry after decades of dependence on China, which now controls nearly 70% of global production and 90% of refined products like magnets. Mountain Pass, California, home to the only active U.S. rare earths mine, has resumed not only mining but also domestic processing — a key shift in reestablishing strategic supply chains. This comes at a time of escalating U.S.-China trade tensions, where rare earth access has emerged as a critical geopolitical issue.

Producing rare earths is no simple task. While the materials aren't scarce, the infrastructure, technical expertise, environmental safeguards, and long investment timelines make domestic production extremely difficult. The U.S., like other advanced economies, once outsourced these burdens for cost and efficiency, but rising geopolitical risks and supply chain vulnerabilities have triggered a global rethink. Countries like Japan, Australia, and the U.K. are also pursuing localized production in key industries once deemed expendable.

Despite the growing focus on reshoring, long-term success will depend on more than tariffs and rhetoric. Stable industrial policy, government incentives, workforce development, and international collaboration are all essential. Even if the U.S. rebuilds its rare earth capacity, countries like Brazil, Vietnam, and India hold significantly larger reserves. Ensuring smooth coordination among these nations—rather than turning natural resources into political leverage—could prove more effective for global resilience than isolationist strategies. WORLD ECONOMIC FORUM

2025 Reshoring Survey Report

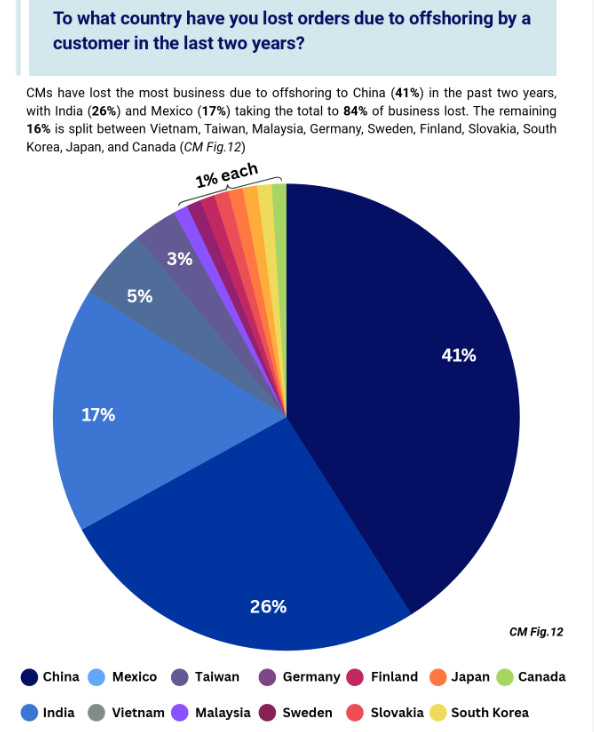

The 2025 Reshoring Survey Report highlights a critical shift in U.S. manufacturing priorities. While reshoring momentum remains strong, the biggest challenge cited by companies is no longer policy-related—it’s the skilled labor shortage. This workforce gap now surpasses tariffs, taxes, and regulation as the top concern, signaling that human capital is the limiting factor in reshoring growth.

Interestingly, although many original equipment manufacturers (OEMs) are satisfied with their reshoring efforts, only a minority use Total Cost of Ownership (TCO) models to guide sourcing decisions. This suggests many are still relying on incomplete cost analyses, potentially missing opportunities to justify local production based on long-term value rather than upfront price alone.

Contract manufacturers (CMs) are increasingly becoming the engine of reshoring. Most report that they’ve already brought production back or are actively quoting projects—especially those linked to U.S.-assembled products. Additionally, proximity to engineering resources has overtaken cost and logistics as the top driver of reshoring decisions, reflecting a shift toward quality, speed, and innovation in the domestic supply chain.

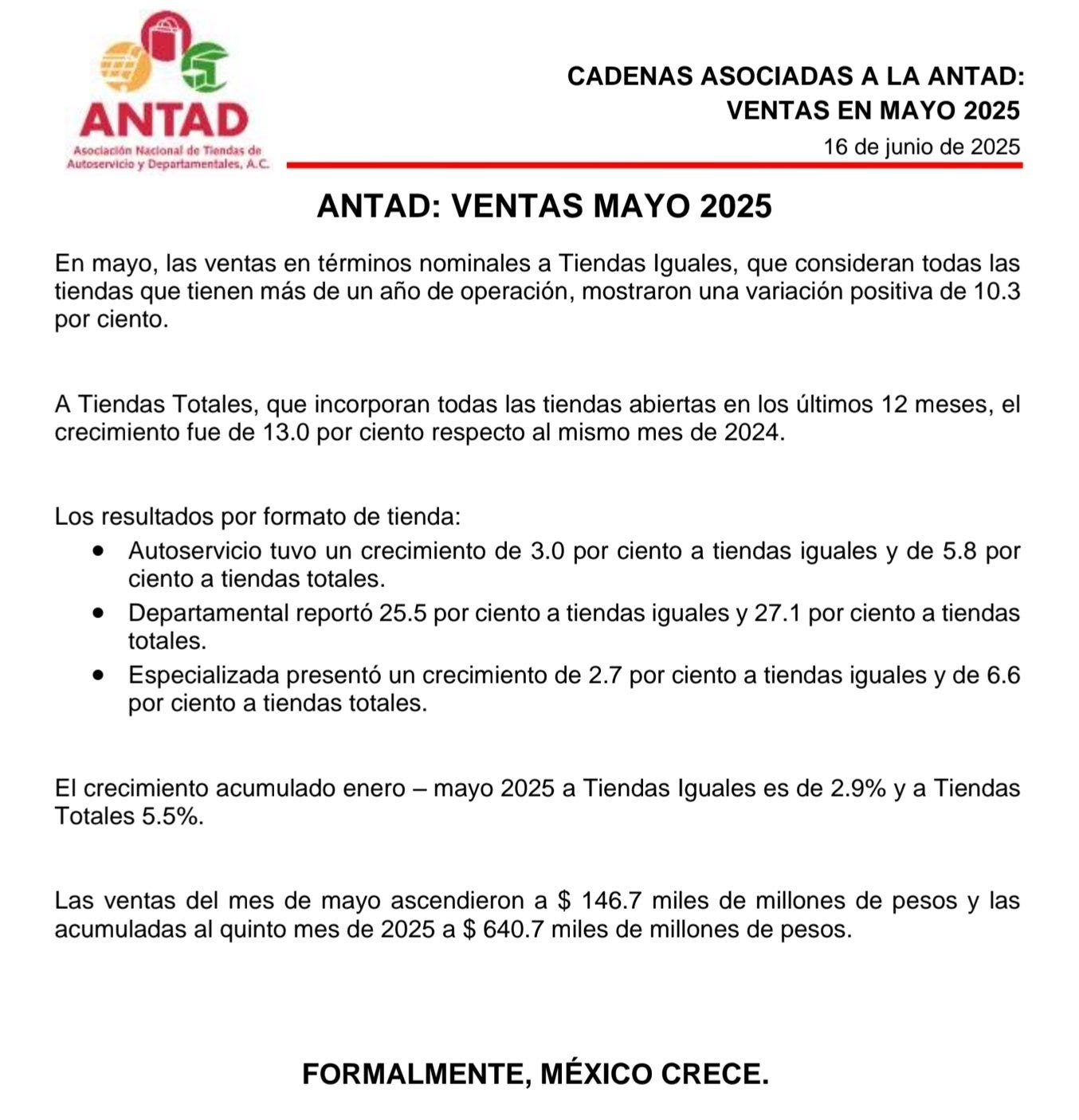

MEXICO CONSUMER: ANTAD SSS 10.3% actual vs 2.4% estimate. The May Same-Store Sales (SSS) figures are beginning to reflect the impact of the Hot Sale campaign. While WALMEX no longer reports SSS data to ANTAD, Liverpool remains included, and the overall results indicate solid performance across the Mexican consumer sector.

PE&OLES*: Peñoles lost -5.9% as investors take profits following a 22% rally since June 4th. The pullback comes amid a retreat in gold prices from record highs, while silver has remained steady, limiting further upside for the stock.

VOLARA: It reported a 2.0% increase, closing at 8.7 pesos per share. Brent crude oil prices fell nearly 2.0% amid signs that the Middle East conflict may not impact oil production, following Iran’s statement expressing an intention to ease tensions with Israel. VOLAR remains highly sensitive to fuel prices, which accounted for approximately 33% of its operating expenses in the first quarter of 2025.

VECTOR RESEARCH

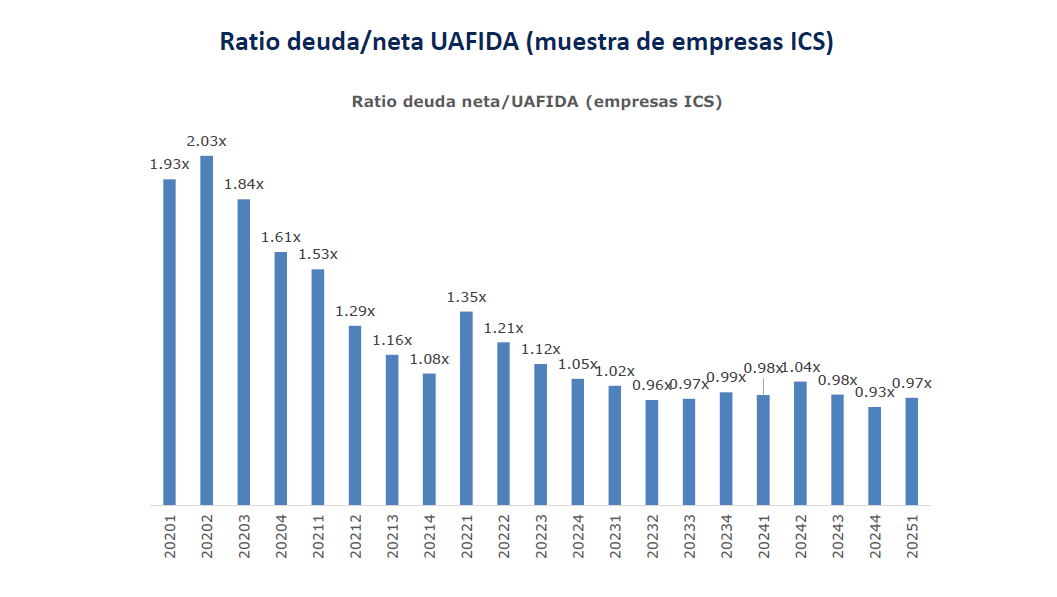

MEXBOL: Review of key financial position indicators as of Q1 2025.

GMEXICOB: Grupo México has agreed to sell its highway business line. The transaction was announced on June 16, 2025.

This business line represents approximately 0.4% of Grupo México’s revenues and 0.6% of its EBITDA.

Grupo México has agreed to sell 81.31% of the capital of its highway business line, while retaining an 18.69% minority stake. The buyers are the trusts FEXI and FIBRAeMX, holding 51% and 49% respectively. The transaction is subject to various conditions, including approvals from the Federal Economic Competition Commission (COFECE) or, if applicable, the National Antitrust Commission, as well as the Secretariat of Infrastructure, Communications, and Transportation (SICT), along with necessary third-party consents. The deal is expected to close in the second half of 2025.

Over the past 12 months, the highway business accounted for approximately 0.4% of Grupo México’s revenues and 0.6% of its EBITDA. The estimated transaction value is MXN 7.7 billion, subject to adjustments, representing about 0.9% of the company’s market capitalization. Grupo México stated that the proceeds will be allocated to investment projects in Mexico and general purposes across its business units.

For now, we maintain our Buy recommendation on GMEXICO shares, with a 12-month intrinsic value estimate of MXN 129 per share.

GAP B: The adjustment has already placed it below the 50-day moving average at 431.5, and if the breakdown is confirmed, it opens the possibility of a decline to the price support at 416.5 or even to the stronger accumulation zone at 400 pesos.

Momentum indicators are trending downward and still have significant room for a further correction.

INTERNATIONAL DAY

June 17 is recognized as the World Day to Combat Desertification and Drought, designated by the United Nations. This day aims to raise awareness about international efforts to combat desertification and the effects of drought, especially in areas vulnerable to land degradation. Each year, it highlights the importance of sustainable land management and the urgent need for global cooperation to address environmental challenges related to soil, agriculture, and water resources.

There's great potential for nearshoring in North America, but only time will tell if domestic politics will help or hamper regional collaboration.