MEXICO: US BOND MARKET CRISIS

The U.S. debt ceiling standoff, GOP tax bill, and surging JGB yields are triggering a crisis in the U.S. bond market.

Wall Street Warns Trump Aides About GOP Tax Bill

Wall Street executives are expressing growing concern about the GOP-backed tax bill championed by President Donald Trump, warning it could exacerbate U.S. deficits, increase borrowing costs, and destabilize the bond market. The House-approved legislation, projected to add at least $2.3 trillion to the national debt, primarily through tax cut extensions, also includes provisions for increased defense and immigration spending. Financial experts worry that surging deficits may lead investors to demand higher yields on U.S. debt, thereby raising long-term interest rates across the economy. This pressure is already visible with Treasury yields surpassing key thresholds. While the Trump administration downplays these concerns, citing future economic growth and potential Federal Reserve rate cuts, skeptics argue that the bill’s fiscal impact could outweigh any growth benefits. Critics, including Senator Rick Scott, suggest that the bond market is signaling that U.S. fiscal policy is unsustainable.

The U.S. bond market has become ultra-focused on what the incoming Trump administration and its Congressional allies may deliver as they strive to enact a wide-ranging agenda that also includes deporting illegal immigrants and introducing new tariffs on imports. Additionally, Congress is facing a mid-year deadline to address the nation’s debt ceiling, or else risk a default. Longer-dated U.S. Treasury yields jumped to their highest levels since November 2023 this week, with the 10-year bond hitting a high of 4.79%. It traded lower to 4.66% on Wednesday afternoon. “Congress has to reduce the deficit,” Republican Representative Andy Barr said. “The bond market is telling Congress that if we don’t get our fiscal house in order, everybody’s mortgage rates, everybody’s credit card rates, everybody’s auto loan rates, are going to continue to go up.”

Former President Bill Clinton’s political strategist James Carville famously said in 1993 that he wanted to be reincarnated as the bond market, because “you can intimidate everybody.” If Congress’ moves signal too big of a deficit hike, some market analysts are concerned that excess debt issuance will cause market indigestion that drives up yields sharply. “One can’t exclude the risk that trust in U.S. economic policymaking might be lost, the bond vigilantes could come out in full force and pressure rates significantly higher, and the U.S. and global economies could be badly shaken,” said Mark Sobel, a former U.S. Treasury official who is now the U.S. chairman at the Official Monetary and Financial Institutions Forum, a think tank. Nathan Thooft, chief investment officer and senior portfolio manager for Manulife Investment Management, said Congress and Trump’s administration will likely adjust course based on market reactions. “They will react to incoming feedback as it comes,” Thooft said. “Dollar gets too strong, they’re probably going to back away a little bit. Equity markets act up too much, they might back away a little bit. They care about these things.” WASHINGTON POST

Wall Street Warns Trump Tax Bill Risks Bond Market Shock

Wall Street executives are voicing serious concerns that President Donald Trump’s proposed tax legislation—aimed at extending the 2017 tax cuts—could destabilize the U.S. bond market and raise borrowing costs across the economy. The GOP-backed bill, recently passed in the House, is projected to add $2.3 trillion to the national debt over the next decade—and potentially over $5 trillion when interest and likely future extensions are included. Despite mounting fiscal anxiety, the White House maintains that the bill’s impact is manageable, citing expected revenue boosts from tariffs and economic growth.

The core of Wall Street’s anxiety lies in the Treasury bond market, which anchors the global financial system. Analysts warn that expanding federal deficits could force the U.S. government to offer higher yields to attract investors—leading to elevated rates on mortgages, business loans, and other forms of credit. Bond yields have already climbed past key psychological thresholds, with the 30-year Treasury briefly exceeding 5%. Some prominent figures, like JPMorgan CEO Jamie Dimon, warn that a “crack in the bond market” is inevitable, even if the timing remains uncertain.

While administration officials defend the bill’s growth potential, market experts caution that if the tax cuts fail to produce significant economic gains, investor reaction could worsen. Critics like Sen. Rick Scott point to bond market movements as a warning sign, arguing that rising yields reflect waning confidence in U.S. fiscal discipline. As Wall Street scrutinizes the legislation’s long-term implications, the bill has become a flashpoint for debate over America’s debt trajectory and economic future. NEWS MAX

Dollar’s correlation with Treasury yields breaks down

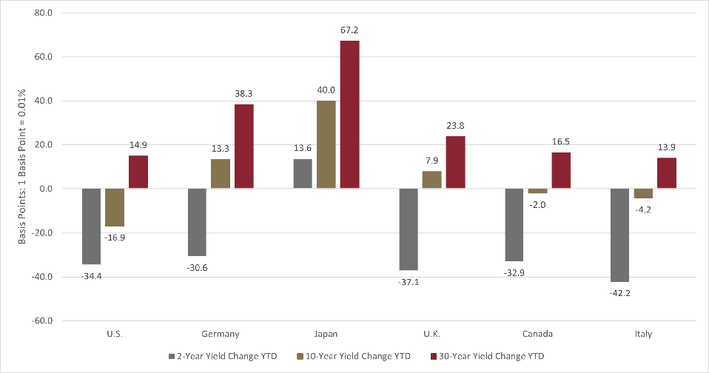

The historically strong correlation between U.S. Treasury yields and the U.S. dollar has broken down, as global investors grow wary of American assets in light of President Donald Trump’s erratic fiscal and trade policies. Typically, rising yields attract foreign capital and bolster the dollar, but recent developments—such as Trump’s aggressive tariff measures and a ballooning deficit—have driven a divergence. Since early April, 10-year Treasury yields have climbed from 4.16% to 4.42%, while the dollar has fallen nearly 5% against major currencies, marking the weakest correlation in nearly three years.

Analysts suggest that the rise in yields is now being driven less by economic optimism and more by fears of U.S. fiscal instability. Warnings from Moody’s about the U.S. credit rating, rising credit default swap spreads, and Trump’s public pressure on Federal Reserve Chair Jerome Powell have all undermined investor confidence. Experts like Citadel’s Michael de Pass argue that the dollar’s strength depends on institutional credibility—something now seen as under threat. UBS strategist Shahab Jalinoos noted that these dynamics, more common in emerging markets, are now appearing in the U.S. due to growing fiscal and political uncertainty.

This shift has significant implications for portfolio strategy. Amundi’s Andreas Koenig and Goldman Sachs analysts warn that the dollar’s newfound volatility disrupts its role as a stabilizing asset in global portfolios. With the dollar falling alongside equities and yields rising, traditional hedges are breaking down. Investors are increasingly hedging dollar exposure and reallocating toward other currencies like the euro, yen, and Swiss franc, while Goldman Sachs recommends considering gold as a defensive asset amid rising uncertainty about U.S. policy and fiscal sustainability. FINANCIAL TIMES

Credit default swaps are back in fashion — even if the panic might be overblown

The cost of insuring against a U.S. government default has surged in 2025, as investors grow anxious over the unresolved debt ceiling. Credit default swap (CDS) spreads on both one-year and five-year U.S. sovereign debt have climbed significantly, reflecting rising political risk rather than concerns of actual insolvency. Analysts emphasize that the spike in CDS demand is a hedge against growing fiscal dysfunction and partisan gridlock, particularly after the U.S. hit its $36.1 trillion borrowing limit in January. Treasury Secretary Scott Bessent has warned Congress that the government could run out of borrowing capacity by July unless the ceiling is raised.

This anxiety has caused CDS spreads to reach their highest levels in two years, reminiscent of previous debt ceiling standoffs in 2011, 2013, and 2023. The House has passed a tax package that may allow for a $4 trillion increase in the debt ceiling, but the Senate has yet to act. Investors fear that political brinkmanship could lead to a repeat of past close calls, where last-minute deals narrowly averted technical defaults. Some fear that growing debt and interest obligations may eventually crowd out government spending, requiring higher yields to keep attracting buyers.

Despite the heightened caution, many experts argue the current spike in CDS prices is likely temporary. They stress that the U.S. is highly unlikely to default, as the government has always prioritized debt servicing and resolved previous debt ceiling crises. Moody’s recently downgraded the U.S. credit rating due to fiscal concerns, but analysts say the real threat lies in long-term fiscal management, not immediate default. If the Senate acts before its August recess, as expected, much of the current market stress could quickly subside—though worries about America’s long-term fiscal path may persist. CNBC

Pension Funds Won’t Save the Bond Market

Pension funds, particularly in the corporate sector, are in their strongest financial position in over a decade—an outcome driven by soaring equity markets and a rise in long-term bond yields. The aggregate funded ratio of the 100 largest U.S. corporate defined-benefit pension plans reached 101% at the end of 2024, according to Milliman, marking the first time since 2007 these plans were fully funded. This milestone is reshaping how pension funds invest: with fewer concerns about catching up to meet future obligations, many are moving away from riskier assets and long-duration bonds, favoring more stable, intermediate-term fixed-income instruments instead.

This shift is already being felt across markets. The long end of the Treasury yield curve—particularly 30-year bonds, which recently touched 5.15%—has seen waning demand from well-funded pensions. These investors once heavily relied on long-duration bonds to match future payouts, but now, as their plans mature and beneficiary pools age, there's a growing preference for more liquid, medium-term securities that offer easier portfolio rebalancing and less exposure to volatility. Analysts at Bank of America and Capital Group highlight this trend as a structural headwind for long bonds and illiquid assets like private equity, which pensions may reduce in favor of more nimble holdings.

Public-sector pensions, which remain underfunded on average (with a funded ratio of just 80% as of April), have not mirrored this shift. Unlike many corporate pensions that are now frozen and closed to new beneficiaries, public pensions remain active and often rely more heavily on equities and private investments in pursuit of higher returns. Their allocation to fixed income remains low—around 20%, compared to over 50% for corporate plans. As funding disparities grow and the broader market responds to both interest rate uncertainty and shifting demand, the investment strategies of large pension funds will be increasingly consequential—not just for their beneficiaries, but for bond markets, private equity, and fiscal policymakers alike. WALL STREET JOURNAL

Investors are piling into big, short Treasury bets alongside Warren Buffett

In 2025, fixed-income investors are avoiding long-term Treasuries amid persistent bond market volatility and shifting economic signals. The short end of the yield curve has become the preferred destination, offering higher yields and greater stability. The 3-month T-bill is yielding over 4.3%, while the 10-year note is barely outperforming at around 4.4%, making the risk premium for longer maturities less compelling. As a result, ultra-short bond ETFs such as the iShares 0–3 Month Treasury Bond ETF (SGOV) and SPDR Bloomberg 1–3 Month T-Bill ETF (BIL) have seen massive inflows, collectively taking in more than $25 billion year-to-date. Even Warren Buffett's Berkshire Hathaway has taken a strong position in short-term Treasuries, reportedly owning 5% of the entire T-bill market.

Strategists and analysts point to the volatility concentrated on the long end of the yield curve as a key reason for this flight to safety. Joanna Gallegos of BondBloxx notes that the 20-year Treasury has swung between negative and positive territory multiple times this year, while Todd Sohn of Strategas warns that long-duration bonds, particularly those over seven years, are underperforming and not worth the risk. This trend has emerged nine months after the Federal Reserve began cutting interest rates—a cycle it has since paused amid rising concerns about inflation, government deficits, and the potential impact of looming tax cuts. Long-term Treasuries and corporate bonds have posted rare negative returns since last fall, drawing comparisons to performance last seen during the Financial Crisis.

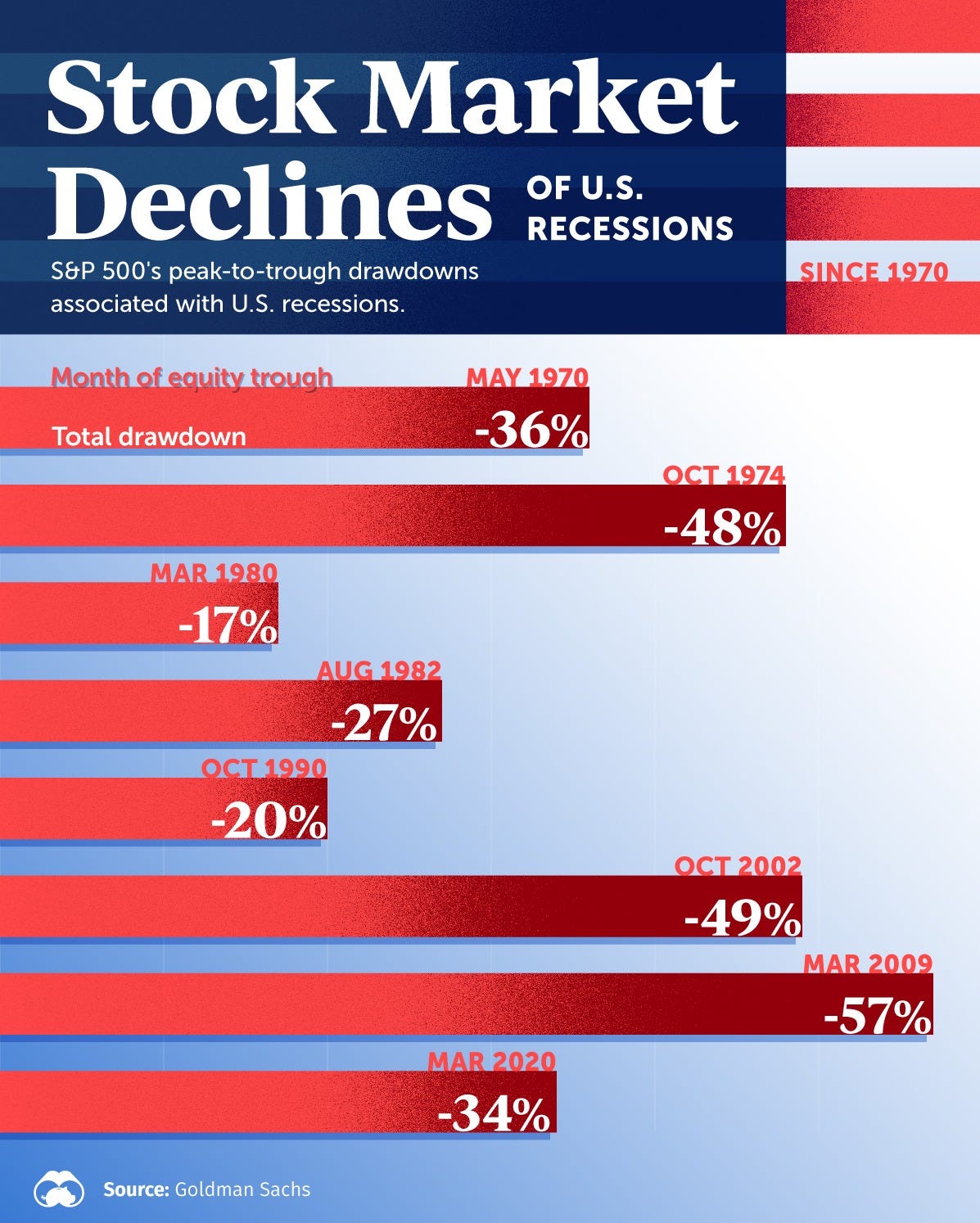

Despite these concerns, some investors are still overly concentrated in equities, particularly U.S. large-cap tech, at the expense of fixed-income diversification. Gallegos warns that this imbalance could leave portfolios vulnerable in the event of a market correction. Meanwhile, Sohn encourages investors to broaden their horizons internationally. European and Japanese equity ETFs have delivered strong returns, with the iShares MSCI Eurozone ETF (EZU) up 25% in 2025 alone. As the S&P 500 recovers from a volatile year that included a 20% drawdown and subsequent rebound, the evolving bond landscape—and opportunity abroad—suggests that disciplined diversification, both across asset classes and geographies, is more important than ever. CNBC

Japan's bond market ignites fears of outflows from U.S., carry trade unwind and market turmoil

Yields on Japan’s long-term government bonds have surged to record highs, raising global alarms about potential capital repatriation and the unwinding of the yen carry trade. The 40-year Japanese government bond yield hit a historic 3.689% last Thursday and remains elevated, alongside similarly steep increases in 30- and 20-year bonds. This rapid rise stems from waning domestic demand—particularly from life insurers who have largely fulfilled their regulatory buying—and reduced support from the Bank of Japan, which began pulling back on bond purchases in a major policy shift last year. As yields climb, analysts warn that Japanese investors may shift capital back home, pulling funds out of U.S. assets and potentially triggering broad financial disruption.

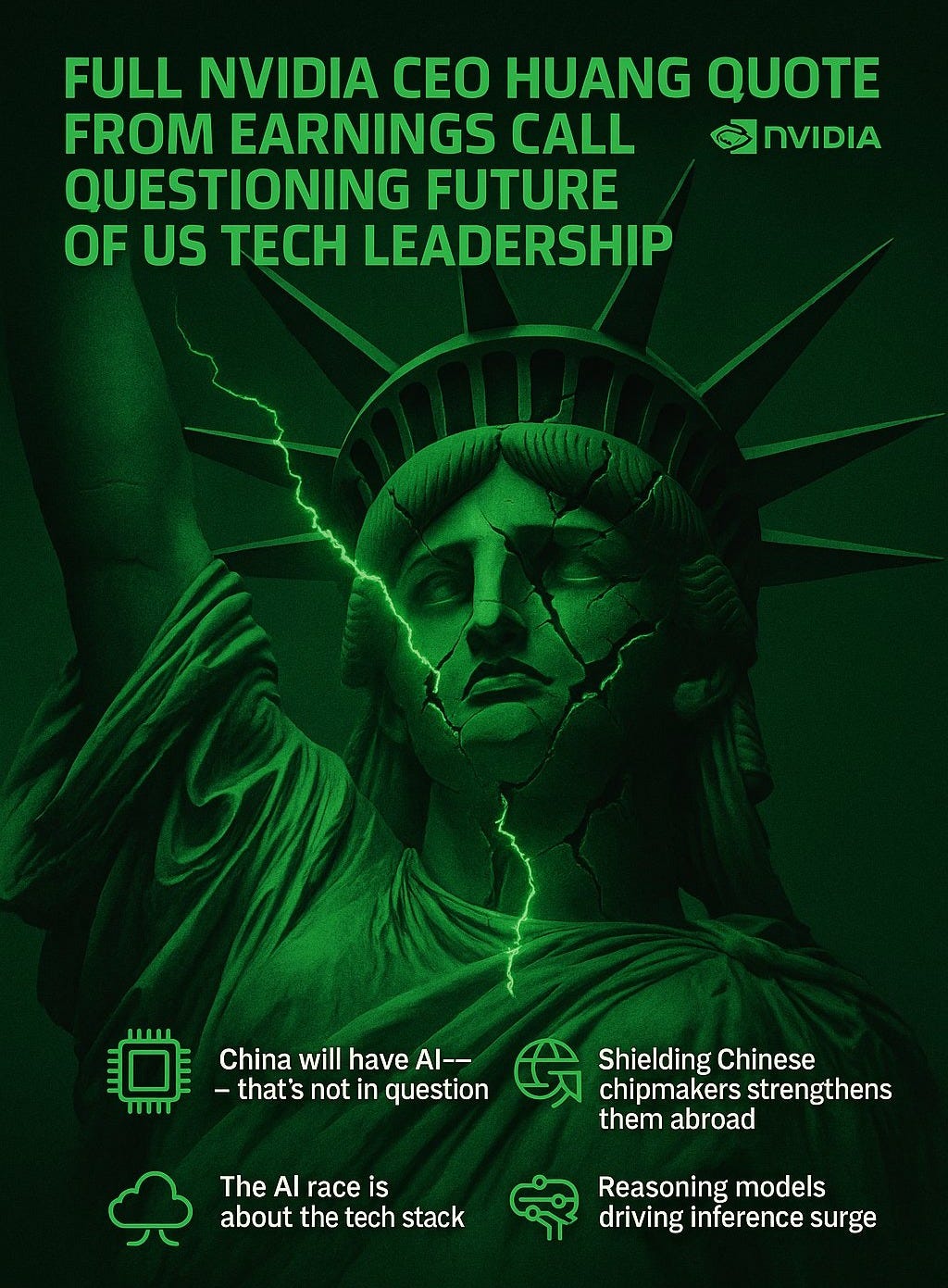

Such a move could spark a powerful reversal in the carry trade—a long-standing strategy where investors borrow cheaply in yen to invest in higher-yielding foreign assets. A stronger yen, driven by capital returning to Japan and a declining interest rate advantage versus the U.S., would erode the trade’s profitability. Strategists including Albert Edwards of Societe Generale and Alicia García-Herrero of Natixis caution that a major unwind could echo or even surpass the volatility seen last August when a sudden yen surge roiled global markets. U.S. tech stocks, which have drawn heavy Japanese investment, could be among the hardest hit. Meanwhile, elevated yields globally translate to rising borrowing costs, further tightening financial conditions and threatening asset prices.

Still, some analysts expect a more gradual shift rather than a sharp dislocation. Riccardo Rebonato of EDHEC sees a slow erosion of U.S. dollar confidence and yen carry positions, rather than an abrupt crash. Others, like Masahiko Loo of State Street, argue that Japan’s large holdings of U.S. Treasurys are deeply entrenched in the broader U.S.–Japan strategic relationship, limiting the likelihood of mass bond selling. Additionally, most foreign-held U.S. assets are equities rather than Treasurys, suggesting that if capital outflows accelerate, the impact could hit stocks first. Nevertheless, with Japan being the world’s largest net creditor and its domestic yields rising fast, global markets are increasingly vulnerable to shifts in Japanese investment behavior. CNBC

Japan's bond selloff is a warning to the world

apan’s bond market is rapidly unraveling, and it’s becoming a cautionary tale for other debt-heavy nations. Demand for Japan’s ultra-long bonds—particularly the 40-year maturities—has plunged, with recent auctions flopping at historic levels. Yields have surged to record highs, a stunning shift in a country long associated with near-zero interest rates and reliable demand for sovereign debt. Despite efforts from Japan’s Ministry of Finance to calm markets by signaling a potential cut in long-term bond issuance, investor confidence remains shaky. The dramatic rise in yields and evaporating demand is sending a clear warning: patience with unsustainable deficits may be running out.

Behind this turmoil is a broader economic trap. Japan is wrestling with stagflation—rising inflation, shrinking GDP, and declining real wages—while sitting on the world’s largest debt burden relative to GDP at over 260%. Life insurers, traditionally among the largest buyers of long bonds, are now reporting staggering paper losses, with Nippon Life alone seeing $25 billion in unrealized losses last quarter. With the Bank of Japan stepping back from bond purchases, policymakers are caught between raising rates to fight inflation or keeping them low to avoid deepening the downturn—both unattractive options with potentially global consequences.

Japan’s unraveling may be a preview of what’s coming for other advanced economies. The U.S., for example, is also flooding markets with long-term debt just as demand is softening—evidenced by poor auction results and surging yields, especially after the announcement of a Trump-endorsed tax cut package. Although yields have momentarily eased, the core issue of fiscal imbalance and buyer fatigue remains. If Japan, with its decades of policy experimentation and financial discipline, is struggling to maintain confidence, it poses an urgent question for other nations: what happens when the world’s biggest bondholders begin to walk away? QUARTZ

VECTOR SALES AND TRADING DESK

Wall Street closed with little change on Friday. The indexes ended mixed, though with a negative bias, as investors assessed the new trade environment following an accusation by U.S. President Donald Trump against China and the reactivation of tariffs.

The Dow Jones Industrial Average, made up of 30 major companies, gained 0.13% to 42,270.07 points, while the S&P 500, which tracks the most valuable companies, fell 0.01% to 5,911.69 points. The tech-heavy Nasdaq Composite dropped 0.32% to 19,113.77 points.

Mexico's stock markets declined this Friday. Local equity indexes pulled further away from record highs, digesting news from the United States and awaiting Sunday’s historic first elections for the Judicial Branch.

The benchmark S&P/BMV IPC index of the Mexican Stock Exchange (BMV), which tracks the most traded local stocks, fell 1.32% to 57,841.69 points.

We Are Witnessing the Bond Market’s Power to Intimidate

The bond market, long seen as a sober barometer of economic health, is sending unsettling signals. Soaring long-term yields in the U.S. and Japan reflect growing investor unease with runaway deficits, erratic trade policy, and political dysfunction. Wall Street is anxious, not just because of stock market swings, but because bonds — normally a haven — are falling in tandem with equities, amplifying fears of deeper instability.

In the U.S., the recent surge in Treasury yields, briefly topping 5% for 30-year bonds, comes amid a record debt burden and a GOP tax bill that could push the debt-to-GDP ratio past 129% within a decade. Investors are starting to question how long global demand for U.S. debt can keep up. Meanwhile, Japan — with the highest public debt of any major economy — is struggling to sell long-term bonds, a warning that even deeply entrenched buyers may lose patience.

If bond investors grow skittish, borrowing costs could rise sharply, hitting everything from mortgages to government budgets. The U.S. still enjoys the privilege of issuing the world’s reserve currency, but as global bond markets wobble under the weight of political and fiscal uncertainty, that advantage may not be enough. The lesson: don’t underestimate the bond market’s ability to impose discipline — or inflict pain.

Trump accuses China of violating preliminary trade deal

Former President Donald Trump sharply criticized China on Friday, accusing it of violating a preliminary trade agreement that had paused retaliatory tariffs between the two nations. In a post on Truth Social, Trump expressed frustration, stating, “So much for being Mr. NICE GUY!” and claiming China had reneged on the deal made earlier this month. The agreement had been intended to ease tensions after the U.S. imposed steep tariffs on Chinese imports, prompting reciprocal action from Beijing. Following Trump’s statement, U.S. stock futures declined, reflecting renewed market uncertainty.

Trump’s criticism was echoed by U.S. Trade Representative Jamieson Greer, who, in an interview with CNBC, described China’s alleged non-compliance as “completely unacceptable.” He insisted that the U.S. had held up its end of the agreement while accusing China of stalling implementation. Meanwhile, Treasury Secretary Scott Bessent indicated that trade negotiations with China had stalled, adding to concerns about the stability of the already fragile economic relationship between the world’s two largest economies. The Chinese embassy in Washington, D.C., has yet to respond to requests for comment.

In his post, Trump also described the initial economic pressure on China as severe, claiming that the U.S. tariffs had nearly halted Chinese trade and caused widespread factory closures and civil unrest. He said he agreed to a quick deal not out of necessity for the U.S., but to prevent economic collapse in China. However, Trump now alleges that China has broken that deal, reigniting tensions and hinting at possible retaliatory measures. His remarks come amid renewed political scrutiny over his trade policies, including criticism suggesting that Trump often softens his stance after tough talk—an idea reflected in the “TACO trade” term coined by financial commentators. CNBC

China hits back after Trump claims it is 'violating' tariff truce

Tensions between the United States and China have reignited after President Donald Trump accused Beijing of violating a recently negotiated truce on tariffs. The agreement, reached during high-level talks in Geneva on May 11, included mutual commitments to suspend and reduce certain tariffs for 90 days. However, Trump claimed on Friday that China had “totally violated its agreement with us,” though he did not provide specific details. U.S. Trade Representative Jamieson Greer later clarified that China had failed to remove non-tariff barriers as agreed and accused Beijing of slow-rolling its compliance, particularly in areas such as blacklisting U.S. firms and restricting exports of critical materials like rare earth magnets.

China responded by urging the U.S. to halt what it called “discriminatory restrictions,” pointing specifically to Washington’s tightened controls on semiconductor technologies and machinery exports. Chinese officials have also criticized the U.S. for abusing export control measures and have called for a renewed commitment to the spirit of cooperation from the Geneva talks. Despite ongoing communication between the two sides, Treasury Secretary Scott Bessent acknowledged that negotiations have “stalled,” citing the complexity of the issues at stake. He nevertheless expressed hope that future discussions — possibly including direct talks between Trump and Chinese President Xi Jinping — could revive progress.

Meanwhile, domestic and international scrutiny over Trump’s trade policies continues to grow. A U.S. federal court recently ruled that Trump overstepped his authority by imposing certain tariffs, though an appeals court has temporarily blocked that decision. At the same time, the administration has moved to revoke visas for Chinese students and tighten export rules, actions seen as further straining the already fragile relationship. Trump maintains that his aggressive use of tariffs is a strategic tool to bring back manufacturing jobs and reduce trade deficits, but analysts warn that the uncertain legal landscape and volatile rhetoric could make it harder for the U.S. to secure lasting trade agreements moving forward. BBC

Steel Tariff Hike Undermines Mexico–U.S. Integration

The U.S. government’s decision to raise tariffs on steel imports from 25% to 50% starting June 4 has sparked concern in Mexico and beyond. Mexican Economy Secretary Marcelo Ebrard criticized the move, calling it a blow to productive integration between the two countries. He emphasized that the U.S. actually runs a trade surplus in steel with Mexico, largely due to tight bilateral cooperation in industries like automotive manufacturing. Ebrard has held eight meetings with U.S. officials in an effort to address the issue diplomatically.

President Donald Trump confirmed the tariff hike at a rally in Pennsylvania, promoting a $14 billion deal between Nippon Steel and U.S. Steel. He framed the increase as a measure to protect American steelworkers from "unfair foreign competition" and preserve national control over a key industry. However, business leaders and trade experts argue that the tariffs will raise costs for critical U.S. sectors like auto and aerospace, while creating confusion and legal uncertainty for companies.

The backlash has been swift. European Union officials warned the move could derail ongoing trade negotiations and provoke retaliation. Trade specialist Adrián González called the tariff policy an “abuse of power,” criticizing Trump’s unpredictable use of trade tools. He warned that if the U.S. is concerned about China’s influence, it should better recognize Mexico’s strategic importance. Meanwhile, falling global steel prices may soften the immediate impact of the tariffs, but the longer-term risks to U.S. supply chains and global partnerships are growing. EL ECONOMISTA

Judicial Election Unlikely to Rattle Markets: "Negative Impact Was Priced In Last Year"

Following Mexico's unprecedented election to choose members of the judiciary, analysts expect markets to remain calm on Monday. Any negative effects, they argue, were already absorbed last year. While political criticism may generate some noise, financial markets had largely priced in the potential downside from judicial reforms during the second half of 2024, when the peso lost around 2% against the dollar as judicial changes advanced in Congress.

Some analysts noted that only extremely low voter turnout could have triggered significant market reactions—something that did not occur, despite reports of lower-than-expected participation late Sunday. Attention has now shifted to U.S.–Mexico trade relations, which are seen as a key driver of current market volatility. For now, optimism remains after Mexico avoided retaliatory tariffs amid a new wave of U.S. protectionism.

While immediate disruption is not expected, markets will continue to monitor how the new judicial figures operate. Analysts suggest that the political noise around the reform could subside by 2026, as the new structure becomes clearer and legal stability returns. LA POLITICA ONLINE

VECTOR RESEARCH

Mexico: Monetary Policy Meeting Minutes

In the minutes from its most recent monetary policy meeting, Banco de México signaled its willingness to continue cutting the local benchmark interest rate.

The arguments presented by members of the central bank's governing board support a 50 basis point cut in June, citing significant weakness in the Mexican economy and its implications for inflation risks, which are expected to remain contained.

The central bank remains firm on the need to maintain a restrictive monetary stance, which sets a floor for the benchmark rate between 7.25% and 7.50% over the coming quarters and likely through year-end. Looking ahead, a rate cut is confirmed, with a 50 bp reduction expected in June and smaller adjustments anticipated throughout the second half of the year. Heading into 2026, the phrase “maintaining monetary policy in restrictive territory” continues to be a key message in the central bank’s communications.

Mexico: Quarterly Inflation Report

In its latest quarterly inflation report, Banco de México cut its economic growth forecast for 2025 from 0.6% to 0.1%. The outlook for 2026 was also revised downward, from 1.8% to 0.9%.

INTERNATIONAL DAY

Italy’s Republic Day (Festa della Repubblica) is celebrated on June 2nd each year to commemorate the 1946 institutional referendum in which Italians voted to abolish the monarchy and establish a republic, following the fall of Fascism and the end of World War II. The vote marked a historic turning point, particularly significant as it was the first time Italian women were allowed to vote in a national election. The day is honored with various official ceremonies, the most prominent being the military parade in Rome, held at the Via dei Fori Imperiali, attended by the President of the Republic and other high-ranking officials. It also includes the laying of a wreath at the Tomb of the Unknown Soldier at the Altare della Patria. Across the country, Italians celebrate with civic events, concerts, and displays of the national flag, symbolizing unity, democracy, and the rebirth of Italy as a modern nation.