MEXICO INVESTMENT: FROM PROMISES TO PAUSES

Private Sector Analysts Warn of Nervousness Over Reforms Hindering Investment Realization.

Business Uncertainty Rises in Mexico and the U.S.

The business sector in the country has increased its concerns regarding confidence and investments due to constitutional reforms that have led to the overrepresentation of Congress, all without an ideal environment characterized by the rule of law and clear regulations.

Following President Claudia Sheinbaum's meeting with business leaders from Mexico and the United States, aimed at bolstering investor confidence, the prevailing sentiment is one of heightened nervousness about how the economy will operate under a judicial system dominated by the ruling party and lacking independent bodies as checks and balances.

The Center for Private Sector Economic Studies (CEESP) has also noted growing anxiety over a potential hardening of the U.S. stance in the renegotiation of the USMCA.

Given these factors, the CEESP emphasizes that private investment in Mexico will fall short of what is needed, despite the 143 investment announcements made by the Ministry of Economy, which have an expected value of $45.464 billion, in addition to the $110.744 billion reported during 2023—amounts that have yet to materialize.

In its latest analysis, the CEESP points out that the goal of Sheinbaum's meeting with business leaders from Mexico and the U.S., within the framework of the summit known as the CEO Dialogue, was to strengthen the confidence of both national and foreign investors in Mexico as an investment destination.

However, business leaders have observed a paralysis in investments since the presidential elections in Mexico, as there are signs of diminishing certainty, as reflected in key economic indicators. Contra Replica

Investment Requires an Ideal Environment, Not Just Meetings Between Government and Private Sector: CEESP

The change in government has raised significant concerns about the accompanying reform proposals.

"It is clear that, in addition to meetings with national and international business leaders and commitments of support, it is essential to first have the conditions that not only increase the attractiveness of investing in the country but also make it practically a necessity for interested countries.

"The responsibility of the new government lies in creating an ideal environment where the rule of law prevails, clear rules of the game are established for all participants, and trust is strengthened for those wishing to invest in Mexico's productive activities," stated the Business Coordinating Council (CCE). Fortuna y Poder

The investment that will come.

Companies require energy, water, communication routes, security, skilled labor, but above all, legal certainty—something that is not clear whether the new government can guarantee.

However, in the short term, many executives have expressed their concerns about the speed and, above all, the methods being used to implement the judicial reform, the positions of judges and magistrates, the federal government, and the potential impact this could have on the future of their investments. El Financiero

Investors Know What Awaits Them: Judges and Legal Experts Warn of Risks from Sheinbaum's Disobedience.

Judges and legal experts expressed their disagreement with President Claudia Sheinbaum's defiance of a court order requiring her to remove the publication of the judicial reform from the Federal Official Gazette (DOF). They warned that this decision exposes any citizen to potential noncompliance from other authorities regarding amparo suspensions that do not favor them.

Carlos Soto, a circuit judge, stated on his X account that Sheinbaum's remarks during Friday's morning conference—where she asserted that she would not revoke the decree and announced plans to file a complaint against the judge with the Judiciary Council—send a clear message that her government will not comply with unfavorable rulings.

In light of this, Soto noted that "investors know what awaits them" if they have to go through an amparo trial and the suspension does not please the authorities. Latinus

Investors pause projects in Mexico to monitor progress on judicial reform under Sheinbaum: BBVA

Álvaro Vaqueiro Ussel, CEO of Corporate and Investment Banking at BBVA Mexico, clarified that despite the uncertainty the reform may generate, he does not foresee a scenario in which companies pull back or move their investments from our country to other destinations.

Foreign investors have paused their investments and projects in Mexico in the context of nearshoring, as they want to see how the judicial reform of the Federal Judiciary unfolds in 2025 under President Claudia Sheinbaum’s government, said Álvaro Vaqueiro Ussel, CEO of Corporate and Investment Banking at BBVA Mexico.

He explained that for foreign investors, the main focus of attention is the legal certainty in a country, meaning there must be clear rules in place when it comes to investing. El Economista

Federal Government Analyzes Tax Incentives to Attract Foreign Investment: Luis Gutiérrez.

Undersecretary of Foreign Trade, Luis Gutiérrez, stated that the Mexican government is considering offering tax credits to invest in sectors such as electric vehicles (EVs), semiconductors, rare minerals, batteries, and electronics.

"We are seriously analyzing the possibility of creating incentive programs with tax credits very similar to those in the United States and Canada (...) we believe this could allow us to attract many companies to Mexico," said Undersecretary of Foreign Trade Luis Gutiérrez in an interview with Reuters. El Economista

Tesla and BYD Plants: Unfulfilled Promises for Mexico?

Both manufacturers have created high expectations regarding their plants in Mexico, but their realization may take longer than anticipated, potentially being postponed until after 2026.

According to a source close to the matter in China, where Tesla has a gigafactory and relationships with several key suppliers, many of these suppliers who had expressed interest in joining the value chain for the complex in Nuevo León have decided to pause their plans.

Like Tesla, BYD also expressed interest in setting up a plant in Mexico last year. However, sources told Bloomberg in September that it was unlikely BYD would establish a plant in Mexico before the U.S. elections scheduled for November 2024.

Although the company has denied these claims, other sources told Expansión that the project will not materialize in the short term and could even be postponed until after the USMCA review in 2026.

VECTOR SALES AND TRADING DESK

MEXICAN BANKS: GFNORTEO (-1.36%), BBAJIOO (-2.7%), RA (-1.60%)

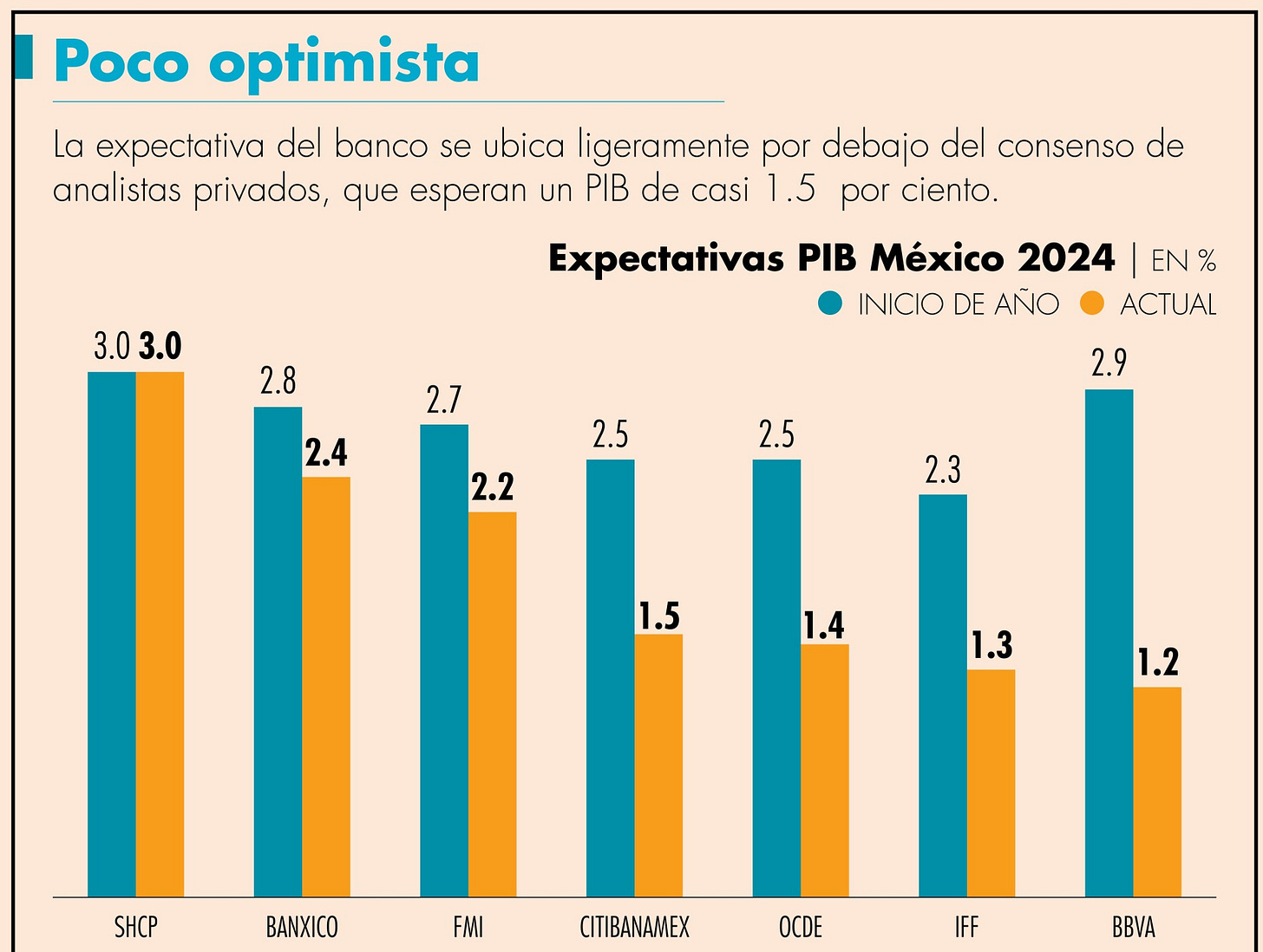

It is expected that the reference rates will decrease in the next year, which would impact the banks income .

Banking is a cyclical sector, and there is an expectation that the Mexican economy will slow down at the end of this year and early next year, which is expected to affect the profitability of the banks.

On October 14th Moody´s wrote Fintechs Are Expected to Consolidate in Mexico by 2025. Moody´s

The firm anticipates increasing convergence between these platforms and traditional banks, with fintechs continuing to gain ground, especially those seeking banking licenses.

Moody´s anticipates a growing convergence between technology platforms and traditional banks, with the former continuing to gain ground in the financial sector, particularly those that have opted to pursue banking licenses.

"In 2025, we expect a consolidation of innovative financial models, along with a union between these and the more traditional, yet widely digitized, banking practices in Mexico. This aligns with the initiative of some fintechs to pursue banking licenses, which will be a positive development," stated Moody's Local in its report, "The Rise of Fintechs in Mexico Will Continue in 2025."

Moody's Local Mexico noted that in recent years, fintechs have implemented disruptive business models, allowing them to capture market shares and motivating them to seek banking licenses.

In the past three years, the major fintech players offering credit in the country have chosen to obtain a regulated license under the figure of Popular Financial Companies (Sofipos), allowing them not only to lend but also to accept deposits from the general public. Over the last year, there has been significant competition to attract depositors, primarily driven by interest rates, which have reached up to 15%. This phenomenon largely explains the remarkable growth in deposits within the Sofipos system.

It is often assumed that traditional banks and the fintech sector coexist harmoniously as part of the same financial system; however, the reality is different. The fintech sector, with its numerous advantages, is increasingly gaining ground through a variety of options that attract more customers.

Fintech companies are now considered direct competitors to banks, which continue to operate with traditional practices and numerous procedures that are not only outdated but also perceived as inefficient. While their model may have been highly effective in the past, it is now viewed as slow and lacking the flexibility needed to meet new demands.

BOLSAA: The institution alerted on its social media about an attempted fraud involving the impersonation of its name and that of its CEO, Jorge Alegría.

Through its social media channels, the stock exchange detailed how scammers contact users via WhatsApp and Telegram, requesting initial deposits and offering investment recommendations through these platforms.

CEO DIALOGUE INVESTMENTS: AP News wrote on October 15th. AP News

Mexico says foreign firms have pledged $20 billion in investments, but many are old or uncertain

However, foreign governments and some foreign business groups have expressed concerns about a reform passed in September that would make all judges — including the justices of the Supreme Court — stand for election.

The fear is that would politicize court cases and put foreign firms — who obviously have no vote in the elections — at a disadvantage. They fear judges would be likely to heed the will of their constituents than the letter of the law.

And foreign energy companies are still smarting from their treatment at the hands of Sheinbaum’s predecessor and political mentor, former president Andrés Manuel López Obrador, who left office on Sept. 30.

MEXICO INVESTMENT MONITOR DELOITTE

LASITEB1: Announced the approval of a capital increase of 1 billion shares at 3 pesos each, totaling a rights offering of 3 billion pesos. The dilution will be approximately 24%, and the funds will be used to reduce the company's debt.

AMXB: This is a favorable announcement from the IFT, particularly given recent discussions indicating that new regulations for the telecommunications company were forthcoming. This communication suggests that the upcoming rules may not be as stringent as previously anticipated.

Telmex renews concessions to provide Internet in 134 areas of high and very high marginalization.

In June 2016, El Economista reported that the IFT renewed a batch of concessions in the 400 MHz band to Teléfonos de México for the provision of local and long-distance wireless fixed-line services, as well as Internet coverage in 134 local service areas (ASL), all of which are rural and of very high marginalization.

These concessions are related to a renewal from 2016, when the Federal Telecommunications Institute (IFT) granted spectrum to Telmex to maintain service in those 134 locations across Mexico. Despite Telmex submitting a late request for the renewal of concessions, the IFT faced the dilemma of either not renewing the permits for the company or leaving the residents of those regions disconnected, as Telmex was the only communication alternative available to them at the time. El Economista

COPPEL: Coppel, one of Mexico's retail giants, inaugurated its largest Distribution Center (Cedis) in Texcoco, State of Mexico, on Monday. The complex, located on the federal highway Mexico-Texcoco in San Miguel Coatlinchán, required an investment of 1.2 billion pesos.

The Cedis will serve as a logistical hub for the company's more than 1,600 stores across the country. It covers an area of 124,000 square meters and has a storage capacity of 10 million products.

"This Distribution Center is a key component in strengthening our logistical capacity in Mexico, allowing us to continue growing and responding to our customers' demands more efficiently, as it is 25% more productive than a traditional Cedis," commented Agustín Coppel during the inauguration.

AC*: Announced the Launch of TUALI, a Platform That Optimizes Operations for Nearly One Million Retailers in Latin America

In a statement, Arca Continental announced that this platform was developed by its Digital Nest. It is available in Mexico starting in October, while it will reach Ecuador, Peru, and Argentina in the last quarter of the year.

The bottler explained that this new platform will utilize agile methodologies and generative artificial intelligence, in addition to developing cutting-edge solutions to optimize both customer experience and operational efficiency.

The bottler detailed that in 2023, it helped retailers increase their sales by 5 to 10 percent, and now with TUALI, the company continues to drive growth in the traditional channel while exploring new opportunities in the digital realm.

VECTOR RESEARCH

GAP (BUY, TP MXN 409.00): They company announced the refinancing of the credit line that expired on Friday, October 18, 2024, for MXN 1.5 billion, extending the maturity by 12 additional months. The interest will be payable monthly at a variable rate of TIIE-28 plus 38 basis points, with no commissions, and the principal will be due on October 17, 2025. According to our estimates, we expect the net debt to EBITDA ratio at the end of this year to be 2.1x. For 2025, we project it will close at 1.6x. In our opinion, this is neutral news for the valuation and for the stock price behavior in the short term. We reiterate our fundamental recommendation of BUY on the issuer, with an expected intrinsic value (IV) of MXN 409.00.

OMA (HOLD, TP MXN 177.00): On Friday October 18th, the company reported that it has identified a recent cybersecurity incident involving unauthorized access to certain information systems. The issuer commented that, to date, there has been no material adverse effect on the company’s operations, results, or financial position, which will be continuously evaluated until the situation is fully resolved. In our opinion, as long as such incident does not have material effects on aeronautical operations, we consider that the news would have a neutral impact on both the valuation and the short-term behavior of the stock price. However, we believe that the market will be more focused on news regarding the evolution of airport traffic, particularly those related to expectations or announcements of investment projects aimed at taking advantage of nearshoring opportunities in regions of the northern part of the country, as well as the evolution of insecurity in some cities in the north of the country. On this point, in the state of Sinaloa, the airports managed by the company, which are those of Culiacán and Mazatlán, represented 9.7% and 6.0% respectively of the passenger traffic managed by the issuer in 2023.

MEXICO CORE PORTFOLIO: will participate in the increase of ALFA's share capital based on the number of shares they would receive through the full exercise of the Right of Preference (0.1535050125165 new shares for each share representing the company's capital), at a price of MXN 10.75.

To finance the subscription of new shares of ALFA at MXN 10.75, we will sell approximately 11.2% of our position in ALFA at market prices (approximately MXN 14.52, intraday price; the final amount will be adjusted according to the average weighted closing price for today).

In practical terms, the operation we are undertaking is equivalent to ALFA having paid a dividend in shares, at a rate of around 3.99%.

INTERNATIONAL DAY

October 22 is also celebrated as World Brain Day. This day focuses on raising awareness about brain health and neurological disorders, promoting education, and advocating for better resources and support for those affected by brain-related issues.