MEXICO FENTANYL: TRUMP EFFECT

Ebrard stated that Mexico has made progress on issues of concern to the United States, particularly in areas such as security, migration, and the fight against organized crime.

Sheinbaum Celebrates 'Largest' Fentanyl Seizure in History in Sinaloa

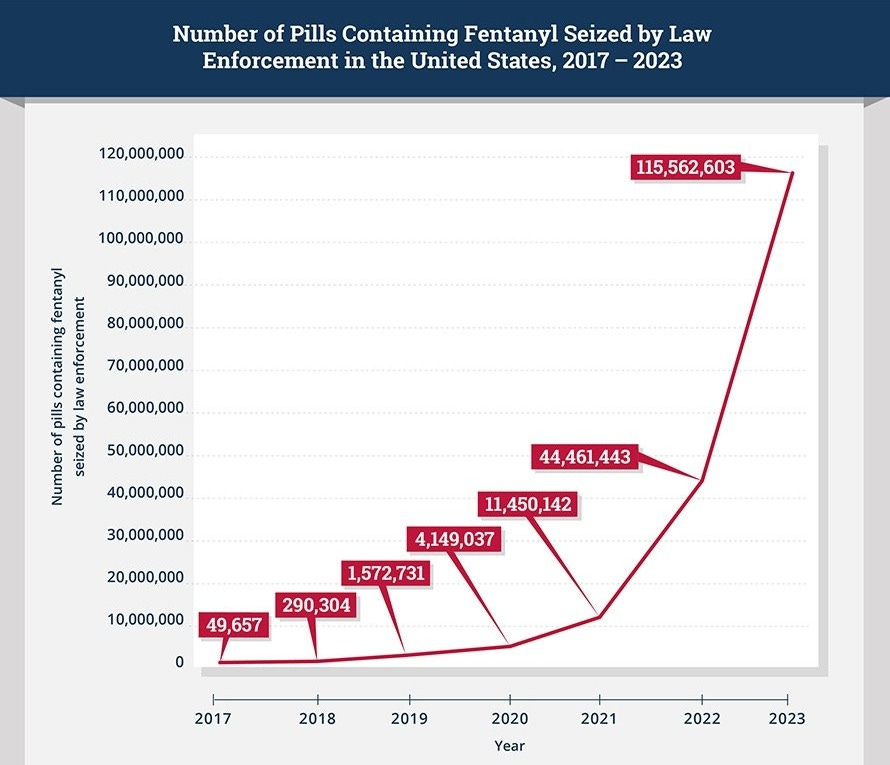

President Claudia Sheinbaum announced on Wednesday that her government had carried out the "largest fentanyl seizure in history" in an operation in the northern state of Sinaloa. The seized fentanyl, equivalent to over 20 million doses, could have generated nearly 8 billion pesos in the black market.

The operation, conducted by various security agencies, resulted in the confiscation of approximately 300 kilograms of fentanyl from a home and another 800 kilograms found in a vehicle. Sheinbaum emphasized that this major bust is a significant step in her administration's strategy to reduce violence in the state, which has been plagued by internal cartel conflicts.

"This operation is part of a broader national strategy against drugs, with specific plans for states with the highest violence levels, like Sinaloa," she said during her morning press conference.

The seizure takes place amid increasing pressure from U.S. President-elect Donald Trump, who has threatened to impose 25% tariffs on Mexican goods unless the country tightens control over migration and drug trafficking, particularly fentanyl.

Sheinbaum expressed confidence that actions like this would help reduce violence in Sinaloa, especially following the internal power struggle in the drug cartel after the July 25 arrest of Ismael "El Mayo" Zambada in the United States. While she acknowledged that violence won't decrease drastically in a short period, she emphasized the importance of coordinating efforts across various sectors to address the root causes. Forbes

Mexican Lawmakers Ban the Use of Vapes and Illegal Fentanyl in the Constitution

On December 3, 2024, Mexico’s federal lawmakers voted overwhelmingly in favor of amending the Constitution to prohibit the production, distribution, and acquisition of vapes and toxic substances like fentanyl for recreational purposes. The reform, which passed with 410 votes in favor, 24 against, and no abstentions, elevates the use of vapes and fentanyl to a constitutional crime that violates the right to health.

The amendment modifies Articles 4 and 5 of the Political Constitution of Mexico, ensuring that the production, distribution, and sale of electronic cigarettes, vapes, and other electronic devices, as well as illicit drugs like fentanyl, will be banned.

Irais Virginia Reyes, a deputy from the Movimiento Ciudadano party, raised concerns during the debate, suggesting that equating vapes with fentanyl could be excessive. The National Alliance of Small Merchants (ANPEC) also criticized the measure, arguing that it could fuel the illicit market and harm legal businesses. They urged for the regulation of vapes, including measures to prevent sales to minors and combat illegal trade.

This constitutional change comes after former president Andrés Manuel López Obrador’s 2022 decree banning the sale of vapes, though legal challenges had allowed some citizens and businesses to circumvent the ban. The new law will give Congress 180 days to harmonize secondary laws, including the General Health Law, and state legislatures will have one year to implement the necessary adjustments. Animal Politico

U.S. Authorities Train Mexican Forensics in the Fight Against Fentanyl

On December 4-5, 2024, the U.S. Bureau of International Narcotics and Law Enforcement Affairs (INL) is hosting a training event in Mexico City to enhance the capabilities of Mexican forensics teams, prosecutors, and authorities in combating fentanyl and other synthetic drugs. This initiative comes amid increasing pressure from U.S. President-elect Donald Trump, who has warned of imposing tariffs on Mexico unless the country takes stronger action to stop fentanyl trafficking.

The event, held at a hotel on Paseo de la Reforma, involves workshops, roundtables, and presentations focused on key issues such as synthetic drug production and trafficking, the role of chemical precursors, and advanced criminal investigation strategies. Katie Stana, INL Director at the U.S. Mission to Mexico, emphasized the importance of international cooperation in improving law enforcement efforts to tackle the growing synthetic drug crisis, which has significantly impacted public health in the U.S.

Mavíl López Casamichana, representing Mexico's Attorney General’s Office, highlighted the importance of such cooperation in addressing the global drug problem. This training follows a significant fentanyl seizure by Mexican authorities, with 415,309 pills confiscated in a recent operation. The discussions also come in the context of the growing concerns about the upcoming U.S. administration’s stance on fentanyl trafficking and the potential economic sanctions on Mexico. Expansion

Fentanyl, the Great Hypocrisy

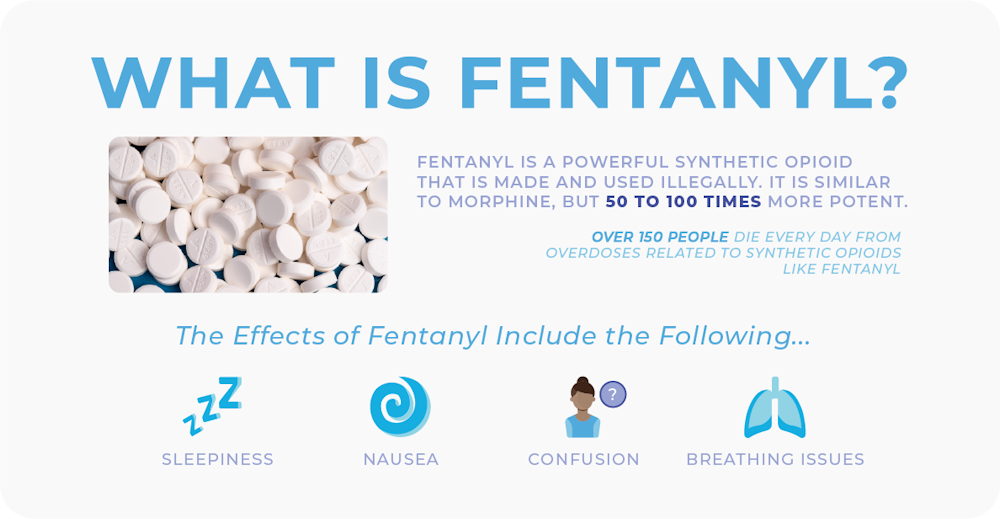

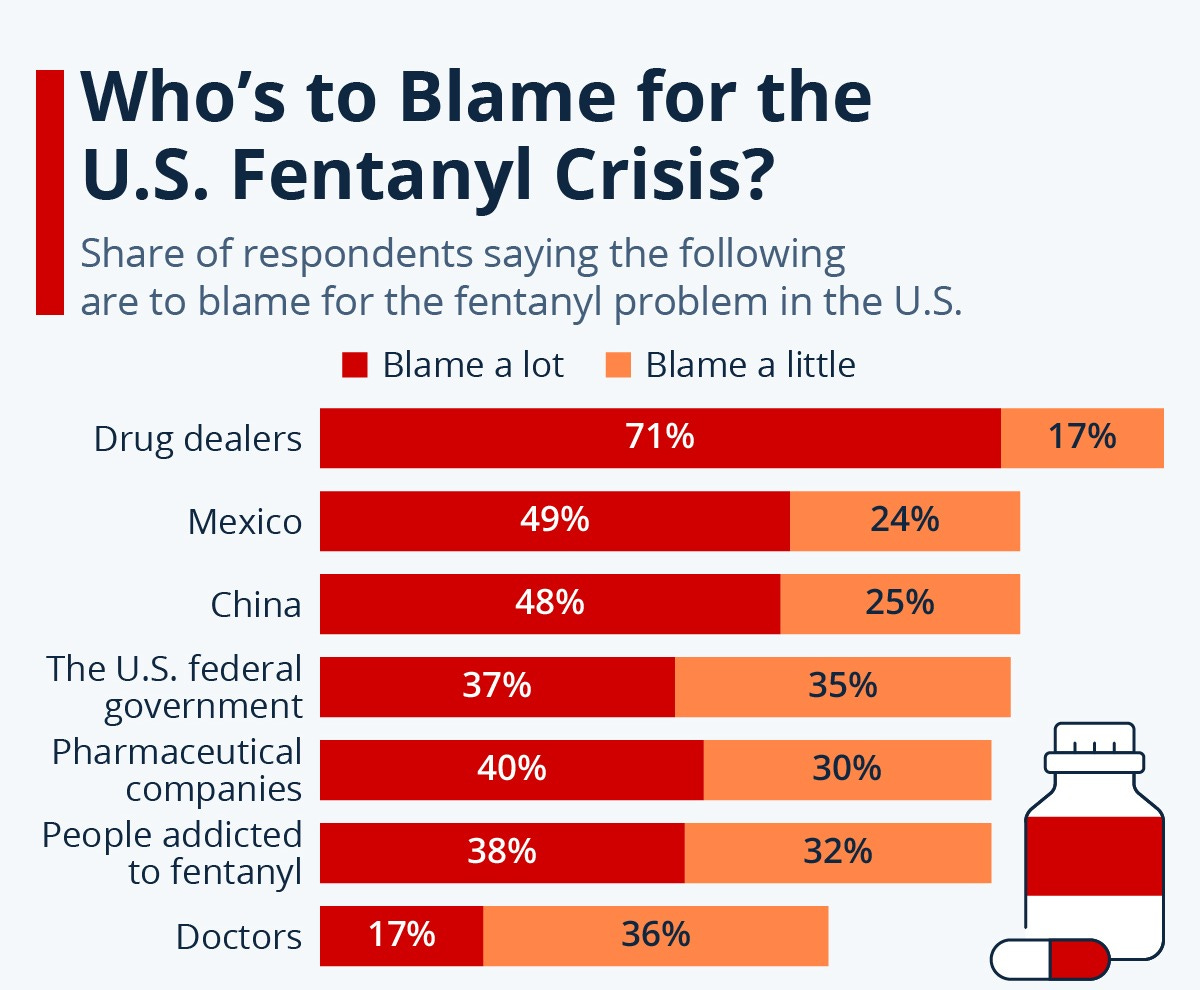

The fentanyl addiction crisis in the United States, a devastating public health issue, is not the result of illegal migration, as President-elect Donald Trump claims, but rather the consequence of collusion between pharmaceutical companies, politicians, and doctors in the U.S.

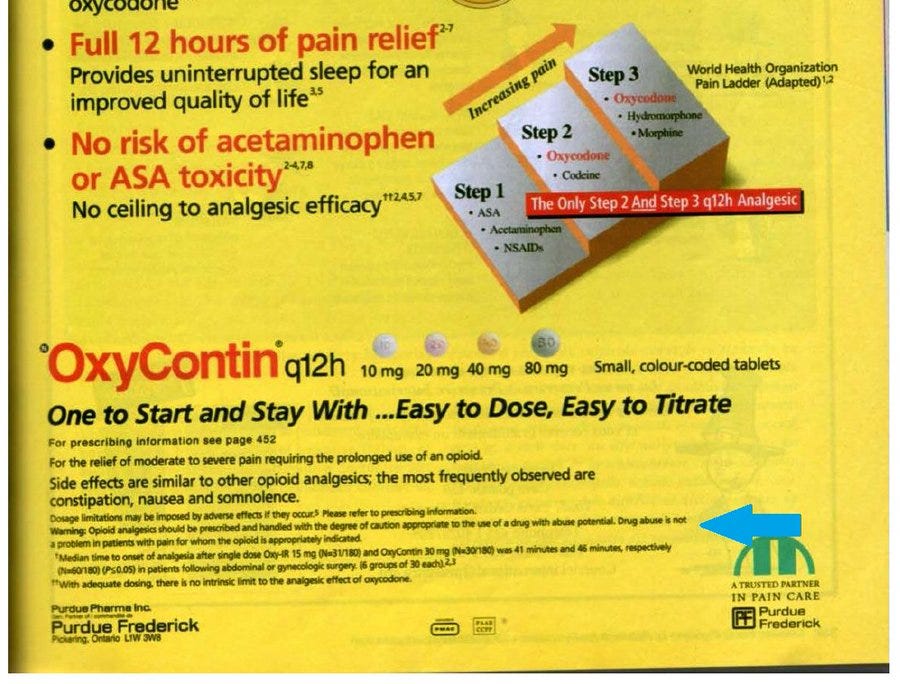

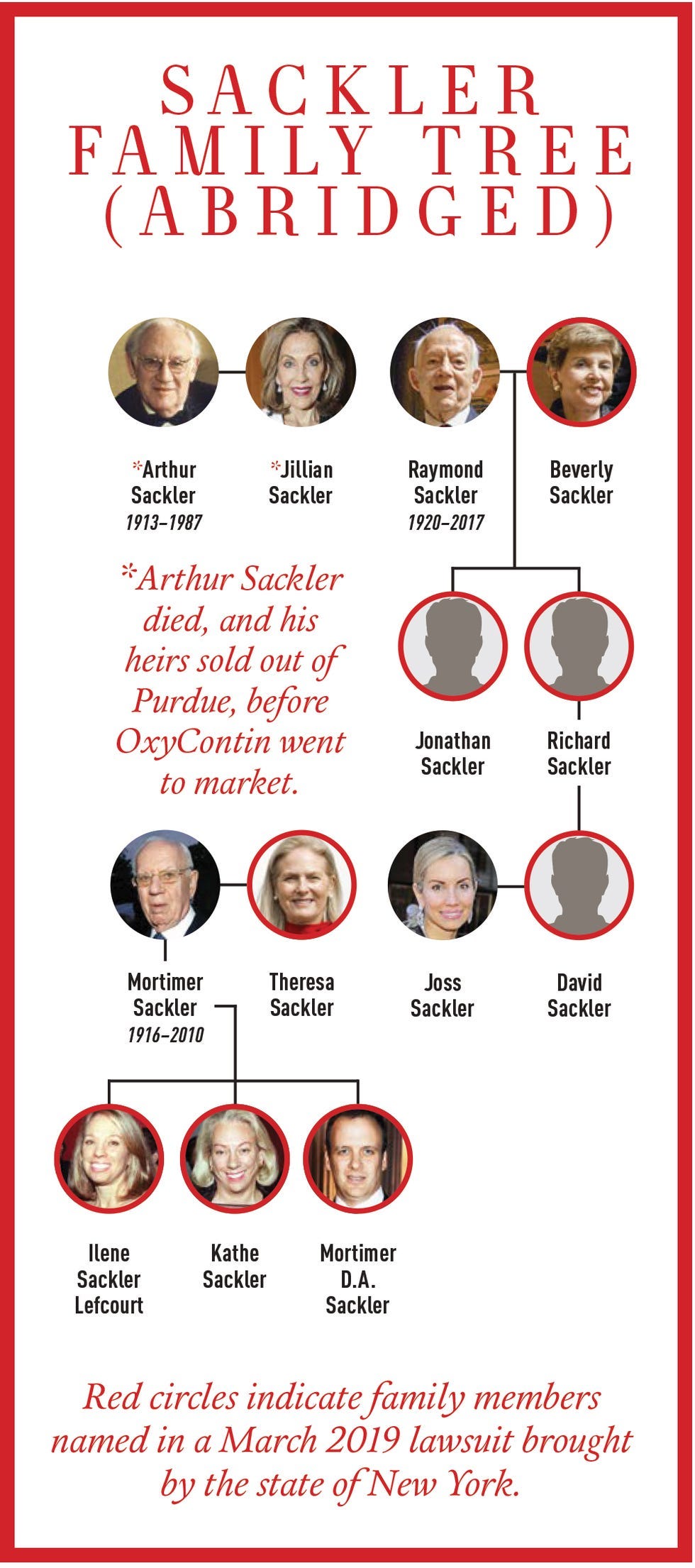

The drug OxyContin, a derivative of the opioid, is the true culprit behind this epidemic. Its creator, Purdue Pharma, owned by the Sackler family, pushed for the widespread prescription of this drug through bribes, campaign financing, and an aggressive marketing campaign. OxyContin, originally intended for patients with extreme cancer pain, was prescribed in massive doses for any type of pain, creating widespread addiction that costs over 60,000 lives annually in the U.S.

As addiction to OxyContin spread, users began turning to fentanyl, a cheaper and more potent version of the drug. Purdue Pharma and the Sacklers made billions, while U.S. doctors received incentives to prescribe this opioid to their patients. Despite lawsuits and sanctions, the Sacklers continue to enjoy their fortune without facing prison time.

While it is acknowledged that Mexican cartels manufacture and traffic fentanyl into the U.S., the real root of the crisis lies in the responsibility of the U.S. healthcare system, which, through corruption and greed, allowed this addiction to become a pandemic. Trump’s hypocrisy in blaming migrants for the fentanyl crisis, when his own country is the source of the problem, is both evident and colossal. El Financiero

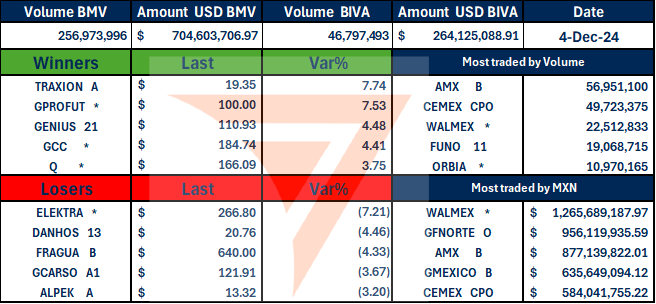

VECTOR SALES AND TRADING DESK

Financial Economics Letters Oct 2023

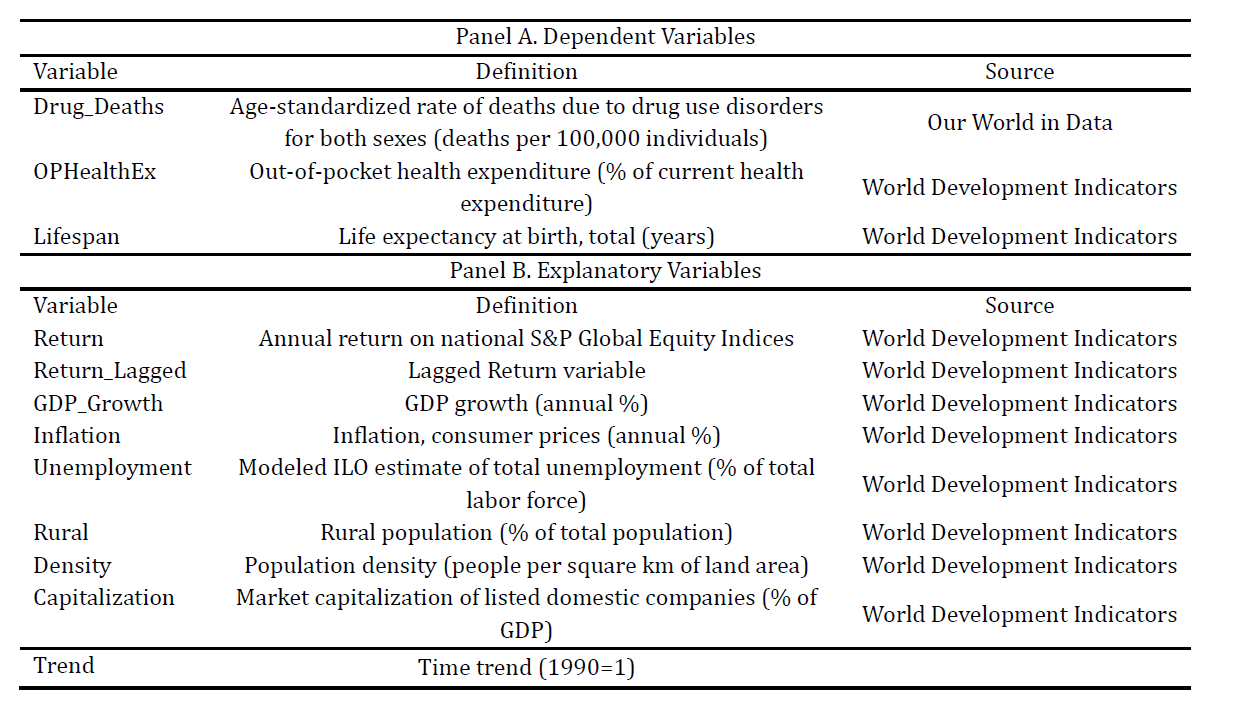

Over the last couple of years, several thought-provoking pieces of evidence have emerged linking stock price fluctuations to the psychological health of investors and the broader society alike. The stress and anguish triggered by stock market downturns was shown to undermine the self-reported mental wellbeing (Cotti et al., 2015; Ratcliffe and Taylor, 2015), which resulted in increased admissions to psychiatric wards (Lin et al., 2015; Engleberg and Parsons 2016), upturns in suicide cases (Wisniewski et al., 2020) and treatment for depression (McInerney et al., 2013). Furthermore, the strong emotional responses evoked by stock losses appear to contribute to fatal car accidents (Giulietti et al., 2020), as well as precipitate smoking and binge drinking that are possibly used as stresscoping mechanisms (Cotti et al., 2015).

Our paper contributes to the debate by showing that, through income augmentation, bullish markets can increase mortality amongst those predisposed to drug abuse. Even though Cotti et al. (2015) suggested that the connection between stock market gains and illicit drug use is worthy of investigation, scholars remain silent on this issue. Our finding suggests that drugs should be viewed as hedonic items with a positive income elasticity, rather than vehicles to release tension during stock market slumps. Our second contribution is to document that behavioral responses are triggered by largely unpredictable gains.

We show that increases in stock market indices are associated with elevated mortality arising from drug abuse. Capital gains relax budgetary constraints and afford individuals more freedom to engage in addictive behaviors involving illicit substances. Even if such actions induce short-term pleasure, they have long-lasting and deleterious effects on health status. Individuals try to counter these adverse outcomes by reactively increasing their spending on healthcare, but their life expectancy is nonetheless inescapably diminished.

LATAM BANKS: S&P GLOBAL

Profitability will moderate from strong levels but will remain solid compared to international peers

Risk of Deterioration

So far, authorities in advanced economies have steered their economies toward a gradual slowdown, but risks could rise again. A deeper-than-expected slowdown could depress exports from major emerging markets by reducing trade volumes, portfolio flows, and foreign direct investment. Slower economic activity could jeopardize the fundamentals of corporate sectors and the asset quality of banks.

The complex political landscape in Latin America is likely to generate market volatility in the coming quarters. Investors are struggling to understand the policies of new governments and the power balance that will drive the legislative agenda in the years ahead.

… and what it means for the sector

Asset quality indicators have deteriorated across the region due to weak economic performance, low credit growth, and pressure on consumer lending and small- and medium-sized enterprise (SME) loans. We expect asset quality indicators to stabilize by the end of 2024 and start improving in 2025.

Provisions are likely to remain high, which will affect profitability. However, operating performance should still be solid due to banks' higher margins compared to those in their peer countries. Banks in the region will continue to operate with strong capitalization and liquidity.

Our expectations for the next 12 months

We expect loan growth to remain in the single digits. In our view, corporate credit demand will increase once interest rates fall to more accessible levels. However, banks are likely to continue applying conservative origination practices given the slow pace of asset quality stabilization.

Banks in Latin America are used to operating in challenging conditions and have solid regulatory capital and liquidity levels, which will help them navigate a more difficult environment. Local regulation is typically strict due to economic volatility and is enforced across all regulated entities.

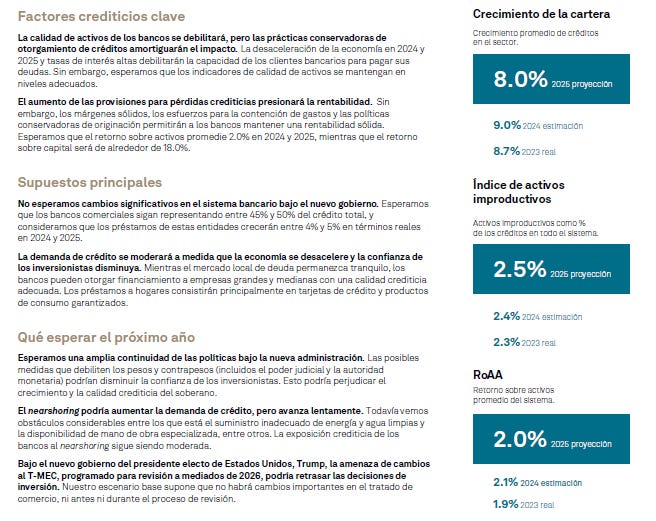

MEXICO

Given the solid credit fundamentals, banks are well positioned to navigate headwinds.

The economic slowdown and persistently high interest rates will pressure banks' growth, asset quality, and profitability.

We expect a broad continuity of policies under the new government. However, if checks and balances weaken, investor confidence could decrease, affecting economic growth.

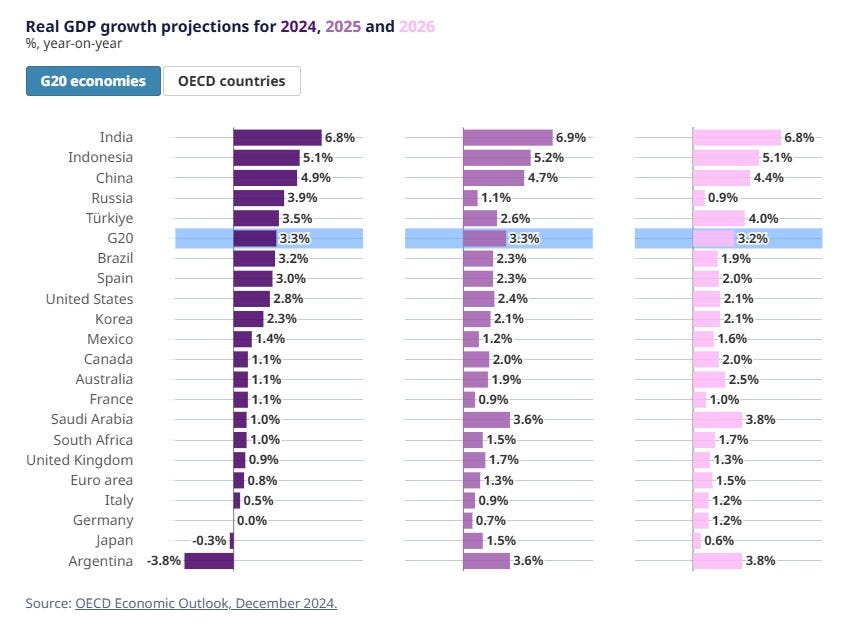

Global growth is projected to remain stable

Global GDP growth is projected to strengthen slightly to 3.3% in 2025 and remain stable at this level through 2026. In OECD economies, GDP growth is projected to be modest relative to the pre-pandemic period, at 1.9% in both 2025 and 2026. In non-OECD economies, aggregate growth is also anticipated to remain broadly stable around its current pace with emerging Asia continuing to be the biggest contributor to global growth.

Inflation is projected to fall further

Headline inflation has continued to ease in most countries through 2024, led by further falls in food, energy and goods price inflation. However, services price inflation is still proving persistent, and was approximately 4% in the median OECD economy in September. Looking ahead, annual consumer price inflation in the G20 countries is expected to decline further and, by the end of 2025 or early 2026, inflation is projected to be back to target in almost all remaining major economies.

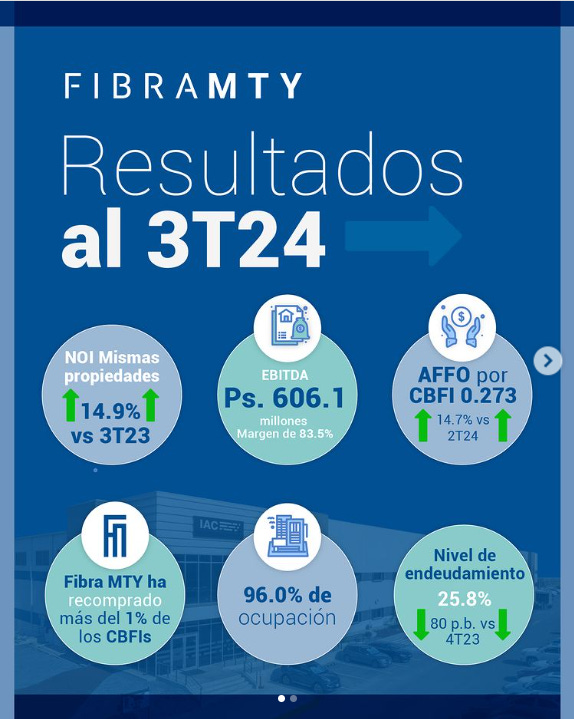

Uncertainty Drives Down Fibra MTY Certificates

Fibra MTY's real estate investment trust certificates (CBFIs) have fallen 11.13% to 10.57 pesos per unit from 12.25 pesos in 2024.

"Throughout the year, it was expected that the interest rate would decrease, but by April we realized this would not happen because inflation had not been controlled as expected," said Jaime Llaca, Director of Operations and Acquisitions at Fibra MTY.

The executive assured that many investors were anticipating the rate cut, leading them to withdraw their positions, which caused the REIT sector to lose value.

During the celebration of its 10th anniversary at the BMV, Fibra MTY announced that its investment forecast for the next 12 months is 700 million dollars.

“We are managing our acquisitions, new properties, and the stock buyback program carefully, but we expect sustainable growth and an average of positive investments of 700 million dollars,” Llaca mentioned.

He added that divestments will continue in the office portfolio, which is valued between 350 to 400 million dollars. Currently, 85% of Fibra MTY’s portfolio is concentrated in the industrial sector.

Jorge Ávalos, CEO of Fibra MTY, highlighted that the trust is interested in markets with light manufacturing for export, mainly in the North, Central, and Bajío regions, and has explored opportunities in the southeastern part of the country. El Economista

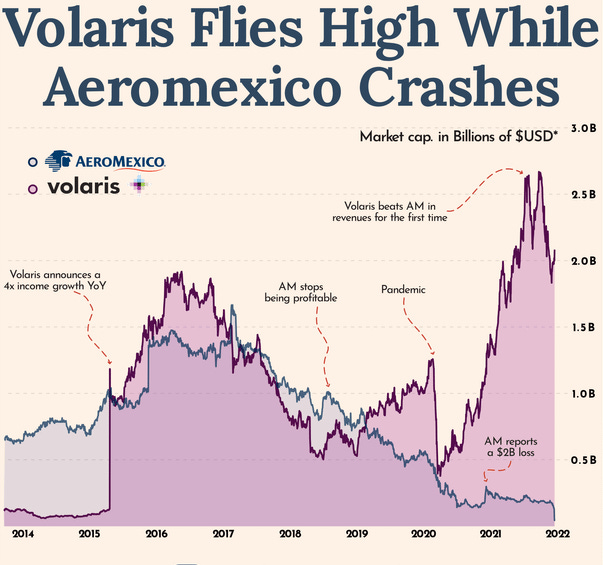

Aeroméxico Plans to Return to the BMV in 2025

Grupo Aeroméxico plans to relist on the Mexican Stock Exchange (BMV) and in the United States, potentially in 2025. The airline’s return to the Mexican stock market will occur through a secondary public offering of shares, according to a document presented at the stock exchange.

The secondary offering, which will not involve new capital for the company, will involve up to 150 million 66,355 shares. Simultaneously, American Depositary Shares (ADSs), backed by shares in Mexico, will be offered in the United States.

The number of shares to be offered and their commercial value have not yet been determined, according to the prospectus. The company has not set a date for the offering but anticipates it will take place at some point in 2025. Aeroméxico has hired Barclays Capital, Morgan Stanley, Morgan Securities, Evercore Group, and Apollo Global Securities as its international lead underwriters.

The airline had previously delisted from the Mexican stock market in 2022 after undergoing a restructuring process in the U.S. under Chapter 11 bankruptcy protection due to the severe impact of the Covid-19 pandemic on the airline industry.

Following this restructuring agreement, the U.S. investment fund Apollo Global Management, along with other creditors such as The Baupost Group, Silver Point Capital, and Oaktree Capital Management, became the primary owners of the company.

Among the Mexican investors who held stakes in the airline before its delisting, Eduardo Tricio Haro, Valentín Diez Morodo, Antonio Cosio Pando, and Jorge Esteves Recolóns remain, collectively holding 4.4%, with the rest of the shares in the hands of other investors. Other shareholders lost their investments. El Economista

ELEKTRA*: Elektra Deepens Losses on the BMV, Moody’s Highlights Reputational Risks

Grupo Elektra’s shares extended their losses for a third consecutive day, after the Mexican stock exchange lifted a three-month suspension imposed due to a potential fraud involving one of the company's creditors.

On December 4, 2024, the company’s shares closed down 4.36% at 274.99 pesos per share, following a near 11% drop during the day. This further deepened the 70% loss registered on December 2, completely erasing the 6.5% gain made the previous day (December 3).

Elektra, a Mexican retail and financial services chain, criticized the stock market regulator for lifting the suspension of its shares, which had been in place since July. The suspension came after the company claimed to have been informed of a possible fraudulent scheme involving one of its creditors, Astor Assets. According to Elektra, Astor Assets illegally disposed of over 7 million shares, which were then sold on the market.

In light of these issues, Elektra plans to propose the privatization of the company during a shareholders’ meeting scheduled for December 27, after 95% of its shareholders expressed interest in the proposal.

Moody’s analysts noted that the privatization plan poses reputational risks for the financial arm of the group, Banco Azteca. They pointed out that the bank maintains significant direct and indirect ties with the Salinas Group, Elektra’s parent company, and highlighted the substantial exposure to related parties, which reveals weaknesses in the governance framework due to the group’s closed ownership structure. Expansion

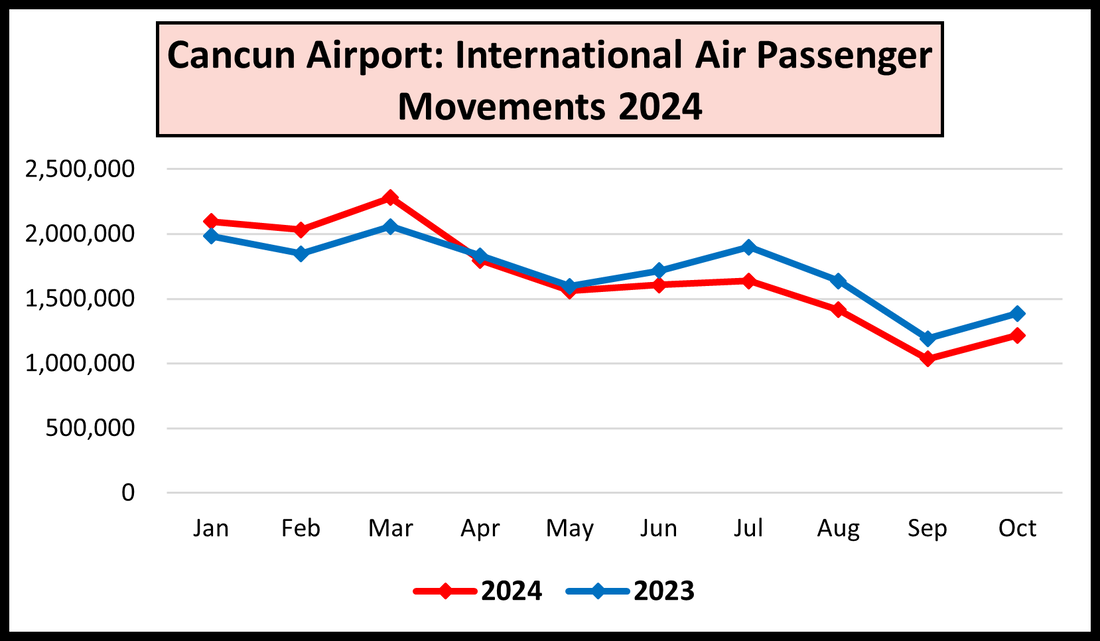

ASURB: Devastating for the Cruise Industry: $42 Charge for Tourists

The $42 charge for cruise tourists starting in 2025, for the Non-Resident Fee, will place Mexican tourist ports among the most expensive in the world.

Cancún, Quintana Roo.- Business organizations, civil associations, and unions in Quintana Roo anticipate that the approval of the $42 charge for cruise tourists starting in 2025, under the Non-Resident Fee (DNR), will make Mexican tourist ports some of the most expensive globally, particularly Cozumel, which will be up to three times more expensive than other Caribbean destinations.

They also pointed out that Cozumel is the port with the most arrivals in the world, with a $341 million economic impact in 2023 and $300 million from January to September of this year, which could be lost starting in 2025, after cruise lines have threatened not to dock on the island anymore. El Economista

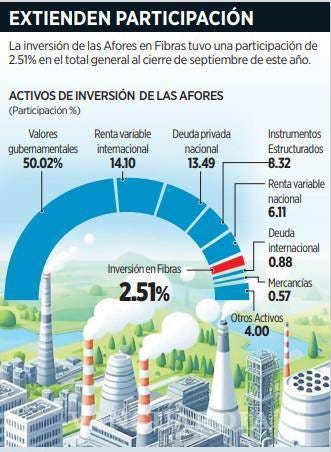

AFORES: Assets Managed by Afores Exceed 20% of Mexico's GDP

The National Retirement Savings System (Consar) reported that by the close of the third quarter of 2024, the assets managed by the Afores (Retirement Fund Managers) exceeded 20% of Mexico's GDP. According to the latest quarterly report submitted to the Mexican Congress, by the end of September 2024, the net assets managed within the Retirement Savings System (SAR) reached 6.8 trillion pesos, representing 20.7% of the national GDP.

Furthermore, Consar reported that by the end of the third quarter of this year, Afores had accumulated capital gains equivalent to 630,655 million pesos, delivering historical real returns of 4.84% on average per year.

Afores are legally required to invest workers’ retirement savings in financial instruments to generate returns and provide the highest possible pension once they retire.

Moreover, by the end of September, 50% of the Afores' assets were in Mexican government debt instruments, 14.1% in international equity (stock market), and 13.5% in national private debt, highlighted Consar. El Economista

VECTOR RESEARCH

GRUMA Issues Senior Notes with Strong Oversubscription

GRUMA announced yesterday afternoon the issuance of senior unsecured notes denominated in US dollars for a total amount of USD 500 million, with a coupon rate of 5.39% and a maturity in 2034, and USD 300 million with a coupon rate of 5.761% and a maturity in 2054.

The net proceeds from this offering will be used to pay down GRUMA's existing bank debt maturing between 2025 and 2027, with any excess funds, if applicable, being used for general corporate purposes. This will improve the company's debt maturity profile. The Notes saw strong demand, with the offering being oversubscribed by 9x. The transaction received a BBB rating from S&P Global and a BBB+ rating from Fitch Ratings.

The Notes are issued under the exemption provided by Rule 144A and Regulation S of the U.S. Securities Act of 1933, as amended. The settlement for both transactions is expected to occur on December 9, 2024, subject to the satisfaction of closing conditions typical for such transactions. The Notes will be governed by New York law and are expected to be listed on the Singapore Exchange Securities Trading Limited (SGX-ST).

This news is considered neutral for the issuer’s valuation, but it reflects the strong appetite for corporate bonds.

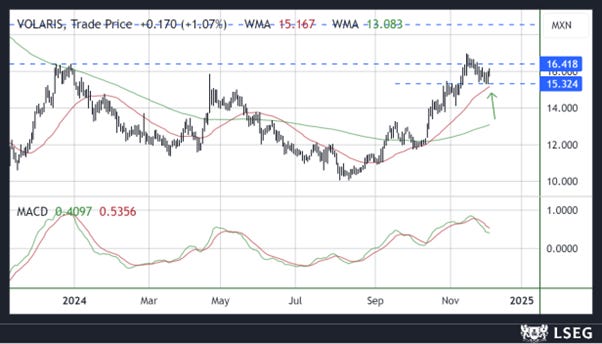

VOLAR A: Recent Correction Stops at Support Zone of 15.3, Close to 50-Day Moving Average, but Gains Remain Limited

The recent correction in Volar A's stock price halted at the support level of 15.3, very close to the 50-day moving average, and the stock has since recovered some ground. However, due to the negative direction of the momentum indicators, the potential for further upward movement appears limited by the resistance between 16.4 and 17 pesos.

The risk lies in the possibility that the stock confirms this resistance level and undergoes a new adjustment.

INTERNATIONAL DAY

International Ninja Day is celebrated on December 5th each year. It is a fun and unofficial observance that honors the legendary ninjas, known for their skills in stealth, combat, and espionage. While the origins of the day are not clear, it has become a way for fans of ninja culture—often inspired by historical figures or popular media like movies, TV shows, and video games—to celebrate everything related to ninjas.