MEXICO: "MIDNIGHT HAMMER" STRIKE

U.S. President Donald Trump described the damage as “monumental” after the U.S. hit three Iranian nuclear sites, though the U.S. assessment was unfinished.

U.S. used 14 bunker-busters, 7 B-2 bombers in "Midnight Hammer" strikes on Iran

The United States launched a surprise military strike on Iran’s nuclear facilities, involving more than 125 aircraft and 75 precision-guided weapons in an operation dubbed Midnight Hammer. This marked the longest B-2 Spirit bomber mission since 2001 and the first real-world deployment of the 30,000-pound GBU-57 Massive Ordnance Penetrator, the most powerful non-nuclear bomb in the world. The mission was carried out in coordination with Israel and signaled a significant escalation in the conflict with Iran, bringing the U.S. back into direct military engagement in the Middle East.

According to Defense Secretary Pete Hegseth and Joint Chiefs Chairman Gen. Dan Caine, the operation was executed with a mix of stealth bombers, advanced fighters, cruise missile strikes from a submarine, and dozens of refueling aircraft. Satellite imagery from Maxar revealed large craters at the Fordow nuclear site, indicating successful penetration of hardened underground targets. Hegseth confirmed all munitions hit their intended targets, and Fordow, believed to be Iran’s most secure facility, was the primary objective. Remarkably, Iran’s defenses failed to respond — no fighter jets were scrambled, and surface-to-air missile systems did not engage U.S. aircraft.

The strike on Fordow, along with simultaneous hits on Natanz and Isfahan, delivered what President Trump later called a “spectacular military success” in a televised address. The move comes after months of Israeli preparations and effectively ends any remaining hopes for a renewed nuclear deal with Tehran. As the region braces for possible retaliation from Iran or its proxies, the world watches closely to see how prepared U.S. forces are for the next phase of this widening conflict. AXIOS

How badly have US strikes damaged Iran’s nuclear facilities? Here’s what to know

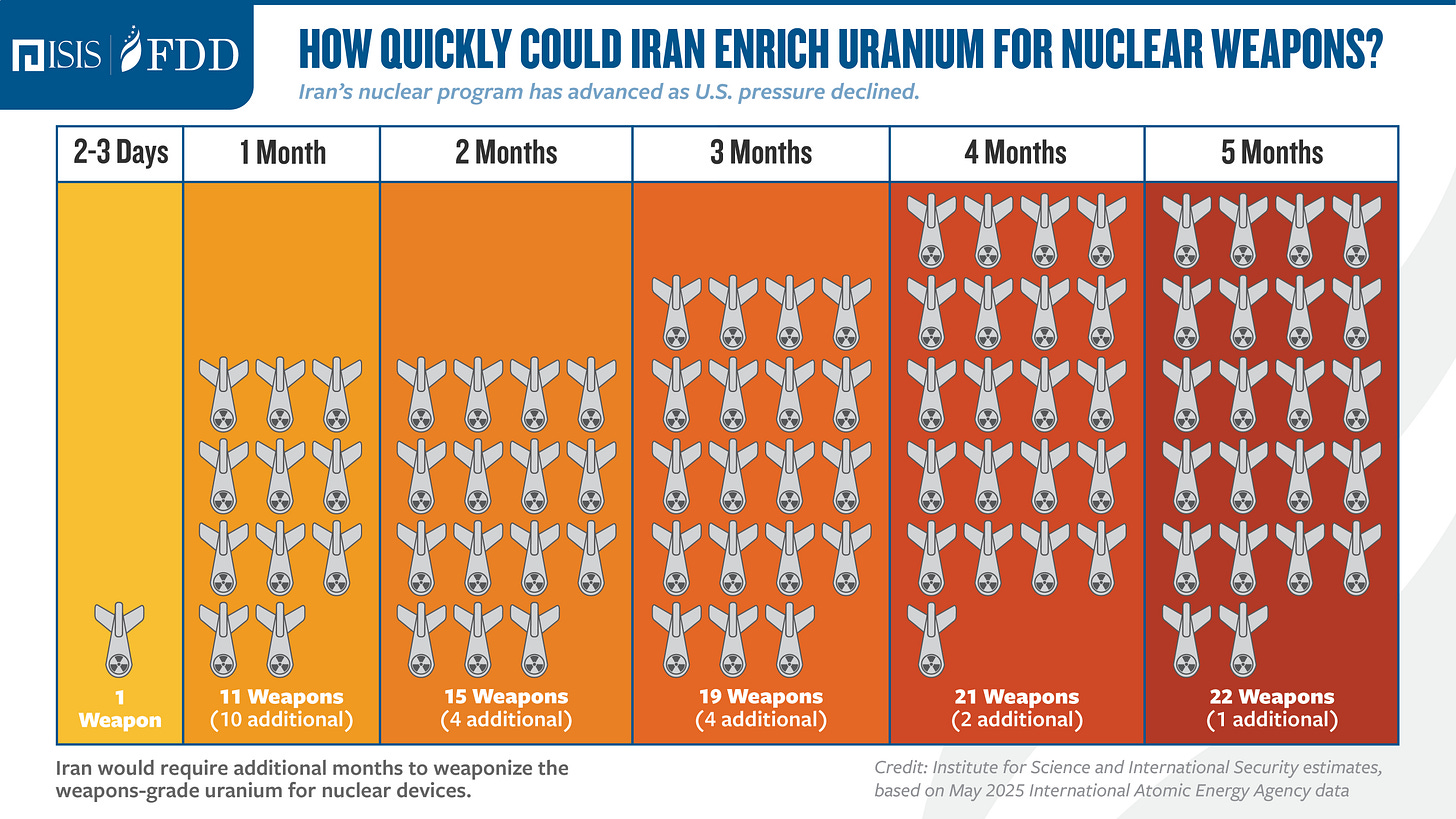

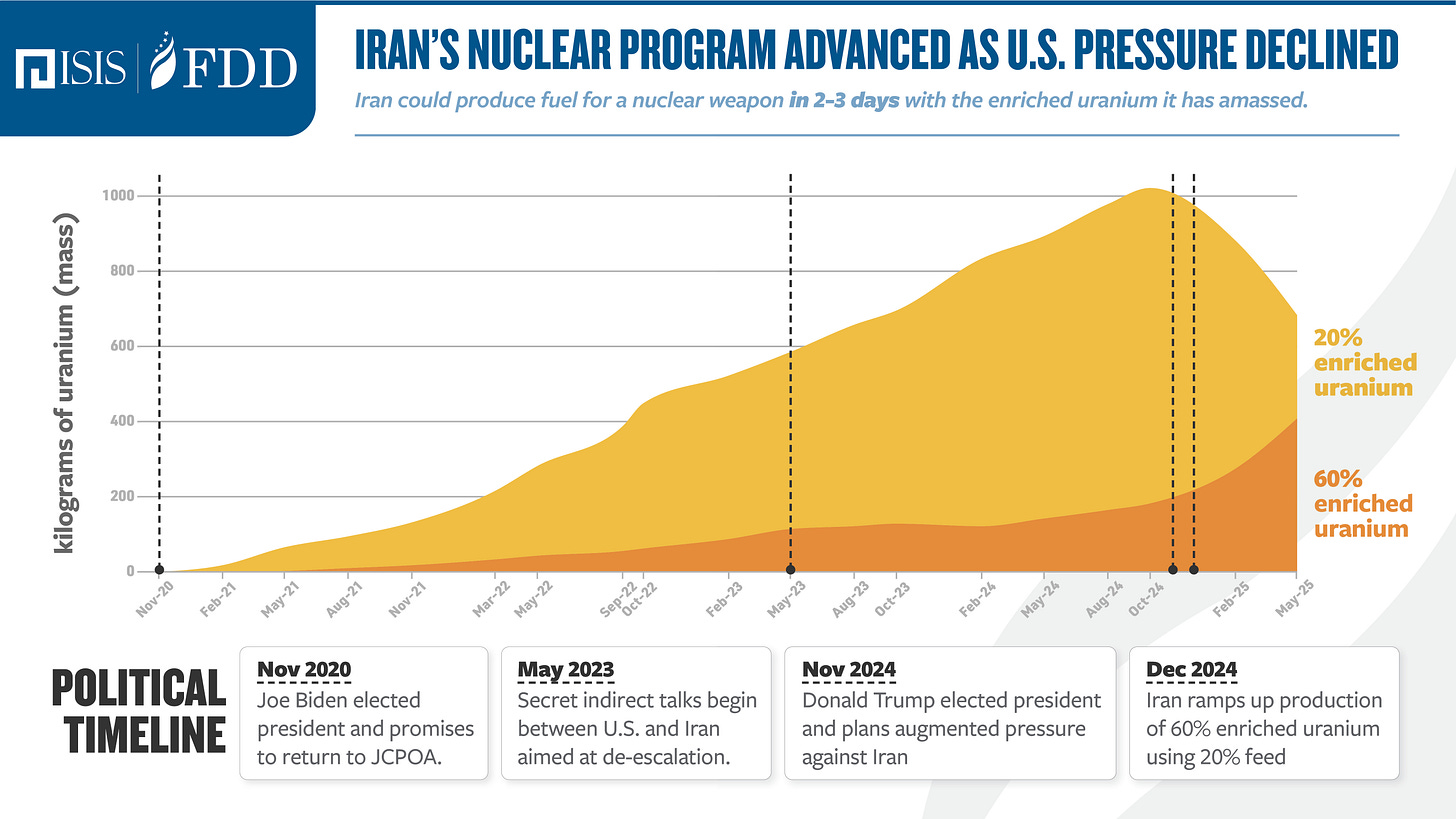

The U.S. strike on Iran’s nuclear program over the weekend marked one of the most forceful military actions in years. Warplanes, submarines, cruise missiles, and 30,000-pound bunker-busting bombs were deployed to hit three of Iran’s most fortified nuclear sites: Fordow, Natanz, and Isfahan. After initially favoring diplomacy, President Donald Trump ordered the strikes, declaring Iran’s nuclear facilities had been “obliterated.” However, Iranian officials downplayed the impact, echoing their response to Israel’s June 13 attack. Satellite imagery now offers the clearest view yet of the destruction, particularly at Fordow, where craters and discoloration of the mountainside suggest severe damage to the underground enrichment facility.

Fordow, Iran’s most protected site, lies deep beneath a mountain and was the primary target for the GBU-57 bombs, delivered by six B-2 bombers. Satellite imagery analyzed by CNN and Maxar shows at least six large craters along a ridge directly above the underground complex. Experts suggest that the precision and concentration of these strikes point to a concerted effort to breach the fortified halls more than 260 feet below. While Iran has claimed the damage was superficial, analysts from the Institute for Science and International Security and Armament Research Services argue that total destruction of key enrichment halls is likely, though internal damage assessments remain incomplete.

The Natanz and Isfahan facilities also sustained major hits. At Natanz, U.S. bombers and submarines targeted both above- and below-ground structures, leaving new craters over vital underground centrifuge areas. Isfahan—home to Iran’s largest nuclear research complex—appears to have been heavily damaged, with over a dozen buildings destroyed or compromised. Satellite images revealed collapsed tunnel entrances and widespread damage near uranium storage sites. According to U.S. officials, cruise missiles launched from a submarine also hit key surface infrastructure. Collectively, these strikes represent not just a tactical escalation, but a strategic blow to Iran’s nuclear ambitions, with lasting implications for regional stability. CNN

Iran’s ‘proportionate response’ to US strike will be set by military, envoy tells UN

At an emergency United Nations Security Council meeting, Iran's ambassador, Amir-Saeid Iravani, sharply condemned the United States’ airstrikes on three of Iran’s nuclear sites, accusing Washington of escalating the regional conflict at Israel’s behest. Iravani warned that Iran retains the right to respond militarily under international law, stressing that the scale and timing of its retaliation would be determined solely by its armed forces. “The Islamic Republic of Iran has repeatedly warned the warmongering U.S. regime to refrain from stumbling into this quagmire,” he said, framing the strikes as a “blatant U.S. aggression” serving Israel’s "vile agenda."

The emergency session, held Sunday, brought direct confrontations between Iranian, American, and Israeli envoys. Israeli Prime Minister Benjamin Netanyahu praised the U.S. response and thanked President Trump, stating that “first comes strength, then comes peace.” Iravani, in turn, accused Netanyahu of hijacking U.S. foreign policy and dragging Washington into a costly, unnecessary war. These sharply divergent statements highlighted the growing international polarization as tensions in the Middle East threaten to spiral into broader conflict.

Defending the airstrikes, interim U.S. ambassador Dorothy Shea told the Council that Iran has long deceived the international community about its nuclear ambitions and has fueled instability throughout the region. She cited Iran’s track record of supporting proxy groups and killing U.S. service members, framing the strikes as a necessary act of defense for both American and allied interests. Shea also pushed back on Tehran’s narrative, arguing that Iran had increased its belligerent rhetoric in recent weeks, leaving the U.S. no choice but to act decisively. THE HILL

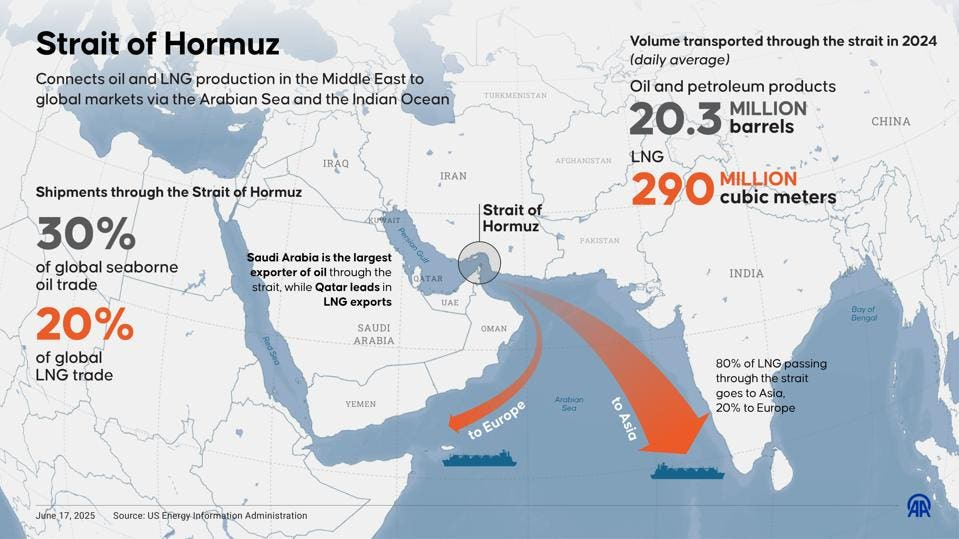

Iran parliament reportedly backs closing Strait of Hormuz, which could spike oil prices

Iran’s parliament has backed the closure of the Strait of Hormuz in response to U.S. airstrikes on its nuclear facilities, raising fears of a potential disruption to one of the world’s most critical oil arteries. Though the endorsement has no legal authority—only Iran’s Supreme National Security Council can enact such a move—it signals rising tensions in Tehran and highlights how the conflict with Israel and the United States is beginning to ripple into global energy markets. The narrow waterway handles about 20% of global oil flows and nearly a third of maritime oil trade, making it a crucial chokepoint for the world economy.

Analysts remain skeptical that Iran will follow through with actually closing the strait. The U.S. has a formidable military presence in the Gulf, and any attempt to block the channel would likely provoke a severe military response. Eurasia Group noted that a closure would amount to an “effective declaration of war” against both the United States and Gulf states—something Iran, currently in a weakened strategic position, is unlikely to risk. While a full blockade is improbable, analysts believe Iran may ramp up harassment of commercial tankers, using asymmetric tactics to unsettle global shipping without triggering a full-scale war.

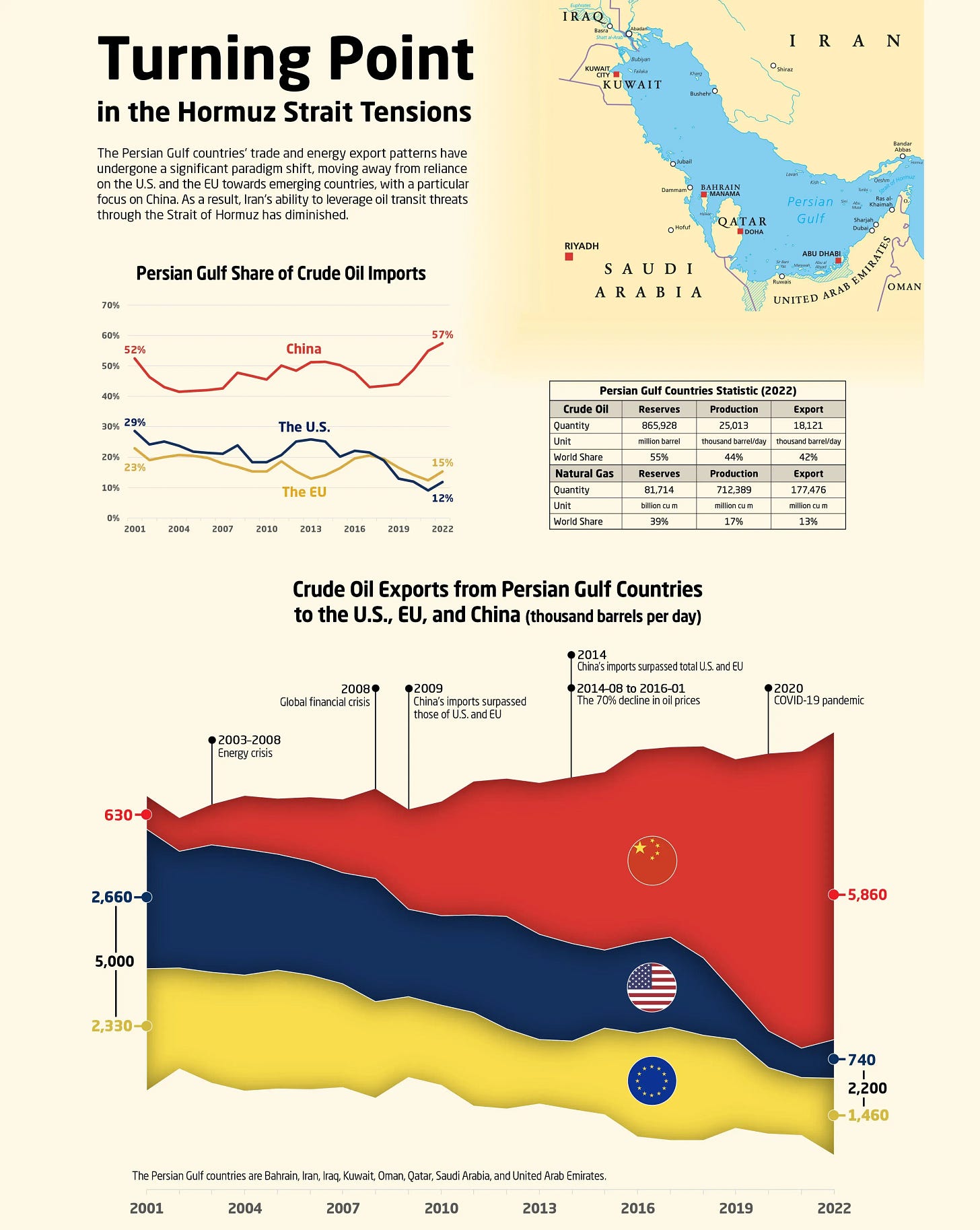

Markets are already on edge. Brent crude oil prices are expected to open well above their last close of $77.01 per barrel if tensions escalate further, according to ClearView Energy Partners. U.S. Vice President JD Vance echoed the sentiment that closing Hormuz would be “economically suicidal” for Iran, which relies heavily on the very waterway it’s threatening to shut down. With its economy tied to oil exports—most of them destined for China through the strait—Tehran risks inflicting more damage on itself than on its adversaries. Still, even the threat of disruption is enough to send global oil markets into a state of high alert. AXIOS

U.S. calls on China to prevent Iran from closing Strait of Hormuz and disrupting global oil flows

U.S. Secretary of State Marco Rubio issued a direct call to China to intervene diplomatically and dissuade Iran from closing the Strait of Hormuz in retaliation for the recent U.S. airstrikes on Iranian nuclear facilities. With around 20% of the world’s crude oil passing through this narrow waterway, any disruption would send shockwaves through global markets. Rubio emphasized China’s unique leverage, noting that Iran’s oil exports—especially the 1.84 million barrels per day shipped last month—are heavily reliant on access through the strait, with China as its largest buyer.

The threat to the Strait has rapidly become one of the most dangerous flashpoints following the escalation in U.S.-Iran tensions. Iranian lawmakers have voiced support for closing the passage, though any formal decision would come from the country’s national security council. Oil prices have already climbed more than 2% on fears of a disruption, and analysts warn of a spike above $100 per barrel if Iran moves to block the strait. Despite assessments from firms like JPMorgan that downplay the likelihood of a closure, others caution the market is underestimating Iran’s capacity for prolonged disruption.

Rubio warned that closing the Strait would be “economic suicide” for Tehran, as it would sever Iran’s access to its own vital oil revenues—particularly from China. Yet even if a closure would ultimately hurt Iran, experts like Bob McNally of Rapidan Energy argue it could still inflict major short-term damage on global supply lines. The U.S. Navy’s Fifth Fleet, based in Bahrain, stands ready to respond, but McNally contends any military operation to reopen the strait would be no quick fix. "It would not be a cakewalk," he warned, suggesting shipping could be disrupted for weeks or even months, reshaping oil markets and geopolitical calculations. CNBC

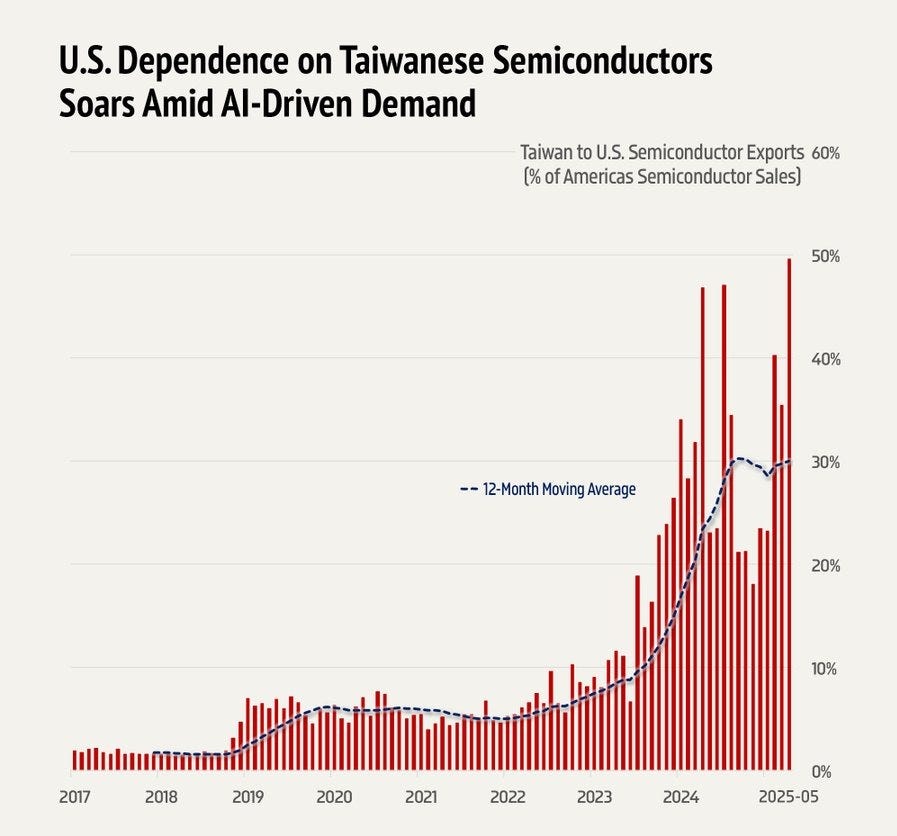

Taiwan launches unity drive as China threat looms

Taiwanese President Lai Ching-te has launched a high-profile campaign aimed at fostering national unity in the face of escalating pressure from China, asserting Taiwan’s de facto independence and historical distinctiveness. Speaking at the first of ten planned events under the banner "Unite Taiwan," Lai emphasized the island’s sovereign status, pointing to its unique history, government, and people. His remarks—delivered with a domestic focus as his Democratic Progressive Party (DPP) seeks to regain parliamentary control—are nonetheless expected to provoke further military and diplomatic pressure from Beijing.

Lai’s rhetoric comes at a delicate moment, as China continues to intensify its show of force around Taiwan, including near-daily military operations, maritime incursions, and simulated invasion exercises. U.S. Indo-Pacific commander Admiral Samuel Paparo has labeled these maneuvers “rehearsals,” warning they could serve as cover for a sudden real-world assault. Since Lai’s inauguration in May 2024, Beijing has ramped up its tactics, not just militarily but through global diplomatic pressure and espionage efforts aimed at isolating Taiwan and reinforcing its claim over the island.

In his speech, Lai rooted Taiwan’s identity in centuries of separation from mainland China, noting that its indigenous population is Austronesian and the island remained largely beyond Chinese control through much of history. He also highlighted that after Japanese colonial rule ended in 1945, Taiwan’s sovereignty was never formally transferred to any other country. Though his stance is in line with the DPP's longstanding position, Beijing views Lai as more provocative than his predecessor Tsai Ing-wen. With more speeches planned on cross-Strait relations, democracy, and peace, Lai appears determined to strengthen Taiwan’s national resolve while carefully navigating the increasing risks of Chinese retaliation. FINANCIAL TIMES

VECTOR SALES AND TRADING DESK

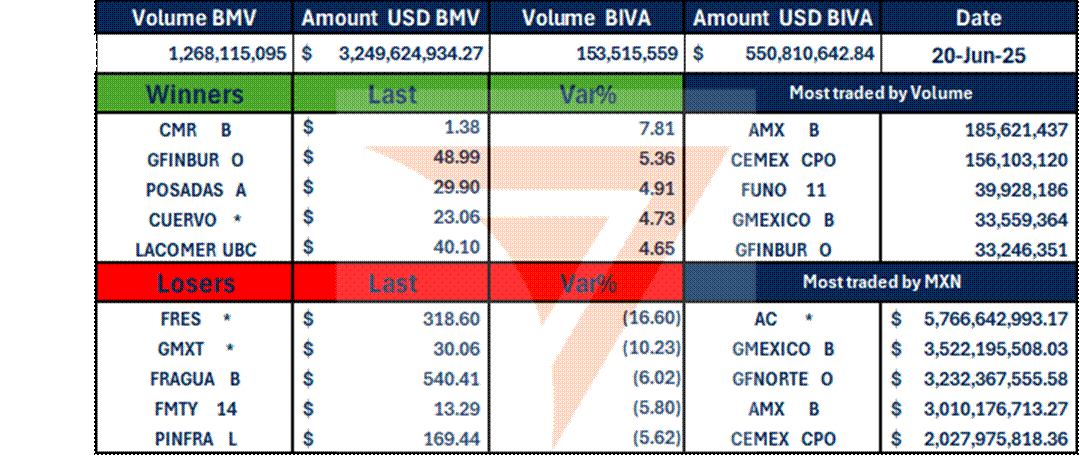

Stock futures fell ahead of Monday’s session after the United States entered Israel’s war against Iran over the weekend by striking three nuclear sites, a move by President Donald Trump that raised oil prices and risked a bigger conflict in the Middle East.

Mexico's stock exchanges closed the final trading session of the week with gains, despite ongoing concerns over the war between Israel and Iran. Local indexes rose amid volatility driven by the expiration of futures and options on what is known as Witching Day.

The main index, the S&P/BMV IPC of the Mexican Stock Exchange (BMV), which includes the most actively traded local stocks, gained 0.35% to close at 56,264.69 points.

Concern Over Escalation, Recognition of Iranian Nuclear Threat Dominate World Reaction to U.S. Strikes

FOUNDATION FOR DEFENSE OF DEMOCRACIES

In the aftermath of U.S. airstrikes on Iran’s nuclear facilities, international leaders responded with a mix of concern and cautious endorsement. British Prime Minister Keir Starmer emphasized that Iran must never be allowed to obtain a nuclear weapon, praising the U.S. for taking decisive action to neutralize the threat. French President Emmanuel Macron echoed that view but stressed the urgent need for renewed diplomatic and technical negotiations to prevent further escalation. Across Europe, similar calls emerged, urging Iran to return to talks while warning of the risks of unchecked nuclear development and regional destabilization.

European Union foreign policy chief Kaja Kallas urged all parties to “step back” from the brink of conflict and reiterated the EU’s firm stance against a nuclear-armed Iran. Italy’s Foreign Minister Antonio Tajani described Iran’s nuclear capabilities as a danger to the broader region. Meanwhile, reactions from the Arab world were subdued; Saudi Arabia voiced “deep concern,” and Qatar expressed “regret” over rising tensions, while Lebanese President Joseph Aoun warned against dragging his country further into conflict. His comments were widely interpreted as a message to Hezbollah to stay out of the fight.

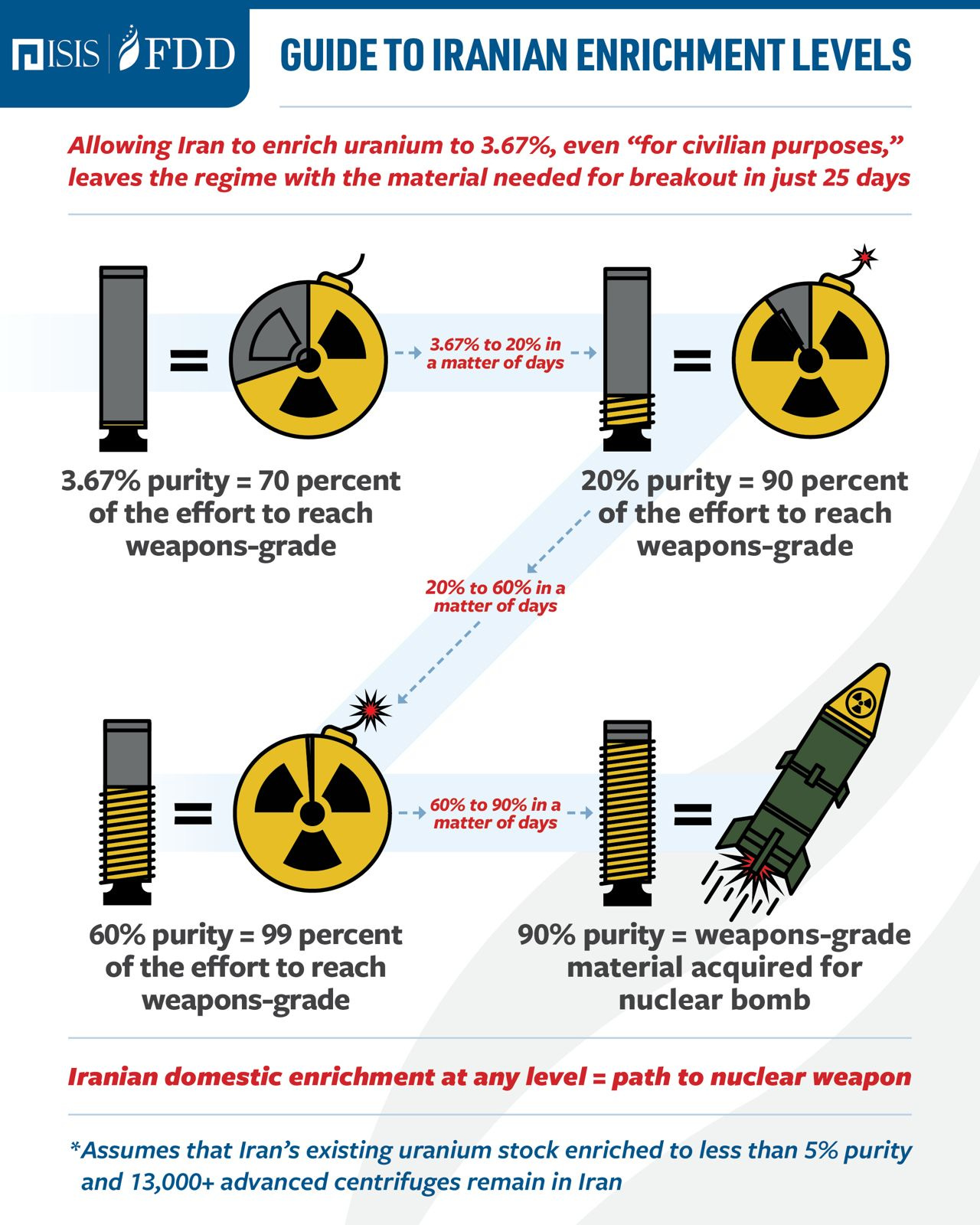

On the other side, Iran and its closest allies sharply condemned the strikes. Iranian Foreign Minister Abbas Araghchi threatened “everlasting consequences” and urged global condemnation. China, Russia, and several other anti-U.S. governments, including Venezuela and Cuba, accused Washington of violating international law. Dmitry Medvedev, Russia’s deputy security council chair, mocked President Trump’s peacemaker claims and hinted that unnamed countries could arm Tehran. Experts from the Foundation for Defense

MEXICO MINING: Mexico Signals New Era for Mining, but Investment Uncertainty Persists Amid Regulatory Gridlock

On Wednesday, an educational agreement was signed between the Ministry of Economy and CAMIMEX (led by Pedro Rivero), involving 27 universities and aimed at professionalizing the mining industry. This surprised many in the sector due to the government’s sudden shift in tone and approach. Marcelo Ebrard highlighted the importance of mining for Mexico’s development, stating that, with Claudia Sheinbaum’s support, the country is entering “a new phase to reduce dependence on mineral imports and protect the economy.”

Despite this more favorable discourse, the mining industry continues to face major challenges. The sector suffered a 4.3% contraction in 2024 and a further 4.8% decline through April 2025. Investment has dropped more than 20%, with exploration budgets plummeting—expected to reach just $400 million this year, according to CAMIMEX. New mining projects take over a decade to mature, and with reserves dwindling, reactivation of the industry is critical. While Sheinbaum has been more cautious than her predecessor, the open-pit mining ban (which affects 60% of the sector) remains uncertain due to pending congressional legislation.

Additionally, regulatory bottlenecks persist. Numerous permits and concessions await approval by SEMARNAT under Alicia Bárcena. The private exploration ban remains in effect, now subject to the discretion of the Geological Service led by Flor de María Harp. Although the mining industry's reputation has improved and better aligns with the goals of “Plan México,” lingering questions and a lack of legal clarity continue to deter investment. The future of the sector hangs in the balance. EL SOL DE MEXICO

VECTOR RESEARCH

Waller Signals Possible Fed Rate Cut as Soon as July

Federal Reserve Governor Christopher Waller struck a notably dovish tone, stating that the Fed is well-positioned to cut interest rates as early as its next meeting in July. Waller downplayed concerns over the inflationary impact of new tariffs, suggesting such effects would likely be one-off and not indicative of a persistent shock. He emphasized that current data is favorable, with low unemployment and inflation nearing the Fed’s target. Waller believes the Fed has room to begin easing policy cautiously and monitor developments, advocating a gradual approach to avoid surprises and ensure flexibility should shocks arise. He also noted that labor conditions are beginning to show soft spots—like higher unemployment among recent graduates and slowing job creation—but are still generally healthy.

Waller highlighted that wage growth is not showing signs of excessive pressure and therefore doesn’t pose a threat of second-round inflation effects. He stressed that the Fed should not wait for a labor market collapse before acting, and reiterated that managing government borrowing costs is the responsibility of Congress, not the central bank. Importantly, he acknowledged that not all FOMC members share his view—recent projections revealed a split, with seven participants seeing no need for cuts in 2025. Waller’s remarks represent the most dovish public commentary from a Fed official so far regarding the start of a new rate-cut cycle.

Meanwhile, President Donald Trump said he currently does not plan further military action against Iran, citing the possibility of diplomatic negotiations. He indicated he will decide within the next two weeks whether to escalate U.S. involvement in the conflict.

The Dilemma of Banco de México's Neutrality

A central bank's monetary policy is closely tied to the economic conditions of its country. The most influential variables are inflation and economic growth. The weight given to each depends on the central bank's mandate. In decision-making, central banks rely on various tools, analyses, and monetary rules to determine the appropriate level for the benchmark interest rate. One of the most important resources in monetary policy is the so-called neutral rate range, which defines the stance of monetary policy in a country. A central bank will seek to bring interest rates to this range when GDP is near its potential level and inflation is close to the target. Adjustments around the neutral level depend on prevailing inflation and growth dynamics. A restrictive stance is when the interest rate is above the neutral range—typically used during high inflation. In contrast, an expansionary stance occurs when the rate is below the neutral range, often seen during low inflation and weak economic growth.

In Mexico, monetary policy has remained in restrictive territory since October 2022, when headline inflation exceeded 8% annually and was clearly rising. The peak of this restriction occurred in the first quarter of 2024. Since then, 15 months of rate cuts have taken place, driven not only by easing inflationary pressures but also by a sharp economic slowdown, particularly in late 2024 and early 2025. The current benchmark interest rate stands at 8.5% and is expected to drop to 8% this coming Thursday. At that level, the central bank’s stance would be just 75 basis points from the upper limit of the estimated neutral range (official estimates place Mexico’s neutral rate between 5.5% and 7.3% nominal, with a midpoint of 6.4%).

In the coming months, Banco de México will face a dilemma: should it bring the rate into neutral territory? The answer, as expected, lies in the data—though perhaps not as clearly as the central bank would prefer. On one hand, economic growth remains weak and is expected to stay subdued for several more quarters, supporting further rate cuts. On the other hand, inflation has yet to show the consistent downward trend the bank wants, as it remains affected by shocks in goods, agricultural products, and persistent service prices. This would argue for keeping the rate restrictive until forecasts show a more definitive decline in inflation. So far, Banxico has prioritized economic growth and continued with rate cuts. In the second half of 2025, the pace of cuts is expected to slow from 50 to 25 basis points, contingent on better inflation data as the stance nears neutrality. Market sentiment suggests that a neutral stance may be reached by mid-2026, though this will depend on inflation behaving as expected.

INTERNATIONAL DAY

National Let It Go Day, observed on June 23, is a day dedicated to emotional release and personal growth. It encourages individuals to reflect on past regrets, grudges, mistakes, or emotional baggage that may be holding them back, and to make a conscious decision to let go. Whether it's forgiving someone, moving on from a failure, or releasing guilt, the day serves as a reminder that healing often begins with acceptance and surrender. By choosing to "let it go," people create space for peace, clarity, and new opportunities in their lives. It's a symbolic fresh start—an invitation to release what no longer serves you and embrace what lies ahead.