MEXICO 3Q24 EARNINGS: BEFORE AND AFTER ANALYSIS

Regarding the next year, preliminarily, as our macroeconomic framework for 2025 is being reviewed, we have determined an intrinsic value (IV) for the S&P/BMV IPC of 59,933 points.

3Q24 EARNINGS: Vector Analysis

Unlike previous quarters, the MXN/USD exchange rate showed an increase compared to the previous year, particularly in its closing quotation, where it experienced growth of 12.8% YoY and 7.7% QoQ in Q3 2024, a situation not seen in prior quarters. Naturally, companies with USD-denominated revenues saw a positive exchange rate impact. In this case, we can include the construction materials and mining sectors, mainly. On the other hand, companies with cost and expense structures in USD, as well as debt denominated in this currency, experienced unfavorable exchange rate effects.

In general terms, we continue to observe a favorable environment for consumption, with companies in this sector reporting solid figures, with growth in average transactions (ticket size) above inflation, although moderate due to the internal economic slowdown. The increase in wage mass, the good performance of remittances, the growth of credit, and the increase in social support from the federal government continue to be positive factors for this sector. Notably, good results have been reported in the food, fast-moving consumer goods, supermarkets, and department stores industries. To a lesser extent, a positive performance is also observed in restaurants. As for the beverage industry, sales volumes in our country were affected by unfavorable weather conditions caused by intense rainfall compared to the previous year.

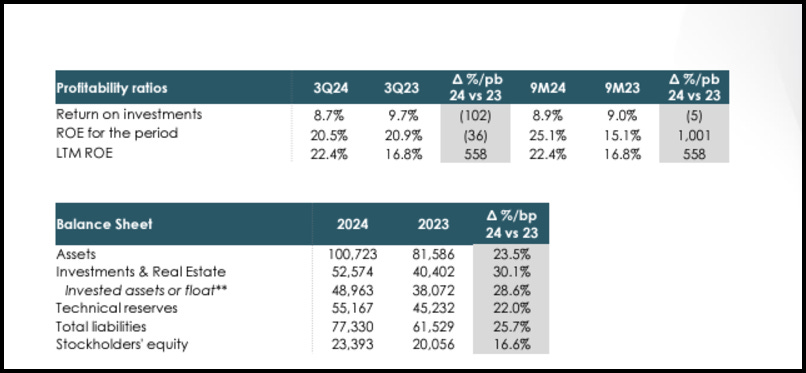

Similar to the immediate previous quarter, companies in the financial sector, particularly those with banking institutions within their subsidiaries, were also favored by the strong increase in credit portfolios and interest rates, which remain high, thereby strengthening their financial margins. Going forward, the results will primarily be determined by the evolution of the economy. On the other hand, the results of the airport and airline sectors were affected by the suspension of several Airbus aircraft using GTF engines, which were "called" for inspections due to issues detected in their manufacturing. This situation will persist throughout the current year and likely into the first half of the next.

As for the FIBRAs (Real Estate Investment Trusts) that we provide coverage for, there is an appreciation in revenues due to rent updates and higher occupancy levels, particularly in office spaces. Specifically, the results of issuers with a larger proportion of revenue and debt in USD, such as FUNO, were impacted by the depreciation of the MXN against the USD. In terms of profitability, the aggregated EBITDA margin for the S&P/BMV IPC sample in Q3 2024 contracted by 50 bps YoY, due to unfavorable exchange rate effects on imported raw material prices, as well as the increase in labor costs resulting from labor reform effects in Mexico.

VECTOR SALES AND TRADING DESK

BOLSAA: +6.46% to 34.27 after the company released its November 2024 market statistics.

Reporting a 10% increase in the value traded in the local market, while the global market saw a 3.7% fall. Also, assets under custody grew by 12.3% to P$36.413 billion, driven by a 25.6% surge in the international market.

TLEVISACPO: How Mexico’s Soap-Opera Tycoons Became the Country’s Trump Whisperers.

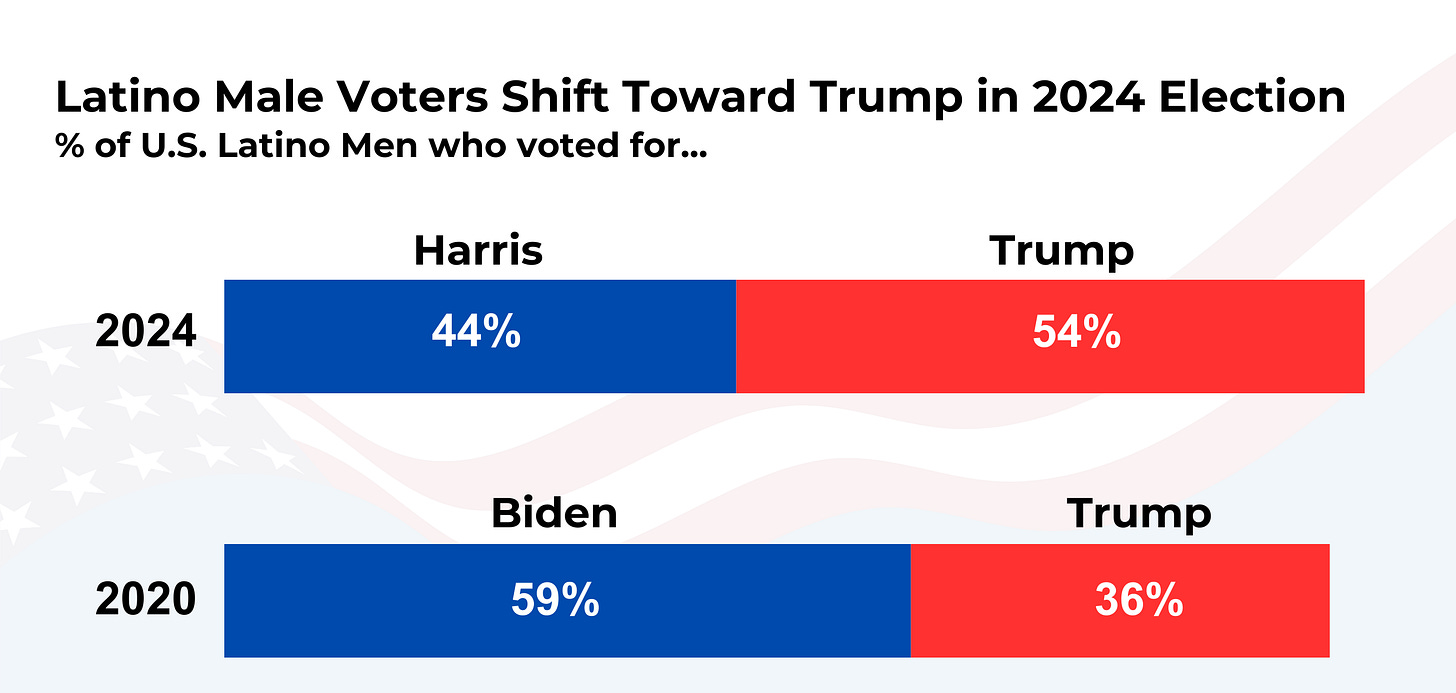

Surprising surge of support from Hispanic voters bolstered president-elect’s comeback. WSJ

A week after Donald Trump's election victory, two Mexican media executives flew to the Mar-a-Lago resort in Florida so the president-elect could personally thank them for TelevisaUnivision's Spanish-language coverage after Hispanic support shifted toward Republicans.

In Mexico, Alfonso de Angoitia and Bernardo Gómez are known for their political acumen and the longstanding influence of Grupo Televisa, a company that gained fame for taking soap operas, called telenovelas, to a global audience. Now, they are important interlocutors between Trump and Mexican President Claudia Sheinbaum.

They might assist with contentious cross-border issues such as security, migration and trade but also play a role in shaping the views of Hispanic Americans who are increasingly willing to cross party lines. Trump is proposing mass deportations of illegal immigrants and 25% tariffs on Mexican imports.

Q*: Rose +2.22% to 178.24

On November 28th, The company celebrated its Investor Day, where it presented growth opportunities in Mexico and its international subsidiaries. The event covered various topics such as the company’s corporate governance, strategic development plans, international expansion, and initiatives for technological integration and risk prevention. It was well received by Investors stock has surged 27% since that date.

Finally, street analyst released its calculations for IPC rebalance on Dec 20th at the close. With Q* Inflows of 1.8M shares.

Adds/Deletes: None

Major Flows: TLEVICPO (-23M shares, 4.2x ADV), ALFAA (-36M shares, 3.9x ADV), PE&OLES* (1.8M shares, 3.4x ADV), Q (+1.8M shares, 2.7x ADV), & CEMEX (-106M shares, 2.1x ADV)

WALMEX*: According to El Sol de México, the resolution regarding WALMEX will be announced today.

The resolution of the investigation initiated by the Federal Economic Competition Commission (Cofece) regarding alleged monopolistic practices against the retail chain led by Ignacio Caride was known last week, but today the details of the case, which dates back to October 2023, will be publicly announced. The general reading is that, while changes or corrective measures will be imposed on Walmart Mexico and Central America’s practices with its suppliers, the sanctions will not be as severe as initially feared. This is good news for the company's shares, which have accumulated a 20% drop this year, due to the combination of uncertainty from the Cofece investigation and the economic slowdown that has affected the domestic market. El Sol de Mexico

CEMEXCPO: Rose +0.84%, Cemex joins construction of Tampa's largest transportation project.

Cemex, a leading provider of high-quality building materials, announces its pivotal role in the construction of the new Howard Frankland Bridge in Tampa, Florida. The $865 million project, which will be the largest bridge by surface area in the state, is essential for hurricane evacuation preparedness. This marks a significant milestone in bolstering the region's infrastructure resilience.

Expected to span about three miles over Old Tampa Bay, the bridge will enhance connectivity between Tampa and the St. Petersburg area, providing a crucial lifeline for residents during emergencies. Cemex brings its expertise in providing durable and sustainable building solutions, having provided about 141,000 cubic yards of concrete and nearly 104,000 tons of aggregates to the project thus far. The new design will feature a bicycle and pedestrian trail, express lanes and accommodation for a light rail in the future. Thanks to its state-of-the-art facilities, commitment to quality and capacity to meet the project's high demand, Cemex is contributing significantly to the bridge's structural integrity and longevity. CNHINEWS

TBBB: Tiendas 3B: The Chain Going After Bodega Aurrera and Supercito’s Market

Tiendas 3B, the proximity chain, has managed to establish itself in key regions such as Mexico City, State of Mexico, Puebla, Veracruz, and Michoacán, covering areas with high population density and low incomes.

The Keys to Tiendas 3B’s Successful Business Model

Tiendas 3B is focusing on expanding its stores in Mexico.

Tiendas 3B has emerged as a key player in the hard discount sector, positioning itself as a competitor to established chains such as Walmart’s Bodega Aurrera Express and Chedraui’s Supercito. With a business model focused on low prices, proximity, and private labels, the chain led by Anthony Hatoum closed September 2024 with 2,634 stores, surpassing Supercito’s 151 branches and Mi Bodega Aurrera Express’s 1,386.

In the third quarter of the year, Tiendas 3B opened 131 new branches, reflecting an aggressive expansion strategy aimed at consolidating its presence in Mexico. During a call with analysts, Hatoum emphasized that the Mexican market has the potential to sustain up to 20,000 stores of this type. “It’s natural to think we’ll focus on increasing the pace of store openings over time, but for now, we feel very comfortable meeting the guidelines,” he said.

This geographic expansion, based on “organic and circular growth,” has allowed Tiendas 3B to strengthen its position in key regions such as Mexico City, State of Mexico, Puebla, Veracruz, and Michoacán, covering areas with high population density and low incomes.

Proximity and Low Prices as Competitive Advantages

The success of the chain lies in its value proposition: a restricted offer of around 700 essential products, including food, beverages, and general merchandise. The combination of private labels with competitive prices allows the company to reduce operating costs and increase profitability.

“Proximity is one of the keys to its success. Consumers don’t have to travel long distances to buy what they need, which was especially important during the pandemic lockdown,” explains Ángel Méndez, a business consultant and academic at the Escuela Bancaria y Comercial (EBC).

Julián Fernández, CEO of Ferdez Business Consulting, points out that this model meets the needs of a specific niche. “There is a significant portion of the population that depends on low prices and frequent purchases. Tiendas 3B occupies a space that large chains don’t always address.”

Between January and September 2024, Tiendas 3B reported sales of 41,092.4 million pesos, a 29.4% growth compared to the previous year, and an EBITDA of 2,002.3 million pesos. These figures reflect the consolidation of its business model in a challenging economic environment.

Although Tiendas 3B has consolidated its position, its path is not without challenges. The hard discount market in Mexico is competitive, with players like Mi Bodega Aurrera Express and Supercito attempting to gain market share in the segment. However, Hatoum remains optimistic.

“The Mexican market is very competitive, but due to its territorial and market size, there is room for up to four players in the same business segment. This ultimately benefits the customer,”. Expansion

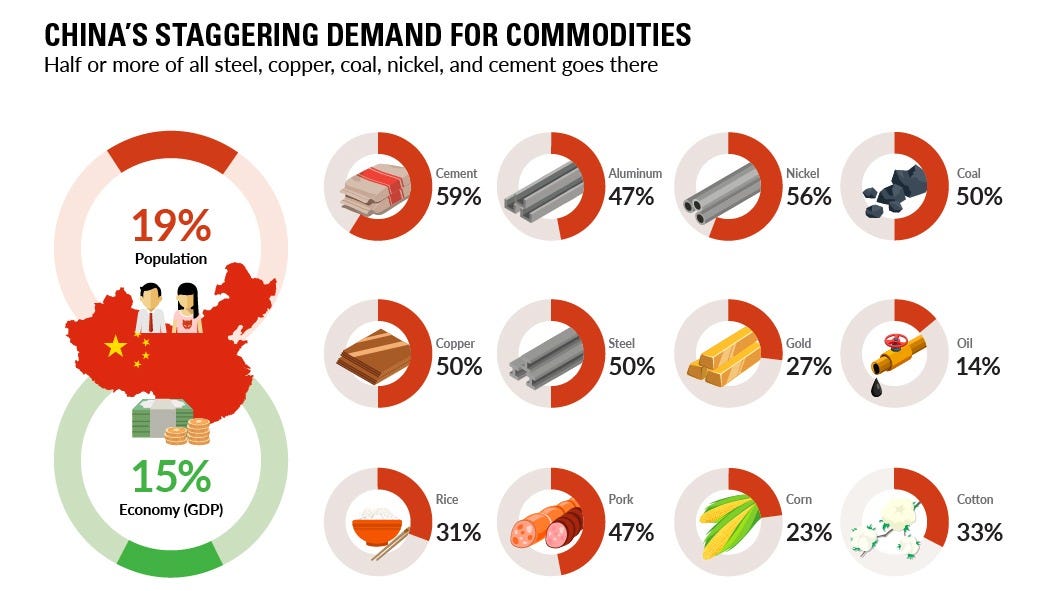

MEXICO MINING: Grupo México (GMEXICO) and Industrias Peñoles (PE&OLES) reported positive performances of 6.3% and 8.5%, respectively, in line with the rise in copper, gold, and silver prices.

This result is attributed to the resumption of gold purchases by the People's Bank of China, as well as changes in the country's monetary and fiscal stances aimed at stimulating consumption and investment in 2025. These factors have boosted expectations for future demand for these metals.

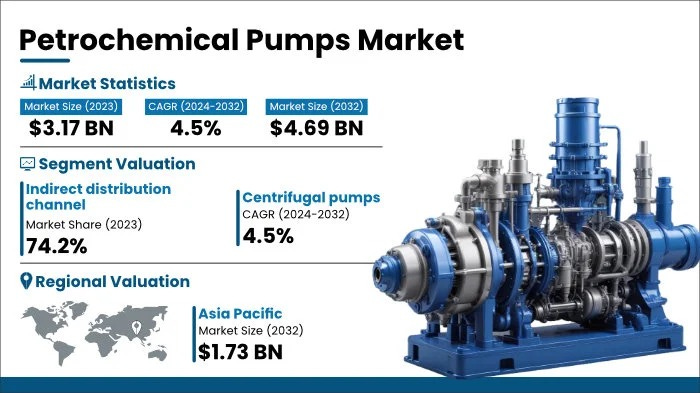

ORBIA* and ALPEKA: Petrochemical companies Alpek (ALPEK) and Orbia (ORBIA) rose by 5.3% and 3.4%, respectively, in sync with the 1.7% increase in oil prices.

This movement is explained by the growing tensions in the Middle East following the ousting of Syrian President Bashar al-Assad, which created uncertainty about oil supply in a key production region.

While Syria is not a major oil producer, it holds geopolitical clout due to its location and ties with Russia and Iran, and mixed with the tensions elsewhere in the region, the regime change has potential to spill into neighbouring territories

These tensions countered concerns about weak demand in China and were supported by expectations of economic stimulus from the country. Reuters

VECTOR RESEARCH

November Inflation Figures in Mexico Were Positive, Keeping Room for Banxico to Cut Interest Rates

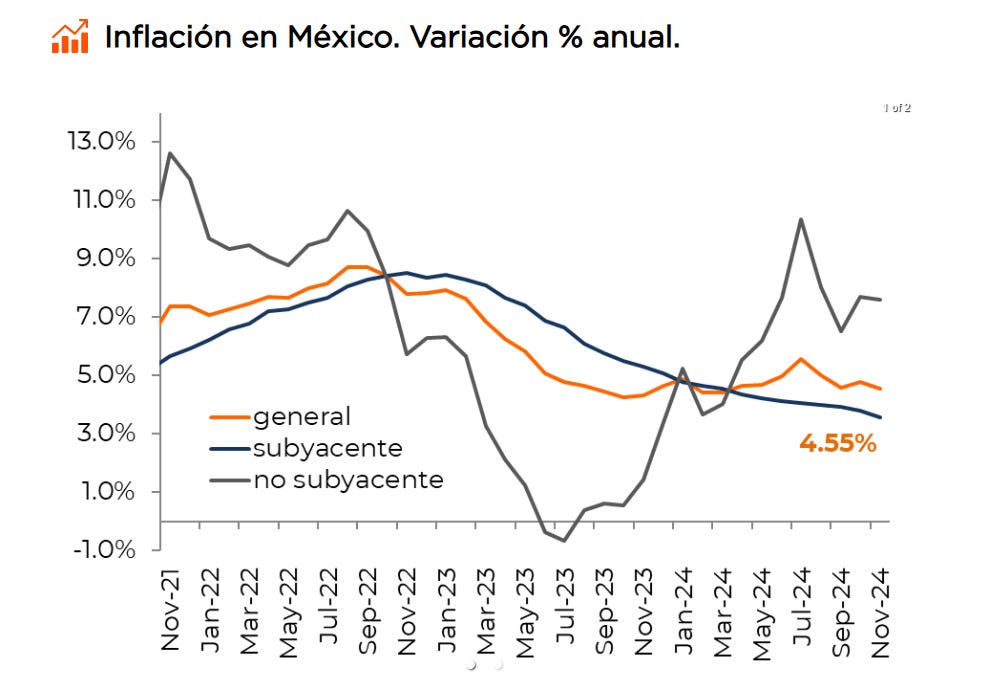

Mexico's inflation for November was 0.44% month-over-month, below expectations. On an annual basis, inflation slowed to 4.55%. Core inflation surprised to the downside and decelerated in its annual measurement.

November's inflation in Mexico stood at 0.44% month-over-month, in line with our estimate, and below market expectations (0.49%, according to Citi’s latest market survey). On an annual basis, general inflation decelerated from 4.76% to 4.55%.

Core prices, on the other hand, rose by only 0.05% month-over-month, also below expectations (0.07%). During the period, goods inflation decreased monthly, due to the favorable effect of the “Buen Fin” promotional campaign. Services inflation remained below 5%. On an annual basis, core inflation continued its downward trend and stood at 3.58%, its lowest level since April 2020.

Regarding non-core inflation, seasonal increases were observed in electricity prices, while agricultural goods experienced slower growth.

The November inflation figures were favorable and align with the expectations of Banco de México in its latest forecasts.

The data continues to support the rate-cutting cycle. While our base case for the December monetary policy meeting is a 25 bps cut, a larger adjustment cannot be ruled out due to the “dovish” bias of some members of the central bank’s governing board. We will be attentive to any comments they may make in this regard or any significant movement in the prices of goods and services.

GFNORTE Shareholders' Meeting Approves Cash Dividend Payment

We calculate an implied dividend yield of 2.5% at current prices.

Grupo Financiero Banorte, S.A.B. de C.V. (BMV: GFNORTE) announces that, as part of the agreements made during the ordinary shareholders' meeting held today, the payment of a cash dividend in the amount of MXN 10,000 million was approved, which is equivalent to MXN 3.554725684779990 per share outstanding. The dividend will be paid on December 18, 2024, upon the delivery of coupon number 9. The cash dividend will be paid from retained earnings from previous fiscal years, and for purposes of the Income Tax Law, it comes from the net fiscal profit account as of December 31, 2014, and subsequent years.

At current prices, the implied dividend yield is 2.5%. This is positive news, in our opinion, so we may expect a similar short-term performance in the stock price. Our fundamental recommendation of BUY with an intrinsic value (IV) expected at MXN 193.00 remains unchanged.

BOLSA A: With the recent rally, it has recovered all the losses from the previous adjustment and is once again testing the resistance at 34.5.

The indicators are heading in the right direction, pointing to a potential positive breakout. If this happens, it could rise to the next supply zone at 36.5. However, the ceiling at 34.5 is strong, and if it fails to break through again, it could fall back to the intermediate support at 32.9 pesos.

INTERNATIONAL DAY

December 10 is Nobel Prize Day. This day marks the anniversary of the death of Alfred Nobel, the inventor of dynamite and the founder of the Nobel Prizes. On December 10 each year, the Nobel Prizes in Physics, Chemistry, Medicine, Literature, and Peace are awarded in a ceremony in Stockholm, Sweden, and Oslo, Norway (for the Peace Prize). This day is dedicated to recognizing and celebrating outstanding contributions to humanity in these fields.