MEXICO AUTO INDUSTRY: TARIFFS REVEAL COMPLEXITY

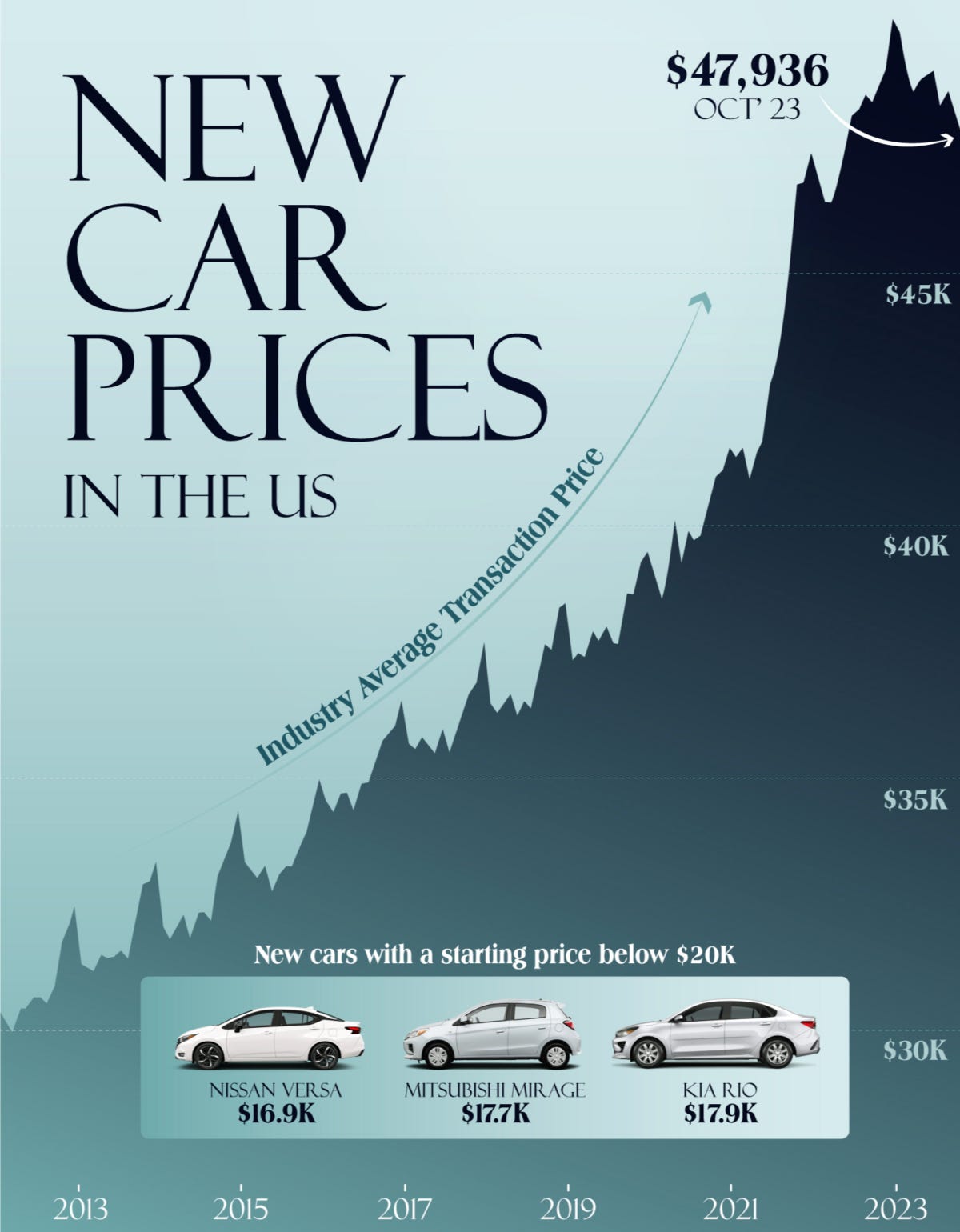

1 in every 5 cars in the United States is made in Mexico. Additionally, 87% of the vehicles produced in Mexico are exported, with the United States being the destination for 80% of them.

Donald Trump's threat of tariffs on cars made in Mexico could significantly affect several automotive brands that manufacture vehicles and components in the country.

The three major U.S. companies involved in car production in Mexico are Ford, General Motors (GM), and Stellantis, the owner of the RAM and Jeep brands. Below is an overview of these brands' presence in Mexico and how they could be affected by the tariffs proposed by Trump.

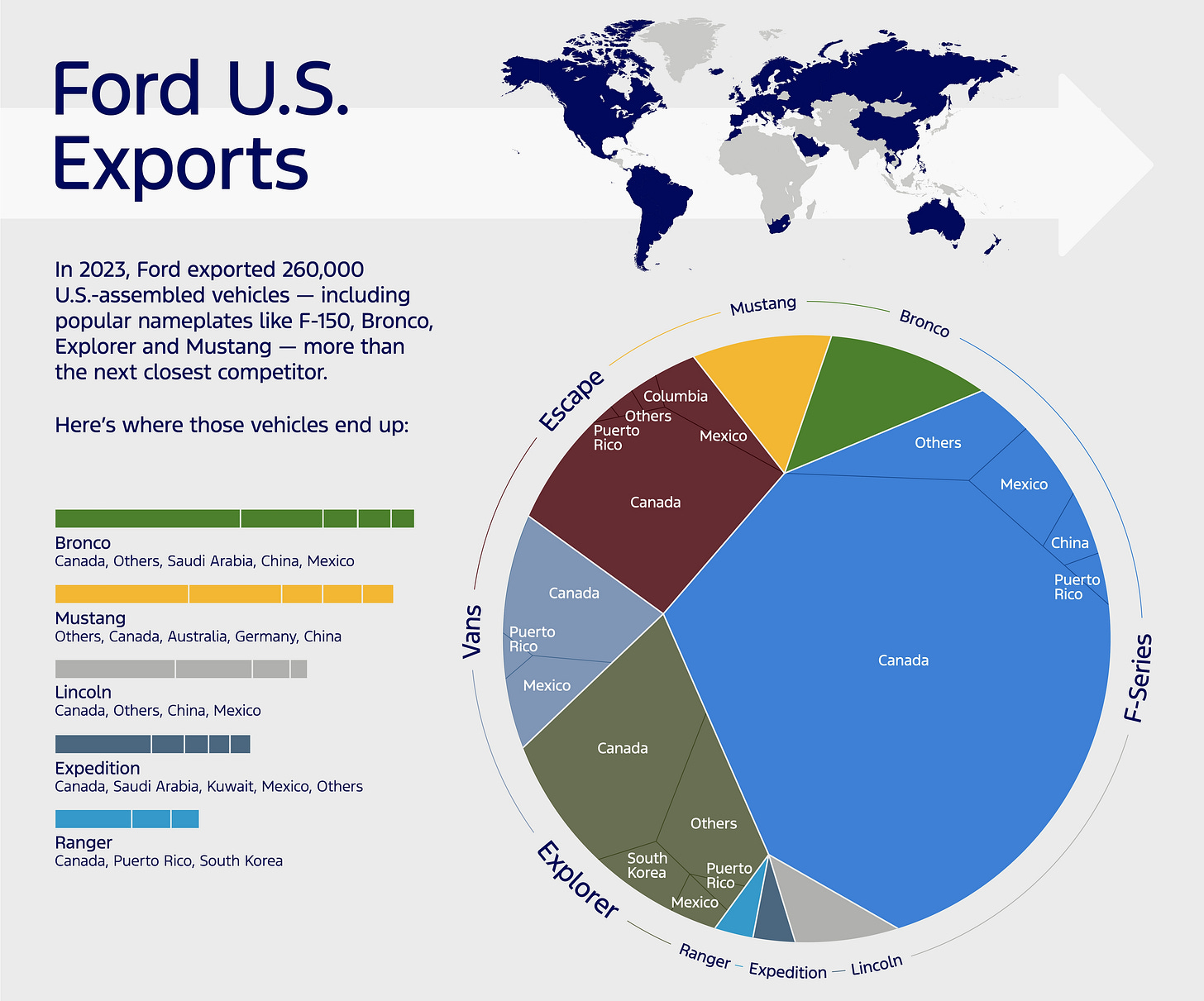

1. Ford

Ford has several plants in Mexico:

Cuautitlán Izcalli (State of Mexico): Produces the Ford Mustang Mach-E, an electric vehicle.

Hermosillo (Sonora): Manufactures Ford Bronco Sport and Ford Maverick.

Chihuahua: Specializes in producing engines, including Duratec I-4 and Power Stroke Diesel engines.

Irapuato (Guanajuato): Produces transmissions.

If tariffs are implemented, these increases could affect Ford’s competitiveness, particularly with the Mustang Mach-E, which competes in the growing electric vehicle market. Rising costs could be passed on to the final vehicle prices in the U.S., reducing demand.

2. General Motors (GM)

GM has several plants in Mexico, producing popular models such as:

Coahuila: Manufactures vehicles like the Chevrolet Silverado and Chevrolet Equinox.

State of Mexico: Produces models like Chevrolet Blazer and GMC Sierra.

Guanajuato: Manufactures models such as Chevrolet Blazer Electric and GMC Terrain SUV.

GM would also be affected by tariffs, as many of their sales in the U.S. come from vehicles assembled in Mexico. The imposition of tariffs could increase the cost of transporting these vehicles and components to the U.S., raising prices for consumers and affecting the company's profitability.

3. Stellantis (owner of RAM and Jeep)

Stellantis has a significant presence in Mexico with several plants:

Toluca (State of Mexico): Produces the Jeep Compass and Dodge RAM Pro Master.

Saltillo (Coahuila): Manufactures engines and vehicles, including Dodge RAM 4000 and Dodge RAM Crew Cab.

In the case of tariffs being imposed, Stellantis could try to compensate for the price increase by selling more vehicles in markets outside the U.S. However, the rise in production costs would affect both their profit margins and the competitiveness of their models, especially in a price-sensitive market like the U.S.

What Would Happen with Tariffs?

The imposition of tariffs could raise production costs, mainly due to materials like steel and aluminum, and negatively impact both Mexico and the U.S. Tariffs would increase vehicle prices, potentially reducing demand in the U.S. and generating inflation in both countries.

BMW might not be as affected, as its sales in Latin America somewhat offset the tariff effects in the U.S. However, brands like BYD (from China), seeking to enter the U.S. market, would face severe consequences from Trump's tariffs. Tesla has also expressed concerns about tariffs, which have delayed its decision on building a plant in Nuevo León.

Is an Indiscriminate Tariff Beneficial?

An indiscriminate tariff would not only affect car manufacturers in Mexico but also the U.S. automotive industry, as many of these companies share supply chains and are deeply integrated. The increase in vehicle prices could lead to higher inflation and reduced competitiveness, negatively affecting both consumers and manufacturers.

In conclusion, while the idea of imposing tariffs on cars made in Mexico aims to protect the U.S. industry, experts suggest that doing so indiscriminately could be harmful to both countries and generate unintended effects on consumers and the economy. El Financiero

Ford Mexico Responds to Tariff Threats: "It's Not Simple"

Ford Mexico responded to Donald Trump's threats of imposing tariffs on exports from Mexico, emphasizing that it's not a straightforward task since the country is crucial in the global supply chain for the automaker. Lucien Pinto, CEO of Ford Mexico, pointed out that 30% of the parts used globally by the company come from Mexico, equating to 79 million pieces, highlighting Mexico’s strategic importance in its production.

Ford Mexico, a pioneer in the country’s automotive industry since 1925, continues to be a fundamental pillar for the American automaker, with a presence in four states and an engineering center that is the largest in the country and the second most important globally within the company. Pinto stressed that the economic interdependence between both countries is deep and complex, making unilateral decisions like imposing tariffs not so simple to implement.

Ford continues to expand its presence in Mexico, with recent investments such as the $273 million in its Irapuato, Guanajuato plant, dedicated to the manufacture of electric vehicles, such as the Mustang Mach-E. With 14,600 employees, the company continues to solidify its leadership in the sector, with models like the Bronco Sport, Maverick, and Mustang Mach-E, which are among the most produced in the country. El Economista

Nissan Confident in Competitiveness Despite Potential Trump Tariffs

Rodrigo Centeno, President and CEO of Nissan Mexicana, expressed confidence that the company will remain competitive, even if President Donald Trump imposes new tariffs on imports starting January 20. He emphasized that, instead of succumbing to concern, the company’s focus is on adapting to potential changes in trade rules.

Centeno noted that Nissan has faced market changes before, such as the shifts from NAFTA to the USMCA (T-MEC), and even operated in Mexico before these agreements under a more closed market with high interest rates and depreciated exchange rates. He stated that adapting to evolving circumstances is part of the company’s strategy for maintaining competitiveness in uncertain times. El Economista

Giant Motors: Defying Trump’s Tariff Threats and Strengthening Its Position in Mexico

Elías Massri, CEO of Giant Motors Latinoamérica, a joint venture between the Massri family and Grupo Financiero Inbursa, has shown remarkable resilience in the face of tariff threats from the Trump administration. Despite the ongoing trade tensions between the U.S. and China, Giant Motors—the only Chinese car assembly plant in Mexico—has successfully consolidated its presence in the Mexican market and expanded its operations.

A Bet on Mexico

Giant Motors' plant in Ciudad Sahagún, Hidalgo, has become a symbol of Chinese investment in Mexico, even amidst tariff threats and criticism. Massri asserts that the company is well-prepared to tackle any challenges, thanks to its strategy of adapting to the Mexican market and its robust supply chain.

Key to Success

One of the key factors behind Giant Motors' success has been its ability to tailor Chinese vehicles to meet the needs of Mexican consumers. The company has made modifications to its car designs to improve their performance on Mexican roads and has developed an efficient distribution network. Moreover, Giant Motors has formed strategic partnerships with local suppliers, helping reduce costs and increase competitiveness.

Expansion and Growth

Despite external challenges, Giant Motors has experienced steady growth. The company has doubled its production since 2021 and has ambitious plans for the coming years. The construction of a new logistics center and the launch of four new models in 2025 demonstrate the company's confidence in the Mexican market.

The story of Giant Motors proves that companies can be resilient and adapt to changing environments. Massri has sent a clear message to the Trump administration: Chinese investment in Mexico is a reality, and it will not be easy to stop. The Mexican company has shown that it’s possible to conduct successful business in an atmosphere of uncertainty and trade tension. America Retail

Challenges and Opportunities for the Automotive Industry with Trump’s Return

Alberto Bustamante, director of the National Association of Automotive Suppliers (ANAPSA), emphasized that with Donald Trump’s return to the U.S. presidency, the industry will face challenges stemming from potential changes in the trilateral relationship with Mexico and Canada under the USMCA, as well as the threat of tariff impositions.

Impact of the Automotive Industry on the Mexican Economy

Bustamante highlighted that the automotive industry remains a key pillar of the national economy, representing 4.7% of GDP and generating a trade surplus of over $107 billion, surpassing remittances and tourism.

Mexico continues to stand out as a global leader in vehicle production and exports, with a forecast of producing more than 4 million light vehicles in 2024. Additionally, sales of hybrid and electric vehicles saw a notable 74.7% increase compared to the previous year.

Bilateral Trade Between Mexico and the U.S.

The U.S. remains the top destination for Mexican automotive exports, accounting for more than 88% of sector exports.

Bustamante emphasized that the integration of Mexico's automotive industry with the U.S. is crucial for the strengthening of both countries, despite the challenges posed by Trump’s upcoming administration.

"Today, bilateral trade between the two countries reaches $738 billion, with a $139.5 billion surplus for Mexico, reflecting the sustained growth of trade since the USMCA came into effect."

Mexico remains the U.S.'s main trade partner in the automotive sector and other strategic industries. 80.8% of the light vehicles produced in Mexico are exported to the U.S., meeting the regional content requirements outlined by the agreement.

Challenges from Tariffs and Competition with China

Despite the threats of tariffs similar to those proposed by Trump in 2017, Bustamante emphasized that the parallel provisions of the USMCA have been essential in protecting Mexican exports, allowing companies in the sector to operate without significant negative impact.

In this regard, Mexico has managed to displace China as the U.S.'s top trade partner in the automotive industry, representing a strategic victory amid the trade war between the two nations.

The Future of the USMCA and Opportunities for the Industry

Bustamante highlighted that the USMCA remains a key driver for Mexico's competitiveness, especially with regional content rules that encourage the substitution of third-country imports.

"As international supply chains are reconfigured and nearshoring gains ground, Mexico continues to strengthen its position within the North American trade bloc," he said.

With the USMCA review scheduled for 2026, new opportunities are anticipated to improve rules on light vehicles, auto parts, and labor and energy issues, with a focus on sustainability and clean energy.

Finally, he added that Mexico, through ANAPSA, has implemented the USMCA Seal program, which certifies companies that meet regional content requirements, granting them access to North America's trusted company registry and enhancing their competitiveness in the region. Revista Magazzine

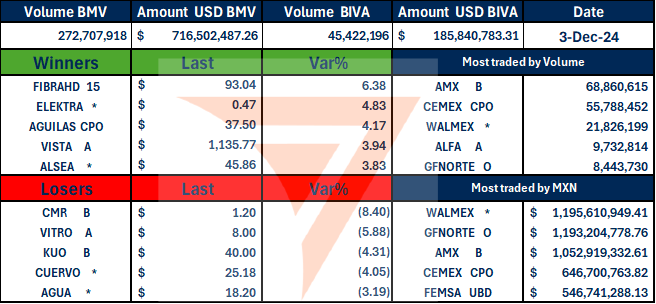

VECTOR SALES AND TRADING DESK

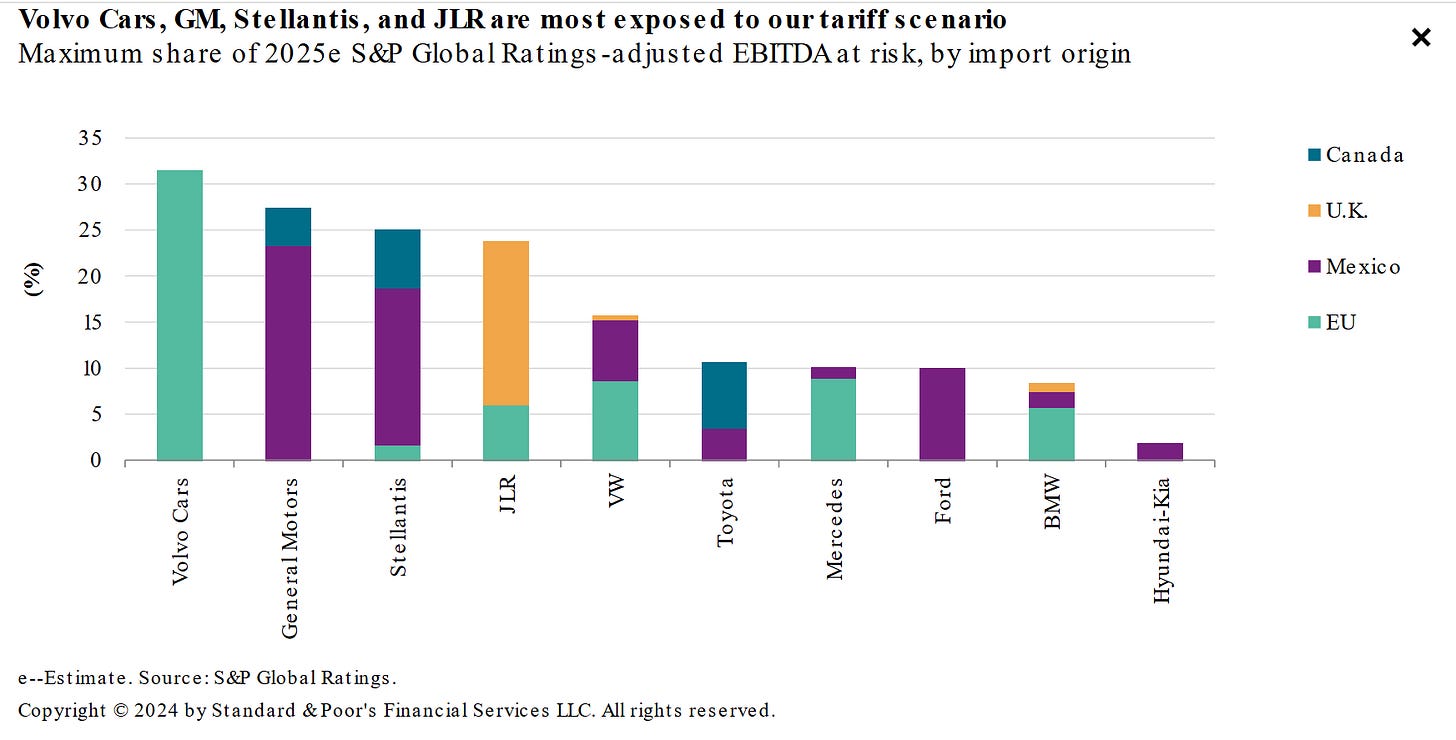

Auto Industry Buckles Up For Trump's Proposed Tariffs On Car Imports

We estimate a 20% tariff on U.S. light vehicle (LV) imports from the EU and the U.K., and a 25% tariff on imports from Mexico and Canada could cost affected European and U.S. carmakers up to 17% of their combined annual EBITDA in a worst-case scenario.

Particularly exposed to potentially higher tariffs are premium original equipment manufacturers (OEMs) Volvo Cars and JLR--given their high reliance on European production--and GM and Stellantis due to the volume of cars they assemble in Mexico and, partly, Canada. The risks for BMW and Mercedes are more contained.

That said, we expect mitigating actions will make potentially higher tariffs manageable, but the combined effects of tariffs, tighter CO2 regulation in Europe from 2025, and earnings pressure from stronger competition in China and Europe could increase the risk of downgrades.

Trade Barriers With Mexico And Canada Are The Biggest Risk For Mass-Market Carmakers

As was the case in previous years, Toyota and Hyundai-Kia will likely remain among the top 3 importers of finished LVs into the U.S. in 2025. We expect total U.S. import volumes will exceed 10% of the two companies' global sales (see chart 1). Although this results in tariff exposure, Japan and South Korea account for most of the two companies' import volumes. Our scenario does not include tariffs on shipments from these markets as we focus on production countries that have been at the center of the political debate.

WALMEX*: The case was originally set for last Thursday but was postponed at the last minute. El Heraldo

It's a hot potato. Apparently, there is a lack of consensus among the commissioners. The situation is further complicated because three of the seven commissioners will not vote due to conflicts of interest. This includes the president commissioner, Andrea Marván, who comes from the Investigative Authority and has a conflict of interest as that body is the accuser. Also recused is commissioner Giovanni Tapia, who was a private consultant for one of the parties before joining the commission. Finally, commissioner Ana María Reséndiz is recused because her husband was once director in the Cofece’s Investigative Division. These absences, along with Walmart’s defense by the Hogan Lovells law firm, led by Omar Guerrero, suggest an uncertain outcome for the case.

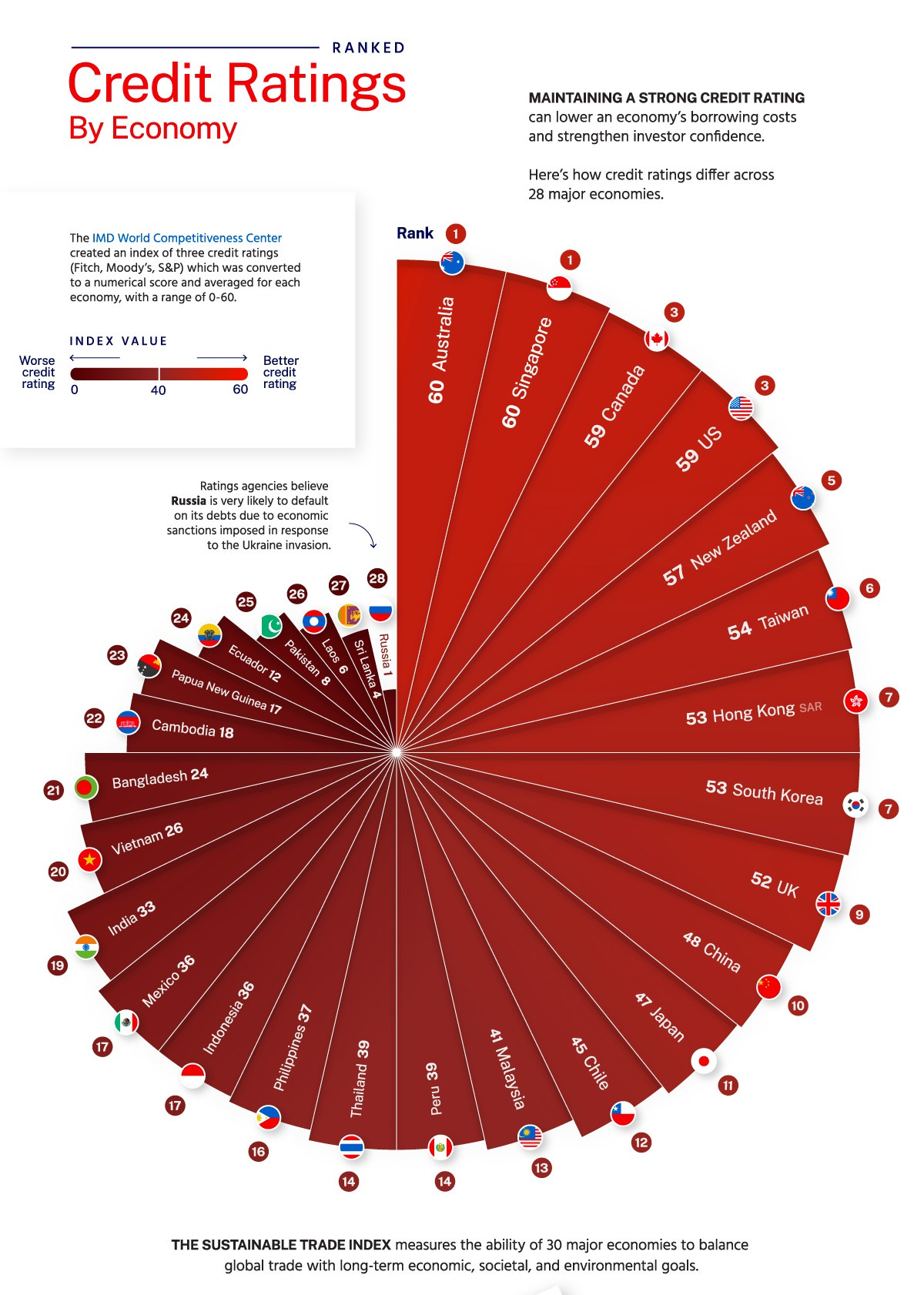

Sheinbaum Meets with S&P Global Following Downgrade of Mexico's Credit Outlook

President Claudia Sheinbaum held a meeting on Tuesday with Roberto Sifón-Arévalo, Managing Director and Global Head of Sovereign Ratings at S&P Global Ratings, at Palacio Nacional. The discussion focused on the country's development and financial outlook, with participation from the Secretary of Finance, Rogelio Ramírez de la O.

Currently, Mexico holds a "BBB" rating with a stable outlook, placing it two levels above investment grade. Countries with similar ratings include Bulgaria, India, Indonesia, and Greece.

This meeting follows a previous one on November 22 with Fitch Ratings' Shelly Shetty, where Sheinbaum discussed Mexico’s economic performance, healthy finances, and future plans. She had also recently requested that Moody’s provide evidence supporting its negative outlook for the country.

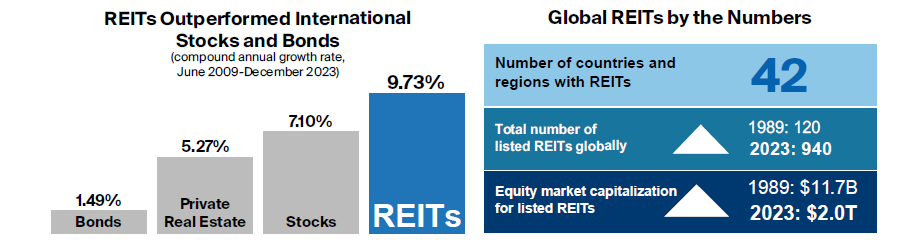

FIBRAS: Global REIT Approach to Real Estate Investing

As the worldwide representative voice for real estate investment trusts (REITs) and listed real estate companies with an interest in U.S. real estate and capital markets, Nareit has long advocated for REITs around the world. This study summarizes the dramatic growth of REITs around the world since their inception more than 60 years ago and the benefits of the REIT model for economies, investors, and communities. There are currently 42 countries and regions, accounting for 84% of global GDP with a combined population of more than 5 billion people, that have enacted REIT legislation. Key findings from the study show that: n REITs have grown dramatically in number and equity market capitalization over the past 30 years: They’ve gone from 120 listed REITs in two countries to 940 listed REITs in 42 countries and regions. n REITs have outperformed global stocks: REITs have seen a compound annual growth of 10% since June 2009 compared to 7% for MSCI EAFE. n REITs have diversified to keep pace with the modern economy: REITs provide access to telecommunications towers, data centers, health care facilities, self storage facilities, hotels, gaming facilities and others in addition to the traditional four property sectors (retail, residential, office, and industrial). n REITs have a low correlation with stocks: The FTSE EPRA Nareit Global REITs Extended Index has a 0.82 correlation with MSCI EAFE. n REITs have a strong commitment to sustainability: Listed real estate outperformed privately owned real estate in the latest GRESB assessment.

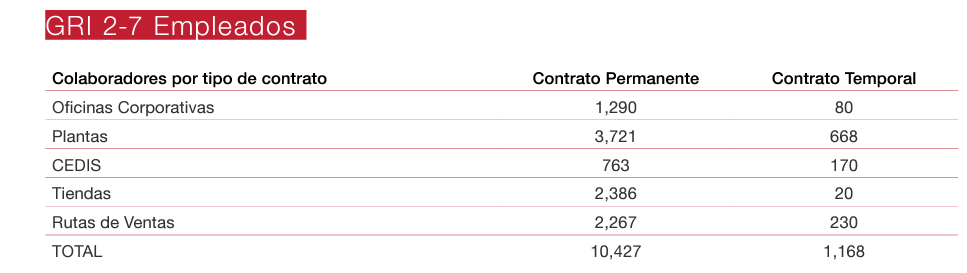

HERDEZ*: Grupo Herdez Anticipates Operational Cost Impact from Labor Reforms in Mexico

Grupo Herdez is preparing for significant changes in operational costs due to upcoming labor reforms in Mexico. Gerardo Canavati Miguel, the company's Director of Administration and Finance, highlighted that the potential reduction of working hours from 48 to 40 and the increase in the minimum wage will require adjustments in workforce management and will put additional pressure on labor that is already in short supply.

Despite welcoming higher disposable income in the country, Canavati noted that implementing the proposed labor reforms will be challenging, impacting operational costs and requiring changes to workforce shifts.

President Claudia Sheinbaum recently announced that an agreement on the minimum wage increase is expected by December 4, while discussions on reducing working hours will begin in 2025. El Economista

Grupo Elektra Intensifies Criticism of CNBV After Historic Stock Crash

Grupo Elektra's stock suffered a historic collapse on December 2, falling more than 60% after the National Banking and Securities Commission (CNBV) resumed its trading following a four-month suspension. However, by the close of trading on December 3, the stock rebounded by 6.47%, closing at 292.02 pesos per share. Despite this slight recovery, Elektra’s market value has plummeted by 144.76 billion pesos since July.

Elektra has raised concerns about the CNBV's handling of the situation, accusing the regulatory body of negligence by allowing the reactivation of its stock, which violated a court order. The company argues that this has caused "irreparable damage" to the market and shareholders, especially benefiting Astor Asset Management, which allegedly used more than seven million shares as collateral for a loan to the company's owner, Ricardo Salinas Pliego.

As Elektra pushes forward with its plan to delist from the Mexican Stock Exchange (BMV), the company is preparing for a potential public offering (IPO) to acquire at least 95% of the outstanding shares. Despite the recent drop in share price, some analysts suggest this could actually work in Elektra's favor, as it could buy back shares at a significantly lower price. Expansion

AGUILASCPO: The stock rose by 4.2%, closing at 37.5 pesos.

This performance is attributed to the announcement of an investment agreement between the U.S. private equity fund, Apollo Global Management, and Liga MX. Although the agreement is still subject to approval by the 18 teams of the league, it includes a capital increase and improvements in governance, aimed at strengthening Mexican football and fostering its growth on the international stage.

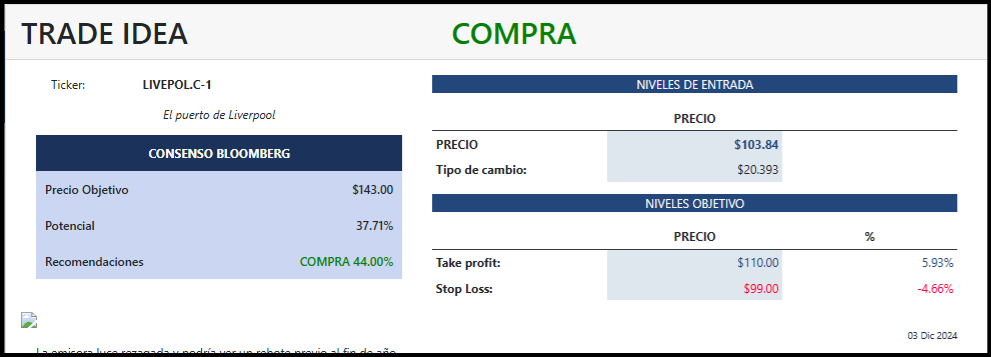

LIVELPOLC1: TRADE IDEA

BUY 103.84 MXN

TARGET 110.00 MXN

UPSIDE 37.71%

STOP LOSS 99.00 MXN

Liverpool (LIVEPOL) has refined its strategy, leveraging “Click & Collect,” offering credit, and enhancing its sales tactics at Suburbia, which has strengthened its results. This positions LIVEPOL as the winner of Buen Fin among department stores, especially driven by sales of durable goods. Specifically, we estimate that LIVEPOL's Same-Store Sales (VMT) grew by around 9% during Buen Fin 2024. While this increase is not directly comparable, it serves as a reference point and would be higher than the +7.6% VMT growth reported in Q3 2024 and +6.7% in Q4 2023.

The technical indicators align with the continuation of the current uptrend; however, a key resistance level is observed at 104. Should this resistance be breached, the price is expected to move towards 109, with the potential to extend to 112 pesos.

VECTOR RESEARCH

Weak internal demand figures for September in Mexico.

Internal Demand

The internal demand figures for September were weak.

Gross fixed investment fell 3.3 percent year-on-year, affected by both its machinery and equipment component and the construction component, with the latter showing the largest losses (-5.3 percent). On a monthly basis, investment declined by 0.8 percent in seasonally adjusted terms.

Private consumption, on the other hand, grew by only 1 percent year-on-year, with marked slowdowns in both domestic and imported components. Consumption of non-durable goods fell. In seasonally adjusted terms, private consumption decreased by 0.3 percent on a monthly basis.

The weak internal demand data for September are consistent with the deceleration trend seen in GDP over the last few quarters. Going forward, we expect this trend to persist, although private consumption will be the component that sustains the dynamism of internal demand throughout 2025.

Unemployment

The unemployment rate for October was 2.5 percent of the economically active population (EAP), below market expectations (2.9 percent) and lower than the same month of the previous year.

During the period, the EAP grew by 317.2 thousand people, while the unemployed population decreased by 142.2 thousand people.

The underemployment rate was 9.4 percent of the EAP, significantly increasing compared to October 2023 (7.9 percent).

Banco de México Market Survey

The Banco de México market survey for November showed few changes in the main projections for Mexico.

Expected inflation for 2024 slightly decreased to 4.42 percent, while the forecast for 2025 remained at 3.8 percent. Core inflation projections also showed marginal changes, but remained above 3.6 percent for both years.

Regarding GDP, the 2024 economic growth forecast was revised from 1.4 percent to 1.53 percent, while the 2025 forecast remained close to 1.2 percent.

In this context of weak growth and lower inflation, the market continues to expect a downward trend in the reference rate. The expected rate at the end of 2024 is 10 percent (implying a 25 basis point cut in December), and 8.0 percent for 2025, both unchanged from the previous month. It is worth noting that the survey includes, for the most part, the latest available information from Banco de México (at least the quarterly report).

Remittances

Remittances sent to Mexico in October fell 1.6 percent year-on-year, marking two consecutive months of declines and five months of negative growth so far this year. The decline in remittances has been negatively influenced by weak labor conditions in some sectors of the U.S. economy.

During the period, the number of transactions increased on a monthly basis, reaching 14.774 million, a level close to its yearly highs. However, the average remittance amount decreased to 387 dollars, the fourth lowest amount of the year.

Remittances are crucial for consumption in some regions of the country, and their weakness could foreshadow similar behavior in private consumption. Attention will be needed for seasonal increases toward the end of the year and for extraordinary flows before the start of the Donald Trump administration in the United States.

ALSEA *: Although the current trend in the stock price remains negative, the short-term rebound may extend, based on the conditions of the momentum indicators. It is likely that the advance will reach at least the resistance level, both in terms of price and the 50-day moving average, at 48.6 pesos.

INTERNATIONAL DAY

National Cookie Day is celebrated on December 4 in the United States. This fun day is dedicated to enjoying and appreciating cookies in all their forms. It's a day to indulge in your favorite cookies, whether homemade or store-bought, and often includes events, discounts, and promotions at bakeries and cookie shops. It's a sweet celebration of this beloved treat!