MEXICO: US INFLATION FORECAST

Economists say tariffs are affecting prices, but not enough yet to show up in broad inflation measures like the CPI. They expect a more noticeable impact by summer.

Where’s the Inflation From Tariffs? Just Wait, Economists Say.

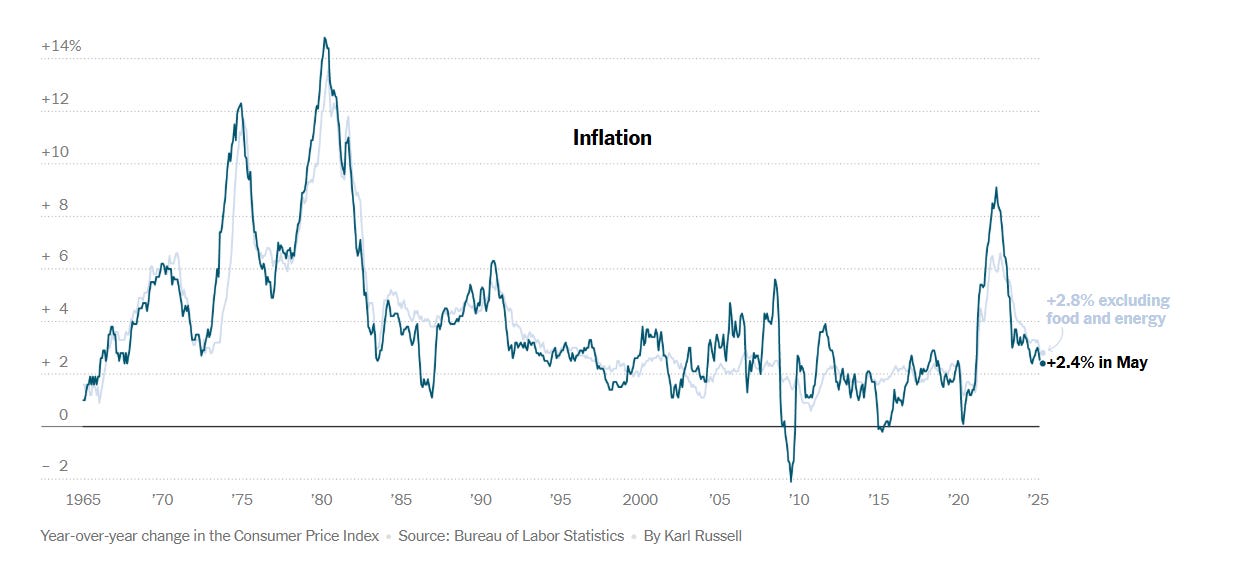

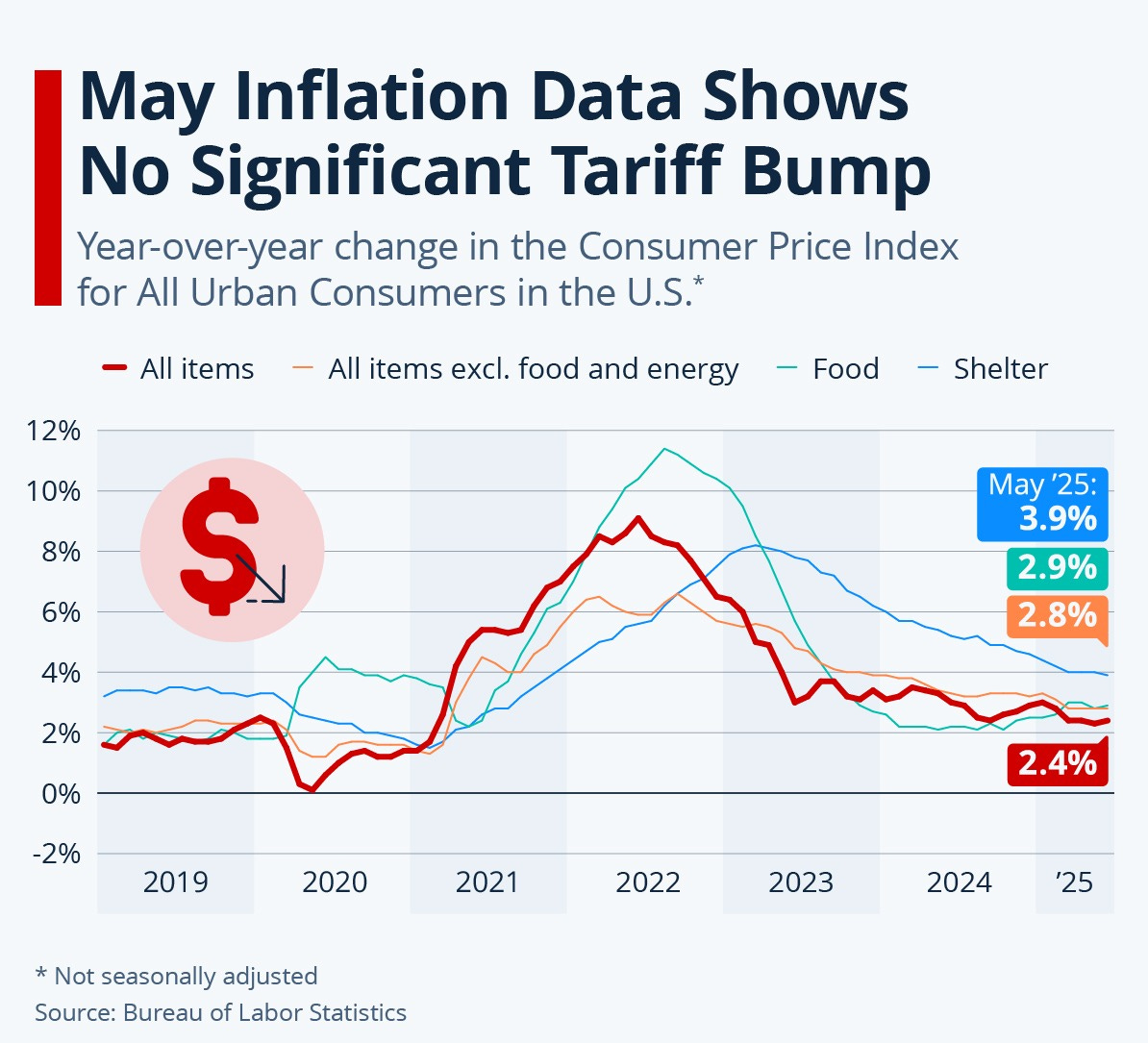

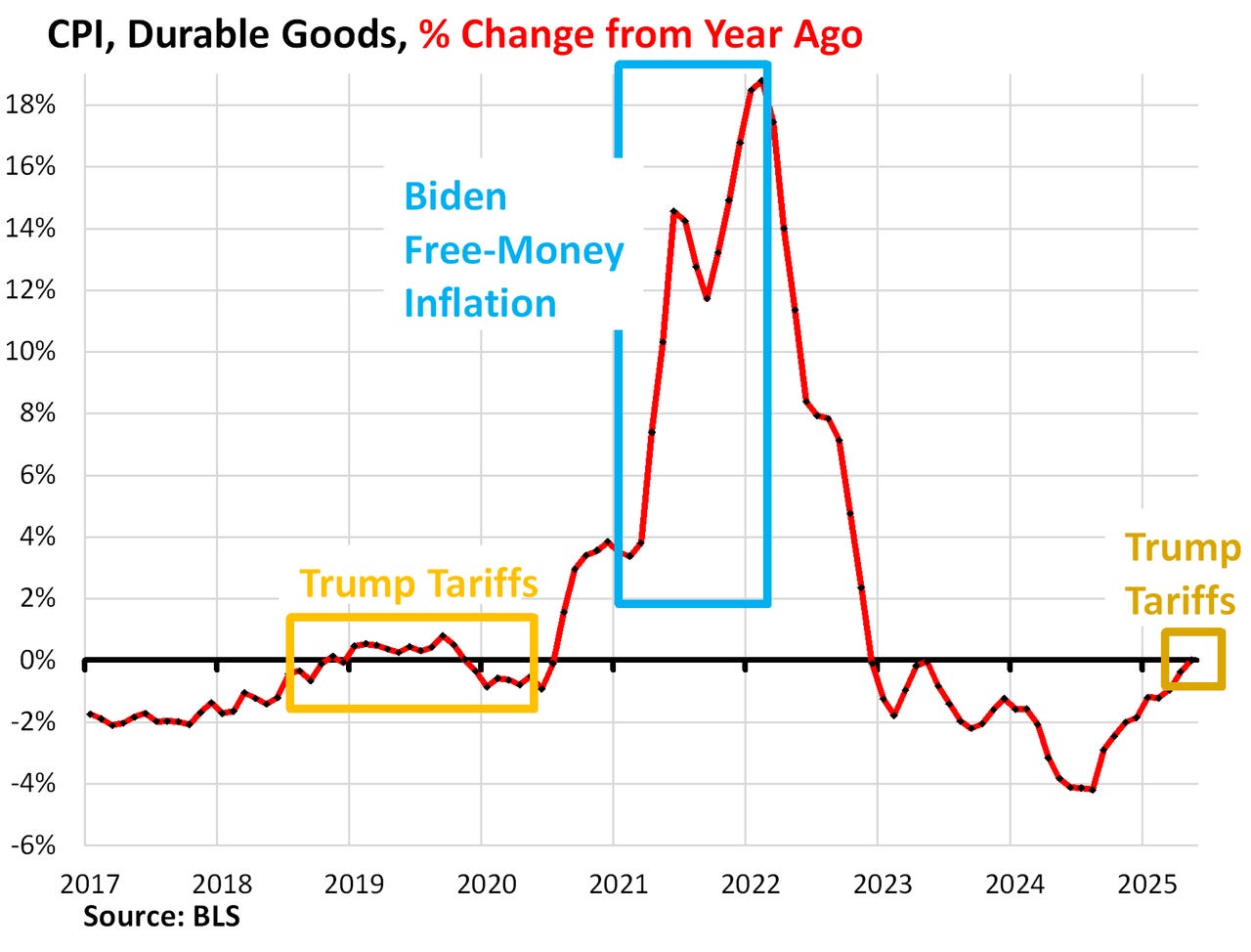

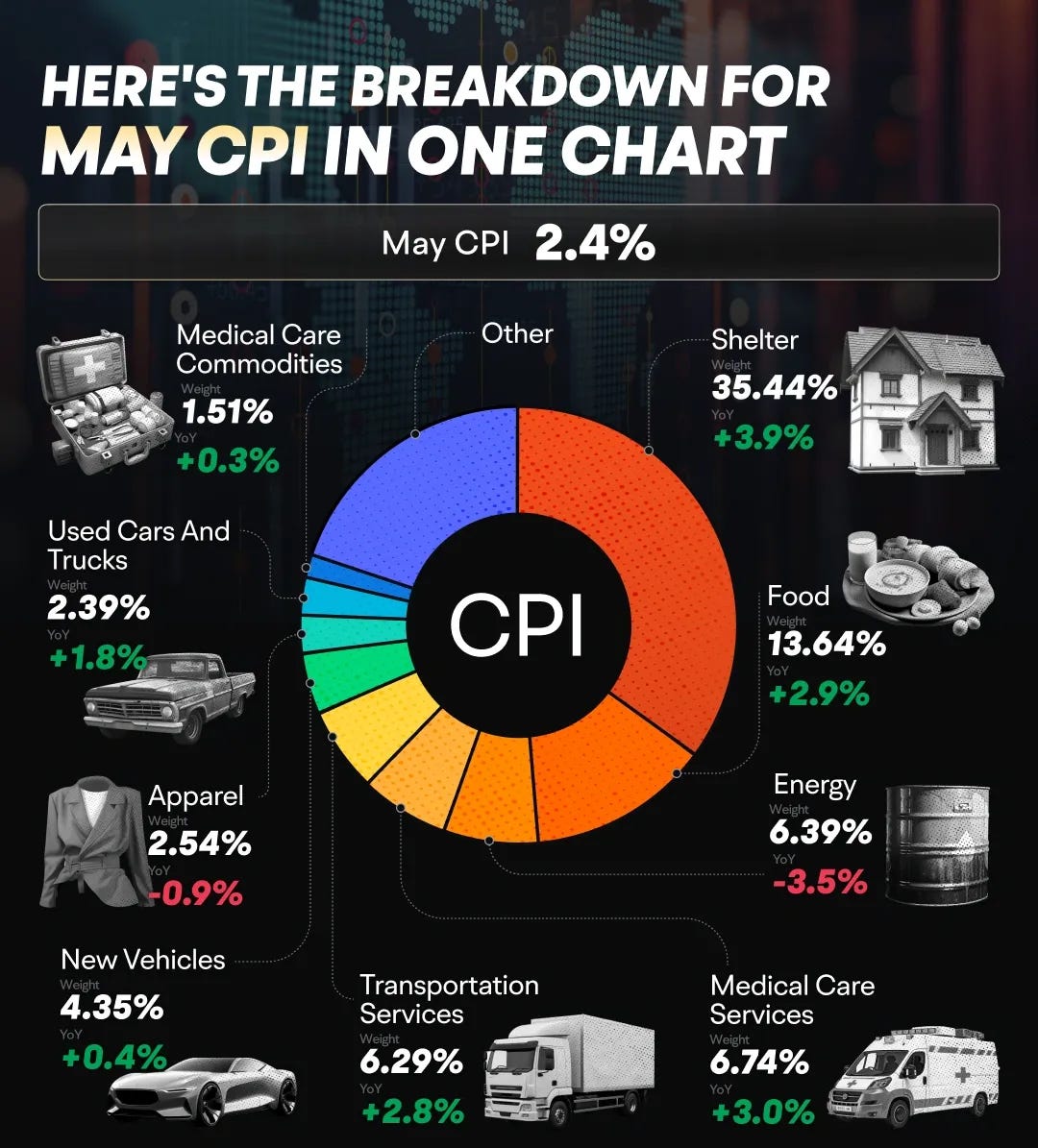

Predictions about a sharp rise in consumer prices have so far failed to materialize, prompting a reassessment among economists. Despite significantly expanded tariffs under former President Trump, inflation has remained relatively muted in recent months, with May’s Consumer Price Index (CPI) up just 2.4% year over year. Economists argue the tariffs are affecting prices — just not fast enough or broadly enough yet to show up in headline inflation data. Historical patterns suggest it may take several months before the full effect is reflected in prices, as was the case during Trump’s first term and the pandemic-era inflation wave.

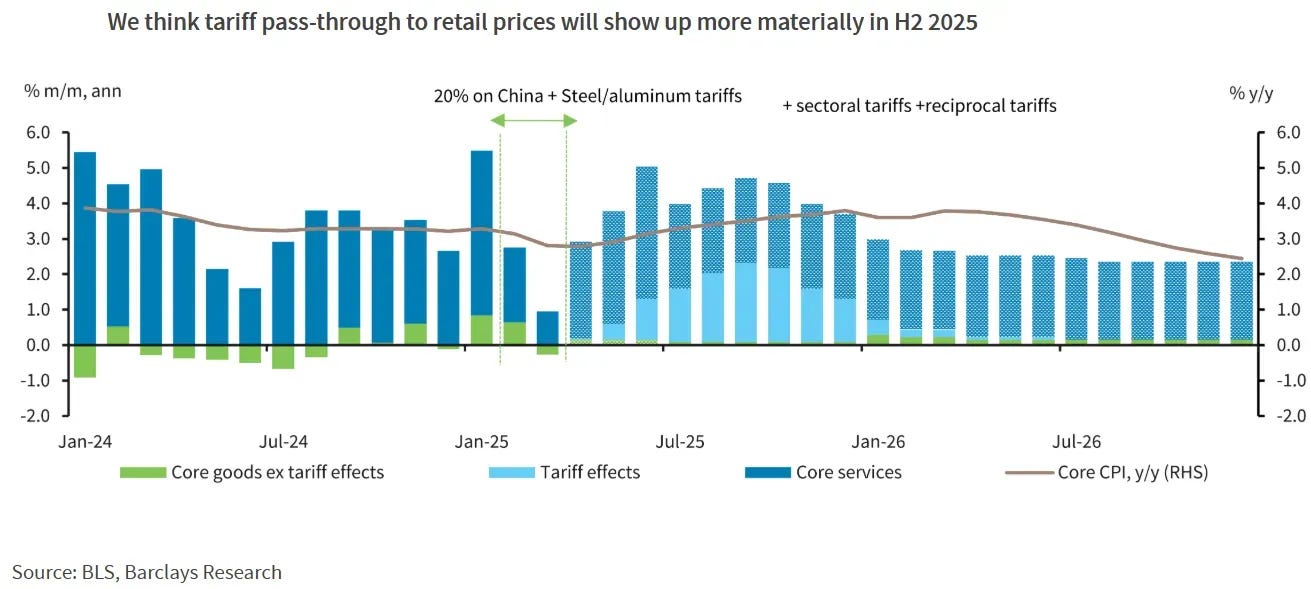

Some early indicators hint at rising pressure. Prices for goods like furniture and electronics — among the most exposed to tariffs — have already begun to tick up, though volatility remains, in part due to excess inventories built up earlier in the year. Retailers have offered discounts to move stock, dampening price increases temporarily. Yet forecasters like Marc Giannoni of Barclays and Stephen Stanley of Santander expect a more pronounced acceleration in prices by summer, potentially pushing CPI inflation toward a 3% annual pace. Still, many believe businesses will absorb some of the cost, limiting how much of the tariff impact is passed on to consumers.

The Federal Reserve remains in wait-and-see mode. With interest rates steady and economic data offering mixed signals, the central bank is holding off on any policy shifts. If inflation does not pick up as expected, the Fed could gain room to cut rates later this year. But if economists’ predictions prove right, and prices surge in the coming months, policymakers may need to stay cautious. Much hinges on whether consumers, increasingly sensitive to higher prices, continue to restrain spending — a factor that could help contain inflation even in the face of trade-driven cost increases.

Here are the three reasons tariffs have yet to drive inflation higher

Despite widespread concerns, President Donald Trump’s tariffs have not yet significantly impacted traditional inflation metrics. Data released this week by the Bureau of Labor Statistics showed only a modest 0.1% increase in both consumer and producer prices for May, suggesting inflation remains subdued—for now. However, that calm may be temporary. While the current figures may not reflect it, economists caution that the delayed effects of tariffs are likely to surface later this summer.

Several dynamics have so far muted inflationary pressures. Businesses stocked up on imports before the April 2 tariff deadline, delaying the pass-through of higher costs to consumers. In addition, it often takes months for tariffs to ripple through supply chains and pricing models. Meanwhile, companies remain hesitant to raise prices due to limited consumer tolerance amid tighter household budgets. According to Nomura economist Aichi Amemiya, “the impact of tariffs will likely materialize in the coming months,” driven by these delayed effects.

Still, early signs of tariff-driven inflation are emerging in specific categories. Prices for canned fruits and vegetables rose 1.9% in May, while appliances and computers also saw notable increases. These moves mirror patterns seen during the 2018–2020 tariff rounds. Whether these gains become broader and more persistent will depend largely on consumer behavior. As the primary engine of the U.S. economy, consumer resilience—or lack thereof—could determine whether inflation accelerates or remains contained. CNBC

Tariff-driven inflation hasn’t hit everyday life yet — but it will, economists insist. Here’s why.

U.S. inflation has remained subdued despite hundreds of billions in new tariffs, leaving economists divided on when—or if—price hikes will fully materialize. While the tariffs have not yet triggered a notable surge in consumer prices, experts warn the calm may be temporary. Stephen Stanley of Santander Capital Markets summed up the consensus: “You can run, but you can’t hide.” Most analysts expect inflationary effects to emerge between June and September as inventories stockpiled in anticipation of tariffs are depleted.

So far, companies have mostly absorbed the costs or delayed price hikes, wary of scaring off customers and unsure of how permanent the tariffs would be. This reluctance, combined with advanced purchasing and pauses in tariff enforcement, has kept price pressures at bay—for now. But with tariffs raising import costs by an estimated $400 billion annually, someone will eventually pay, whether it’s businesses, consumers, or both.

The outlook remains uncertain. Some expect inflation to rise toward 3–3.5% later this year, while others argue any spike will be temporary or muted due to weak consumer demand. If firms can’t pass costs to buyers, profits may suffer, potentially leading to job cuts or reduced investment. Either way, the trade-off will hit the broader economy—through prices, wages, or employment. MARKET WATCH

Yellen expects Trump’s tariffs will hike inflation to 3% year over year

Former Treasury Secretary Janet Yellen warned that tariffs imposed under Donald Trump’s policies are likely to push U.S. inflation to at least 3% year-over-year, potentially even higher. Despite recent inflation prints coming in below expectations, Yellen said, “I definitely expect that we’re going to see them impact pricing,” pointing to the lagged effects of tariff costs working through the supply chain. She added that the average U.S. household could see a hit to income of around $1,000 due to higher prices and knock-on effects on wages and consumption.

Yellen emphasized the uncertainty surrounding which tariffs will ultimately take effect, but maintained that the broader impact on inflation and consumer purchasing power is inevitable. This stands in contrast to claims by Trump and his allies that tariffs won’t significantly affect inflation.

She also expressed concern about potential second-round effects, such as rising wage demands and entrenched inflation expectations, which could prolong elevated inflation. While Yellen did not call for immediate Federal Reserve action, she suggested the central bank remains cautious, acknowledging that it still lacks a clear picture of how the new tariffs will affect both the labor market and inflation dynamics. As a result, she expects the Fed to stay in a holding pattern while monitoring incoming data. CNBC

Oil-Price Surge Could Complicate U.S. Inflation Fight

A sustained rise in oil prices threatens to complicate the U.S. battle against inflation just as consumer prices had shown signs of stabilizing. Ryan Sweet, chief U.S. economist at Oxford Economics, estimates that a $10-per-barrel increase in oil would raise the year-over-year Consumer Price Index (CPI) by 0.5 percentage points. This would dent consumer spending and lower real GDP in the fourth quarter by 0.1% to 0.2%, as the drag from weaker consumption would outweigh any gains in domestic oil investment.

On Friday, U.S. benchmark crude surged $4.94, or 7.3%, fueling concerns that energy prices may reaccelerate after months of relative calm. This adds a fresh layer of complexity to inflation forecasts, particularly at a time when the U.S. economy is also contending with the lagged effects of tariffs imposed earlier in the year. While May’s inflation reading remained tame, energy prices are far more volatile and can quickly ripple through transportation, manufacturing, and consumer goods.

The timing is especially sensitive for policymakers at the Federal Reserve, who have adopted a wait-and-see stance amid mixed signals. A renewed uptick in inflation driven by energy could reduce the Fed's flexibility to cut interest rates later this year. As oil continues to climb, markets and households alike will be watching closely for whether the inflation reprieve was temporary or the start of a more persistent trend. WALL STREET JOURNAL

VECTOR SALES AND TRADING DESK

The three main Wall Street indices fell sharply on Friday. Equities reacted nervously after Iran launched missiles at Israel in response to the initial attacks by the Jewish state aimed at weakening Iran’s nuclear program.

The Dow Jones Industrial Average, made up of 30 major companies, dropped 1.79% to 42,197.79 points, while the S&P 500, which includes the most valuable companies, fell 1.13% to 5,976.97 points. The Nasdaq Composite lost 1.30%, closing at 19,406.83 points.

Mexico’s stock markets also declined on Friday morning. Local equity indices lost ground amid increased risk aversion in global markets following Israel’s attack on Iranian military facilities, which triggered retaliatory actions.

The benchmark S&P/BMV IPC index of the Mexican Stock Exchange (BMV), which tracks the most traded local stocks, dropped 0.86% to 57,332.38 points.

Tariff dent to US inflation limited in May, deeper impact expected ahead

Expected price hikes from the latest wave of U.S. tariffs have yet to significantly appear in official inflation figures, but economists caution that this lull may be temporary. The Consumer Price Index (CPI) rose 2.4% year-over-year through May 2025—virtually unchanged since March—while the core CPI, which strips out food and energy, rose just 2.8%, marking its lowest annual increase since May 2021. Month-over-month inflation also remained muted at just 0.1%, suggesting that the initial impact of tariffs—especially those introduced by the Trump administration—has so far been limited in scope.

Still, early signs of tariff effects are beginning to emerge in specific product categories. Prices for items like toys, audio equipment, and household furnishings—many of which are closely tied to Chinese supply chains—showed noticeable increases, while other categories expected to be affected, such as clothing and motor vehicles, remained stable or even declined. Analysts say the current weakness in inflation readings is likely due to businesses drawing down on inventories stockpiled ahead of the tariff hikes, temporarily shielding consumers from cost increases.

Looking ahead, economists anticipate that the broader impact of tariffs will become more visible by late summer. Companies will face mounting pressure to raise prices as inventories shrink and cost buffers thin. The Federal Reserve’s May Beige Book highlighted growing concern, with mentions of tariffs jumping more than fivefold since January and widespread reports of anticipated price increases. As some firms begin to pass costs on to consumers and others absorb them to protect market share, the delayed inflationary effects of tariffs are expected to gradually seep into the economy—raising the risk of stickier inflation and complicating the Fed’s policy outlook.

Tariff impact still ahead

Despite early fears, U.S. economic data and markets have held up better than expected since the April tariff announcements. Yields on 10-year and 2-year Treasury bonds have risen, and the S&P 500 is up more than 5.5%, signaling investor confidence. Inflation data has been relatively mild, with consumer prices up just 0.1% in May and core inflation steady at 2.8%. This suggests that the impact of tariffs has yet to meaningfully feed through to broader price levels, likely delayed by preemptive inventory stocking and a lag in cost pass-through. However, as inventories thin and tariffs take full effect, inflation pressures are expected to build over the summer.

Job market data reflects a gradual cooling rather than a sharp slowdown. The economy added 139,000 jobs in May, and average gains in 2025 have slowed from 2024 levels. Still, wage growth remains contained, and sectors less exposed to tariffs—like education and healthcare—continue to support job creation. Fed officials are signaling caution. While some, like Governor Kugler, warn of rising inflation risks, others, including Governor Waller, see tariff-related inflation as short-lived and not reason enough to adjust interest rates. For now, the Fed appears more focused on employment stability than preemptively tightening policy.

That stance may be tested by late summer. As firms begin to pass on higher costs, core inflation could climb toward 3.5% year-over-year. With growth slowing and price pressures building, the Fed may face a difficult decision in its September meeting. Meanwhile, the ECB continues to ease policy, cutting rates for the eighth time in this cycle. President Lagarde indicated the rate-cutting cycle is nearly complete, though more reductions are still possible this year. As trade-related uncertainty lingers globally, central banks are navigating diverging paths amid a shifting economic landscape. BNP PARIBAS

Benign US inflation remains vulnerable to tariff-induced price hikes

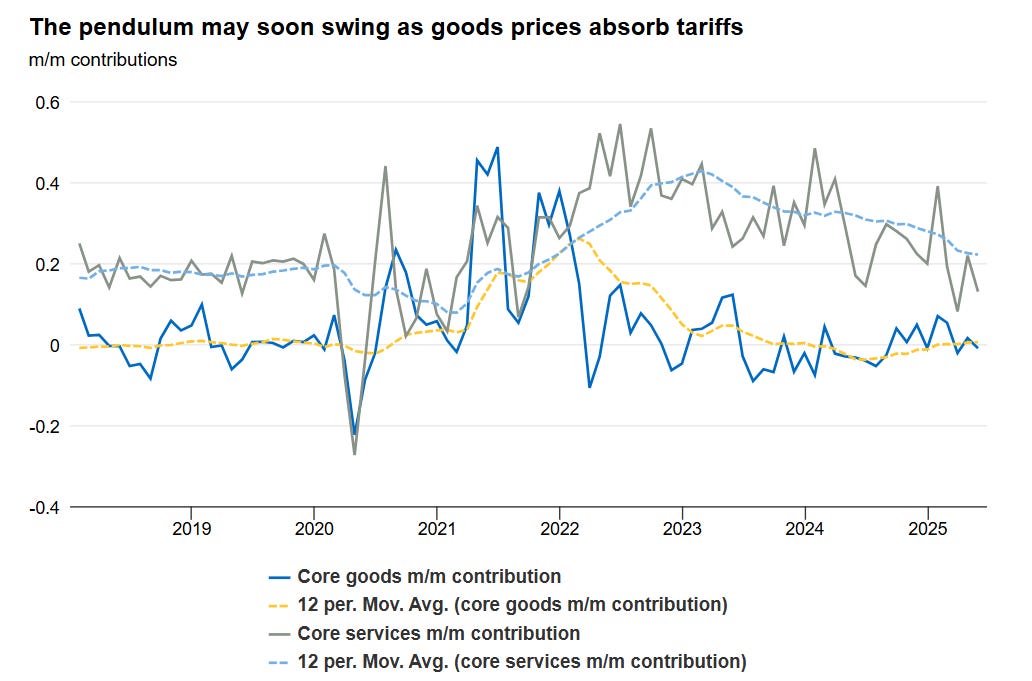

U.S. inflation came in much softer than expected in May, offering markets a temporary reprieve from fears of a sharp price surge triggered by tariffs. Both headline and core CPI rose just 0.1% month-over-month—below market expectations—and continued a trend of subdued price increases. This softness appears largely driven by declines in sensitive categories such as apparel and new car prices, alongside easing airfare and moderate housing rent inflation. Importantly, this suggests that businesses have yet to raise prices in anticipation of tariffs, likely due to the temporary buffer of pre-tariff inventories.

However, this calm may not last. The Federal Reserve's own Beige Book notes growing concern among businesses about cost pressures, with many planning to pass along tariff-related increases by July or August. Based on prior patterns, such as with the 2018 washing machine tariffs, there is typically a lag of about three months before inflation shows a meaningful reaction. As a result, stronger inflation prints are expected in the second half of 2025, with headline CPI likely climbing toward 4% year-over-year by Q3. Despite this, the inflationary effects of tariffs may prove transitory, dropping out of the year-over-year comparisons by late 2026.

Looking ahead, the broader inflation picture remains mixed. While tariffs pose short-term risks, disinflationary forces—particularly from housing—are building. New tenant rent data from the Cleveland Fed points to continued softening in shelter inflation, which makes up about 40% of core CPI. Additionally, a cooling labor market could limit wage-driven price pressures in services, the largest component of the U.S. economy. This dynamic keeps the Fed in a wait-and-see posture for now, with rate cuts still possible later in 2025 if inflation resumes its path toward the 2% target. ING

Core goods helped US CPI in May – but don’t expect it to last

Despite ongoing tariff concerns and a 90-day pause on new measures, the May inflation data largely confirmed expectations that the impact of tariffs has not yet significantly surfaced in the Consumer Price Index (CPI). Core inflation came in softer than forecast, rising just 0.1% month-over-month—below consensus expectations—and holding steady at 2.8% year-over-year. This downside surprise was driven by continued moderation in shelter inflation, falling prices for both new and used vehicles, and flat core goods pricing. However, this relief is likely temporary. If current trade policies persist, analysts expect core inflation to breach 3% later this year as tariff passthrough on goods like auto parts and electronics becomes more pronounced.

Looking deeper into May’s report, headline inflation was also subdued at 0.1% month-over-month, keeping annual CPI growth at 2.4%. Food prices rose by 0.3%, influenced by rising farmer input costs, while energy prices dropped sharply, especially in gasoline and natural gas. In core categories, services inflation again outpaced goods, though some early signs of tariff impact appeared—most notably a near 1% spike in motor vehicle parts and equipment, which could reflect higher input costs from steel and aluminum duties. Yet, weak consumer demand for finished vehicles helped keep broader auto inflation in check.

Despite this temporary reprieve, the broader inflation landscape remains challenging for U.S. consumers. While prices have climbed nearly 25% since the pandemic began, wages have only slightly outpaced this at 27%, leaving many households under pressure. Inflation remains sticky across a wide range of categories, with more items in the CPI basket showing annual price growth of 3–5% than before the pandemic. While this may offer the Fed some short-term flexibility on interest rates, the longer-term risk of persistent inflation tied to tariffs—and its uneven impact on low- and middle-income households—continues to loom large. RBC

GMEXICOB: Grupo México announces the sale of most of its highway business.

Mexican conglomerate Grupo México has agreed to sell most of its highway business for approximately 7.7 billion pesos ($406.4 million), the company announced on Friday.

The deal includes stakes in the highway operators CIBSA, OIBSA, and Autopista Silao, and is expected to close in the second half of 2025, pending regulatory approval.

Proceeds from the sale will be used to finance investment projects in Mexico and for general corporate expenses across Grupo México’s business lines, the company said.

VECTOR RESEARCH

Mexico’s Inflation Surprises to the Upside, But Easing Still Expected by Year-End

Inflation in Mexico has recently surprised to the upside. Of the first five months of the year, inflation came in above market expectations in three, matched expectations in one, and was below in another. As of May, annual inflation stood at 4.42%, above the central bank’s tolerance range and marking the highest level so far in 2025. Core inflation also accelerated unexpectedly, pressuring market expectations for year-end figures. This is raising concerns among some economic agents. Despite persistent inflationary risks, several factors still support the view that inflation may ease in the coming months, with year-end inflation potentially ending below the market consensus of 3.90% (according to Citi’s latest survey).

There are at least four key reasons behind this more optimistic scenario: 1) the Mexican economy still shows significant slack; 2) favorable base effects are expected mid-year, leading to more moderate annual inflation prints; 3) government policy has helped contain low-octane gasoline prices; and 4) supply-side shocks, such as food and energy price disruptions, tend to reverse quickly. Data up to May shows that the main drivers of accumulated inflation so far this year have been food goods, livestock products, non-food goods, and other services. In contrast, fruits, vegetables, and energy have exerted downward pressure. Once seasonal price patterns are accounted for, non-food goods and livestock products stand out as the main inflation contributors.

Non-food goods—such as clothing, appliances, medicine, and vehicles—typically respond to broader economic activity and exchange rate movements. With both weakening in recent months, a slowdown in inflation for these items seems likely. Livestock prices, however, have been unusually high due to factors like weather, avian flu in the U.S., and a screwworm outbreak in southern Mexico. These prices are inherently volatile, suggesting their inflationary contribution may soon reverse. For now, the 2025 inflation forecast remains unchanged, though upside risks are acknowledged. Analysts will closely watch goods and agricultural prices for any trend shifts. Recent inflation data is unlikely to affect Banxico’s monetary stance for now, but the market continues to expect a restrictive policy in 2025 and is preparing for a potential shift to neutral sometime in 2026.

FUNO11: Announced this week it will update the number of CBFIs in circulation. The previously stipulated operation will have a marginal dilutive effect for investors.

FUNO issued a notice on Wednesday regarding the update of the registration in the National Securities Registry (the “RNV”) of the real estate trust certificates with ticker “FUNO 11” (the “CBFIs”) issued by Banco Actinver, announcing:

(i) the issuance of 19,036,441 (nineteen million thirty-six thousand four hundred forty-one) CBFIs to fulfill the Executive Compensation Plan. These will remain in the Trust’s treasury and will be released in proportion and as they are granted as part of the Executive Compensation Plan, in accordance with the resolutions of the Holders’ Meetings dated April 4, 2014, April 26, 2024, and the Technical Committee session dated February 25, 2025;

and (ii) the cancellation of 9,138,416 (nine million one hundred thirty-eight thousand four hundred sixteen) CBFIs that were repurchased by the Issuer through its CBFI Buyback Fund (the “Buyback Fund”), in accordance with the resolutions of the Holders’ Meeting dated October 16, 2015, and the Technical Committee session dated July 22, 2020, pursuant to Rule 3.21.2.7 of the current Miscellaneous Tax Resolution; the foregoing in compliance with the instruction dated April 28, 2025, issued to the Issuer by the special delegates of those meetings and the aforementioned Technical Committee session.

In aggregate, the update will have a marginal (0.3%) dilutive effect on current investors, while being a known event, as the operation had already been authorized at the ordinary meeting on April 26, 2024, and the specific issuance amount was confirmed at the Technical Committee meeting on February 25, 2025.

USDMXN: While the U.S. dollar extended its losses against most currencies, the impact on the USDMXN was limited though it remained below the 19.0 pesos per dollar mark.

A consolidation between that level and the support at 18.80 is not ruled out, although technical indicators still point upward, suggesting a likely rebound after this pullback. That said, a break below the 18.80 support could take the pair down to 18.60 before resuming its upward trend.

INTERNATIONAL DAY

International Waterfall Day is celebrated annually on June 16 to honor the awe-inspiring beauty and ecological significance of waterfalls worldwide. Established in 2020 by Bob Matthews and his wife, the day encourages individuals to appreciate these natural wonders and raise awareness about their conservation. Waterfalls play a crucial role in sustaining ecosystems, supporting biodiversity, and providing vital resources such as freshwater and hydroelectric power. They also serve as cultural symbols and attract millions of tourists, contributing to local economies. Observing International Waterfall Day involves activities like visiting nearby waterfalls, sharing experiences on social media, supporting environmental organizations, and creating art inspired by these majestic features. The day serves as a reminder to balance enjoyment with preservation, ensuring that future generations can continue to marvel at these natural masterpieces.