MEXICO: HOUSING BILL

The program to build up to one million homes during the current administration must include incentives, support for buyers, construction companies, and private sector.

What is the controversy surrounding the new Infonavit Law?

Recently, the full Senate of the Republic approved the reform to the new Law of the Institute of the National Housing Fund for Workers (Infonavit), which introduces a series of changes not only in its structure but also in its functions. One of the most notable changes is the inclusion of Infonavit as a builder of housing, with the goal of addressing the national housing issue.

The government of President Claudia Sheinbaum has announced that her housing construction plan aims to build one million homes during her administration. Of this total, 50% would be the responsibility of Infonavit, and the other 50% would fall to the National Housing Commission (Conavi).

However, the controversy over the new law stems from the changes made to the Board of Directors of Infonavit, which have raised concerns among employer organizations. These changes, according to them, pose a risk to the tripartite system, which is the foundation of the Institute's functioning.

What is tripartism?

Tripartism refers to the composition of Infonavit's General Assembly, where three sectors are represented: the government, the labor sector, and the business sector, with equal representation for each. Through these three actors, decisions are made, votes are cast, and policies for the Institute are defined.

Under the new reform, the General Assembly of Infonavit will be reduced from 45 to 30 members, with equal representation for all three sectors (10 members from each). However, a controversial aspect is that the Director General, Octavio Romero Oropeza, will have veto power over decisions, which would grant him greater authority over voting.

Additionally, in the Board of Directors, the number of members will be reduced from 15 to 12, with four representatives from each sector. Other changes will affect different bodies within Infonavit, such as the Audit Committee, which will now have five members, with an unbalanced representation in favor of the government (three for the government, one for the business sector, and one for the labor sector).

Finally, the Supervisory Committee will maintain its nine members, but the majority will be from the government (five), while two will come from the labor sector and two from the business sector.

These changes, which reduce the representation of the business and labor sectors in favor of the government sector, have sparked a debate about the potential concentration of power in the government and the risks to the tripartite system. Milenio

Sheinbaum guarantees safety of Infonavit funds amid reform criticism

President Claudia Sheinbaum assured that the changes to the internal organization of Infonavit introduced by the reform are aimed at improving its governance, not at using workers' savings.

She emphasized that the savings are secure, are not at risk, and are safeguarded by the Ministry of Finance.

Last week, the Senate approved a reform to create a state-owned construction company, which will require a restructuring of Infonavit's organizational structure.

Sheinbaum stated that all workers' savings in Infonavit are fully backed, calling out the irresponsible media reports that suggested the workers' funds were in trouble. "These claims are false; the savings of workers are completely safe, and that will not change," she emphasized.

She added that the creation of a construction company would allow for consolidated purchases of building materials, obtain lower prices, and meet the goal of one million housing units during the current administration.

Sheinbaum reiterated that Infonavit's tripartite nature will remain intact, with decisions being made collectively by the government, business, and labor sectors.

"This is a comprehensive plan that strengthens Infonavit, maintaining its tripartite nature, oversight by the Ministry of Finance, but also provides governance to Infonavit, eliminating any issues related to corruption and ensuring full transparency," Sheinbaum concluded. Excelsior

Trump Threatens to Resume Border Wall Construction with Mexico: "It's a Very Expensive Wall"

Donald Trump complained that building the border wall with Mexico will cost "hundreds of millions" of dollars more than the first section he built during his previous term (2017-2021).

On December 16, 2024, during a press conference at his Mar-a-Lago residence in Palm Beach, Florida, the Republican president-elect, who will begin his second term in January, reiterated his commitment to continue constructing the border wall, though he noted its rising costs.

“It’s a very expensive process, a very expensive wall,” Trump recalled about the first wall, which used steel. He also remarked that the current construction industry has improved, and a lot can be done with concrete.

"We have very strong concrete, and also, a reinforcing bar," Trump added, also referencing his plan for mass deportations as a core element of his immigration policy. El Financiero

VECTOR SALES AND TRADING DESK

MEXICO HOUSING: FANVIT AND INFONAVIT

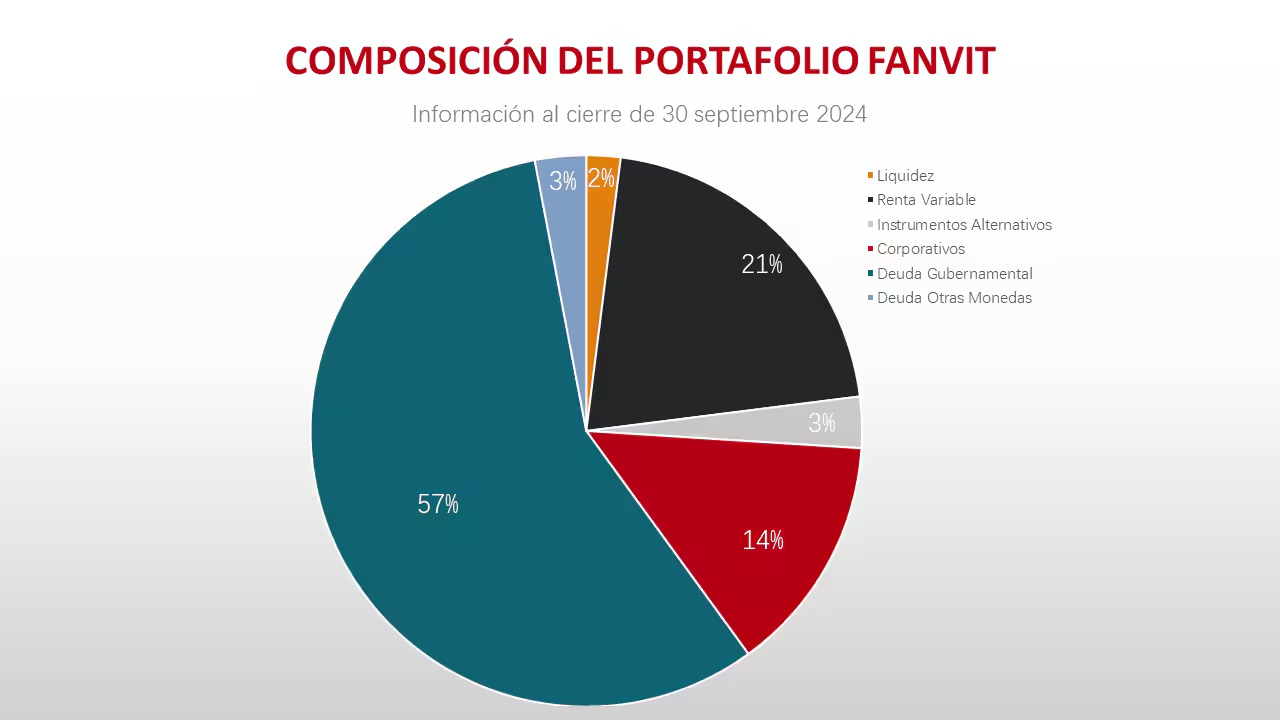

FANVIT stands for Fondo de Apoyo a las Necesidades de Vivienda de los Trabajadores, which is a fund created by the Infonavit to invest in values for its beneficiaries.

What is INFONAVIT?

INFONAVIT was established in 1972 to manage the National Housing Fund and provide a credit system that enables workers in Mexico to access decent housing. According to the Mexican constitution, every worker has the right to decent housing, and INFONAVIT facilitates this by offering various types of housing credits. These credits can be used for:

Buying a home

Building a home

Remodeling or expanding a current home

Paying an existing mortgage

Renting a home

Employer Obligations

Employers in Mexico are required to register with INFONAVIT and contribute to the fund as part of their payroll process. Key obligations include:

Registration: Employers must register themselves and their employees with INFONAVIT within five business days of hiring.

Contribution: Employers must contribute 5% of each employee’s salary to INFONAVIT. These contributions are made bi-weekly.

Notification: Employers must notify INFONAVIT within five days when an employee leaves the company.

Failure to comply with these obligations can result in significant fines ranging from three to three hundred and fifteen times the locally established minimum wage.

How INFONAVIT Contributions are Used

The contributions collected from employers are used to fund various housing-related loans and benefits for employees. These loans are designed to help employees:

Purchase new homes

Build new homes

Remodel or expand existing homes

Pay off existing mortgages

These contributions directly benefit employees, making housing more affordable and accessible.

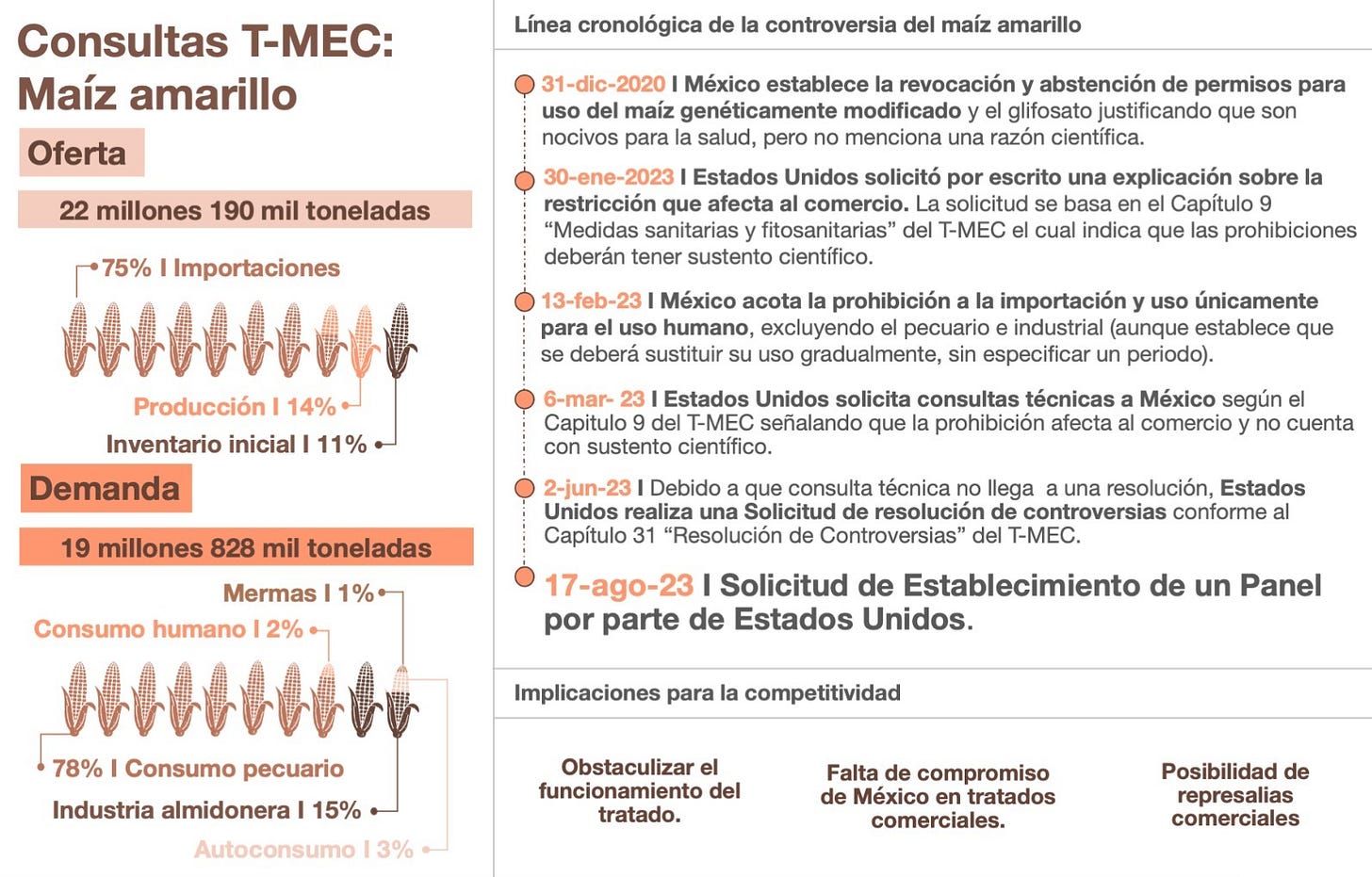

MEXICO LOST THE GMO CORN PANEL: FINAL REPORT

Recent developments have shed light on the panel related to the 2023 ban on GMO corn in Mexico. The USTR, under Katherine Tai, quickly reacted and brought the issue before the T-MEC in August. Multiple reports had indicated that the ruling on the matter was likely to be unfavorable to Mexico. Marcelo Ebrard's economic team addressed the situation, noting that the verdict would be announced on December 14. In reality, this was primarily a procedural matter, as the final report—which was expected to be resolved by November 29—had already been received, and the ruling indeed proved unfavorable for Mexico.

With the prospect of Donald Trump returning to the White House, retaliatory measures are anticipated. This issue remains contentious, especially considering that Mexico has been importing approximately 24 million tons of corn from the U.S. annually for livestock and manufacturing industries. El Sol de Mexico

Our View: While the ruling represents a setback for Mexico, it should be viewed positively from an investment perspective. The outcome demonstrates that the USMCA's dispute resolution mechanism is functioning effectively, providing assurance to investors that trade-related conflicts will be managed and resolved transparently and predictably. This process reinforces the integrity and effectiveness of the USMCA, offering stability and legal certainty for businesses engaged in cross-border trade between the U.S., Canada, and Mexico.

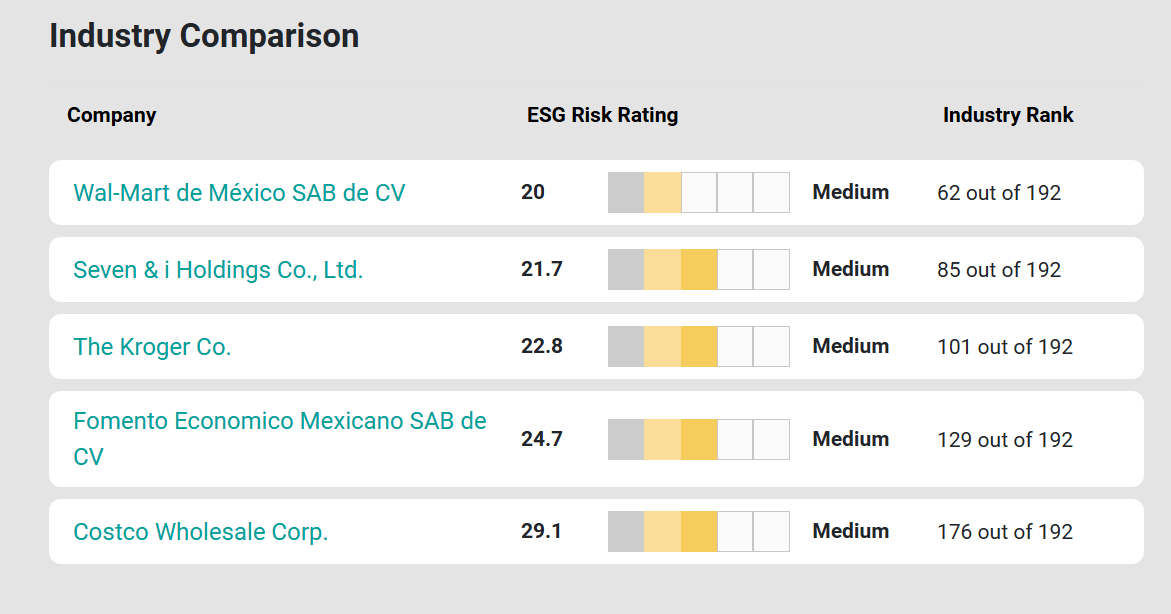

WALMEX*: Cofece fines Walmart and orders it to eliminate abusive practices against its suppliers

Photograph of the loading entrance for supermarket suppliers

The Plenary of the Federal Economic Competition Commission (Cofece) determined that Walmart engaged in illegal conduct regarding the supply and distribution of food, beverages, and household hygiene and cleaning products in Mexico.

For 13 years, Walmart used its market power to impose abusive conditions on its suppliers, gaining illegal advantages over its competitors. Walmart had a system that allowed it to impose discretionary discounts, forcing suppliers not to offer better prices and conditions to other self-service stores, severely affecting them, especially small and medium-sized ones.

In addition, these practices also harmed Mexican families, as Walmart made it difficult for other self-service stores to offer better deals without this necessarily resulting in better prices for Walmart's customers.

Therefore, Cofece's Plenary fined Walmart, ordered it to stop these illegal practices, and prohibited it for the next ten years from:

Retaliating against its suppliers (such as sanctioning or terminating contracts) as a result of their commercial relationships with other self-service stores.

Demanding or imposing prices on its suppliers to enable them to make attractive offers to other self-service stores.

Requiring suppliers to provide information about the prices or conditions they offer to other businesses.

Applying discounts on the prices at which it purchases products without the prior and express consent of the supplier.

Additionally, the ruling orders Walmart to:

Update its internal policies, guidelines, and contracts to comply with the resolution.

Establish a communication channel for suppliers to report any irregularities that violate the resolution.

Implement a compliance program in economic competition and designate a high-level compliance officer.

These measures were carefully designed by Cofece so that Walmart can continue to negotiate freely and competitively with its suppliers, without gaining illegal advantages over other self-service stores. Thus, these measures do not mean that Walmart cannot offer low prices to its customers, but that it must do so by competing on equal terms for the preference of Mexican families.

Cofece will monitor compliance with these measures for ten years and may fine Walmart up to 8% of its revenue if it fails to comply with this resolution.

Through this ruling, Cofece seeks to ensure that all self-service stores can negotiate freely with any supplier and that everyone can offer low prices to Mexican families, reaffirming its commitment to work toward ensuring competition in the markets so that the Mexican population has access to more and better goods and services. COFECE

Our View: In reality, there is no significant material impact on the issuer, particularly given its assertion that it has consistently acted in accordance with the highest standards. However, the most notable effect may be on the Environmental, Social, and Governance (ESG) funds in which the issuer participates. The imposition of such fines can result in a reduction of the issuer's ESG score, potentially affecting its standing within these funds and influencing investor perception.

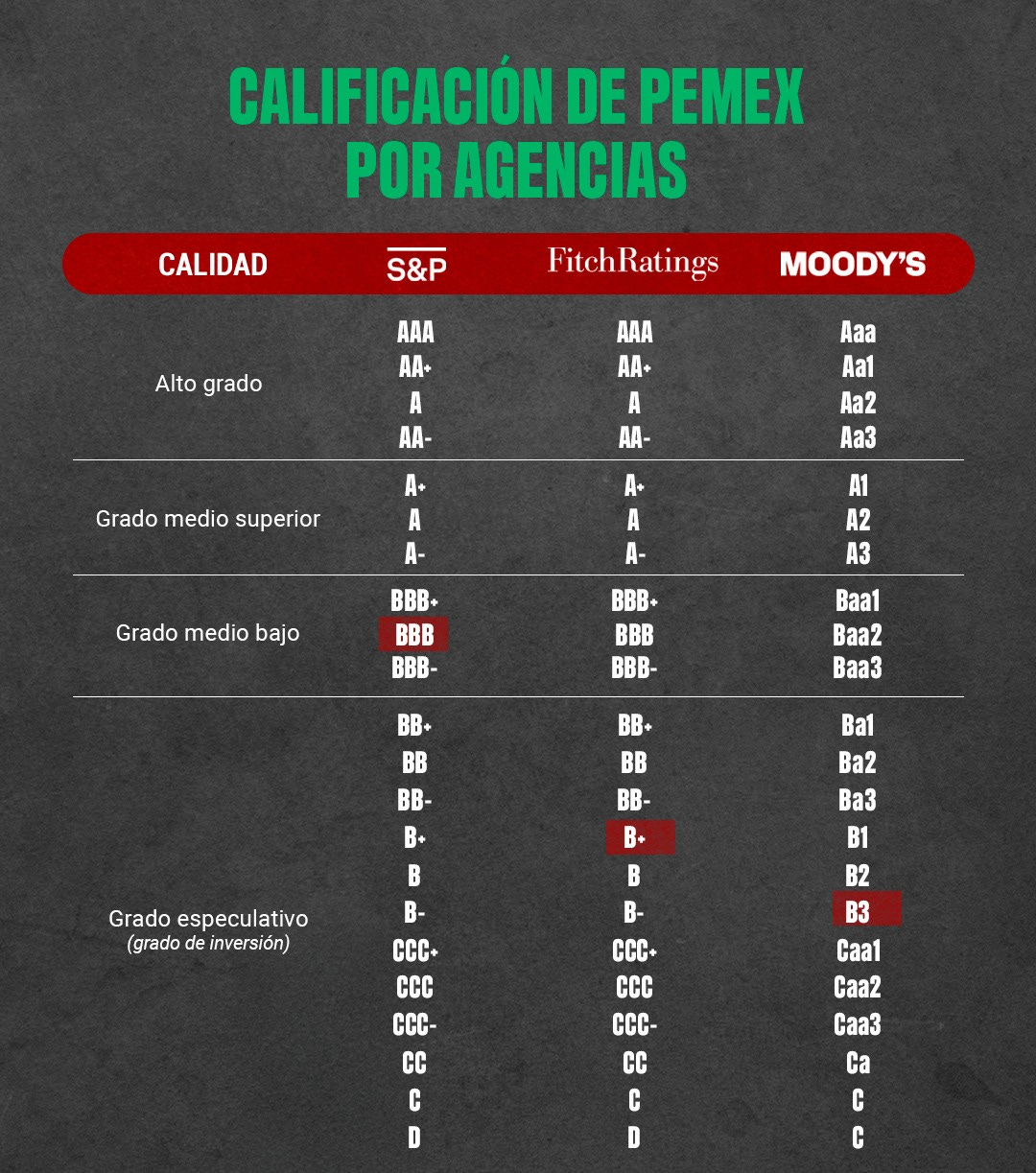

PEMEX: Fitch Affirms PEMEX's IDRs at 'B+'; Outlook Stable

Linkage to Sovereign Rating: The inclusion of PEMEX in Mexico's annual budget, for the second year in a row is credit positive, signaling increased visibility on timing and magnitude of government support. The approved budget included USD6.7 billion of support for PEMEX in 2025, covering most of its USD8.9 billion of debt maturities for the year. Although still unclear, it is likely that the balance will be covered with tax reductions and deferrals, and possibly refinancing of some sort. Additional support is needed to address the company's USD18.2 billion of short-term debt reported in 3Q24.

Fitch believes continuing inclusion of PEMEX in the annual budget will make further support easier. Fitch estimates PEMEX will need to address a USD75 billion cash shortfall between 2025 and 2027, in addition to USD20 billion in maturities between 2025 and 2027, assuming no capital injections and no contribution from the government past 2025. A continuing trend of support and enhanced visibility could prompt a reassessment of the linkage score, which could, in turn and per Fitch's Government-Related Entity Criteria, trigger a change in the approach to notching to PEMEX's rating. Fitch Ratings

AGUILASCPO: Why stock lost -1.5% after winning the championship.

Investment Funds in Liga MX: What They Are and How They Relate to the Crisis in French Football

The concept of investment funds is becoming increasingly prevalent in sports business models. These funds typically involve a group of investors who contribute millions of dollars in exchange for equity stakes. Recently, interest has been growing in the Liga MX, with Apollo Management Inc. expressing intent to invest $1.3 billion into the Mexican football league. The aim of this investment is to enhance the infrastructure of the league's teams.

This proposal has sparked debates among the league's team owners, with reports indicating opposition from certain owners and organizations. The primary point of contention appears to be the requirement to share ticketing revenue, a condition that has not been well-received. Similar investment models have been successfully implemented in top leagues such as the NFL, NBA, MLB, Ligue 1, and teams like Inter Milan, Manchester City, Chelsea, and Paris Saint-Germain, all of which have received backing from investment funds. If the 18 Liga MX team owners accept Apollo Management's proposal, they would be joining this global trend.

Understanding Investment Funds in Sports

The Mexican Stock Exchange (BMV) defines investment funds as organizations that pool money from various investors to acquire financial assets and generate returns. According to Sports Pro magazine, sports are considered an attractive industry for these funds for three main reasons: guaranteed cash flows, fan loyalty, and resilience during economic downturns.

Andrew Umbers, partner at Oakwell Sports Advisory, explained that "the returns from sports franchises outperform most assets over 5, 10, or 20 years." In simpler terms, sports franchises represent a secure business model with substantial profit potential.

In Mexico, the use of investment funds in sports is not new. Necaxa, a Liga MX team, is the most recent example, having attracted foreign investors through the company NX Football USA. This group includes notable figures such as actress Eva Longoria, model Kate Upton, and athletes Justin Verlander (baseball) and Odell Beckham Jr. (American football).

While the injection of capital is an attractive proposition for club owners, the model is not always as profitable as it appears. There have been global instances where teams or leagues have ultimately lost more money than they gained, one of the most prominent being France's Ligue 1.

The Crisis in French Football

In July, the French Football League (LFP) was accused by the French Senate of mismanagement, possible corruption, and embezzlement of funds related to an investment deal with CVC Capital Partners. In 2022, CVC invested $1.6 billion in exchange for a 13% stake in a new commercial subsidiary that would manage the league's television rights. This deal was struck after French football faced a financial crisis due to the collapse of a broadcasting agreement with Mediapro.

Reports indicate that the agreed-upon capital from CVC was supposed to be distributed among the teams of Ligue 1 and Ligue 2, but the agreement lacked clarity on how the funds would be allocated. After adjustments to a sports law, the money was partly used to repay loans taken from the French government.

On November 5, French authorities raided the home of LFP president Vincent Labrune and the league's offices as part of an investigation into a €37.5 million transaction that may have been embezzled. This case is becoming one of the most significant scandals in French football.

How This Relates to Liga MX

The conditions of Apollo Management's proposed investment fund have not been publicly disclosed. In a letter sent to team owners on November 29, Juan Carlos Rodríguez, the Commissioner of the Mexican Football Federation (FMF), discussed what he called the “biggest transformation project” in Mexican football history. The proposal includes the NFL’s involvement in investment and collaboration with Major League Soccer (MLS) to expand their current relationship through the Leagues Cup. However, financial details such as the fund’s demands and the distribution of the capital were not included.

According to sports journalist Ignacio Suárez, some of the wealthier teams in the league, particularly those with higher television revenues, better attendance, and more titles in the 21st century, oppose the investment fund. Notably, Club América, owned by Emilio Azcárraga, former president of Grupo Televisa, supports the proposal.

It is expected that the investment proposal will be debated at the next owners’ meeting, which is set to take place before the Liga MX final this week. However, the outcome of this meeting will not be definitive, as the proposal is regarded as a "master plan" from the FMF president.

On December 13, 2024, Juan Carlos Rodríguez resigned as FMF commissioner after the investment proposal was rejected by a group of team owners. According to sports journalist David Medrano, the proposal was heavily scrutinized, and no vote was held. Despite the rejection, this is not the first time a similar proposal has been delayed, as there have been intentions since 2022 to bring significant capital injections into Liga MX.

In conclusion, the proposed investment fund, though met with resistance, remains a critical development for the future of Mexican football. Whether it progresses or not, it illustrates the growing global trend of investment funds reshaping sports leagues, as well as the complex dynamics and challenges involved in such high-stakes business ventures. INFOBAE

VECTOR RESEARCH

Interest Rate at 10%

Banxico Interest Rate Cut: Expectations and Economic Challenges

The majority of economists surveyed by Citibanamex expect the Bank of Mexico (Banxico) to reduce its benchmark interest rate by 25 basis points this week, bringing it to 10.0%. Only 9% of those surveyed predict a half-point reduction. This expectation is based on the context of a better-than-expected inflation result for November, although Banxico officials remain cautious about future risks, especially concerning the policies that the new U.S. administration might implement.

The general inflation rate decreased from 4.8% year-on-year in October to 4.6% in November, while core inflation dropped from 3.8% to 3.6%. These figures suggest that the short-term shocks affecting food prices, such as fruits and vegetables, are gradually correcting, which also reflects the effectiveness of the monetary policy implemented by Banxico. Specifically, the continuous decline in core inflation over the past 22 months indicates that monetary policy is working.

However, the Mexican economy still faces challenges. In October, industrial production fell sharply by 2.2% year-on-year, with construction and mining sectors being the most affected. On the other hand, the exchange rate has remained relatively stable in recent weeks, closing at 20.12 pesos per dollar, after surpassing 20.70 pesos at the end of November. Additionally, the Congress approved the fiscal program for 2025, which aims to reduce the fiscal deficit to 3.9% of GDP and maintain a stable public debt-to-GDP ratio.

These elements provide arguments for another interest rate cut, and there might even be room for a reduction greater than 25 basis points. However, economists note that the policies the new U.S. administration may adopt, particularly regarding migration and drug trafficking, cannot be overlooked. In the most likely scenario, the U.S. president may use tariff threats to negotiate agreements with Mexico, which could lead the Mexican government to reinstate some of the previous administration's strategies on these issues. Additionally, the renegotiation of the United States-Mexico-Canada Agreement (USMCA), scheduled for 2026, could include new clauses on rules of origin and further commitments regarding U.S. imports.

Although the U.S. is expected to impose tariffs on specific products, especially those related to exports from Chinese companies and certain raw materials, these measures are expected to have a marginal impact on growth and inflation in Mexico. In such a case, there would be few obstacles for Banxico to continue reducing interest rates, though it would do so cautiously, ensuring that the inflationary environment remains under control.

However, an extreme scenario in which the future U.S. president imposes a 10% general tariff on all imports would have significant consequences for the Mexican economy, both in terms of production and inflation, which could necessitate a change in economic policy and, particularly, in monetary policy. Despite this risk, the likelihood of implementing such high tariffs is low, as it would also have a considerable negative impact on the United States and the rest of the world.

In summary, Banxico's monetary policy faces a complex environment where interest rate cuts could continue as long as inflation continues to decline and the impact of potential U.S. policies remains within reasonable bounds. Caution will be key to ensuring that the effects on the Mexican economy do not deviate from current expectations.

ALFA A: The adjustment has brought the stock to the 50-day moving average support level at 15.22, which could potentially lead to a bounce with resistance at 16. However, the downward trend of the indicators keeps the risk of an extended adjustment alive. If the stock remains below the moving average, it could drop to the next support at 14 or even reach the demand zone, which is supported by both price levels and the 200-day moving average at 13.1 pesos.

INTERNATIONAL DAY

The International Day of the Wright Brothers, observed on December 17th, commemorates the first successful powered flight by Orville and Wilbur Wright on that date in 1903. The Wright brothers, two American inventors and aviation pioneers, made history when they flew their aircraft, the Wright Flyer, at Kitty Hawk, North Carolina, marking the beginning of modern aviation.

This day honors their achievement and celebrates the significant advancements in air travel and technology. The Wright brothers' first flight lasted just 12 seconds, covering 120 feet, but it revolutionized transportation and opened the doors for the development of the aviation industry worldwide.