MEXICO CREDIT RATING: SAFE FOR NOW

"Unexpected events that weaken investor perception and investment, such as setbacks in the relationship with the United States could undermine macroeconomic stability and lead to a downgrade."

S&P Global Ratings confirmed Mexico's long-term sovereign ratings at 'BBB' in foreign currency and 'BBB+' in local currency; the outlook remains stable on December 13, 2024.

Summary:

The government of Claudia Sheinbaum has committed to reducing Mexico's fiscal deficits and stabilizing public finances and the level of debt.

Potential disputes between Mexico and the United States over trade, immigration, and other issues are likely to be managed pragmatically, supporting economic stability.

Consequently, we confirm our long-term foreign currency sovereign rating of 'BBB' and long-term local currency sovereign rating of 'BBB+' for Mexico.

The stable outlook reflects our expectations for prudent monetary policy and a return to low fiscal deficits, which will stabilize public finances and maintain Mexico's strong external position.

Rating Action: On December 13, 2024, S&P Global Ratings confirmed its long-term sovereign credit ratings of 'BBB' in foreign currency and 'BBB+' in local currency for Mexico. The outlook remains stable. We also confirmed our short-term sovereign ratings at 'A-2' and maintained our transfer and convertibility (T&C) assessment at 'A'.

Outlook: The stable outlook reflects our expectation that cautious macroeconomic management, including prudent monetary policy and a return to low fiscal deficits, will stabilize Mexico's public finances and debt level over the next two years. We believe that potential disputes between Mexico and the United States over trade, immigration, and other issues will be managed pragmatically, supporting economic stability and maintaining the deep economic integration between the two countries. S&P GLOBAL RATINGS

What Trump’s Promise to Renegotiate His Own Trade Deal with Canada and Mexico Could Mean

The frequent calls by U.S. President-elect Donald Trump for new tariffs on foreign products may have overshadowed another significant trade promise he made about a month before the November elections: renegotiating the United States-Mexico-Canada Agreement (USMCA).

The trade agreement, known as the USMCA, was negotiated by Trump’s first administration and replaced the quarter-century-old North American Free Trade Agreement (NAFTA) in 2020.

A review of the trade pact was expected in 2026 regardless of Trump’s promise, due to a provision in the agreement.

However, Trump’s proclamation put Canada and Mexico—two of the U.S.'s biggest trading partners—on notice that he might seek significant changes. The renegotiation could play a crucial role in other political priorities for the president-elect, such as national security, immigration, and crime. While the USMCA does not directly address those issues, the trade deal could be used as leverage.

“It’s a very functional tool for Trump to achieve whatever he’s trying to get through negotiation,” said Francisco Sánchez, who served as Undersecretary of Commerce for International Trade during President Barack Obama's administration and is now a partner at the law firm Holland & Knight.

“The fact that there is a mechanism to discuss a review is, I think, an advantage for him,” he added.

What could a renegotiation of the USMCA mean?

Trump’s previous comments suggest that he might want to help boost the U.S. automotive industry, having proposed a 100% tariff on foreign-made cars during his campaign.

The USMCA’s vehicle rules require that a certain percentage of car parts come from any of the three countries, so there could be a stronger way to incentivize parts manufacturing in the U.S.

A provision that increases wages in Mexico, for example, could help boost U.S. manufacturing. Currently, it may be cheaper to manufacture in Mexico, where workers tend to earn less than in the U.S.

The U.S. president-elect could also be seeking Mexico’s help in confronting China, specifically to prevent Beijing from circumventing Trump’s tariffs by entering the U.S. market through Mexico.

“It’s very likely that negotiators will explore how to deal with Chinese parts and components,” said Gregory Husisian, a partner at Foley & Lardner who chairs the firm’s International Trade and National Security Department.

“Many of these behind-the-scenes things will have as much, if not more, of an impact than what we see in the news,” he said.

Trump might also be looking for ways to reduce the U.S. trade deficit, one of his favorite economic measures. He argues that the trade deficit—which occurs when the U.S. buys more goods manufactured abroad than it sells overseas—shows that other countries are taking advantage of the U.S. economy.

However, the trade deficit is influenced by many economic factors, including the value of the dollar and consumer demand, and the USMCA did not lead to a reduction.

The goods trade deficit with Mexico alone grew by more than 78% between 2020, the year the USMCA took effect, and late 2023. The deficit with Canada also grew by about 27%, according to the latest government data. CNN

The Ruling Against Mexico in the Corn Panel

Secretary of Economy Marcelo Ebrard had previously suggested that the resolution of the panel on genetically modified corn could be unfavorable for Mexico.

Today, what was preliminarily announced in November is expected to be made official: the ruling against Mexico in the dispute filed by the United States and Canada regarding regulatory measures related to biotech corn.

The final report from the panel, established under the USMCA (T-MEC), favors the U.S. and Canada regarding the Mexican government’s decree prohibiting the use of genetically modified corn for masa or tortillas.

On November 29, the final English report of the international panel on biotech corn was published with a ruling against Mexico.

A month ago, on November 13, Secretary Ebrard acknowledged the possibility that the panel's decision could be unfavorable for Mexico. At that time, he stated that "on October 22, they shared their preliminary conclusions, which were then made public. On November 6, we responded with arguments from our perspective for the panel’s consideration. On November 29, we will receive their response, and on December 14, (the process) ends with the publication of the conclusions they reached.”

Well, today is December 14, and barring any extraordinary developments, what was preliminarily reported a month ago will be confirmed: Mexico lost the arbitration panel requested by the U.S. under the USMCA concerning the ban on the importation of genetically modified corn for human and animal food consumption.

"The process is not over yet, it will finish in December, but they might beat us," Ebrard admitted on November 13.

On November 29, the final report on biotech corn was published in English, and according to Ebrard, the Spanish translation is expected on December 14.

Following the publication of the final report, Mexico will have 45 days to eliminate the decree from February 13, 2023, regarding glyphosate and genetically modified corn, or to reach an agreement on compensation that is acceptable to the counterparts.

The deadline for this would be January 28, a week after Donald Trump assumes the presidency of the U.S., who previously threatened to impose a general 25% tariff on U.S. imports of goods produced in Mexico.

On August 17, 2023, the U.S. Trade Representative (USTR) requested the establishment of a dispute resolution panel under the USMCA regarding Mexico’s regulatory measures related to biotech corn.

This followed the conclusion of the dispute resolution consultations on the GM corn ban in tortillas or masa, which began on June 2 of that year, where no mutually satisfactory solution was reached.

The dispute had to be settled by an international panel, with Canada joining as a claimant because it is a third party interested in the matter, due to its biotech canola exports to Mexico.

The U.S. based its claim on the assertion that Mexico’s measures regarding genetically modified corn are incompatible with USMCA obligations.

The complaint against the Mexican government was not about causing commercial harm, but about maintaining an ideological stance and failing to present scientific evidence justifying the presidential decree on genetically modified corn.

The "unwritten rule" is that the party requesting a panel is confident of winning, as happened in the panel on the application and interpretation of rules of origin in the automotive industry, which was won by Mexico and Canada, but whose ruling the U.S. has refused to comply with.

In the case of corn, the process moved from technical consultations to dispute resolution consultations and finally to the panel. The next step in the process is the implementation of the final report.

If no agreement is reached within 45 days of the publication of the final report, the U.S. may impose tariffs or compensatory measures unilaterally. El Financiero

In the Hands of the Private Sector

It will be the private sector in both Mexico and the United States that may have the only influence on the project of the elected President Donald Trump.

As 2025 approaches, it is already expected to be a challenging year, particularly in economic terms. The incoming U.S. president, Donald Trump, has been clear about how he intends to conduct himself with his trading partners.

For the Republican, there is no hesitation in threatening a trade war if Mexico does not meet his demands on security and immigration.

The concern is justified, as the economies of both countries are deeply intertwined. To put it into perspective, Mexico has maintained the position of the most important trading partner of the United States for most of the year, accounting for nearly 16% of the total imports from the "largest market in the world."

However, despite the virtual threats that Donald Trump is making against the Mexican economy (even after the electoral campaign has ended), it will be the private sector in both countries, but mainly in the U.S., that could have the most significant influence on the incoming president's project.

Trade tension with the United States is not new. During Trump’s first administration, he successfully renegotiated NAFTA, leading to the creation of the USMCA (T-MEC), a modern version of the world's largest trade agreement.

Back then, it was the influence of business groups that succeeded in convincing Trump to moderate his aggressive rhetoric against Mexico, as economic interdependence prevailed.

A report from Fitch indicated that U.S. states in the Midwest and those rich in natural resources are the most vulnerable to tariffs from Canada, Mexico, and China. More specifically, industries in the U.S. that would be hit first by a trade war in Trump's second term would include the automotive, manufacturing, oil and gas extraction, and especially the agricultural sectors.

Meanwhile, the first voices have begun to rise. This week, major electrical manufacturing associations from Mexico, the United States, and Canada signed a joint declaration calling for free trade of electrical products in the North American region.

The letter was signed by the Mexican National Chamber of Electrical Manufacturers (CANAME), Electro-Federation Canada (EFC), and the National Electrical Manufacturers Association (NEMA), who argue that since the USMCA took effect, exports of electrical goods have increased by 40%, boosting regional trade.

In this context, the government of President Claudia Sheinbaum, through Secretary of Economy Marcelo Ebrard, faces a major challenge heading into meetings that begin in 2025 and culminate in the treaty's review, scheduled for 2026. However, the trade war that Trump aims to unleash to strengthen the dollar, starting on January 20, along with the unfavorable ruling against Mexico in the dispute resolution panel set to be published underline the urgency of sitting down at the negotiation table soon. El Financiero

VECTOR SALES AND TRADING DESK

EXPLAINER | United States Awaits USMCA Dispute Panel Report on Mexico's Genetically Engineered Corn Decree

The US and Mexico presented arguments at the dispute panel hearing in June 2024. If the USMCA dispute panel determines that Mexico violated the USMCA, the US and Mexico will have forty-five days to agree to a resolution. If the parties cannot agree on a resolution, the USMCA would allow the US to suspend benefits to Mexico “of equivalent effect to the non-conformity or the nullification or impairment until the disputing parties agree on a resolution to the dispute."[15] If Mexico determines that the US’s suspension of benefits is excessive, it can request the dispute panel to reconvene. The final report by the USMCA dispute panel is expected by the end of 2024.

Midwest and Resource-Rich States Vulnerable to Canada, Mexico, China Tariffs

Fitch Ratings-New York-05 December 2024: Midwestern U.S. states’ economies could be particularly vulnerable to imposition of blanket tariffs on Canada, Mexico and China as recently proposed by President-elect Trump, says Fitch Ratings. Additionally, natural resource-rich states could face the most direct consequences from retaliatory tariffs by those nations. A broad-based trade war would likely be disruptive to U.S. states’ economies and tax revenue collections, potentially straining their ability to maintain budgetary balance and credit quality.

In May Fitch modeled the implications of worldwide tariffs suggested by then candidate-Trump and retaliation by other nations. The harshest scenario resulted in an overall U.S. GDP reduction of approximately 1.1%.

President-elect Trump recently indicated that on his first day in office he would impose blanket tariffs of 25% on all goods from Canada and Mexico and a 10% tariff on all goods from China. The China tariffs would be on top of existing tariffs initially imposed during his first administration. Actual policy could differ markedly from these statements, as seen during the first Trump administration. Headline tariffs were imposed on dutiable goods only, and duty-free imports were spared, leading to a lower effective tariff rate. Currently, 80% to 90% of Canadian and Mexican imports and 40% of Chinese imports are duty-free.

Fitch’s analysis of U.S. Census Bureau trade data highlights which states have the highest level of economic exposure to trade with Canada, Mexico and China. We compared the dollar value of these countries’ imports and exports in 2023 to and from individual states with those states’ 2023 GDP to provide a common scaling factor. This scaling is not intended to forecast Fitch’s actual expectation of economic implications from recent tariff comments, and this analysis does not distinguish dutiable versus duty-free imports. Effective tariff rates would likely be considerably lower than headline rates, limiting near-term economic and credit implications. Fitch Ratings

WALMEX*: Walmart to Challenge Cofece's Decision on Monopolistic Practices in Mexico

Wal-Mart de México (Walmex), the largest retail chain in the country, announced that it will challenge the decision made by the Federal Economic Competition Commission (Cofece), which determined that it had engaged in monopolistic practices in the distribution and commercialization of products.

The retailer stated that Cofece had imposed a financial penalty of 93.3 million pesos (around 5 million USD), as revealed in a communiqué sent to the Mexican Stock Exchange (BMV).

Walmex explained that it is carefully reviewing the details of the decision issued by the antitrust authority, contained in a document exceeding 900 pages. According to its preliminary review, Walmex believes that Cofece's analysis is erroneous and that there were errors in the interpretation and application of the law.

The company argues that both it and its subsidiaries have operated in compliance with existing laws, with the goal of benefiting Mexican families. It also pointed out that there were irregularities in the process and investigation carried out by Cofece.

“Given that Walmex and its subsidiaries believe they have acted in accordance with applicable laws for the benefit of Mexican families, and due to irregularities in the investigation and procedures of Cofece, Wal-Mart de México will challenge the decision,” the statement emphasized.

While expressing disappointment over the decision, the company reiterated that it will continue to work with its suppliers to ensure business continuity, while also complying with the regulatory authority's ruling and contesting the decision.

The retail giant noted that Cofece had imposed restrictive measures that prevent the company from applying two of the four contributions (without specifying which ones) under investigation, even if they were negotiated and accepted by the suppliers.

Cofece, following an investigation that lasted over four years, concluded that Wal-Mart de México had engaged in practices that limited competition in certain market segments, negatively affecting both suppliers and consumers.

The investigation focused on monopolistic practices within the wholesale supply and distribution market of consumer goods, as well as their retail commercialization and associated services. This process began in 2020 after a complaint was filed by Tiendas Chedraui.

In a divided decision, Cofece’s board of commissioners concluded that Walmart had engaged in a single monopolistic practice regarding supplier contributions.

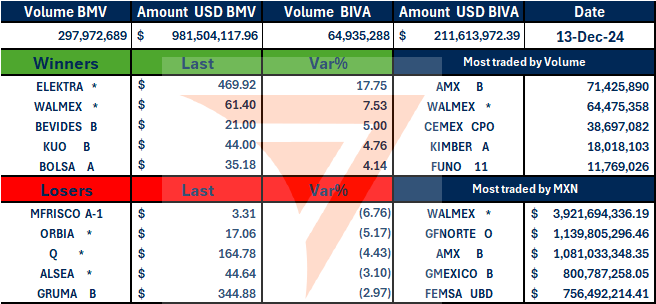

Following the news, the retailer’s shares rose by 5.32% on the BMV around 10:00 AM, trading at 60.14 pesos, up from 57.10 pesos at the previous day's close. It became the second-best performer on the Mexican stock exchange on Friday, December 13. El Economista

KUOB: Stock gained +4.76% to 44.00 MXN.

Pork Meat: A Growing Trade Between Mexico and China

China is the world's leading producer and consumer of pork. One of the key factors behind the increase in pork imports to China is its status as the most consumed meat in the country, forming the basis of many traditional recipes. Its popularity is largely due to its affordability and accessibility compared to other meats, such as beef. Additionally, pork is considered versatile, as nearly every part of the animal is used, from the meat and skin to the organs and fat.

Since China opened its market to Mexico, pork imports have steadily risen. A crucial factor in this growing trade is China's desire to diversify its suppliers, particularly due to increasing tensions with its major trading partner, the United States. This shift presents a significant opportunity for Mexico, as it has built strong relations with China over recent years.

Mexico's pork industry benefits from its ability to meet high-quality and food safety standards, which include product traceability and adherence to strict sanitary regulations. These factors are essential for ensuring the safety and quality of meat exports to international markets.

In summary, the importance of Mexican pork to China lies in the high demand for the product in the Chinese market, the need to diversify suppliers, Mexico's capacity to meet stringent quality standards, and the benefits of the growing commercial agreements between the two countries.

Elektra's Stock Surges 71% After Dramatic Drop, Ahead of Possible Delisting

Elektra, one of Mexico's largest retail and financial companies, saw its stock surge by 71% following a sharp decline after it resumed trading on the stock market. The company had previously lost more than two-thirds of its value in less than two weeks, marking a historic drop. Despite the recovery, the stock has not fully rebounded to its previous levels.

After resuming trading on December 2, the company saw significant gains over six of the last eight days, with two of the biggest increases in its history—21.5% and 17.8%, respectively. These gains, while impressive, are still far from recovering the full extent of the earlier drop. The company's stock price on December 2 was 0.8 times its book value, a steep drop from 2.9 times before its suspension, reflecting a rare and significant undervaluation for a company with no major business difficulties.

The company’s dramatic drop on the day of its suspension, which followed a legal dispute involving Ricardo Salinas Pliego, the principal shareholder, was excessive, according to some analysts. Salinas Pliego had accused an asset manager, Astor Asset Management, of fraud after they took possession of shares he had pledged as collateral for a $110 million loan. The shares were frozen by a UK court, but the matter remains unresolved.

Elektra’s recovery, however, is still far from complete. To fully regain the value it lost in July, the company’s stock would need to increase by 244%. While the situation surrounding the legal dispute is still uncertain, the drastic drop and incomplete recovery may facilitate Salinas Pliego’s goal of delisting the company from the stock market.

Investment bank BCP Securities speculated that at the current share price, a buyout could be possible, though it would result in an unrealized loss of around 11 billion pesos. However, the total book value of the company would only decrease by 13%, which is seen as manageable. If the Salinas Pliego family’s control over Elektra reaches 95%, they could potentially approve the delisting without much resistance from minority shareholders, who would face the prospect of holding illiquid shares in a private company. AXIS

GENTERA*: Banco Compartamos Faces Fiscal Claim of 1.24 Billion Pesos from SAT

Banco Compartamos, a subsidiary of the financial group Gentera, is facing a fiscal claim of 1.24 billion pesos (approximately 61 million USD) from Mexico's Tax Administration Service (SAT). This claim pertains to alleged tax compliance issues for the fiscal years 2015 and 2016.

The bank stated in a public notice that it intends to defend itself through legal channels, emphasizing that it has always complied with its tax obligations. Banco Compartamos further noted that, as a credit institution with recognized solvency, it is not required to guarantee such liabilities under the Law of Credit Institutions. Neither the bank nor its parent company Gentera will reserve funds for the claimed liability, in line with relevant financial reporting regulations.

This issue places Banco Compartamos among other large companies accused of tax noncompliance, and it is the first publicly listed company on the Mexican Stock Exchange (BMV) to report such a fiscal claim during the presidency of Claudia Sheinbaum. AXIS

MEXICO MINING: US Labor Panel Against Mexico Over Camino Rojo Mining Rights

The United States government has requested its third labor panel against Mexico, this time regarding the Camino Rojo mining complex. The panel, which falls under the United States-Mexico-Canada Agreement (USMCA or T-MEC), addresses alleged labor rights violations at a gold and silver extraction facility located in Mazapil, Zacatecas, owned by the Canadian company Orla Mining.

This complaint was filed by the National Union of Mine Workers, led by Napoleón Gómez Urrutia, on June 24. The union claimed that the company undermined workers' support for the union and promoted affiliation with a competing labor group, the National Union of Exploration, Exploitation, and Mining Benefit Workers.

Following the complaint, the Interinstitutional Labor Committee (ILC) found sufficient evidence to support the allegations, triggering the initiation of labor enforcement mechanisms under the USMCA. On August 29, US Trade Representative Katherine Tai formally requested Mexico to review the case, but since no resolution was reached, the United States decided to pursue a labor panel to ensure compliance with Mexican labor laws. Plano Informativo

VECTOR RESEARCH

S&P Reaffirms Mexico's Credit Rating at BBB with Stable Outlook

Standard & Poor's (S&P) has reaffirmed Mexico's credit rating at BBB with a stable outlook. This rating remains two notches above the investment grade threshold, and the agency does not anticipate any changes over the next 12 months.

This decision aligns with S&P's assessment of Mexico's 2025 economic plan, which aims to reduce the fiscal deficit (RFSP) from 5.9% to 3.9% of GDP. While risks to this forecast persist, the likelihood of a significant reduction in the deficit by the end of next year is high, especially considering the potential for a surplus from the central bank's operations.

In terms of other rating agencies, S&P's stance is in line with Moody's, while it is one notch higher than Fitch, which has yet to make a statement following the presentation of the public budget on November 15. No significant changes in Fitch's rating are expected at this time.

WALMEX*: COFECE Resolution Expected to Have Marginal Monetary Impact Initially

Wal-Mart de México S.A.B. de C.V. (BMV / BIVA: WALMEX) reported this morning that on Thursday, December 12, the Federal Economic Competition Commission ("COFECE") notified its main operating subsidiary in Mexico that the COFECE Plenary, in a divided decision made by the acting commissioners in the case, concluded that Walmex had engaged in a single relative monopolistic practice regarding supplier contributions. COFECE imposed a fine of MXN 93,366,000 (less than USD 5 million at the current exchange rate).

COFECE acknowledges that Walmex can continue negotiating contributions with its suppliers, except for two contributions out of the four originally investigated. COFECE ordered conduct measures that limit Walmex's ability to implement these two contributions, even if they are negotiated and agreed upon with suppliers, are common in the market, and benefit consumers.

While Walmex reviews the specific details of the over 900-page decision, based on our preliminary review, Walmex believes that COFECE's analysis is incorrect and that COFECE made errors in applying the law. Since Walmex and its subsidiaries believe they have acted in accordance with applicable laws for the benefit of Mexican families, and due to irregularities in COFECE’s investigation and procedures, Walmex will challenge the decision.

Walmex is disappointed by this decision but will continue to work collaboratively with its suppliers to ensure business continuity, complying with COFECE’s resolution while challenging the decision.

From our perspective, the imposed fine is not material to WALMEX. However, it is crucial that the company challenges the decision regarding its relationships with suppliers and industry practices in order to ensure that its value proposition remains competitive and profitable.

We maintain a Buy recommendation for WALMEX with a 12-month estimated fair value of MXN 73 per share.

Decline in Industrial Production in October and Weakness Expected in IGAE

Mexico's industrial production in October fell by 2.2% year-on-year, a sharper decline than expected (0.6% decline) and even surpassing the most pessimistic market forecasts.

Breaking it down by sector:

Mining dropped 6.9% annually.

Construction fell 8.5%, primarily due to decreases in civil engineering projects and specialized construction work.

Manufacturing grew by 0.5%, maintaining its slower pace throughout the year. Specifically, the production of transportation equipment declined by 0.1%.

When adjusted for seasonality, industrial production decreased by 1.2% monthly and 3.3% annually. This 3.3% annual decline represents the largest drop since September 2020.

Given these poor results, which exceeded even previous forecasts, the industrial decline suggests a weak performance for the IGAE (Gross Domestic Product Indicator) in October, with an annual change potentially close to zero percent. A negative annual variation in the economy cannot be ruled out at this point.

INTERNATIONAL DAY

National Chocolate-Covered Anything Day, celebrated on December 16, is a fun and indulgent holiday that encourages people to enjoy various foods covered in chocolate. Whether it's fruits, nuts, pretzels, or even more unique items like potato chips or bacon, this day is all about celebrating the versatility of chocolate as a coating for different treats.