MEXICO: FINTECH GROWTH

Mexico remains the second largest fintech ecosystem in Latin America and the Caribbean, accounting for 20% of the region's financial technology startups.

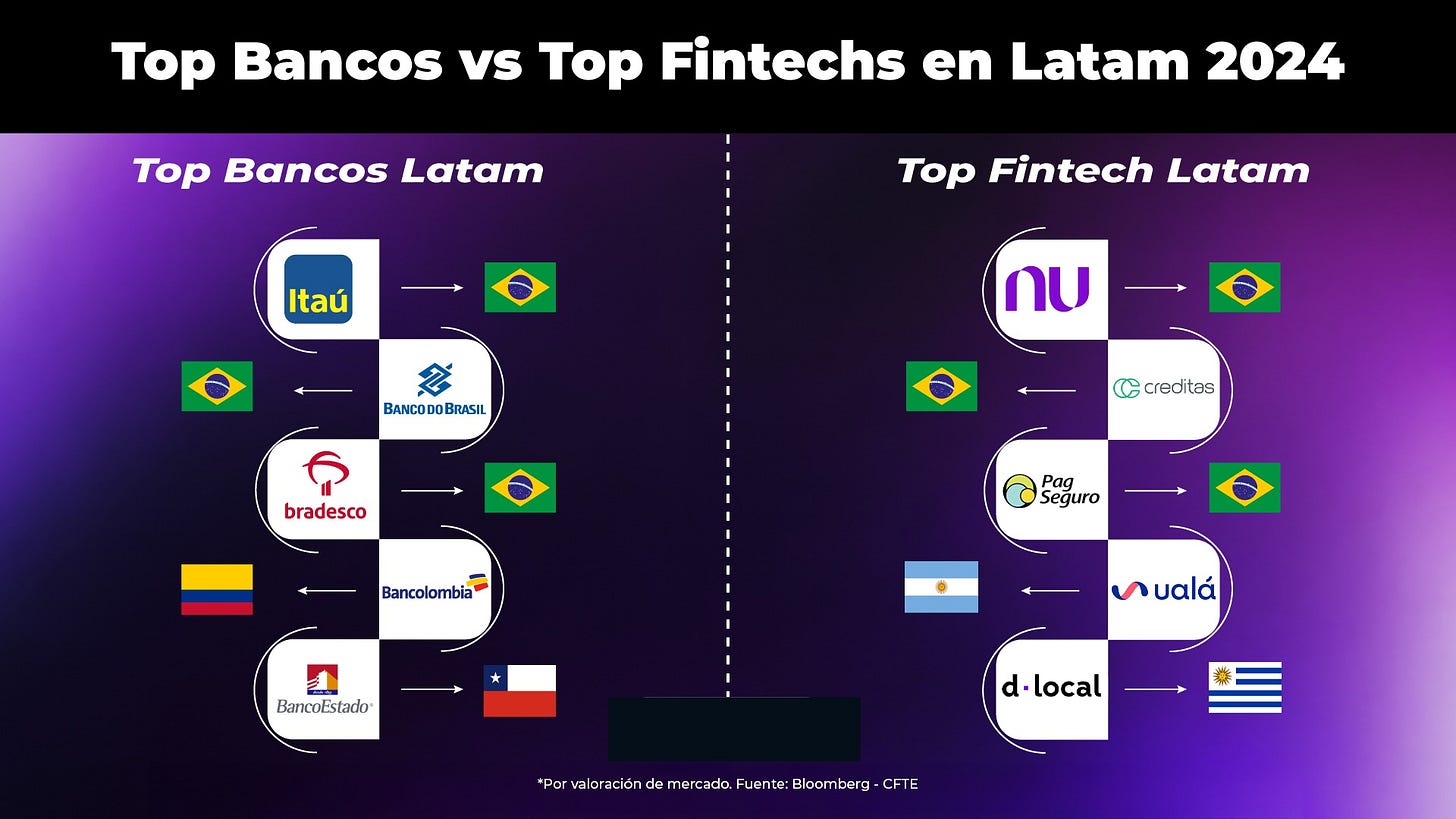

Banks and Fintech: Differences and Similarities in Financial Products

Choosing between traditional financial options and those offered through technological platforms can raise many questions. Understanding the strengths of both alternatives is important in order to select the one that best suits your needs.

In case of any complaints with banks or a fintech, the agency responsible for addressing them is Condusef.

In recent years, with the rise of financial technology companies (fintech), the range of financial products has expanded significantly. We are constantly exposed to advertisements for numerous debit and credit products via social media, television, and street billboards.

Given the wide variety of financial products available from both traditional banks and fintech, it is important to know the similarities and differences between these products to make an informed decision when choosing what to contract.

Debit Accounts

According to data from the Bank of Mexico, there are more than 194 million active debit cards in the country, meaning an average of one and a half cards per person. The number of debit cards indicates that such a product is essential for daily financial life.

Joel Cortés, CEO of Kardmatch, a digital platform specializing in financial products, explained that both traditional bank and fintech debit products allow users to manage and access their money through physical and digital cards.

"The differences lie in five key aspects: deposit insurance, deposit limits, banking infrastructure, returns, and the diversity of products and services," Cortés listed.

Deposit insurance is managed by the Institute for the Protection of Bank Savings (IPAB). Traditional banks offer coverage up to 3,250,975 pesos in the event of a bank failure, while fintechs operating as Popular Financial Societies have coverage of up to 208,000 pesos.

Regarding deposit limits, several debit cards, especially payroll cards, have restrictive limits. However, the physical infrastructure of traditional banks allows customers to easily resolve this by visiting a branch. The physical infrastructure of banks enables easier cash withdrawals and transactions, while fintechs depend on services and third-party alliances. On the other hand, fintechs' digital infrastructure tends to be more agile, intuitive, and robust.

"Returns on savings are a feature that fintechs have implemented to attract customers. Nu, Ualá, and Mercado Pago are some fintechs offering this," Cortés detailed.

Traditional banks hold an advantage in offering complementary products like insurance or payroll accounts, while fintechs excel in specific services such as digital payments or international transfers.

Credit Cards

Credit cards are another important financial component. In Mexico, there are nearly 40 million active cards, according to the Bank of Mexico, making competition among providers beneficial for consumers.

Both banks and fintechs offer credit cards with additional benefits such as cashback, insurance, presales, and reward programs. The availability of both physical and digital cards is also widespread.

"The differences in credit products between banks and fintechs mainly lie in the credit limits, interest rates, and the requirements set by the institution to grant them," clarified the Kardmatch director.

In fintechs, requirements tend to be more lenient, granting credit to individuals with poor credit histories or without proof of income. As a result, the credit limits offered are lower.

Interest rates may, in some cases, be lower at fintechs in order to attract a larger customer base. However, attractive products can be found at both types of financial institutions. El Economista

Mercado Libre and Nubank Intensify Their Fight for Fintech Dominance

The fintech ecosystem in Latin America is undergoing a major transformation, with two giants competing to solidify their leadership: Mercado Libre and Nubank. Although both companies have different approaches and target audiences, their competition is intensifying daily in key regional markets. From Brazil and Mexico to Colombia, these companies are reshaping the financial landscape with strategies that go beyond traditional solutions.

Parallel Growth with Different Approaches

Mercado Libre, founded in 1999, began as an e-commerce platform and later diversified its operations with the creation of Mercado Pago in 2003. On the other hand, Nubank was founded in 2013 as a digital bank with the goal of simplifying financial services and empowering users with accessible technology. Both companies have shown impressive growth: Mercado Libre reached a market value of $94 billion in 2024, while Nubank positioned itself as the largest financial company in the region with $58 billion.

Although their executives, Marcos Galperin (Mercado Libre) and David Vélez (Nubank), have minimized the idea of direct rivalry, their expansion and diversification strategies make it clear that both companies are competing to dominate the fintech space in the region.

Data and Personalization: Key Assets

One of Mercado Libre's greatest assets is its vast user data generated through millions of users on its e-commerce platform. This information allows Mercado Pago to offer personalized financial products, such as consumer loans and insurance, even in markets with limited access to traditional credit histories. For example, they have identified that mobile phone users who keep their batteries fully charged tend to be better payers, a correlation that other financial players had not explored.

Nubank, on the other hand, has developed its "secret sauce" based on financial transaction data. This has enabled them to offer credit more tailored to each customer’s profile and explore new products, such as mobile phone plans. Furthermore, Nubank has become the main bank account for a large proportion of its users, something Mercado Pago has yet to achieve.

Competition in Key Markets

Brazil:

The Brazilian market is crucial for both companies. In this country, Mercado Pago has grown rapidly in the credit card segment, with a $2.3 billion portfolio in 2024, nearly tripling its volume in a year. However, Nubank continues to lead with 92 million active customers and a $21 billion credit portfolio. Credit cards, regarded as the "crown jewel" of the Brazilian banking landscape, are a key area where the competition is fierce.

Mexico:

Mexico, an attractive market due to its low banking penetration (only 10% of the population has a credit card), has seen significant investment from both companies. Mercado Pago has leveraged its experience in Brazil to offer high yields to users who deposit money in their accounts, attracting cheap financing. Meanwhile, Nubank continues to build its customer base with a focus on user experience and technology.

Colombia:

In a less developed market like Colombia, both Mercado Libre and Nubank see significant opportunities. While it's not as competitive as Brazil or Mexico, the region promises to become a key battleground in the coming years.

The Future of Fintech in Latin America

Although it is unlikely that a definitive winner will emerge in the short term, the competition between Mercado Libre and Nubank is accelerating the digital transition in Latin America. According to Morningstar analysts, "the race is still a tie" due to the early growth phases in key markets such as Brazil and Mexico. Meanwhile, users are benefiting from a broader, more efficient, and personalized financial service offering.

Both companies are prime examples of how innovation and technology can transform traditional sectors, and their rivalry could set a new standard for fintechs worldwide. America Retail

Crowdfunding Financing Maintains Growth in Debt Placement

Debt defaults continue to be high in some of these IFCs, with levels exceeding 30 percent in certain cases.

This increase also represented a 29.1% rise compared to the second quarter of 2024.

Crowdfunding Financing Institutions (IFCs) operating under the Law to Regulate Financial Technology Institutions (Fintech Law) have accumulated a third consecutive quarter of growth in debt placement amounts, according to the latest "Financial Stability Report" published by the Bank of Mexico (Banxico).

By the end of September, financing facilitated through IFCs saw a 13.8% increase compared to the same quarter in 2023, specifically in debt IFCs, meaning those models that specialize in credit for individuals or businesses and not in royalties or real estate financing. This represented a 29.1% increase compared to the second quarter of 2024.

However, the report highlighted that the default rate (delinquency) remains high in some of these Financial Technology Institutions (ITFs), with levels reaching 30% in certain cases.

"The ITF sector continues to face challenges arising from tightening financial conditions, which may affect the viability of some companies engaged in financing. However, given their size, they do not pose a risk to financial stability," the report emphasized.

The weighted average financing for all debt IFCs reporting data stands at 7.8%, a segment that currently consists of 27 Crowdfunding Institutions.

Regarding the models of co-ownership, equity, or royalty IFCs, Banxico noted that few changes have been observed in recent years, with a slight increase in financing granted during the first half of 2024.

"In this business model, unlike debt IFCs, investors acquire a percentage of ownership in a company or future project, or a share in the income or profits generated," the report states.

The report also highlighted that during the second half of 2024, new ITFs were added to the sector.

During this period, five licenses were granted, and in the last six months, four additional entities were authorized. Of the nine institutions authorized in 2024, five correspond to IFPEs, and four to IFCs.

To date, a total of 83 ITFs have been authorized under the Fintech Law, of which 27 are IFCs and 56 are IFPEs.

"ITFs provide innovative financial services and can help complement the existing offer to promote inclusion, efficiency, and competition among participants," stated Banxico. El Economista

VECTOR SALES AND TRADING DESK

FINTECH: BID

The fintech ecosystem in Latin America and the Caribbean has grown 112% since the Inter-American Development Bank (IDB) and Finnovista published the previous version of the sector analysis in 2018. The Latin American and Caribbean region went from having 1,166 fintech platforms to 2,482 in just over three years. The geographic concentration of platforms changed little compared to the previous publication and continues to be led by Brazil (31% of the total), followed by Mexico (21%), Colombia (11%), Argentina (11%), and Chile (7%). Although the segment with the highest number of platforms continues to be payments and remittances (driven by recent regulatory developments in Brazil and Mexico), with 25% of the total, the lending (19%) and crowdfunding (5.5%) verticals are starting to become relevant in the region.

The Fintech Frontier: How Digital Wallets Are Changing Payments MSCI

From bartering to cash to digital options, the way people pay for things has changed substantially over time. Innovation in financial technology, also known as fintech, is transforming the payment industry.

IMEF Raises 2024 GDP Forecast to 1.5%, Lowers Inflation Estimate to 4.4%

Economists surveyed by the Mexican Institute of Finance Executives (IMEF) have increased their forecast for the country's GDP growth this year, while lowering their inflation estimate.

In December, 24% of the participants maintained their growth forecast, setting the median at 1.5%, according to IMEF's monthly survey for the last month of the year. The most optimistic forecast stands at 1.8%, while the most pessimistic is 1.2%.

For the upcoming year, economists kept their growth forecast unchanged at 1%.

Additionally, IMEF's specialists reduced their inflation estimate for 2024 from 4.5% to 4.4% and left the 2025 projection unchanged at 4%.

IMEF also noted that economists expect a quarter-point cut in the Bank of Mexico's reference interest rate before the year ends, bringing it to 10%. For 2025, they raised their estimate from 8.25% to 8.50%.

Finally, the analysts surveyed increased their estimate for the value of the dollar in 2024 from 20 to 20.35 pesos and raised the 2025 estimate from 20.50 to 20.90 pesos. AXIS

Economic Expectations: What to Expect in 2025? IMEF

Attempting to establish a clear narrative about what can be expected economically in 2025 is more complex than in other years. This is primarily due to the convergence of several factors that are addressed in this article, which provides a brief overview considering the risks and uncertainties that currently loom. However, these factors could change over the months, as the economic evolution throughout the year will be heavily influenced by political actions.

Falabella to Invest $650 Million in 2025, Focusing on Sodimac in Mexico

Falabella Group has announced a $650 million investment plan for 2025, with a primary focus on expanding its supermarket business in Peru and Sodimac in Mexico. This announcement was made by Juan Pablo Harrison, the Group's Corporate Manager of Administration and Finance, during an investor presentation.

The plan represents an increase of nearly 30% compared to this year's investment and includes the opening of new stores and renovations of shopping centers in Chile and Peru. "Our 2025 Investment Plan strategy is designed to drive sustainable growth with a strong focus on enhancing our omnichannel customer experience," said the executive.

The strategy includes the opening of 15 new stores, focusing on supermarkets in Peru and Sodimac in Mexico, alongside improvements to Mall Plaza shopping centers in Peru and transformations of such assets in Chile. Additionally, the plan includes renovations of stores across all its formats to enhance the shopping experience for customers. El Economista

Banamex Sale Scheduled for Second Half of 2025

Victoria Rodríguez, the governor of Mexico's central bank (Banxico), confirmed that the sale of Banamex will take place through an Initial Public Offering (IPO) in 2025. The sale is expected to occur in the second half of the year, with the possibility that some shares may also be sold in other markets.

"The sale process through the public offering will take place after the second half of 2025... The shares of Banamex will be deposited in Mexico, but some may be sold in other stock markets," she stated during the presentation of the Financial Stability Report.

Earlier, the central bank governor had mentioned that the IPO would be conducted in the Mexican stock market, as Banamex is a domestic institution. However, this time she did not rule out the possibility of some shares being sold in other international exchanges.

At the beginning of the month, US banking giant Citi, led by Jane Fraser, completed the separation of its businesses. Banamex will handle retail banking, including consumer credit, mortgages, insurance, pension funds, and small business banking, while Citi Mexico will focus on wholesale banking, primarily corporate banking. Dinero en Imagen

VECTOR RESEARCH

Consumer Confidence in Mexico Drops in November

The Consumer Confidence Index for November in Mexico fell by 1.8 points, reaching 47.7 points after seasonal adjustments.

Within the index, four out of its five components decreased, with a notable decline in expectations regarding the economic situation for the country and household members. The international political environment and the depreciation of the exchange rate are believed to be factors contributing to the lower confidence levels.

Looking ahead, it is expected that the Consumer Confidence Index will continue to show limited fluctuations, influenced by the depreciation of the exchange rate and potential impacts on remittance flows. Private consumption is also expected to experience some sluggishness but will remain the main driver of aggregate demand throughout 2025.

USDMXN: Although the USDMXN opened with gains, it saw a rebound during the session that pushed it into the resistance zone between 20.30 and 20.35.

The important point is that, while it closed below the 50-day moving average and below the previous upward trend line, it hasn't yet shown the strength to break the support at 20.10 to the downside, which could keep it fluctuating laterally.

However, the indicators still point downward and support a continuation of the decline, meaning it cannot be ruled out that the currency could eventually break below 20.10 and head towards the next support zone between 19.80 and 19.70.

INTERNATIONAL DAY

Lost and Found Day, celebrated on December 13, is a lighthearted observance that encourages people to reflect on the moments when they’ve lost something important—and, hopefully, found it again. Whether it's a lost wallet, a misplaced phone, or a missing sock, this day is a reminder of the joy and relief that comes from recovering something that was once thought to be gone forever.

It also serves as an opportunity to appreciate the importance of keeping track of our belongings, and perhaps to organize or declutter our spaces to avoid future losses.