MEXICO: JARED KUSHNER

Trump's son-in-law helped maintain U.S.-Mexico ties and played a key role in the 2018 USMCA negotiations, earning Mexico's Order of the Aztec Eagle, the country's highest honor for foreigners.

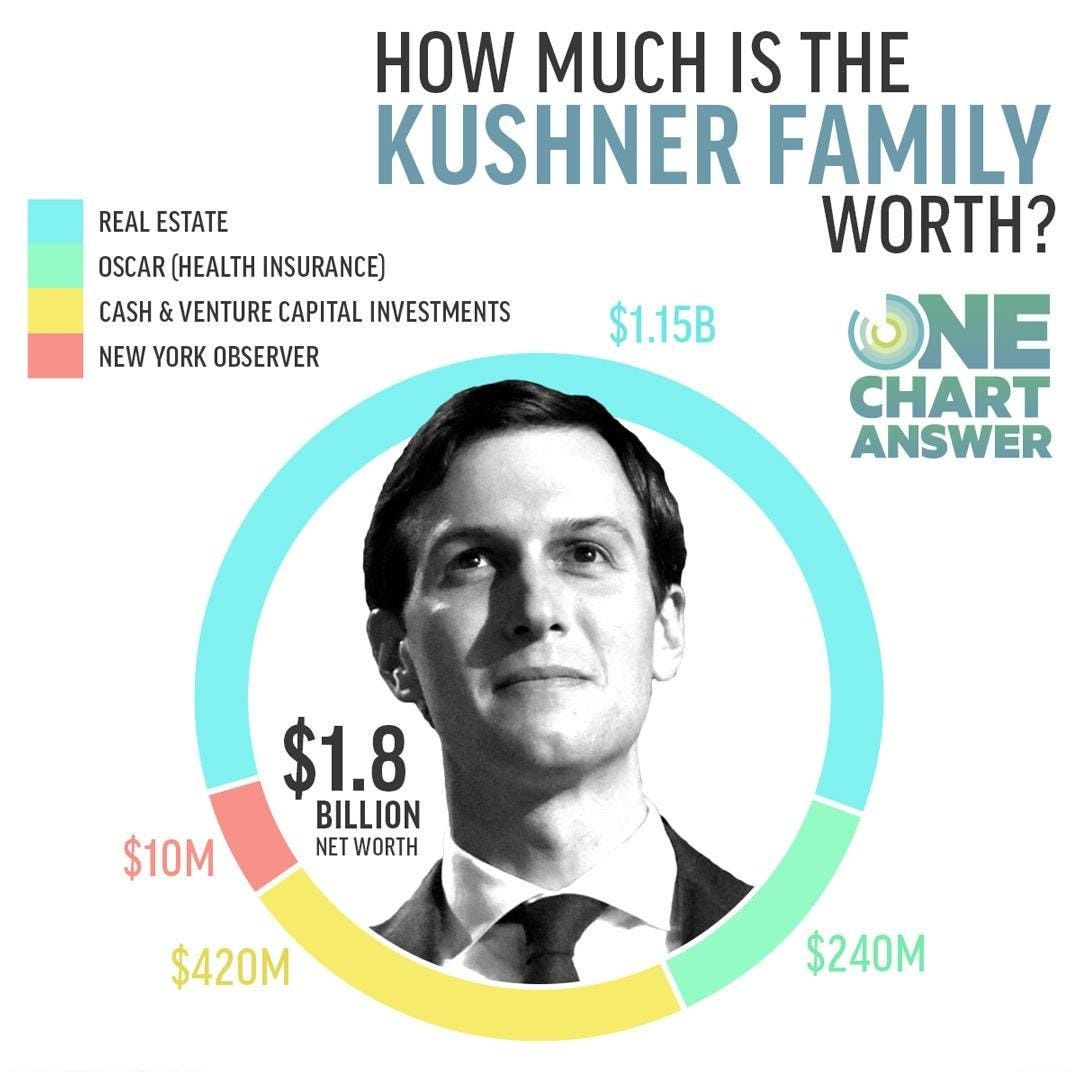

The House of Kushner

During Donald Trump’s first presidency his son-in-law Jared Kushner was involved in the renegotiation of the North American Free Trade Agreement, the response to the coronavirus pandemic, a blockade in the Middle East, and the normalization of relations between Israel and Gulf countries.

It propelled Kushner’s profile from a property developer best known for his years-long effort to salvage a $1.8bn investment in a Manhattan office tower and into a global power broker with deep access to the key players in the Middle East and the highest rungs of finance.

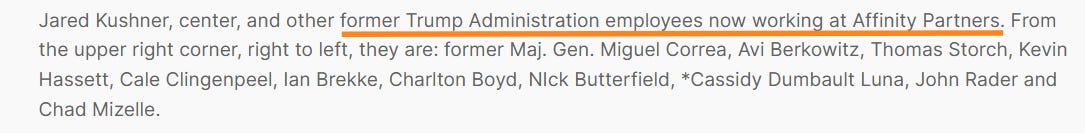

On his way out of the White House, Kushner translated his Rolodex into a multibillion-dollar business, a private equity firm called Affinity Partners that mostly invests cash for the state-backed investment vehicles of Saudi Arabia, the United Arab Emirates and Qatar.

Affinity has gained attention from those on Wall Street to Washington since it was launched in January 2021.

Democrats have viewed the vehicle suspiciously and called for investigations into the fund. The fledgling firm’s initial $2bn fundraising mostly from Saudi Crown Prince Mohammed bin Salman, whom Kushner befriended, took many by surprise.

Now, Kushner is poised to seize the moment.

He will not take a formal role in the Trump White House this time around, freeing him to focus on his family and investments. Those investments range from high-profile property deals in the Balkans, to companies benefiting from artificial intelligence to bets on new trade dynamics in a deglobalizing world.

Some deals, such as an ongoing negotiation for a waste management company in Mexico, may be derailed by Trump’s trade policies.

In an interview, Kushner laid out his vision for Affinity and his response to lawmakers who have characterized his outfit as a pay-to-play operation for foreign governments to gain influence with Trump.

In its first few years, Affinity invested sparingly, deploying less than half of its capital, moderate activity that Kushner says was a result of fears over corporate valuations.

The firm, which employs about 30 people and has seen staff churn, avoids buying companies outright, preferring minority equity stakes. Kushner views it as a more nimble investment operation that minimizes administrative burdens. It is also lucrative for Kushner, the majority owner of Affinity.

So far, Affinity’s results are inconclusive. While some deals have gained in value, others like a stake in an Amazon aggregator backed by Adam Neumann have a cloudy outlook.

Kushner is now planning billions in new investments and recently struck two prominent deals, building stakes in Israeli insurer Phoenix Financial and billionaire Brad Jacobs’ acquisition vehicle QXO.

Notably, Kushner views the Phoenix deal as helping to build regional ties among potential adversaries. In it, he is ploughing cash from Saudi, Qatari and the UAE directly into Israel’s markets. A UAE fund had tried to invest in Phoenix in 2023, but was blocked by Israeli regulators.

Kushner says to his critics: “A lot of these people will say everything is a conflict. I am not going to let that stop me.”

He adds: “These guys won’t acknowledge [that] I have an incredible track record of success in the Middle East . . . I have those great relationships because of the success that I achieved, which was something that I was criticized for trying to do at every step along the way.” Financial Times

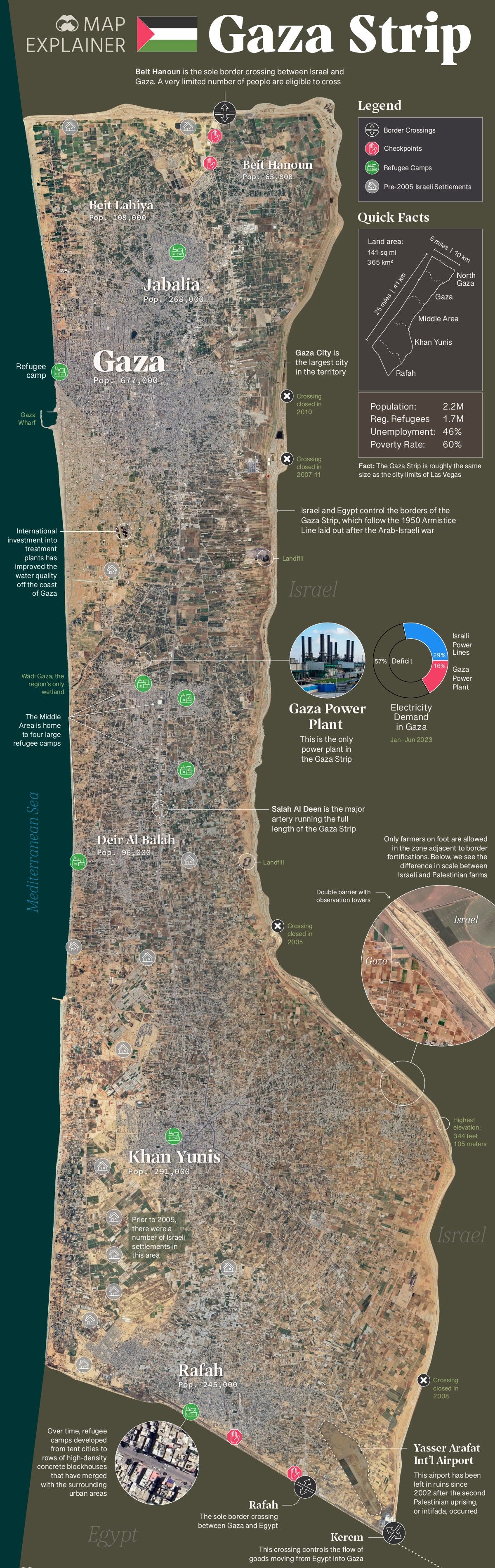

What to Know About the Trump Family’s Deals in the Middle East

The Trump family has significantly expanded its business interests in the Middle East, with major real estate projects in Oman, Saudi Arabia, and Dubai. These ventures primarily focus on luxury golf courses, hotels, and high-rise apartments, developed through branding deals. The Trump Organization has earned millions from these agreements, including at least $7.5 million from a golf course and hotel project in Oman. The family also has plans for additional developments in the region, with past interests in Israel now on hold due to ongoing conflicts.

President Trump has proposed that the United States take control of Gaza, suggesting the region could be developed into a real estate project similar to his previous endeavors. His plan involves relocating the Palestinian population and building new, luxurious housing on the waterfront property. While Trump’s aides later clarified that there were no plans for military intervention in Gaza, the proposal highlights his ongoing interest in Middle Eastern real estate development.

Jared Kushner, Trump’s son-in-law, has also been deeply involved in Middle Eastern investments through his private equity firm, Affinity Partners. The firm has raised $4.5 billion, primarily from sovereign wealth funds in Saudi Arabia, Qatar, and the UAE. Kushner’s investments include stakes in Israeli businesses, and his business connections have extended to controversial sectors, including military contracting. Additionally, the Trump family’s partnership with LIV Golf, a Saudi-backed golf league, has brought substantial revenue through tournaments held at Trump-owned properties, further solidifying their business ties in the region. NY Times

Kushner’s Mexican Investment Halted Amid Trump’s Tariff Threats

Jared Kushner’s private equity firm, Affinity Partners, faces uncertainty in Mexico after President Trump’s decision to impose tariffs on Mexican goods. A planned investment in a Mexican infrastructure company, which had been in the works for 18 months, is now on hold due to the tariff threats. Kushner’s investment strategy was based on the growing nearshoring trend, which involves companies relocating production closer to target markets, with Mexico being seen as a key beneficiary. However, the tariffs have disrupted this plan, threatening to undermine the economic dynamics that underpinned Affinity’s investment approach.

The tariffs could significantly impact the Mexican economy, especially the infrastructure sector, which was a key focus for Affinity. Tariffs on imported materials and potential retaliatory measures from Mexico could increase construction costs, making large projects less attractive to investors. Kushner’s prior involvement in negotiating the USMCA trade agreement and his relationships with Mexican officials had positioned Affinity well in the market, but the resurgence of tariff threats has created a volatile environment, complicating future investment plans.

Affinity Partners, which launched in 2021, has quickly grown with substantial backing, raising over $4.6 billion. While it has investments across multiple countries, including Brazil and Germany, both of which have faced tariff threats, the uncertainty surrounding U.S.-Mexico trade relations presents a major challenge. The pause in the Mexican investment underscores the risks of political decisions on global business ventures, particularly when intertwined with family interests. Comms Trader

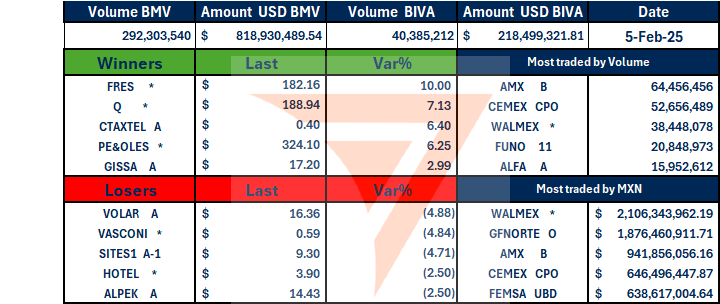

VECTOR SALES AND TRADING DESK

The three major New York stock indices closed higher on Wednesday, recovering from losses as investors overlooked disappointing Alphabet results and weighed the prospects of future interest rate cuts by the U.S. Federal Reserve.

The S&P 500 rose 0.39% to 6,061.47 points, while the Nasdaq gained 0.19% to 19,692.33. The Dow Jones Industrial Average increased 0.71% to 44,873.22.

Mexican stock markets closed lower on Wednesday, following two days of gains, as investors focused on trade tensions sparked by the United States.

The benchmark index of the Mexican Stock Exchange (BMV), the S&P/BMV IPC, which includes the most traded local stocks, dropped 0.62% to 51,570.19 points.

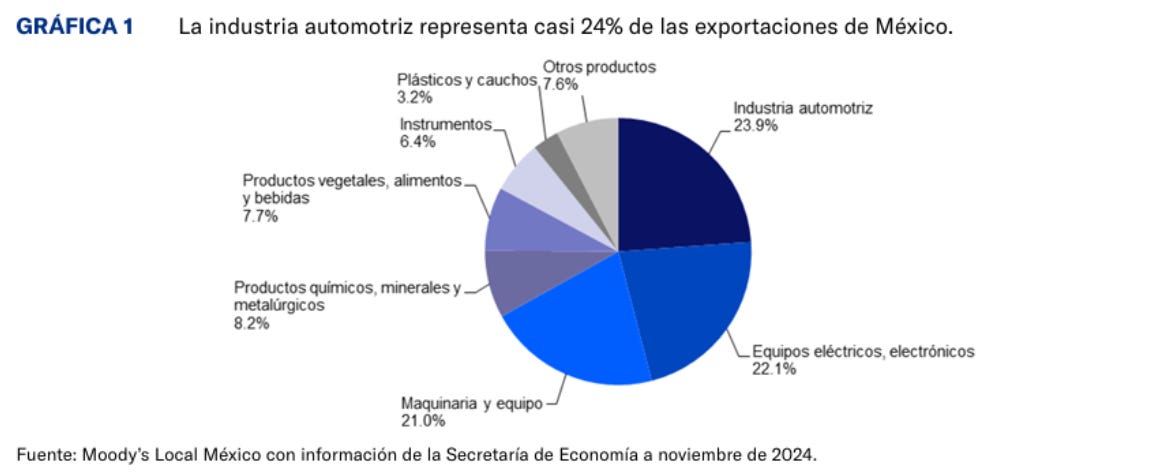

MEXICAN BANKS: MOODYS, Tariffs Present Credit Risks to Issuers in the Private and Public Sectors

Financial Institutions Benefit from Strong Solvency and Stability

In general, financial institutions in Mexico demonstrate strong solvency and stability, which will allow them to weather the contingencies arising from tariff measures. That said, there are specific cases of very weak credit profiles, with previously identified deterioration recognized by the market. In these particular cases, we expect an exacerbation of their risk, already considered very high.

For the credit financial sector, we believe that the impact of the tariffs will have a very limited direct negative effect, as the direct transmission channels are less impactful due to the low level of financial penetration. The most important regional banks could face lower credit placement volumes, although we do not expect significant deterioration in their portfolios, considering their prudent risk controls. If tariffs remain for a prolonged period, they could pressure consumer payment capacity, which would reinforce our outlook of higher risk costs for banks in 2025.

Q*: Stock Rose +7.13% to 188.94 mxn. Street analyst expects stock to be included in the MSCI Index. MSCI REBALANCE: BOFA estimates

The next MSCI review will be announced on Feb 11th, to be effective Mar 3rd.

“In Mexico, think Telesites (SITES1 MM) could be deleted. In the event SITES1 MM is deleted, Qualitas (Q* MM) would be the most likely addition. "

MSCI will post the list of additions to and deletions from the indexes for the February 2025 Index Review on its web site, MSCI, shortly after 11:00 p.m. Central European Time (CET) on February 11, 2025..

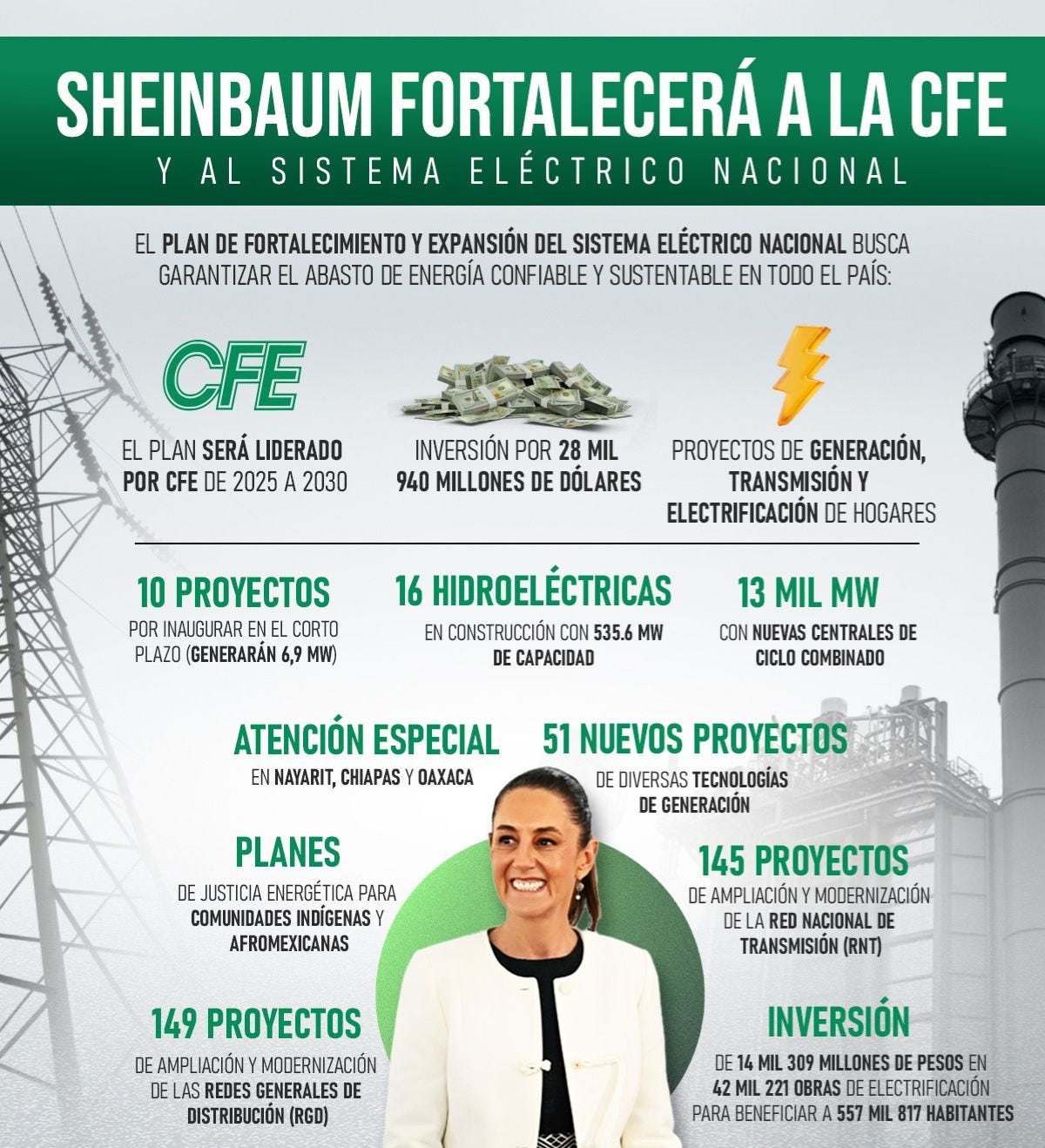

CEMEXCPO: The Mexican government has unveiled a plan to strengthen and expand the National Electric System, aiming to add 29,074 megawatts to its capacity with a total investment of $22.37 billion.

The project was presented by Energy Secretary Luz Elena González Escobar, emphasizing the plan’s focus on modernizing infrastructure and ensuring accessible electric service, particularly in marginalized communities. The government also intends to involve private investment to accelerate the country’s energy transition.

The plan includes investments of $46 billion for transmission networks and $3.6 billion for distribution. The goal is to expand electricity coverage to more than 500,000 homes without access. The plan also aims to increase clean energy contributions from the Federal Electricity Commission (CFE) from 22.5% to 38%. New renewable energy projects, including solar plants and wind farms, will be developed across various states.

President Claudia Sheinbaum noted the program's ambitious scope, supported by financing mechanisms developed by CFE and expected legislative approval. The plan also includes efforts to bring electricity to underserved regions, furthering Mexico's energy sovereignty and ensuring stable supply for future development.

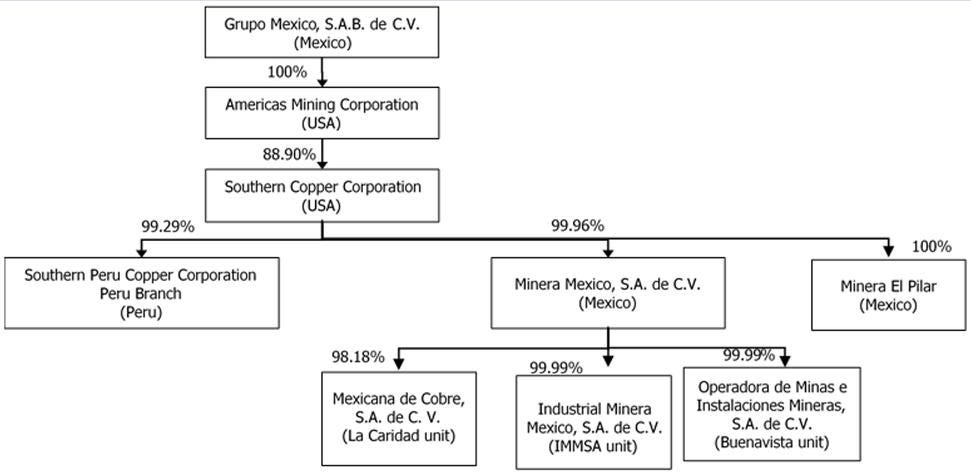

GMEXICOB: Minera México Prepares Senior Bond Issuance of Up to $1 Billion

Fitch Ratings assigned an investment-grade rating of “BBB+” to a proposed senior unsecured bond issuance by Minera México, S.A. de C.V., owned by Southern Copper Corporation and Grupo México, for up to $1 billion, maturing in 2032.

The net proceeds from the offering will be used to fund capital expenditures and general corporate purposes. Previous bond issuances by the company have been related to mining projects in Mexico, where Southern Copper Corporation operates most of its activities.

SCC is the fifth-largest copper producer globally and holds the highest reported copper reserves in the sector. Minera México contributes about 48% of SCC’s consolidated copper reserves.

Fitch highlighted that SCC’s operational risk is mitigated by its ownership of multiple mines in Mexico, contributing nearly 60% of EBITDA, with the remainder coming from operations in Peru. Revista Fortuna

VECTOR RESEARCH

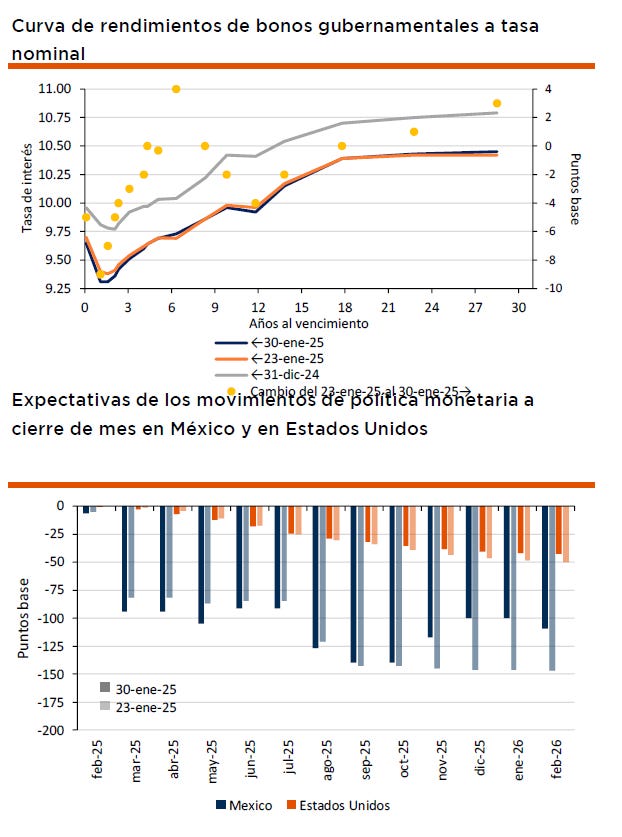

FIXED INCOME STRATEGY

The local fixed income market showed a mostly positive dynamic, although with limited movements. The interest rate changes were associated with speculation around rates in the United States and the potential shift in the monetary stance of Banco de México next Thursday. In this regard, the market is incorporating a more optimistic sentiment about the rates, anticipating that the impact will be more limited than initially expected, which would provide room for a 50 basis point reduction by Banco de México.

Next week in the United States, key events include the publication of the PMI and ISM indices for manufacturing and services, the ADP payroll change, non-farm payrolls, the unemployment rate, and employment and housing data. In Mexico, key highlights include the release of the manufacturing PMI, gross fixed investment, January inflation, and the monetary policy decision.

In terms of prospects, in the long term, there is significant potential for capital gains derived from the expected cycle of rate cuts by Banco de México, which is why steepening strategies are recommended, along with maintaining exposure to fixed income instruments, especially in the 2 to 10-year sector. In the short term, we adopt a tactical stance in light of potential volatility from actions by the new U.S. administration.

GAPB: Issues Debt for MXN 6 Billion to Refinance Liabilities; Neutral

Grupo Aeroportuario del Pacífico (GAP) issued MXN 6,000 million in long-term debt through the placement of 60 million certificates. The placement was conducted through two tranches under the "communicating vessels" modality. The initial amount was MXN 5,000 million with a 20% oversubscription option, which was fully realized. The offering was oversubscribed 3.4 times the amount. The transaction was structured as follows:

First Issue: 30 million certificates maturing in three years with ticker “GAP 25” for MXN 3,000 million. The interest rate is variable, at TIIE plus 50 basis points, with principal payment due on February 1, 2028, and an option for early amortization.

Second Issue: 30 million certificates maturing on March 4, 2032, with an interest rate of 9.67% fixed, for MXN 3,000 million. This represents the first reopening of the long-term issuance “GAP22-2” originally issued in March 2022.

The certificates received credit ratings of “Aaa.mx” by Moody’s and “mxAAA” by S&P, both with stable outlooks. The funds from these emissions will be used to repay the principal of existing certificates “GAP 20” and “GAP 21,” and the remainder will finance commitments in the 2025 Master Development Program in Mexico and commercial investments.

In our view, this is positive news regarding the improvement of maturity profiles, but neutral in terms of valuation. Based on our estimates, the net debt-to-EBITDA ratio for the end of this year will be 1.9x, down from the 2.3x we projected for 2024. Our fundamental recommendation remains HOLD, with a target price of MXN 412.00.

INTERNATIONAL DAY

National Lame Duck Day, observed on February 6th, commemorates the ratification of the 20th Amendment to the U.S. Constitution in 1933. This amendment reduced the "lame duck" period—the time between an election and the inauguration of a new president—by moving the presidential inauguration from March 4 to January 20.

The term "lame duck" originally referred to stockbrokers in 18th-century London who defaulted on their debts. It later evolved to describe elected officials nearing the end of their term, particularly those who have not been re-elected.