MEXICO: BRAZIL CRISIS

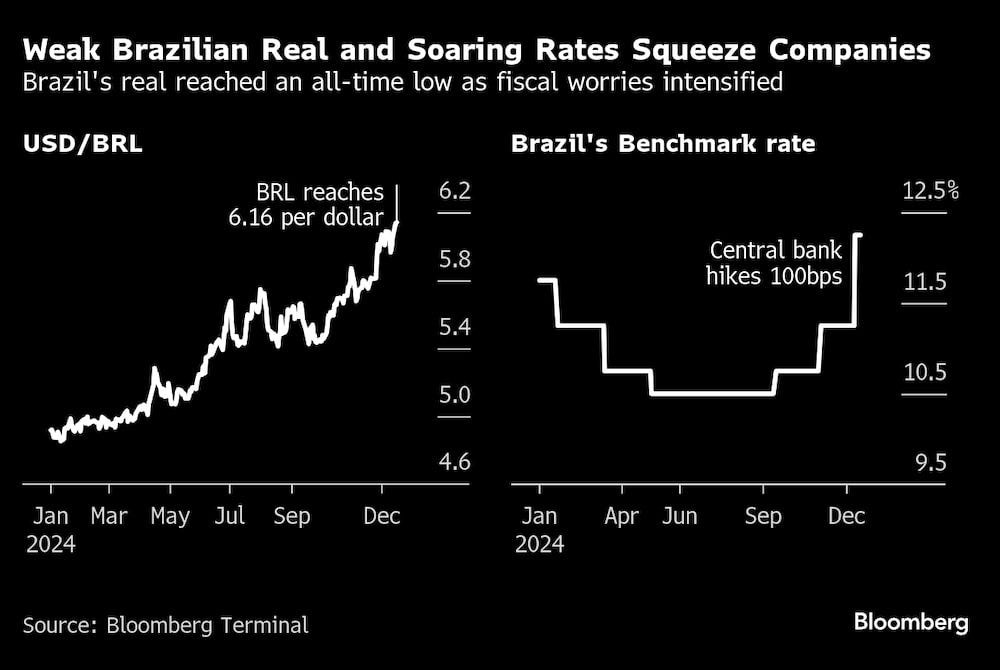

The Brazilian real collapsed on Wednesday to a historic low, while stocks also came under pressure, as financial markets questioned Brazil’s government spending plans and its large budget deficit.

Panic sweeps through Brazil's financial market: Collapse of the real and Bovespa trigger 'sell now' sentiment

The real has been the worst-performing currency in the world over the past four sessions, adding to a 21 percent drop this year against the dollar.

The Ibovespa stock index, the largest in Latin America, has fallen by 3.8 percent.

First, it was the collapse of the currency. Now, Brazil's other financial markets are under scrutiny, as investors have lost faith in the government's ability to contain an increasingly deep fiscal crisis.

The wave of selling that caused the real to plummet to a historic low is affecting everything from stocks to local currency debt and dollar-denominated bonds, with traders even accumulating hedge funds against a sovereign default. Market observers say the extraordinary measures taken by the central bank on Tuesday to stop the currency's fall are little more than a temporary solution, warning that signs that the country's Congress could dilute a high-profile austerity package are likely to increase the turmoil.

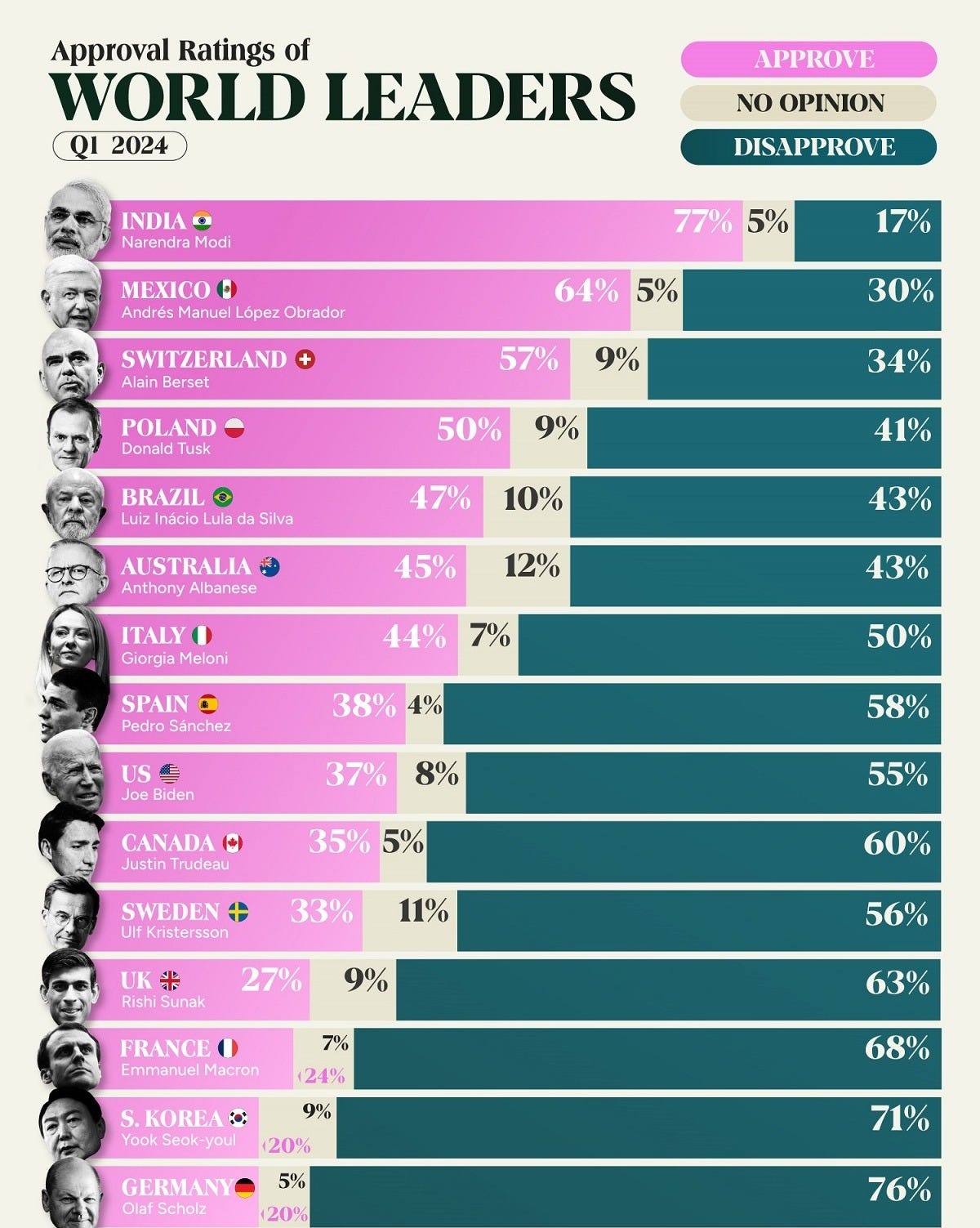

The growing decline shows that investors are becoming increasingly skeptical about whether President Luiz Inácio Lula da Silva is determined to control the growing fiscal deficit. Brazil has an annual budget deficit of 10 percent, much higher than those recorded during the first term of the leftist president. His recent emergency brain surgery came at the worst possible time, further complicating efforts to shore up public finances.

“Brazil has become a market where you sell first and ask questions later,” said Sergey Goncharov, a fund manager at Vontobel Asset Management. “Fiscal concerns, combined with the central bank’s response to the exchange rate measures, triggered some panic selling.”

Investors 'have thrown in the towel'

The real has been the worst-performing currency in the world over the past four sessions, adding to a 21 percent decline this year against the dollar. The Ibovespa stock index, Latin America's largest, has dropped by 3.8 percent. Swap rates have risen. Dollar-denominated bonds were the worst performers in emerging markets after Lebanon defaulted on its obligations, and five-year credit default swaps widened to their highest level in over a year.

“We’ve reached a crisis stage from the bond perspective,” said Jack McIntyre, portfolio manager at Brandywine Global Investment Management. “Lula needs to say something constructive.”

The Brazilian real hit historic lows despite recent interventions from Brazil's Central Bank.

As the wave of selling spread, strategists rushed to abandon bullish bets on the country's assets. In the last two days, JPMorgan Chase & Co. strategists abandoned their positive outlook on Brazil's dollar-denominated debt, while Credit Agricole SA dropped its tactical overweight position on the real two weeks after entering the trade.

“Investors have clearly thrown in the towel,” said Olga Yangol, Head of Emerging Markets Research and Strategy at Credit Agricole. Despite positive signals on growth and central bank measures, “the perception is that while the current president is in power, he seems quite immune to market fluctuations.”

Last month, Lula unveiled a plan to cut 70 billion reais ($11.5 billion) from annual spending but paired it with new income tax exemptions, which disappointed traders. On Tuesday, a lawmaker in charge of the spending cut plan said Congress was considering further diluting the proposal due to its potential impact on social programs.

The government's reluctance to push ahead with cuts has left much of the heavy lifting to the central bank, which last week raised its key interest rate by one percentage point and promised to raise it to 14.25 percent by March while fighting inflation.

The fiscal problem

Despite tough credit conditions, Brazil's economy — the largest in Latin America — has continued to grow, with unemployment near historic lows and rising wages. In addition, the country has about $360 billion in international reserves. Lula has leveraged economic growth to demonstrate that he is fulfilling his promises to improve the standard of living for the poor.

But he has also fueled fears that the economy may be overheating, as inflation expectations have worsened significantly. Traders now expect interest rates to peak near 16.25 percent, which would increase the government's interest burden and further widen the deficit.

In addition to its decision on rates, the central bank has carried out its largest direct interventions since the early days of the pandemic, injecting $5.8 billion into the market through spot auctions since Friday. On each occasion, the measures gave the real a temporary boost that quickly faded.

Investors said the risk of fiscal dominance, where monetary policy becomes ineffective, is starting to appear.

“The central bank is a secondary player,” said Marcos de Marchi, chief economist at Oriz Partners. “The main player in this movie is fiscal policy.”

For now, few investors are willing to bet on when the crisis will end unless the government changes its approach.

“The momentum is driving everything related to Brazil,” said Gregory Hadjian, global macro strategist at Loomis Sayles in Boston. “The fiscal problem is undoubtedly the main one. And a material fiscal response is the real catalyst to change things.” El Financiero

Brazilian real hits record low: Doubts grow over Lula da Silva's fiscal plan

The local currency surpassed 6.25 units per dollar, marking a 22% drop so far this year. Meanwhile, the benchmark Bovespa stock index fell 2% on the day, reaching a six-month low.

The cost of insuring exposure to the country's bond debt remained near its highest level in 14 months, with investors growing increasingly anxious as Latin America’s largest economy faces a deepening financial crisis.

Investors are doubtful that lawmakers will be able to pass key parts of a fiscal reform bill intended to put government finances on a more sustainable footing.

“The markets are primarily concerned about the fragile overall fiscal trajectory and the fact that it is affecting inflation expectations through pressure on the real,” said Thomas Haugaard, portfolio manager at Janus Henderson in Copenhagen. “We often see the market rebel before painful adjustments arrive, but for now, it does not seem like there will be a fiscal response to the recent turmoil.”

The Brazilian Congress approved the main text of a bill late Tuesday but still needs to vote on some amendments proposed by lawmakers. Finance Minister Fernando Haddad said Wednesday that the Senate is ready to vote on the bill as soon as it is sent by Congress.

“We are doing our part: sending the measures to Congress, working to ensure that they are not diluted, and convincing people that these measures are necessary to strengthen the fiscal framework,” Haddad said.

The Central Bank of Brazil held spot dollar auctions for the third consecutive session on Tuesday, reaffirming its commitment to a tight monetary policy.

“The central bank raised more than expected and has been intervening in the currency, so it is doing its part,” said Shamaila Khan, head of fixed income for emerging markets and Asia Pacific at UBS Asset Management.

The yield on the local sovereign bond hovered around 14.5% on Wednesday, after reaching 14.847% on Tuesday, the highest level since March 2016. It started the year at about 10.5%.

“At this point, the bar is very low for a positive fiscal surprise,” said Arif Joshi, co-director of Lazard Asset Management’s emerging markets debt platform. In his view, fiscal consolidation must go beyond relying on stronger growth to make the fiscal side look healthier, and move toward real spending cuts. “You start with baby steps and build from there,” said Joshi. “We’re not looking for the full bazooka, we’re looking for baby steps in the right direction.”

Five-year credit default swaps, which reflect the risk of sovereign debt default, stood at 194 basis points, according to S&P Global Market Intelligence. The MSCI Brazil index, denominated in dollars, has fallen more than 30% since the beginning of the year. Brazil’s nominal budget deficit, including debt interest payments, has risen to 9.5% of GDP from 4.6% when President Luiz Inácio Lula da Silva took office in January 2023.

Impact on Brazilian companies

Meanwhile, the crisis weakening the Brazilian real has exposed vulnerabilities in some of the country’s largest companies.

The currency collapse has significantly increased debt servicing costs and corporate cost coverage. The rise in local interest rates exacerbates the pressure.

According to a study by FTI Consulting for Bloomberg News, about half of the Brazilian companies surveyed that have dollar-denominated debt—33 in total—have average leverage levels greater than five times gross debt relative to EBITDA. Of those, 12 have more than half of their debt in dollars.

Highly leveraged companies, such as Gol Linhas Aereas Inteligentes SA and Azul SA, are facing significant dollar-denominated expenses while generating most of their revenues in reais. Leveraged companies in sectors like real estate, transportation, consumer goods, and retail are most vulnerable to exchange rate fluctuations. The study's criteria included shopping centers within real estate assets, according to FTI.

“Companies that are more sensitive to debt are the ones you want to stay away from,” said Michel Frankfurt, head of the Brazilian brokerage unit at Scotiabank. “They are doubly affected,” by exchange rates and interest rates, he added.

For companies like Azul and Gol, a weaker real raises costs, including dollar-linked fuel prices and lease payments denominated in dollars. The outlook for the currency, at best, remains uncertain: investors who sent the real to a historic low amid concerns over the government's ability to cut spending will also have to contend with Donald Trump’s return to the White House, which could strengthen the dollar.

If the real remains at this level for an extended period—or if the sell-off intensifies—restructurings are likely to increase, said Luciano Lindemann, senior managing director at FTI Consulting.

The real could fall to between 6.70 and 7 reais per dollar, according to Ioana Zamfir, strategist at Morgan Stanley, who pointed to risks stemming from the government’s spending plans.

At 6.50 reais per dollar, the average gross leverage in sensitive sectors could rise to 13 times earnings before interest, taxes, depreciation, and amortization (EBITDA), according to FTI. Their analysis only accounts for the effects of currency depreciation and does not consider any natural hedges against U.S. dollar-denominated earnings, which could mitigate the impact of currency devaluation.

Market observers say that the Central Bank's extraordinary measures, which have intensified interventions in the past week to halt the currency’s fall, are a temporary solution.

High interest rates

Companies also face rising interest rates. Brazil's central bank raised rates to 12.25% last week and pledged more increases by March, at a time when other global central banks are easing their policies. Brazilian economists expect inflation and borrowing costs to rise until 2027, and traders anticipate rates could peak at around 16.25%, which would further strain companies' balance sheets.

Some of Brazil's largest companies are exporters, and they could benefit from a stronger dollar. Companies like Suzano SA, Vale SA, and Minerva SA, all of which have dollar-denominated debt, would benefit from a weaker real, as they earn more in dollars than they spend, according to a Santander Brazil study. INFOBAE

Foreign Minister De la Fuente and his Brazilian counterpart strengthen dialogue on regional cooperation

Juan Ramón de la Fuente had a phone conversation on Tuesday with Mauro Vieira about mutual interests between Mexico and Brazil.

Mexico's Secretary of Foreign Relations (SRE), Juan Ramón de la Fuente, spoke by phone on Tuesday with his Brazilian counterpart, Mauro Vieira, about issues of mutual interest, both bilateral and regional, as well as strengthening international cooperation.

"Foreign Minister Juan Ramón de la Fuente had a working phone call with Brazil's Minister of Foreign Relations, Mauro Vieira," the SRE said in a brief message on X.

During the call, the officials discussed "bilateral matters of common interest between Mexico and Brazil, as well as regional and multilateral issues," the department added.

The conversation follows Monday's meeting between Mexican President Claudia Sheinbaum and Colombian President Gustavo Petro at the National Palace, where they outlined a shared agenda on the migration crisis, just over a month before U.S. President-elect Donald Trump takes office on January 20.

At the same time, progressive leaders of Latin America's left urged for greater regional integration.

After the meeting, Sheinbaum highlighted on social media that they discussed the importance of unity among progressive governments and strengthening ties in Latin America and the Caribbean.

Meanwhile, the Colombian government announced that the heads of state agreed to exchange information to address the migration crisis "in a more orderly manner."

Brazilian President Luiz Inácio Lula da Silva was discharged from the hospital on Sunday after being treated for an intracranial hemorrhage and will remain in São Paulo at least until Thursday for follow-up exams. Lopez Doriga

VECTOR SALES AND TRADING DESK

MEXBOL: Lost -0.9% Following Global stock markets.

Global stock markets experienced a significant downturn on Thursday, December 19, 2024, following the U.S. Federal Reserve’s decision to cut interest rates while signaling a more cautious approach to future cuts. The Dow Jones Industrial Average plummeted by 1,123.03 points, marking a 2.58% decline, its longest losing streak since 1974. This sharp drop came after Fed Chair Jerome Powell indicated that the central bank might only implement two additional rate cuts in 2025, a stark contrast to previous expectations of four cuts. The S&P 500 and Nasdaq Composite also suffered substantial losses, falling 2.95% and 3.56%, respectively.

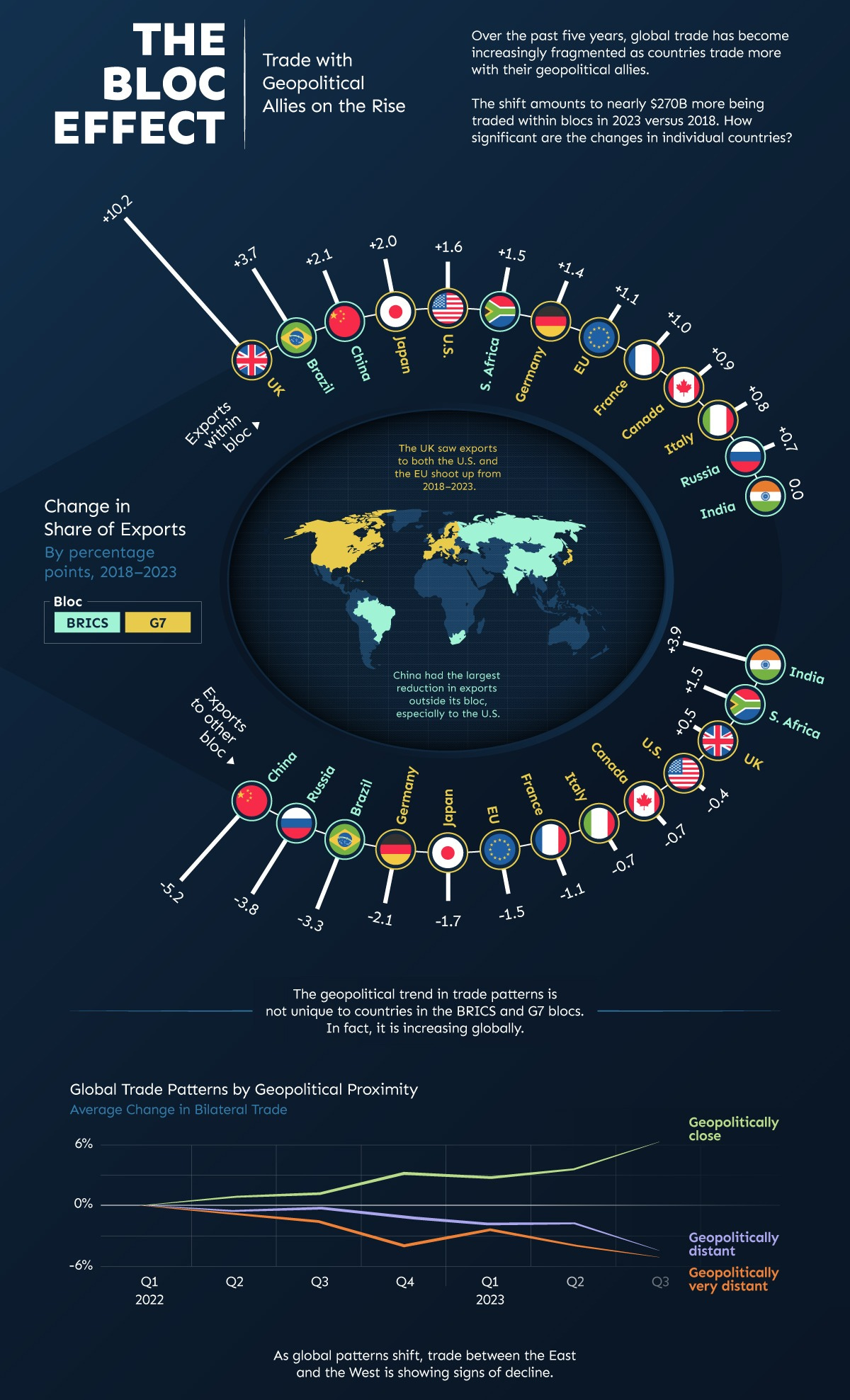

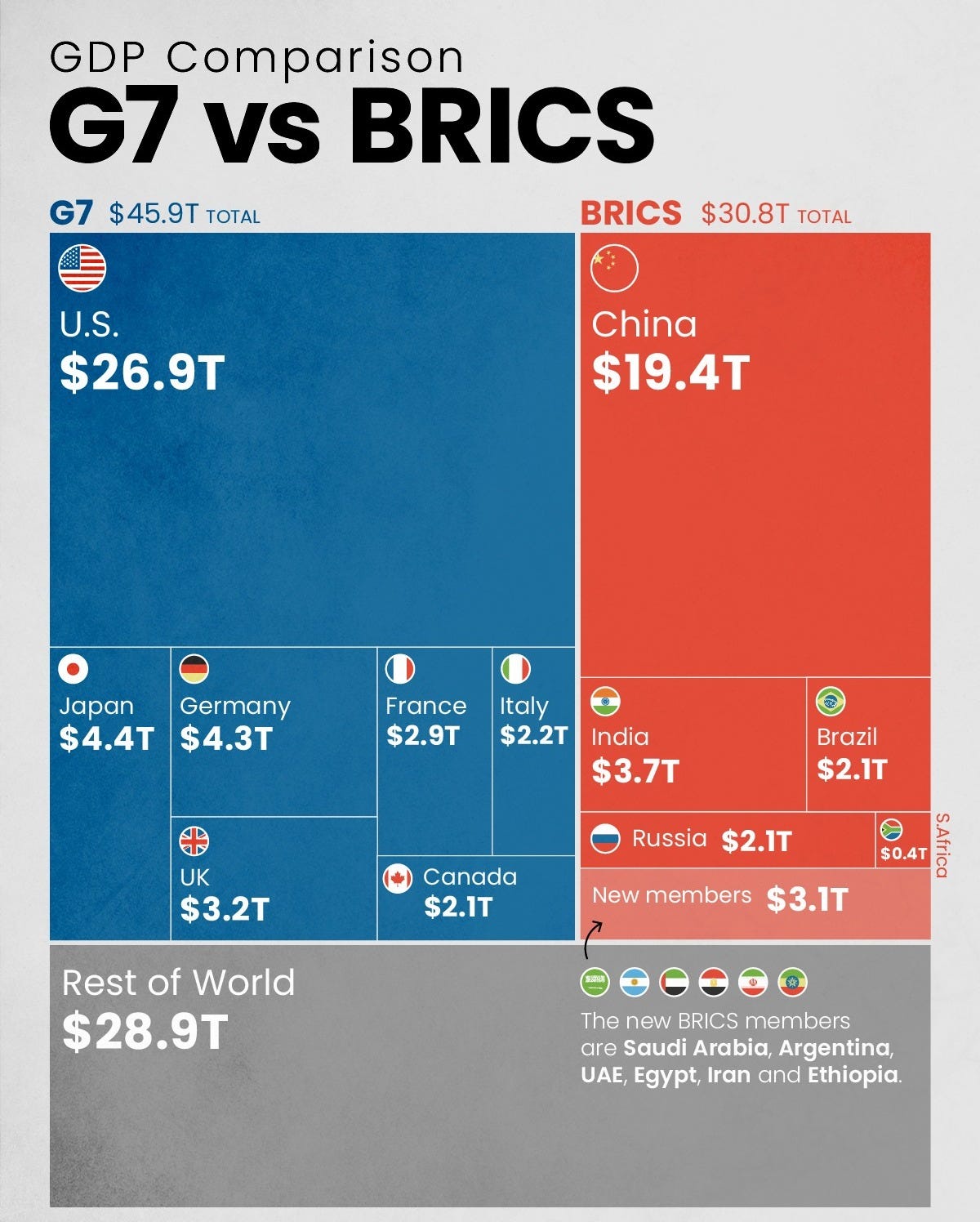

BRAZIL AND CHINA: China and Brazil Strengthened Ties This Year

During Xi Jinping’s latest visit to Brazil for the G20 Summit in Rio de Janeiro, China and Brazil signed 37 documents, including memoranda, agreements, plans, protocols and letters of intent. This is more than twice as many agreements that were signed last year during President Luiz Inácio Lula da Silva’s state visit to Beijing in April 2023 wherein 15 agreements were signed.

The first on the list of agreements was to expand the partnership between the two countries. Strategic partnerships are an important feature of Chinese foreign policy. Brazil was the first country in the world to have such a partnership with China, in 1993, under the governments of Jiang Zemin and Itamar Franco.

Not just waiting around for higher tariffs, China looks to BRICS

And why not when Brazil has over 200 million people and the world’s ninth largest economy, bigger even than Russia’s?

Part of China's plan for reacting to expected higher U.S. tariffs is trading more with some of the BRICS economies, in particular Brazil. Photo: public domain

Donald Trump’s cabinet appointments and policy pronouncements have been dominating the headlines and many of these appointments and pronouncements have dire implications for China. The Chinese have noticed.

They’re signaling some of the ways they will react if Trump tries to shut China out of the US market. You might even say they’re reacting pre-emptively.

Not just waiting around for higher tariffs, China looks to BRICS

Trump has chosen China hawks for his secretary of state (Marco Rubio), national security advisor (Mike Walz) and ambassador to China (David Perdue). He has repeated his promises to impose 60% tariffs on Chinese products. The other day, he threatened the nine members of the BRICS bloc, which include China, with 100% tariffs if they attempt to replace the US dollar as the world’s reserve currency.

The BRICS countries aren’t seriously threatening to do that – any time soon, at least. For the Chinese yuan – the obvious candidate – to play the reserve-currency role, China would have to liberate its controls on flows of capital. It doesn’t want to do that.

But BRICS is an important part of China’s reaction to the risk of severe limitations on its access to the US market. The idea is diversification – relying more on other trading partners for both imports and exports. As US farmers can easily imagine, Brazil – the B in BRICS – is near the top of China’s dance card. ASIA TIMES

Brazil ranks as China’s ninth-largest trading partner, while China holds the position of being Brazil’s largest trade partner. In 2023, the bilateral trade volume between China and Brazil reached US$181.53 billion, marking a 6.1 percent year-on-year increase. Brazil remains China’s largest source of agricultural imports.

Chinese investments in Brazil are primarily concentrated in energy, mining, agriculture, infrastructure, and manufacturing. Conversely, Brazilian investments in China are mainly focused on compressor production, coal, real estate, auto parts manufacturing, and the textile and apparel industries.

As the economic and trade relationship between China and Brazil continues to deepen, there is significant growth potential for trade and investment in areas such as agriculture, new energy products, electric and hybrid vehicles, high-tech products, infrastructure construction, and service industry cooperation.

MEXICO AND BRAZIL: Mexican Companies in Brazil Account for More Than 32% of the Total Value of the IPC.

America Móvil, FEMSA, Bimbo, and Coca-Cola Femsa, which have operations in Brazil, together have a capitalization of 2.37 trillion pesos, representing 32.11% of the total value of the IPC.

The most valuable company among them is America Móvil, with a capitalization of 1.25 trillion pesos, followed by FEMSA at 498.2 billion pesos, Bimbo at 361.2 billion pesos, and Coca-Cola Femsa at 269.2 billion pesos.

LABB: There is no disclosure on the exact contribution of Brazil to consolidated revenues; however, while the Brazilian real has depreciated significantly, this is somewhat offset by the depreciation of the Mexican peso against the US dollar. Therefore, we do not anticipate a negative impact on consolidated figures.

Among South American countries, Argentina remains the largest contributor to consolidated revenues, accounting for 14% of total income. Argentina’s economic situation has been improving, and its local currency has also been relatively stable.

ORBIA: Lost -6.4% to 15.41. Brazil represents 7.42% of ORBIA´s total revenue.

VECTOR RESEARCH

The Fed cuts but enters a more cautious phase.

In the last meeting of the year, the Fed highlighted uncertainty and a lack of consensus. In a divided vote, they decided on a 25 basis point cut. The long-term neutral interest rate projection was increased.

The Federal Reserve cut its interest rate by 25 basis points, as expected, bringing it to a range of 4.25% to 4.50%. As in the September meeting, the decision was divided. In this case, Beth Hammack preferred to keep the interest rate unchanged. Additionally, the dot plot suggested that three other members would have favored no cut.

Moreover, projections show a substantial change in the cuts projected for 2025. The median in September was 3.4%, and now it stands at 3.9%. In September, the most voted ranges were between 3.0% and 3.25%, and between 3.25% and 3.5%. Now, the majority (10 of 19) of votes are between 3.75% and 4.0%.

Additionally, the long-term rate projection was increased again, from 2.9% to 3.0%. In September, the most voted levels for this rate were 2.5% and 2.75%, with three each; now the most voted level was 2.8%, with four, followed by 3.0%, with three. This implies that the current stance is considered less restrictive than in September.

The Committee remains optimistic about the strength of the economy. It projects that GDP will grow by 2.1% in 2025, marginally above the projection made in September. Regarding unemployment, they expect it to close 2025 at 4.3%, slightly below the September forecast. Powell pointed out that there are no signs of a sudden weakening in the labor market, adding that job growth is slightly below the level that would keep the unemployment rate stable.

The inflation projection for the end of 2025 was revised from 2.1% in September to 2.5%, and for 2026, from 2.0% to 2.1%. Similarly, the core PCE was revised from 2.2% to 2.5% in 2025 and from 2.0% to 2.2% in 2026.

Chair Jerome Powell stated that the Fed is now entering a new phase (ending the Recalibration phase). Although he did not name this phase, he suggested that the Fed would adopt a more cautious approach. His communication aimed to signal that the time to reduce the pace of cuts is approaching or has already arrived. He noted that it is uncertain what the neutral interest rate level is, but they are now certain that they are 100 basis points closer than they were before starting the rate-cut cycle.

The most pressing question in the press conference concerned the policies of the new administration. Unfortunately, the conference offered little clarity on this matter. Powell mentioned that some Committee members adjusted their projections considering certain possible scenarios, while others did not consider these scenarios, and some did not comment on whether their projections incorporated potential new policies. He shared that some members of the Committee did express greater concern about inflation linked to possible policies.

Regarding potential tariffs, Powell said that the exercises the Fed conducted in 2019 raised the right questions but might not necessarily be a good guide because, for instance, much of the manufacturing has already moved out of China. He added that there is a high degree of uncertainty about which items would be subjected to tariffs, which countries would be affected, the magnitude of the tariffs, and whether there would be retaliations.

INTERNATIONAL DAY

National Re-Gifting Day, celebrated on December 19, is a fun and lighthearted occasion that encourages people to exchange unwanted gifts they received during the holiday season. The idea behind this day is to give those items a second life by passing them on to someone who might actually appreciate them. It’s a great way to reduce waste, save money, and bring a smile to someone's face by finding the perfect recipient for an item that was never quite the right fit for you. Whether it’s a quirky sweater or an extra set of kitchen gadgets, National Re-Gifting Day is all about making the most of what you have!