MEXICO: SECTION 899

Most countries fall under Section 899, which raises taxes on dividends and interest from U.S. stocks and bonds by 5 points yearly for four years. Sovereign wealth funds lose their exemption.

Foreign tax provision in Trump budget bill spooks Wall Street

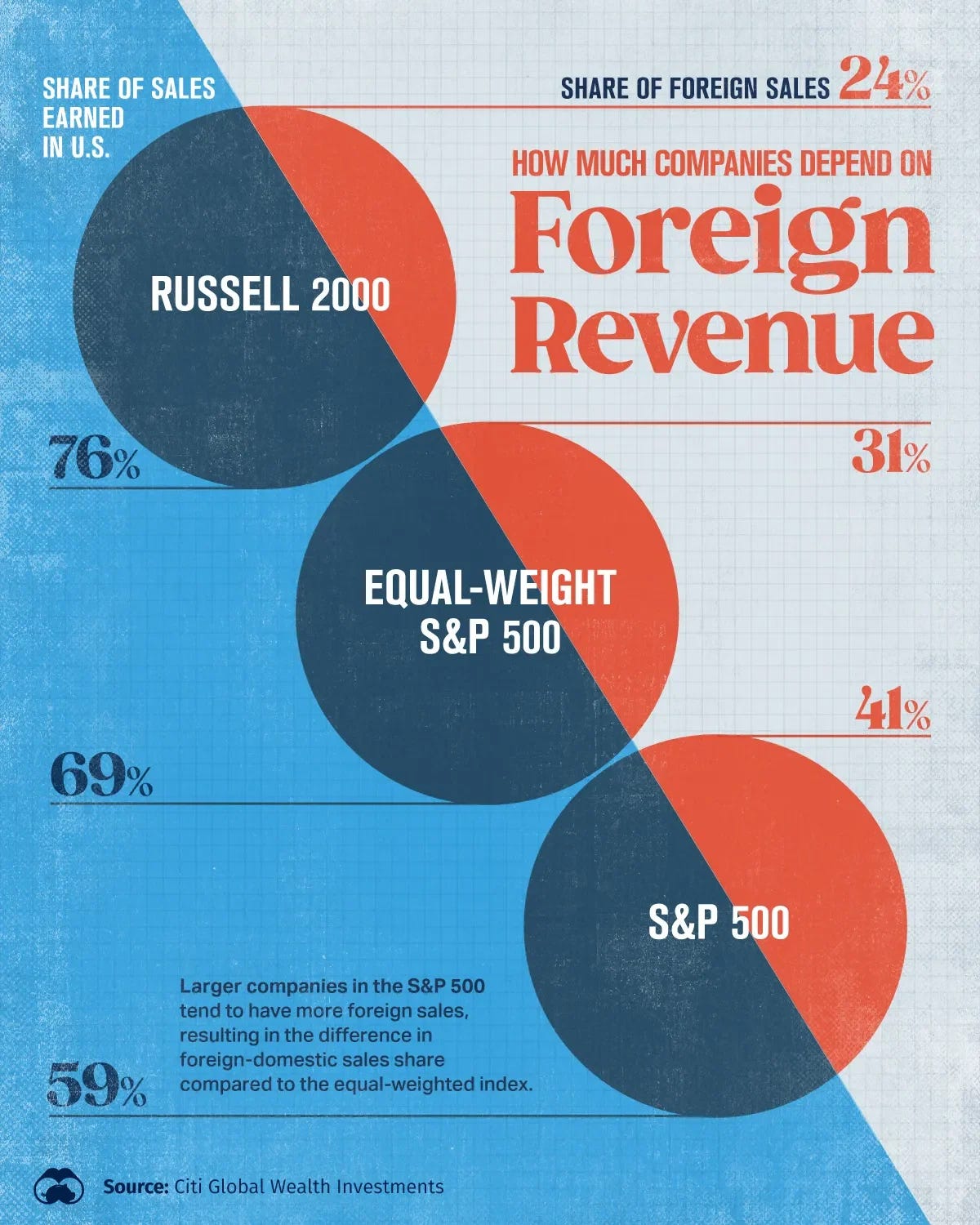

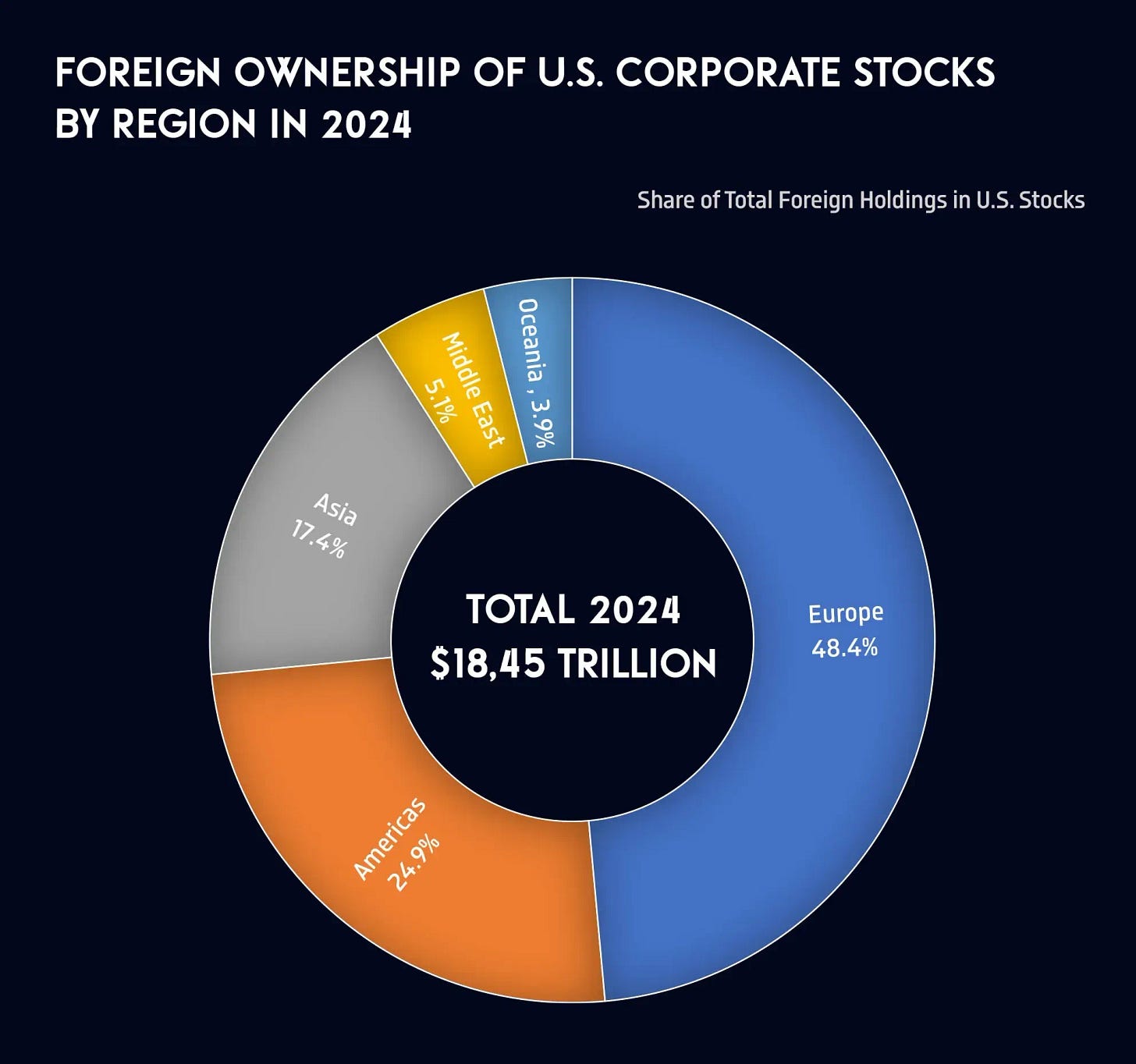

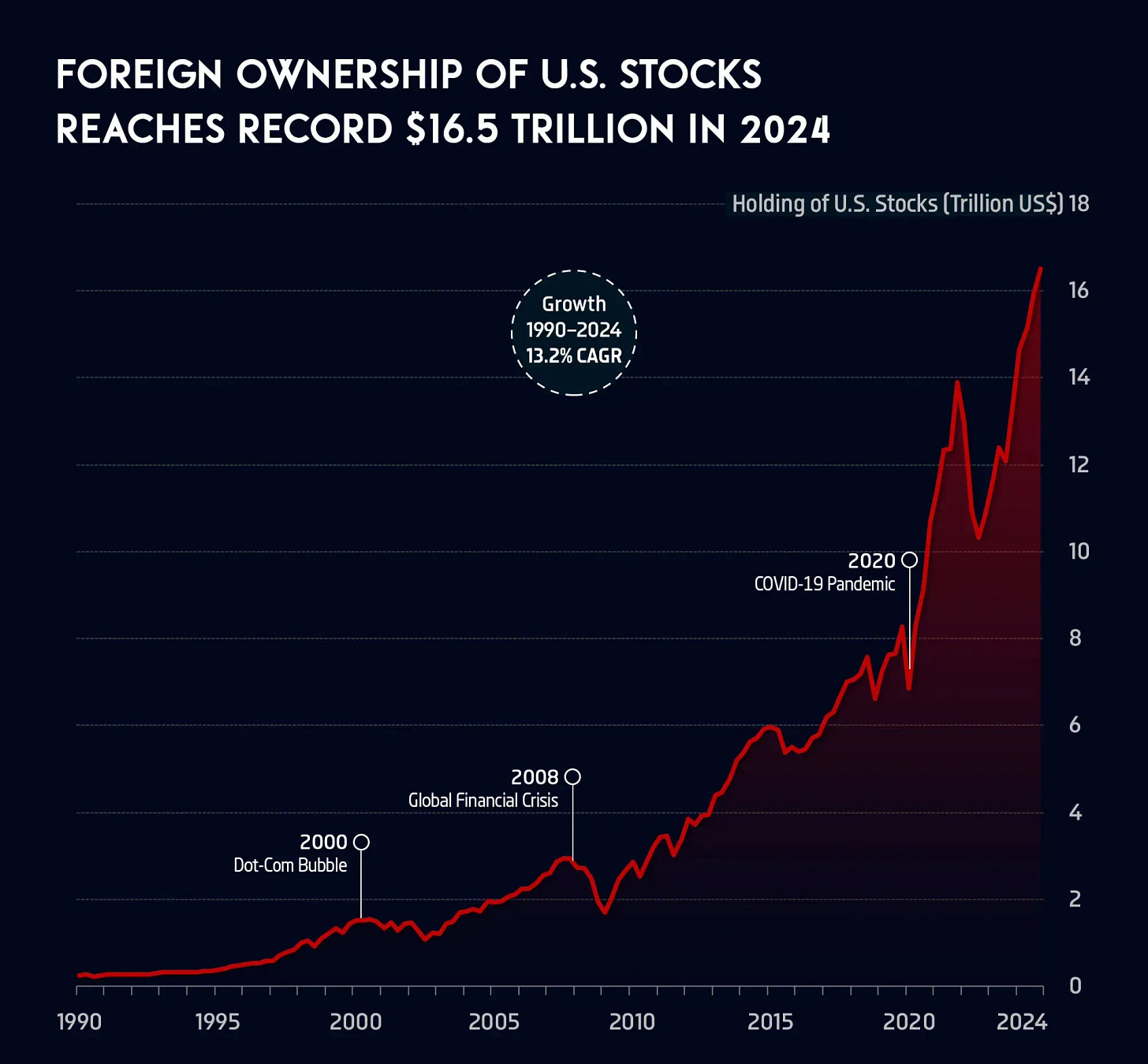

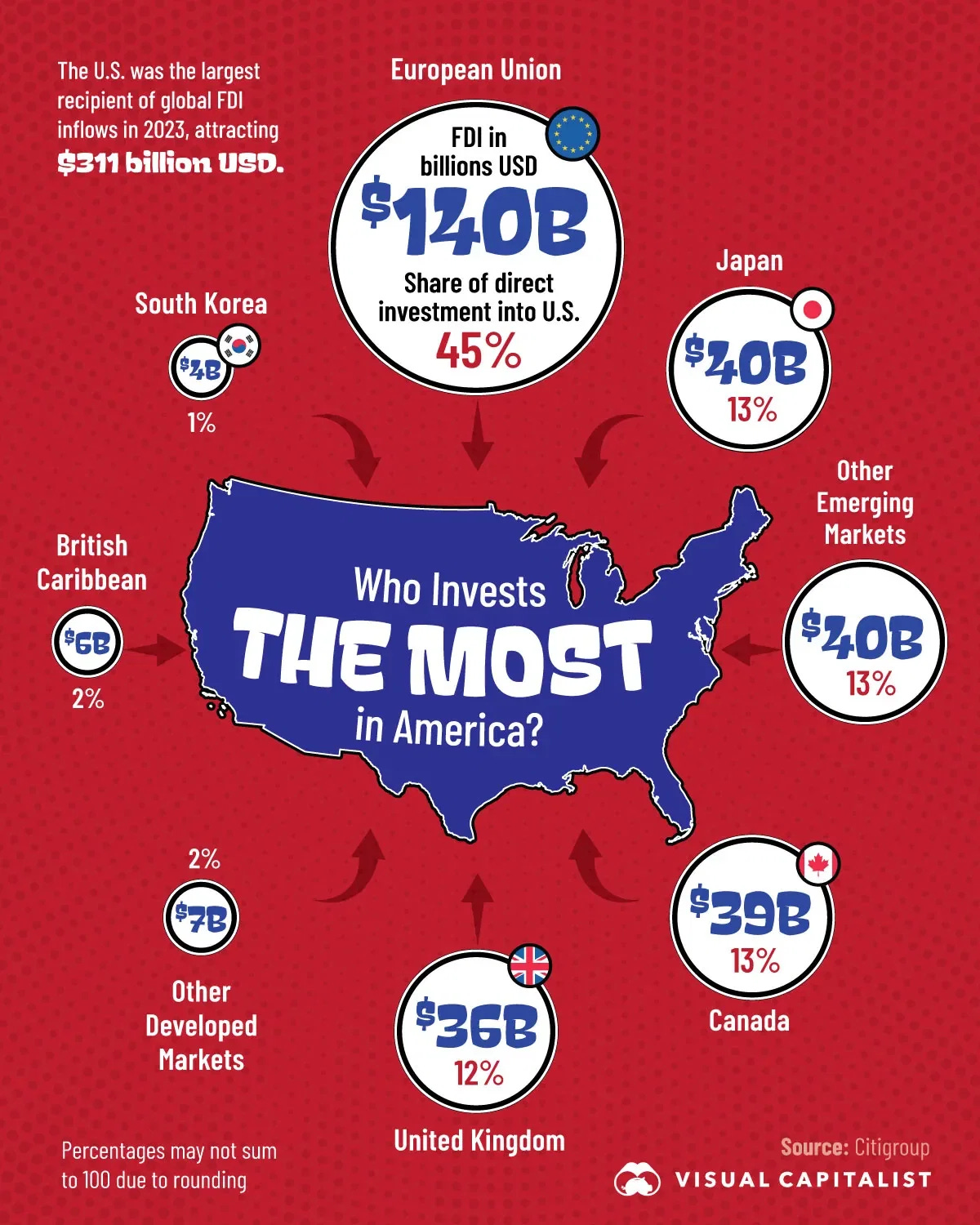

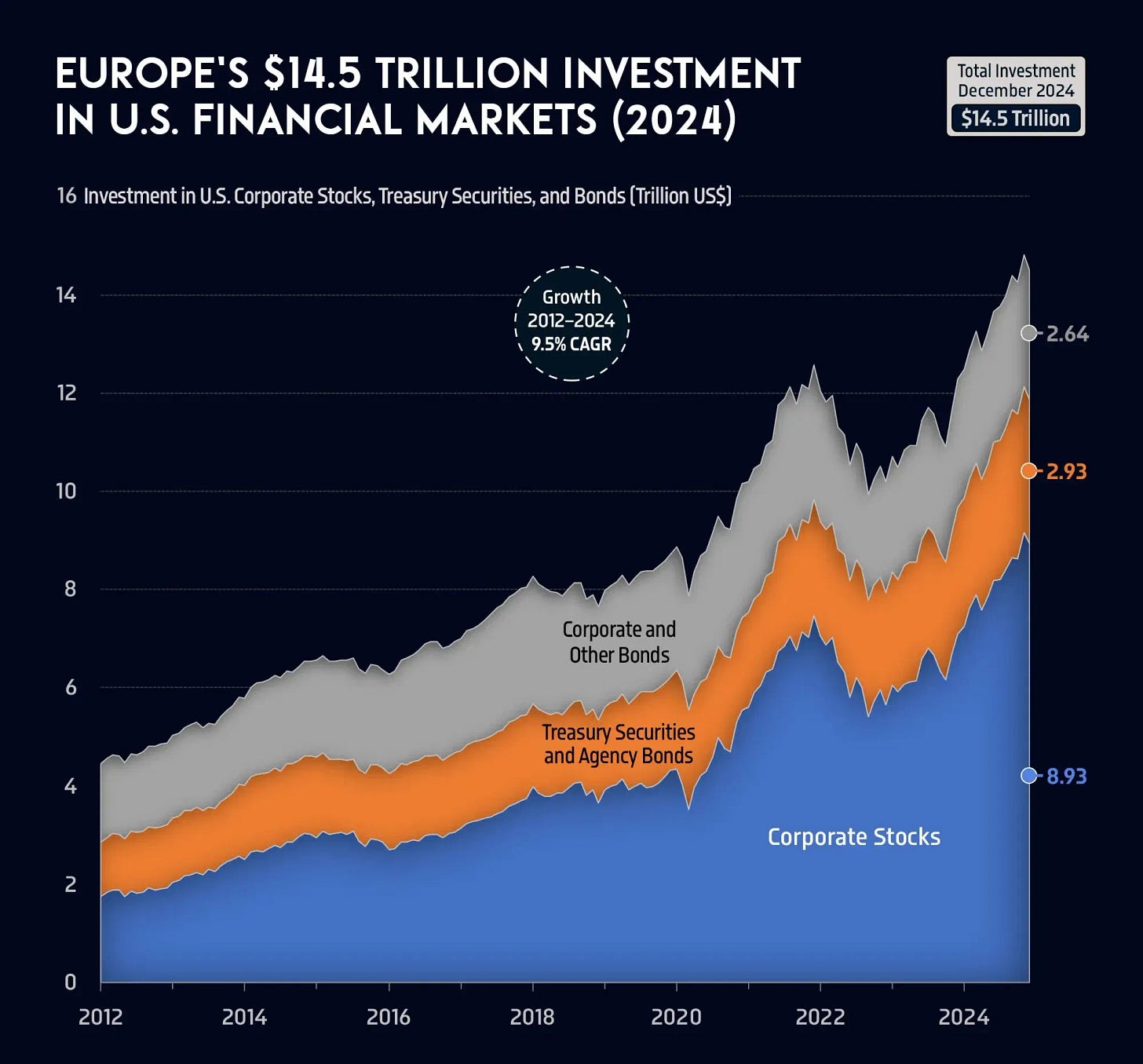

Wall Street is raising alarms over a little-known provision in Donald Trump’s proposed budget bill, which could reshape the landscape of foreign investment in the United States. Section 899 of the bill, recently passed by the House of Representatives, would allow the U.S. government to impose higher taxes on investors and companies from countries it deems to have "punitive" tax regimes. Analysts warn this provision could significantly impact foreign-owned U.S. companies, international firms with American operations, and sovereign wealth funds—many of which are currently exempt from such taxation. The resulting increase in tax burdens could deter foreign investment at a time when global appetite for U.S. assets is already weakening.

The proposed changes are seen by many financial experts as particularly ill-timed. With the U.S. government increasingly reliant on foreign capital to finance its expanding debt load, a reduction in foreign investor demand could lead to higher borrowing costs and further volatility in financial markets. Industry leaders, including executives from PGIM Fixed Income and Morgan Stanley, have voiced concern that Section 899 could depress demand for U.S. corporate bonds and equities while also weakening the dollar. Some analysts are even questioning whether U.S. Treasury debt could be affected—raising fears of a dramatic shift in international investment behavior, should those traditionally tax-exempt securities become taxable.

Beyond the financial markets, critics argue that Section 899 could harm American jobs and economic growth by discouraging foreign multinationals from operating in the U.S. Trade groups such as the Global Business Alliance and the Institute of International Finance argue the policy is counterproductive, especially as the government seeks to promote domestic job creation and manufacturing reshoring. “It’s not going to impact bureaucrats in Paris or London,” said one executive. “It’s going to impact American workers in Paris, Kentucky, and London, Ohio.” With foreign capital already in retreat and confidence fragile, the consequences of Section 899 could ripple far beyond Wall Street. FINANCIAL TIMES

Wall Street fears foreign tax in budget bill may reduce allure of US assets

Wall Street analysts are sounding the alarm over a controversial provision in the U.S. budget bill that could significantly affect foreign investment. Section 899 of the bill, recently passed by the House of Representatives, proposes a tax of up to 20% on passive income—such as dividends and royalties—earned by foreign investors from countries the U.S. deems to have "unfair" tax regimes. The measure could generate up to $116 billion in revenue over the next decade, but experts warn it may also damage the appeal of U.S. financial markets. Deutsche Bank’s George Saravelos noted the legislation opens the door for a shift from a trade war to a “capital war,” potentially reducing demand for U.S. Treasuries.

The timing of the proposed tax hike raises further concern. Global investors have already begun to question the long-standing strength of the U.S. economy—often referred to as "U.S. exceptionalism"—as federal deficits balloon and trade policies grow more protectionist. The introduction of this tax could exacerbate those doubts. Morgan Stanley warned that such a policy would likely weaken the U.S. dollar by discouraging foreign purchases of American assets, especially from European investors who would be particularly exposed under the proposed rules. Despite these implications, the White House has yet to issue a response on the potential economic fallout.

Legal experts say the tax would apply to investors from a wide range of countries, including key U.S. allies such as the UK, Australia, and members of the European Union, as well as emerging economies like India and Brazil. If enacted, Section 899 could mark a significant turning point in U.S. economic policy—prioritizing tax retaliation over global capital flows. At a time when the U.S. needs strong foreign investment to finance its debt and support the dollar, critics argue that such a move may be self-defeating, straining international relations and undermining confidence in U.S. financial markets. REUTERS

A Closer Look at How Proposed Section 899 Would Increase Tax Rates for Certain Non-US Persons and Governments

The proposed Section 899 in the One Big Beautiful Bill Act of 2025 introduces a new retaliatory tax regime targeting "applicable persons"—foreign individuals, entities, and governments—from countries that impose what the U.S. defines as "unfair foreign taxes." These taxes include the OECD’s Pillar Two Under Taxed Profits Rule (UTPR), Digital Services Taxes (DSTs), and Diverted Profits Taxes (DPTs), all of which are automatically subject to retaliation. Section 899 increases U.S. withholding and income tax rates on affected parties by up to 20 percentage points, depending on how long the foreign country’s unfair tax has been in effect. The provision also grants the Treasury authority to identify additional discriminatory countries through quarterly reports.

A major new feature of Section 899 is its incorporation of a modified “super BEAT” regime, which applies more aggressively to U.S. entities controlled by companies in discriminatory countries. This version eliminates key thresholds (such as the $500 million gross receipts test) and raises the BEAT rate to 12.5%, while also denying certain deductions and expanding the scope of base erosion payments. Though the bill avoids explicitly overriding tax treaties—likely to survive Senate Byrd Rule scrutiny—it implicitly weakens treaty protections by capping the benefit of reduced treaty rates at 20 percentage points above the statutory rate.

If enacted, Section 899 could significantly reduce foreign appetite for U.S. investments, particularly in U.S. Treasuries and FDAP income streams like dividends and royalties. It risks escalating global tax tensions by shifting the current focus from trade to capital-based retaliation. Inbound U.S. companies with parent or sister entities in countries with DSTs or similar regimes will need to assess exposure to both higher withholding taxes and BEAT liability. The Senate may further revise the bill, but if passed in its current form, Section 899 would mark a sharp new turn in U.S. international tax policy. BAKER MCKENZIE

The US has declared a tax war, and it’s targeting its allies.

Congress is advancing a powerful new tool—Section 899 of the Internal Revenue Code—that would enable the U.S. to retaliate against foreign tax regimes deemed discriminatory toward American multinationals. This provision targets countries implementing Digital Services Taxes (DSTs), Diverted Profits Taxes (DPTs), or Undertaxed Profits Rules (UTPRs) under the OECD's Pillar Two framework. If a country enacts any of these, it can be labeled a "discriminatory foreign country," triggering elevated tax burdens for inbound investors and affiliates, including higher U.S. withholding taxes (up to 20 percentage points above statutory rates) and overridden treaty protections.

A major feature of Section 899 is its expansion of the Base Erosion and Anti-Abuse Tax (BEAT). Previously limited to large U.S. corporations, BEAT would now apply automatically to non-public U.S. entities majority-owned by "applicable persons" from listed countries. These entities would face a higher 12.5% BEAT rate, denial of standard deductions, and stricter treatment of payments to foreign affiliates. The law’s scope is broad: affected parties include not just corporations, but also trusts, private equity funds, sovereign wealth funds, and pension-backed vehicles. Countries likely to be designated include France, the UK, India, Australia, Canada, and others with existing DSTs or DPTs.

In practice, Section 899 represents a policy shift from multilateral cooperation to unilateral deterrence. By linking U.S. inbound tax treatment to foreign countries’ outbound tax policies, the U.S. is effectively weaponizing its tax code. This could deter foreign investment, increase compliance burdens, and complicate cross-border structuring for multinational groups. As the global adoption of DSTs, DPTs, and UTPRs grows, so too will the reach of Section 899—making it critical for global investors and U.S. inbound businesses to assess their exposure and restructure accordingly. TAX JOURNAL

VECTOR SALES AND TRADING DESK

The three main Wall Street indexes closed with slight gains on Thursday. The market reacted positively to Nvidia's quarterly results, released yesterday after the close, while also digesting a ruling that reinstated tariffs imposed by former President Donald Trump.

The Dow Jones Industrial Average, made up of 30 major companies, rose 0.28% to 42,215.73 points, while the S&P 500, which tracks the most valuable companies, gained 0.40% to 5,912.17 points. The Nasdaq Composite advanced 0.39% to 19,175.87 points.

Mexico's stock markets ended Thursday’s session with losses. Local indexes broke their winning streak but remained near record highs, as investors weighed news of a setback related to U.S. tariffs.

The benchmark S&P/BMV IPC index of the Mexican Stock Exchange (BMV), which tracks the most traded local stocks, fell 0.21% to 58,614.41 points.

Overview of Proposed Section 899

Impact on Foreign Pension Funds

Many non-U.S. pension funds allocate significant portions of their portfolios to U.S. investments. Under the current draft of the bill, the exemption for qualified foreign pension funds under Section 897(l) would remain intact, shielding these funds from FIRPTA. However, many of these pension funds benefit from zero-rate withholding on dividends under U.S. tax treaties. Proposed Section 899 would alter that, subjecting pension funds from “discriminatory foreign countries” to a 5% withholding tax on dividends—even on portfolio investments that previously enjoyed full exemption.

Additionally, some non-U.S. pension funds invest in the U.S. through branches and pay tax on effectively connected income (ECI). These funds often treat themselves as foreign complex trusts, meaning they are taxed as nonresident alien individuals. Under Proposed Section 899, their exposure would mostly be limited to FIRPTA-related gains. However, those that qualify as foreign pension funds under Section 897(l) could still benefit from FIRPTA exemptions, even if based in countries targeted by Section 899.

The provision would take effect the first day of the year after the later of three possible triggers: 90 days post-enactment, 180 days after a foreign tax is deemed discriminatory, or the date such a tax takes effect. If passed before October 2025, funds in countries already enforcing a UTPR, digital services tax, or diverted profits tax could face higher rates by January 2026. That said, additional withholding would not begin until Treasury publishes a formal list of affected jurisdictions. The bill also grants Treasury broad authority to issue anti-avoidance regulations. While already passed by the House, the bill must clear the Senate and be signed by President Trump—where treaty override concerns could spark significant changes during reconciliation.

Trump tariffs reinstated by appeals court for now

A federal appeals court has temporarily paused a lower-court ruling that struck down most of former President Donald Trump’s tariffs, giving the Trump administration time to pursue an appeal. The ruling, issued by the U.S. Court of International Trade, invalidated key tariffs imposed under the International Emergency Economic Powers Act, arguing that the law does not give presidents unlimited authority to reshape trade policy.

Trump officials, including Peter Navarro and Stephen Miller, fiercely criticized the trade court’s decision, calling it a major threat to presidential powers and a blow to Trump’s trade agenda. Trump warned on social media that if the decision stands, it would fundamentally weaken the presidency, describing it as “the harshest financial ruling ever leveled on us as a Sovereign Nation.”

The legal fight is expected to escalate quickly, potentially reaching the Supreme Court. The administration has until June 9 to respond after plaintiffs file their reply, while both sides brace for a high-stakes showdown over the future of U.S. trade policy and executive authority. CNBC

BOLSAA: A Small Stock Market for a Large Economy

The Mexican Stock Exchange (BMV) remains small in proportion to the size of Mexico’s economy. Currently, it represents less than 36% of the country’s GDP, a stark contrast to other global markets—such as the United States, where stock market capitalization exceeds 185% of GDP, and France, where it reaches 224%. As of April, the BMV’s total value was $467 billion, compared to Brazil’s Bovespa at $691 billion and the Nasdaq in New York at a staggering $27.2 trillion.

Among the 356 issuers listed on the BMV, only 132 are publicly traded companies, with the rest made up of instruments like real estate investment trusts (FIBRAs), structured equity instruments (CKDs), and various debt issuers. Despite this limited breadth, the BMV is the second-largest stock exchange in Latin America after Brazil’s Bovespa, and the fifth-largest in the Americas overall. Its origins date back to 1978, when the stock exchanges of Mexico City, Guadalajara, and Monterrey merged.

A key characteristic of the BMV is its concentration: just 10 companies account for nearly 70% of its total market value. These include major names such as Walmart de México (Walmex), América Móvil, Grupo México, FEMSA, Banorte, and Bimbo. On Friday, the benchmark S&P/BMV IPC index—which tracks the most actively traded stocks—fell 1.62% to close at 48,957.24 points, reflecting ongoing market volatility. EL ECONOMISTA

AMXB: Short Interest

We believe there is a significant short position in AMXB, driven by growing concerns around the upcoming TELCO Law, which is scheduled for a vote next month. The proposal is generating considerable noise, particularly regarding the 5G spectrum auction and the increasing role of the government—through CFE and Altán Redes—as a potentially dominant player.

Yesterday, Fitch noted that CAPEX for 2026 and 2027 is expected to decline materially. In parallel, AMXB’s CEO expressed concerns about the possibility of Altán Redes receiving access to spectrum at significantly lower costs compared to private competitors. MEGACPO has echoed similar concerns, signaling a broader unease within the sector.

In my view, the TELCO Law could prove even more controversial than the judicial reform being voted on this Sunday. It also introduces a potentially sensitive topic for the upcoming USMCA renegotiations, particularly in terms of competitive neutrality and market access.

VECTOR RESEARCH

Bank of Mexico to Continue Cutting Benchmark Rate in the Coming Months

The Bank of Mexico will continue to cut its benchmark interest rate in the coming months. According to the minutes from its latest monetary policy decision, the central bank signaled a willingness to proceed with further rate reductions.

Board members continue to support the idea of a 50-basis-point cut at the June meeting, based on the significant weakness in Mexico’s economy and the resulting limited inflationary risks. Despite this easing bias, the bank remains firm on the need to maintain a restrictive monetary stance, which suggests a lower bound for the policy rate of between 7.25% and 7.50% over the next few quarters, likely through year-end.

A notable element in the minutes was the position of one deputy governor who, while generally agreeing with the rest of the board, argued in favor of removing forward guidance about a similar-sized cut in June. This raises the possibility that the next decision may not be unanimous. Looking ahead, the Bank of Mexico is expected to continue lowering rates, with a 50-basis-point cut likely in June, and smaller adjustments during the second half of the year. For 2026, the phrase “maintaining monetary policy in restrictive territory” remains central to the bank’s messaging.

MEXICAN STOCKS: Unable to Break Key Resistance Levels

The loss of momentum and overbought technical indicators suggest a correction is underway.

AC*: The short-term consolidation continues, facing resistance at 215. For now, it's likely to move toward the lower end of the range at 199.5 pesos.

ALFA A: Broke through the key 15 peso long-term resistance level. As long as it holds above that mark, it could climb to 16.2 pesos from 12.8 pesos.

ALSEA*: Faces strong resistance at 49–49.5 pesos. Given overbought indicators, it's unlikely to break it and may correct to 47 pesos.

AMX B: Moving sideways with key resistance at 17 pesos and support at 16.4, which it could retest. A break below could extend the drop to 15.8 pesos.

ASUR: The pullback has placed it below its 50-day average of 625 pesos. It will likely fall to the support zone at 590 pesos before any meaningful rebound. BBAJIO O: Uptrend has slowed, with signs of profit-taking. Key support is at 49.4 pesos; breaking it could lead to a drop to 46.3 pesos.

BIMBO A: Sideways consolidation near 55 pesos support, with a potential rebound to 58 pesos resistance.

BOLSA A: Recovery stalled at recent highs. Technical indicators don’t support further gains and suggest a risk of decline to 40 pesos.

CEMEX CPO: The rally brought it close to yearly highs around 13.5 pesos. Overbought indicators point to possible profit-taking, with initial support at 12.7 pesos.

CHEDRAUI B: Nearing strong supply zone at 144 pesos. A correction is likely unless it holds support at 140 pesos. CUERVO*: In a pause phase, approaching average support at 23.25 pesos. Likely to hold and recover, but a break could push it down to 22 pesos before bouncing.

FEMSA UBD: Once again, the 210 peso level halted gains. Risk remains of falling to 200 pesos, though the broader uptrend may simply be pausing.

GAP B: Momentum is fading, but holding above 440 pesos could push it to 470. If support at 430 breaks, it may fall to 415 pesos.

GCARSO A1: Trying to hold above resistance at 130 pesos. If successful, could climb to 140 pesos, supported by technical indicators.

GCC*: Positive indicators support continued gains toward 193 pesos. A break of 182.5 pesos support could lead to 175 before rebounding. GENTERA*: Extreme overbought conditions suggest a sharp correction is possible, especially if support at 37.5 pesos is breached.

GFINBUR O: After a recent rally, a correction is possible with support at 50 pesos. Upside potential appears limited due to strong resistance at 53 pesos.

GFNORTE O: Resistance at 180 pesos halted gains again. Indicators suggest a possible drop toward 165 peso support.

GMEXICO B: Strong resistance at 109 pesos may prevent further gains due to overbought conditions. Breaking it could lead to 114 pesos.

GRUMA B: Recovery attempt losing steam, likely to retreat with initial support at 357 pesos, near the 200-day moving average. KIMBER A: Holding above the 34 peso average could allow sideways movement with resistance at 35.5 pesos.

KOF UBL: Key resistance at 188 pesos. A break would lead to 198 pesos, but failure could result in a decline back to 175 pesos. Indicators favor a drop.

LAB B: Recent rebound failed to break above the 22.4 peso average. May consolidate with support at 21.25 pesos. If the average breaks, it could climb to 24 pesos.

LACOMER UBC: Rally has weakened near two-year highs at 43 pesos. Overbought indicators and resistance suggest a pullback to 40 pesos.

LIVEPOL C1: Pulling back again, but likely to find a floor at 94 pesos before rebounding to 100 pesos resistance. MEGA CPO: Strong resistance at 52.5 pesos likely to cap the recovery, with a fallback to 46 pesos support expected.

OMA B: Rally seems capped at 240 pesos, and the stock may resume its decline toward the 225 peso support zone.

ORBIA*: Back testing support at 12.8 pesos. Likely to hold and rebound toward first resistance at 14.4 pesos.

PEÑOLES*: Attempting to recover, but main trend is still a correction. Upside is limited to 410 pesos, with risk of falling to 350 pesos.

PINFRA*: Trying to stabilize, but below 226.5 peso resistance, a drop to 210 pesos remains likely. Q*: Recovery was capped at 220 pesos. Risk remains for further correction. A break below 208 pesos could lead to 190 pesos.

R A: Profit-taking has been minor, but breaking 150 peso support could lead to 143 pesos before rebounding.

TLEVISA CPO: Rally has paused, and a pullback to test the 200-day average at 7.5 pesos is likely before resuming the uptrend.

VESTA*: Confirmed breakout above 55 pesos. Still, there's risk of a pullback to retest it as a new support level.

WALMEX*: Rally faces resistance at 67 pesos. If not broken, a correction toward 62.5 pesos is likely.

INTERNATIONAL DAY

National Creativity Day, celebrated on May 30, is a day dedicated to honoring and encouraging the power of imagination, innovation, and original thinking across all fields—whether in the arts, sciences, business, or everyday life. Established to inspire individuals to embrace their unique ideas and creative passions, the day highlights the value of creativity as a driving force behind progress and personal fulfillment. It’s a time for artists, entrepreneurs, inventors, and thinkers of all ages to express themselves freely, take risks, and push boundaries, reminding us that creative thinking is not just for professionals—it’s a vital tool for solving problems and enriching our world.